Announcing the Top Rated Accounting & Budgeting Software for 2019

TrustRadius Top Rated

Today, we awarded the 2019 TrustRadius Top Rated badges for Accounting & Budgeting Software. The TrustRadius Top Rated awards are the most trusted in the industry because they are an unbiased reflection of customer sentiment, based solely on user feedback and satisfaction scores. Top Rated awards are the voice of the market and are not influenced by analyst opinion, the vendor’s company size, popularity, or status as a TrustRadius customer.

Accounting & Budgeting Software

Software buyers have a wide range of Accounting & Budgeting software options to choose from, finding the right one can be a difficult process. Accounting professionals on TrustRadius use reviews written by software end-users and product comparisons to help them make better informed purchasing decisions.

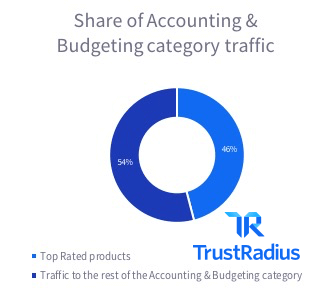

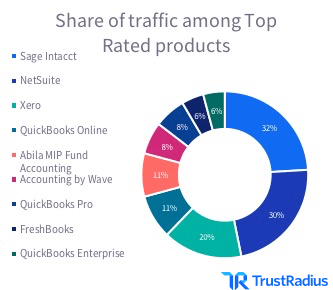

In the past quarter, more than 17,300 professionals used TrustRadius to evaluate Accounting & Budgeting software products—at least 1,188 of them were from enterprise companies with more than 1,000 employees. Visitors evaluating Accounting & Budgeting software were most curious about comparing different products and reading product reviews —64% compared at least two products and 59% read reviews.

Here are the winners:

Accounting by Wave

![]()

Accounting by Wave is an accounting system designed for small businesses. It offers many of its features for free, such as unlimited connections to banks and credit cards, income and expense tracking, multi-currency payments with automatic calculations for exchange rates, and mobile receipt scanning. Accounting by Wave’s free option also includes accounting reports, bulk transaction editing, and multi-business support from a single account. Wave offers pay-per-use credit card processing and bank payments. For a monthly fee, Wave also offers payroll services. A large majority (86%) of Accounting by Wave users on TrustRadius are from small businesses. Reviewers value Wave’s one-click quote-to-invoice process, simple year-end record generation, and professional look and feel.

“I love how the estimates feature integrates with invoices. You start by making an estimate for a client, with a defined expiry date. Once they accept, you can convert that estimate immediately into an invoice and set it up to send…You can look professional and have something easy to manage, and yet also have excellent records come the end of the year.”

– J.P. VanderLinden | Director Of Operations | Marketing and Advertising Company

[easy-tweet tweet=”Accounting by Wave: I love how the estimates feature integrates with invoices.” user=”trustradius” template=”qlite”]

Xero

![]()

Xero is a cloud-based accounting system aimed at serving small businesses. Users can send invoices, automatically import bank transactions, manage expenses, schedule bill payments, and track inventory. Xero’s mobile app supports invoicing, receipt capture and expense recording, and reconciliation for bank transactions. Its project tracking features help project-based businesses evaluate each job separately. Businesses with depreciable assets can use Xero’s fixed-asset management tools to keep track of their value. Xero’s users on TrustRadius are mostly (83%) from small businesses. Reviewers appreciate Xero’s one-click reporting tools, integrations with third-party payment processors and applications, and extensive mobile functionality.

“Their invoicing system is extremely robust and integrates with a variety of payment gateways. Recurring invoices, statements, and reminders to clients help me see all my AR at a glance, and make collecting super simple…Xero hits our “maximum point” on the curves of simplicity, usability, and feature set.”

– Matt Heerema | Director | Web Design Company

[easy-tweet tweet=”Xero hits our maximum point on the curves of simplicity, usability, and feature set.” user=”trustradius” template=”qlite”]

Sage Intacct

![]()

Sage Intacct is a modular ERP system with accounting at its core. Its ledger is designed to consolidate financial data from multiple entities, automate accounting workflow, and manage multiple account books with different accounting standards. Sage Intacct also offers automation for accounts payable and receivable, detailed custom reporting options, and metrics analysis designed for SaaS businesses. Larger finance teams can use its collaboration features to stay on the same page. Software users from mid-sized businesses make up a majority (68%) of Sage Intacct users on TrustRadius. Reviewers recommend Sage Intacct for its multi-entity finance consolidation tools, detailed customizable reports, and extensive automation capability.

“Timing has improved because Sage Intacct’s features and workflows allow us to reduce our monthly close process from 20 to 5 days consistently…We get to go home at a decent hour because we’ve configured our workflows within Sage Intacct to be fluid and effective.”

– Kevin Jackson | Corporate Controller | Computer Software Company

[easy-tweet tweet=”We’ve configured our workflows within Sage Intacct to be fluid and effective.” user=”trustradius” template=”qlite”]

FreshBooks

![]()

FreshBooks is a cloud-based accounting system for small businesses. It offers customizable invoices, time tracking, online credit card payments, and collaboration and file-sharing tools for team members and clients. FreshBooks can automate recurring invoices, late payment reminders, and late fees. End-of-year reports and ledger dashboards help businesses understand their financial state and prepare for tax filing. For a premium fee, FreshBooks offers personalized account management and training services. A sizable majority (79%) of FreshBook users on TrustRadius are from small businesses. Reviewers highlight FreshBooks’ responsive customer support, automated payment reminders and late fees, and client communication records.

“Our company has probably saved/made thousands of dollars by knowing who has and hasn’t paid, along with the ability to auto remind clients about unpaid invoices…FreshBooks is a no brainer for those who want to combine client billing, client management, expense tracking, and reporting into one service/app.”

– Verified User | Professional in Design | Design Company

[easy-tweet tweet=”FreshBooks: Our company has probably saved/made thousands by knowing who has and hasn’t paid.” user=”trustradius” template=”qlite”]

QuickBooks Pro

![]()

QuickBooks Pro is an accounting system with on-site and cloud-based deployment options. It includes real-time invoice status tracking, profit/loss overviews, data importing, and automatic report generation. QuickBooks Pro’s autocomplete functionality helps enter existing names and account numbers quickly. For larger teams, administrators can set user permissions to control access to sensitive data. A majority (64%) of QuickBooks Pro users on TrustRadius are from small businesses. Reviewers value QuickBooks Pro’s invoice tracking features, intuitive user interface, and customizable reporting templates.

“QuickBooks is used to manage all financial aspects of my business, including invoicing, purchasing, time tracking, and inventory…The extensive number of reports available as well as customizations allows me to see how my sales are doing on a regular basis in different areas of the market.”

– Bill Greganti | Consultant | Information Technology and Services Company

[easy-tweet tweet=”QuickBooks is used to manage all financial aspects of my business.” user=”trustradius” template=”qlite”]

Abila MIP Fund Accounting

![]()

Abila MIP Fund Accounting is a modular accounting solution designed for nonprofits and government agencies. Its core features include a ledger, accounts payable and receivable, budgeting tools, bank reconciliation, and reporting. MIP Fund Accounting also offers tools for designing custom accounting forms, multi-currency support, fraud detection, and fixed asset management. Its modular format allows customers to design a system that meets their needs and can change as their business evolves. The majority (61%) of MIP Fund Accounting users on TrustRadius are from mid-sized organizations. Reviewers praise MIP Fund Accounting for its customizable reports and financial statements, user-friendly UI, and easy allocation of funds among various departments and categories.

“We’re a public broadcasting organization with 7 different stations. We have to allocate expenses not only between funds but between stations, departments, activities and restrictions, and MIP gives us the flexibility to do all of that.”

– Verified User | Supervisor in Finance and Accounting | Broadcast Media Company

[easy-tweet tweet=”We have to allocate expenses not only between funds; MIP gives us the flexibility to do all of that.” user=”trustradius” template=”qlite”]

QuickBooks Online

![]()

QuickBooks Online is a SaaS accounting software. It provides users with functionality for invoices, estimates, mobile receipt capture, expense tracking, inventory tracking, records for 1099 contractor payments, and customized reporting. QuickBooks Online helps businesses prepare for taxes by assigning tax categories to income and expenses, viewing real-time tax estimates, and exporting tax filing documents. Project-based businesses can use QuickBooks Online to track per-project costs and profits. A sizable majority (74%) of QuickBooks Online users on TrustRadius are from small businesses. Reviewers highlight Quickbooks Online’s accessibility for remote users, easy year-over-year comparison reporting, and integrated tax assistance tools.

“Implementing QuickBooks saved us lots of money that would have otherwise went to an accountant for tax prep. QuickBooks does a lot of the work for us, saving time with the accountant [and] prep for accountant meetings, and [saving] lots of time and money to prepare a return.”

– Verified User | Professional in Finance and Accounting | Real Estate Company

[easy-tweet tweet=”QuickBooks does a lot of the work for us, saving time with the accountant.” user=”trustradius” template=”qlite”]

QuickBooks Enterprise

![]()

QuickBooks Enterprise is an accounting system designed to for large and growing businesses. Customers have the ability to choose between on-site hosting or cloud hosting. QuickBooks Enterprise offers core accounting functionality, multi-user support, data recovery services, training, real-time invoice status tracking, and customizable reporting. Industry-specific versions of QuickBooks Enterprise include additional tools tailored for different industries, such as contracting, nonprofit, and retail. Its tax preparation and reporting features can help businesses file their taxes quickly and accurately. A majority (59%) of QuickBooks Enterprise users on TrustRadius are from small businesses. Reviewers are consistently impressed with QuickBooks Enterprise’s customizability, comprehensive inventory management tools, and support for large datasets.

“[QuickBooks] Enterprise is best suited for companies that have larger data files, need more robust inventory features, work on a network, and desire more specific customization, just to name a few of the key important aspects it can provide.”

– Jeff Henkel | Consultant | Accounting Company

[easy-tweet tweet=” Enterprise is best suited for companies that have larger data files and work on a network. ” user=”trustradius” template=”qlite”]

NetSuite

![]()

From Oracle, NetSuite is a cloud-based business management suite with accounting modules. It provides essential accounting features like a customizable ledger, invoicing, accounts payable and receivable, automated tax calculation, payment processing, and customizable reports. With additional modules, NetSuite also handles revenue recognition, financial analysis and forecasting, multi-entity consolidation, multilingual UIs, and standards compliance. The majority (61%) of NetSuite users on TrustRadius are from mid-sized businesses. Reviewers appreciate NetSuite’s automation capabilities, data centralization, and financial forecasting features.

“NetSuite addresses the major business problem of organization and trust. By having all of the financials in one location NetSuite has become the “truth” behind our financials…Monthly closes can be coordinated across the company and completed in a much quicker time.”

– Chris Snelling | Investments and Treasury Manager | Financial Services Company

[easy-tweet tweet=”NetSuite addresses the major business problem of organization and trust.” user=”trustradius” template=”qlite”]

Congratulations to the winners of the Top Rated Accounting & Budgeting Software Award!

Top Rated Criteria

Products included in the 2019 Top Rated Accounting & Budgeting Software list must have been in the top tier of their category TrustMap as of February 13th, 2019. To qualify for the Accounting & Budgeting Software Top Rated Award, products must have at least 10 reviews written within the past year, a TRScore of at least 7.5 out of 10, and must receive at least 1.5% of the traffic in their category. Every reviewer is verified and every review is vetted before publication. Products are plotted on the TrustMap based on end-user data, including users’ likelihood to recommend scores as well as buyer research patterns. To learn more about TrustMaps and Top Rated methodology, check out this page.

Was this helpful?