2018 B2B Buying Disconnect Report: Tech Buyers Crave Greater Transparency from Vendors

This is old news. We’ve got new research for 2021.

Many B2B technology vendors claim to be buyer-focused and even “customer-obsessed” in their marketing, sales and product strategies. But in reality, most vendors fall short. Buyers don’t trust vendors to tell them the whole truth about their products, and it isn’t always easy for buyers to connect with customers who have relevant experience. Read on for tips and insights from the 2018 B2B Buying Disconnect Report on how your peers are navigating the buying process, including which resources they use to make confident purchase decisions, and why.

Buyers Need the Whole Truth to Feel Confident Making a Purchase

When you need to find a new tool at work, the stakes are high — both financially and in terms of your professional reputation. It’s a big investment, and you need to get it right.

To explore how modern buyers approach this process, and how well vendors’ marketing and sales tactics align with buyers’ preferences, we conducted a survey of 438 buyers and 240 vendors. The most common cost for one technology product, purchased in the past year by buyers who participated in our survey, was $11,000-$50,000 annually. But a substantial number said they spent far more, with 23% of buyers spending over $100,000 per year.

With that much money on the line, not to mention the resources required for evaluation and implementation, you need to feel confident the product you choose is going to work for your team and yield meaningful results you can share with your boss and other stakeholders.

Among the factors you might care most about are adaptability, scalability, ROI, implementation and adoption, support, integration — essentially everything you need to know to go into a new purchase with eyes open. But if you want the full picture, you’re going to have to look beyond the vendor’s purview to get it, according to buyers who experienced the purchase process this past year.

Where Do Most Vendors Fall Short?

Vendors are the go-to source for lots of need-to-know product information, including technical specs and pricing information. But most buyers don’t trust vendors to tell them the whole story, particularly when it comes to the cons.

Only 37% of buyers in our study said the vendor they worked with was very forthcoming about where the product works well and where it is not a good fit. The rest felt the vendor avoided discussing product limitations, left them with an incomplete picture, or answered their questions but was not proactively transparent.

Part of the problem is the branded resources vendors share, which can be too high-level or seem airbrushed, biased, and full of fluff. This leads buyers to trust vendor-provided resources less, use them less often, and be less influenced by them.

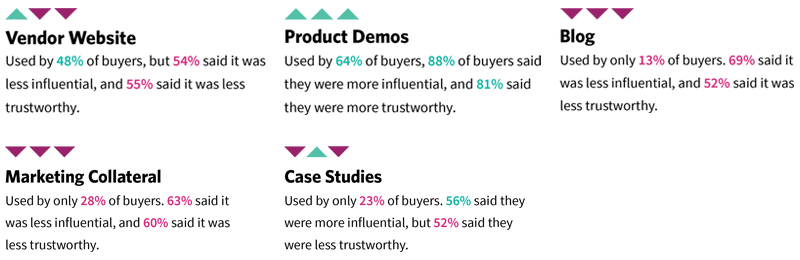

Here are the top 5 tactics used by vendors, with the breakdown of buyer usage, influence, and trustworthiness:

Buyers are also well aware that sales reps are motivated to sell their own product. So even when reps are helpful and friendly, buyers take what they say with a grain of salt.

“Salespeople, no matter how honest, will always have a strong bias and be the least objective voice in the process.”

“Websites can be helpful for finding objective facts like technical specs, etc, but at the end of the day they’re a marketing tool and therefore not going to give you the full picture.”

“While data sheets and demos from product vendor are helpful to customers in making an informed decision, it cannot be the sole source of truth. It is critical to have an unbiased perspective.”

Diverse Resources Work Together to Give Buyers a Complete Picture

The bottom line is that buyers feel the need to investigate product limitations elsewhere, beyond information sources controlled by the vendor. Their advice? The most realistic vision of how this product will work for you on a day to day basis requires compiling information from a range of different sources, so do your homework.

“Being able to trial a product is always important to me because it lets me understand whether or not the solution will truly fit my needs. User reviews are also important because they give me insights into some challenges that might arise with the solutions the vendor isn’t likely to disclose.”

“Typically product demos show what’s possible while free trials, user reviews and analyst rankings validate the capabilities shown in the demo. The [vendor provided] use case studies typically do not get into the details of what was involved with implementation and are not tailored for the specific use case we are looking to tackle.”

“User reviews are a must – the product needs to have a good reputation. Analyst rankings – definitely something to look at as it is compiled by independent professionals. Vendor representative – crucial factor in terms of how the product is presented, explained, what customer support can we expect based on the encounter, live source of answers. Free trial – we wanted to see ourselves what we are buying, to have an opportunity to work with the software in order to believe in it. Vendor blog [was the least influential] – might contain some interesting stuff but rather marginal in terms of decision making.”

You probably want the 2021 version of these stats.

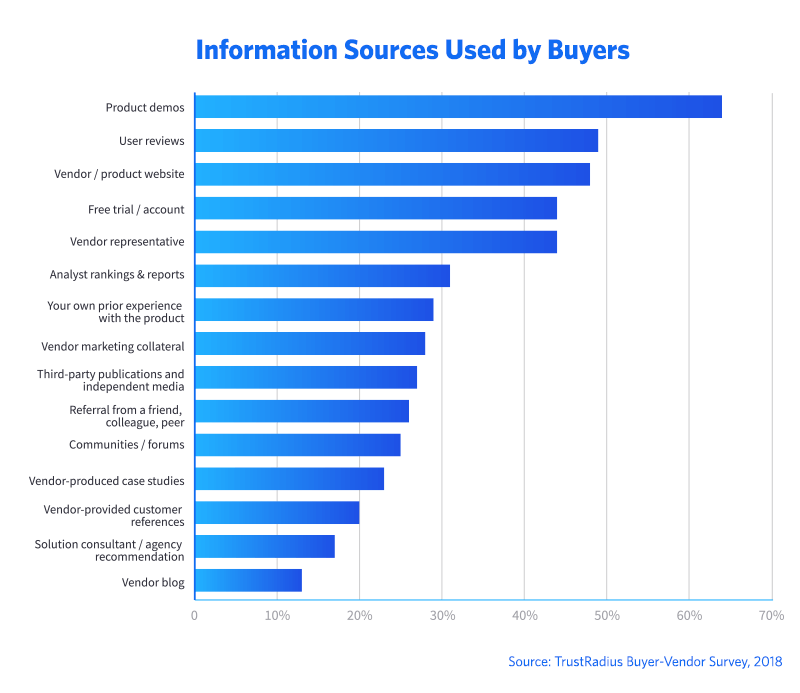

On average, buyers who took the survey used about five different sources of information. Hands-on experience (product demos and free trials) and peer feedback (user reviews) played a key role in balancing and validating the product information they got from vendors. Other third-party resources, like analysts, consultants, and independent media, also played a role in buyer research.

Influential Vendors Embrace Transparency

Vendors that acknowledge this buyer need for a mix of resources can end up being more helpful in the purchase process.

23% of buyers said the vendor they worked with was highly influential in their purchase decision. Compared to less influential vendors, highly influential vendors were about twice as likely to be very forthcoming about product limitations, provide buyers with additional learning opportunities, connect them with customer references, provide them with customer evidence like reviews and case studies.

They were more transparent, and took a more active, strategic role in helping buyers find and interpret the information they needed to feel confident that they were purchasing the right product (warts and all).

No one resource is perfectly adequate or trustworthy, but cross-referencing a diverse mix of resources can give you a pretty good picture of what it will be like to work with a vendor and whether a product is right for your company. And if the vendor helps you get there, that’s a solid foundation of trust for your relationship moving forward.

For more insights about how your peers approached their purchase process, and how B2B tech vendors operate, download the 2018 B2B Buying Disconnect Report here for free. Let us know what you think, and feel free to reach out with any questions about the data.

Thank you to the 438 buyers in our community who participated in this research! We appreciate you. Your insights make it possible for us to improve our site and educate vendors about the changes they need to make so that you can go about researching, evaluating, and purchasing technology in the way that works best for you.

Download the 2019 B2B Disconnect today.

If you’re interested in this, you’ll love the 2021 version.

Was this helpful?