Top 5 Things That Slow Down B2B Sales (and How Effective Marketers Speed Them Up)

B2B sales can feel like a slog. In our recent survey of business technology professionals working in marketing or sales, 57% of respondents said the average deal cycle for their flagship product takes at least 3 months. 18% of respondents reported a much longer deal cycle, ranging from 9 months to over a year.

Only 35% are consistently able to get the deal within a single quarter. And from the buyer’s perspective, it’s no walk in the park either! (It’s more of a hike, actually—check out this buying experience map to see what we mean.)

So you want to accelerate sales

Sales leaders are constantly trying to accelerate deals so that they can beat quota, build a predictable pipeline, generate more accurate forecasts, and shorten the amount of time it takes new reps to onboard and start closing. (The category of sales acceleration software has emerged around this goal!)

Tech marketers, of course, try to set sales reps up for speedy success. They deliver a deluge of qualified leads and arm reps with the materials needed to seal the deal. Having better-qualified leads can save salespeople time talking with prospects who aren’t a fit, or who are still far from ready to buy. Strong enablement helps salespeople move faster because the assets and the answers they need are at their fingertips.

You’re doing great things! But you still want to move faster, to grow more new business.

If you want to accelerate deals, it’s important to know thy enemy. What’s causing the most friction?

Top 5 things that slow down your sales cycle

According to business tech marketers and salespeople, these are the 5 biggest obstacles that can slow down deal cycles:

- Decision Makers & Internal Processes

- Price Tag & Budget

- Doubt

- Competition

- Requirements

But these forces are rarely discrete. In practice, they’re often related—as cause and effect, or playing off one another, compounding the friction. So it makes sense that salespeople and marketers talk about them in the same breath.

Below are some examples of the ways survey respondents described the factors slowing their deals. Note that some comments mention multiple connected obstacles.

How B2B sales and marketing professionals talk about these obstacles (in their own words)

1. More cooks in the kitchen

With the rise of collaborative purchases comes all the fun of having more cooks in the kitchen. Questions and concerns are multiplied, and priorities and preferences might not line up the same for everyone. Politics within buying groups and all of the hoops buyers have to jump through to satisfy their own organization can certainly cause a slowdown.

This one can be particularly excruciating because it feels out of your control. Here’s how some survey respondents described decision makers and internal processes slowing down deal cycles:

“The larger the transaction, the more buyers involved – a committee of buyers to make a decision slows down the cycle.”

“Multifunctional agreement politics”

“Aligning schedules and decision making processes across multiple stakeholders, internal resource availability.”

“Not qualifying PAT criteria (Pain, authority, timeline).”

“Not having a champion, prospects settling with the system they currently have because they are sticky.”

2. Penny-pinching

Money makes the world go round. But there’s never quite enough of it for everything, and without budget, the deal isn’t going anywhere. Buyers want to make sure they’re getting a good deal. The cost to benefit ratio has to be right. And when multiple stakeholders with different priorities are involved, that itch can be hard for you to scratch.

If buyers are uncertain about your product, your company, or even their own needs, it makes proving value that much harder. Here’s how some survey respondents described price tag/budget slowing down deal cycles:

“Consensus purchase, business and funding justification.”

“Industry budget allotment and scheduling, if it’s the wrong time of year for a certain deal, it can take up to 9 months.”

“Convincing CEO’s to spend money on something that they haven’t spent it on before.”

“Budget, not knowing where we fit because it’s a unique product”

“Limited budget, lack of awareness/education.”

3. The uncertainty principle

To actually pull the trigger on a purchase, buyers need a certain level of confidence. The bar gets higher with the size of the investment in terms of cost and number of people/departments it touches. Trust and communication are important factors here, not only between you and your buyer but also within the buying group (i.e. among stakeholders).

If they are uncertain about their requirements, their budget, the resources they’ll need to make the product successful, or have doubts about which product or plan is the best option for them—they won’t buy. They may simply delay or de-prioritize the project. And “no decision” is the biggest deal killer. Life might be better with your product, but it’s also a bigger risk. The status quo is the devil they know. Here’s how some survey respondents described doubt slowing down deal cycles:

“Prospect indecision and budgetary constraints”

“Buyer indecision. Fear of making a bad decision.”

“Status Quo, Lack of Resources”

“Confusing marketing messages”

“Poor understanding of [our] technologies”

“Indecision”

“[The department] decides to do nothing”

“Incumbent systems that are hard to replace”

“Lack of prospect understanding around KPIs they are looking to achieve.”

4. Vying for attention

You know how hard it is to differentiate yourself in a crowded market and make your product stand out. Buyers struggle with it too (and your messaging isn’t helping!). From their perspective it’s about seeing the differences, figuring out what those differences will mean in their business context, getting proof, and being able to convey the gist to other internal stakeholders in a convincing way.

Analysis paralysis gets even worse when there are too many choices. Messaging becomes an arms race when competition is fierce, and often this pushes you to promise more, or use similar lofty language to your competitors.

For buyers, doubt can creep in about how products are actually different, what the must-have versus nice-to-have features are, and what kind of expectations for ROI are reasonable. It takes time to sort through all the noise, get educated, and feel satisfied with the depth of their evaluations. Here’s how some survey respondents described competition slowing down deal cycles:

“We represent a fairly new category. User education and competition with other solutions focused on adjacent areas. Annual budget timing.”

“Too many influencers in the process. Many players being evaluated as part of the process also delays decision making.”

“Market saturation, pricing, proposal processes, lack of synchronicity between decision makers.”

“Noise from the venture-funded, freemium SaaS tools”

5. Perfect is the enemy of good

Sometimes buyers don’t know what they want until they see it—or don’t see it. Other times buyers have a laundry list of requirements that seem impossible to satisfy. Gathering all of these requirements for features, integrations, usability, level of security, customizability, etc. takes time, and it’s not always a linear process, especially for less experienced buyers who don’t have a good sense of the scope of the project and who all it may touch up front.

When there are multiple buyers involved, a lot of money on the line, and various competitors in the mix, requirements can be hard to navigate. Here’s how some survey respondents described requirements slowing down deal cycles:

“Multiple decision-makers, custom requirements, changing requirements, stalled projects”

“Competitors, when multiple stakeholders get involved, technical validation and architecture planning.”

“Unclear objectives inside the customer – Priorities of multiple non-IT teams who have to sign off – Networking-based obstacles inside customer org”

How can you grease the wheels?

Copy what these effective vendors are doing right

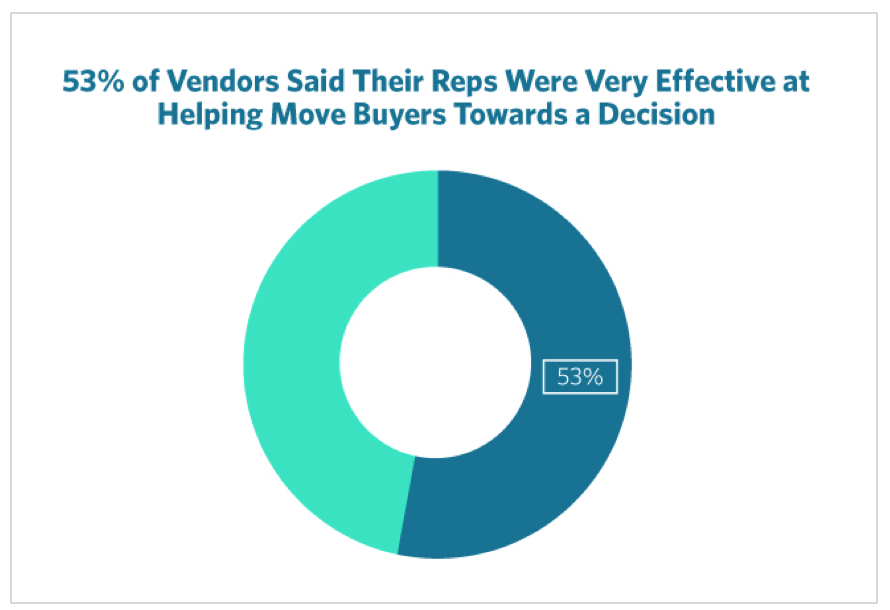

Another question in our survey asked respondents to rank the effectiveness of their representatives on a scale of 1 to 4, 1 being “not effective” and 4 being “very effective.”

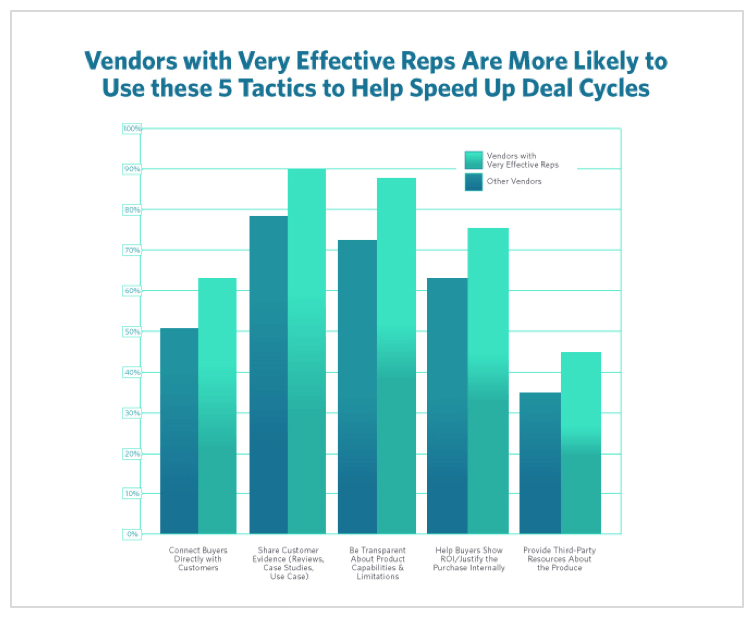

We also asked respondents to tell us which tactics they use to help speed up deal cycles. The group of vendors with very effective reps used the following 5 tactics more often than those vendors with less effective reps:

- Share customer evidence (reviews, case studies, use cases)

- Be transparent about product capabilities and limitations

- Help buyers show ROI internally

- Connect buyers directly with customers

- Provide third-party resources about the product

These are the strategies being used by the most effective tech vendors to speed up deal cycles. Other tactics used to speed up deal cycles—like providing straightforward information on your website and making access to marketing resources easier—don’t differentiate rep effectiveness. But across the board, very effective vendors are doing more and working smarter to accelerate sales.

Reviews can help

A review program can help arm marketing and sales teams in all five of these areas. Obviously, the reviews themselves are sharable customer evidence. And because they’re UGC (user-generated content), the content doesn’t take as much time or resources to craft as a case study.

It’s a lot easier for buyers to take your customers’ word for it when it comes to product limitations than just rely on your word alone. You may not be fully aware of the cons that matter to your buyers or be fully able to satisfy their concerns, but your customers sure can. They speak the same language.

You’ll want to make sure the reviews live on a trustworthy third-party site so that buyers will count them as an independent resource. But you can and should share the reviews with prospects! Reviews will help validate your value proposition, build trust, and accelerate the due diligence process.

For example, here are two salespeople weighing in on using review content from TrustRadius in their deals:

“I use TrustQuotes regularly for cold outreach, to introduce prospects to our company and reinforce our business value. It is helpful for backing up a claim that I make about the effectiveness or impact of our product.”

– Chris Gluckman, Sales Representative at Social Solutions

Read Chris’s full review here.

“I use TrustQuotes for prospecting and competitive information during the beginning and middle of the sales cycle. […] Emails using TrustQuotes to support competitive messaging typically got a 2 to 4 percent higher clickthrough rate, compared to our generic templates without TrustQuotes. They are well suited for using quotes to support competitive campaigns, or to help prospect into new accounts.”

– Sakthi Sambandan, Account Executive at Marketo

Read Sakthi’s full review here.

Depending on the review site you work with, reviewers can share not only their use case but also the impact the product has had on their goals. Make sure you’re investing in reviews that include a dedicated question about the value of your product. That social proof around ROI is a good first step towards helping your buyers set their own goals for success and justify the purchase internally.

Your review program can also help drive references—hand-raisers who want to become a reference after writing a review. With more references stepping up to the plate (without more effort on your marketing team’s part), you can more easily connect buyers directly with customers, and don’t have to rely on the same small pool.

Here are just a couple of examples of how marketing and sales leaders have used reviews to supercharge their teams:

“Overall the content we are able to create from these reviews has been tremendously successful in driving and maintaining engagement with our customers and prospects. […] This biggest impact has been to our locals/independent market where we are leveraging these quotes to accelerate conversions with our eCommerce product and sales enablement.”

– Ryan Bearden, Senior Director of Corporate and Customer Marketing at HotSchedules

Read Ryan’s full review here.

“We are always looking for ways to expand our positive online reputation. While we can get this through many online review websites, TrustRadius’s approach generates more authentic and impartial reviews that our sales team loves, while taking that task off my marketing team’s plate. We know that many of our won deals checked out our reviews on TrustRadius before purchasing, and we’ve even been able to generate new leads through TrustRadius’s Visitor Insights Dashboard.

We have only had it for a few months but we have been able to credit TrustRadius with some won deals. More directly, it has allowed our marketing team to concentrate on other tasks rather than chasing customers down to leave reviews. We have been able to uncover references that we may not have been able to discover quickly on our own. TrustRadius really shines when you have a customer success team that can build a reference library based on what is generated.”

– Steven Shattuck, Chief Engagement Officer, Bloomerang

Read Steven’s full review here.

Want to learn more about how other tech companies are accelerating deals with customer voice? Contact us and we’ll bring you up to speed. Our reps use all of these tactics themselves—we’ll let you tell us whether or not they’re very effective!