Accounting Software Statistics and Trends

The International Monetary Fund recently announced its formal analysis of the COVID-19 pandemic’s effect on the global economy. They predict a “deep” recession that will last until 2021, when we will start to see some recovery. Despite this grim economic outlook, the accounting software market is poised for growth.

According to a report by Fortune Business Insights, the accounting software market will expand to $416.23 million by 2024, expecting to finish 2020 at $347.31 million which is up $12.81 million from 2019. Given accounting software’s ubiquitous importance in business operations, it is a less volatile market compared to other software categories that have been more deeply impacted by the pandemic.

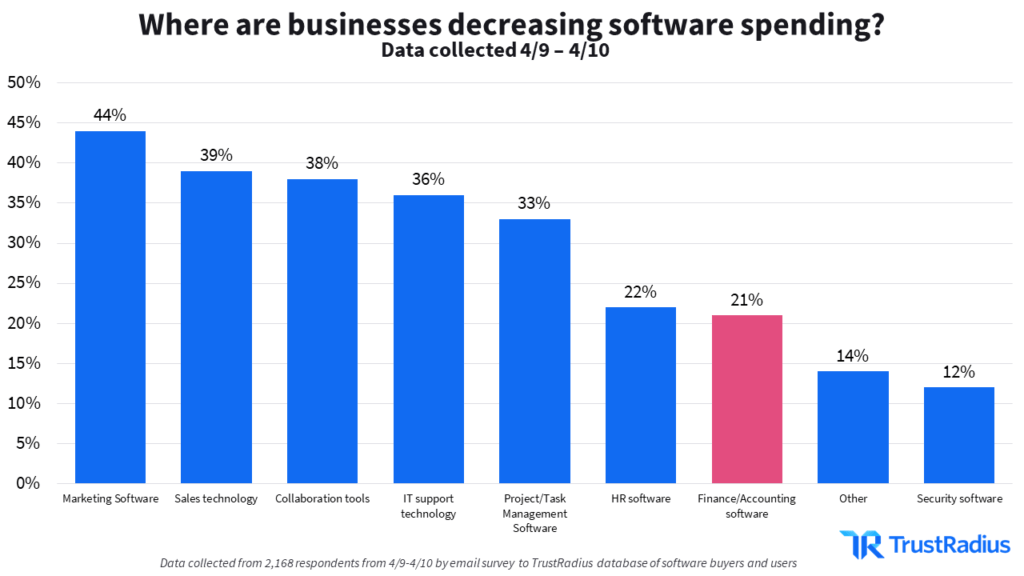

When we polled buyers about expected changes to their software spending, 21% reported that their organization would be decreasing their budget for finance and accounting software. This is to be expected while businesses tighten their budgets and begin tracking expenses with a fine-toothed comb. However, they require tools to manage said budgets. While software buyers may not be rushing to upgrade their accounting software right now, they’re still continuing to use it.

For accounting software vendors, this means the market is more competitive than ever.

Quick Access

Accounting Software: A Year in Review

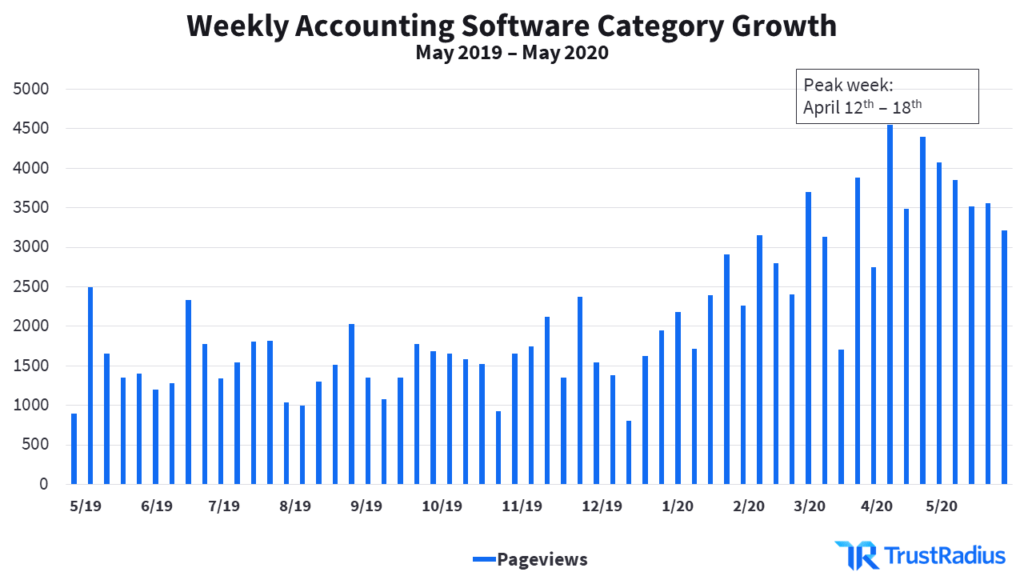

Accounting software has consistently been a popular category on the TrustRadius platform. 503 long-form reviews were published in this category in the past year, and traffic for the accounting software category averages over 2,689 pageviews per week. This high buyer interest makes accounting software one of our top 20 categories for new reviews within the past year, with thousands of long-form reviews published to date.

Looking at total traffic to the accounting software category on TrustRadius from May 2019 to May 2020, we observed a major and expected increase leading up to April during the normal US tax season. However, while we would expect to see interest in this category fall almost immediately, compared to June of last year, we are still seeing 1.7x as much traffic.

Due to COVID-19, the United States has extended its official tax season to July 15. Because of this, we expect the accounting software category to maintain a higher level of traffic through the end of the year, whereas traditionally it wanes after the end of the U.S. tax season in April.

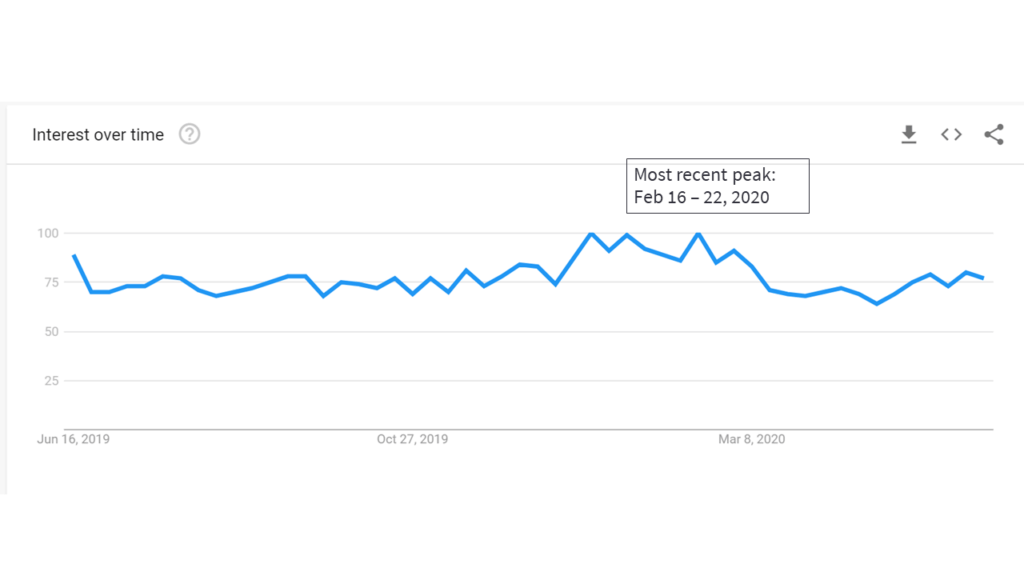

Looking at worldwide Google searches for accounting software within the past year, the highest peak was in February of 2020—the middle of the traditional U.S. tax season before an extension was made for the pandemic.

While search interest in accounting software peaked in February according to Google Trends, on TrustRadius, our peak thus far this year has been in May. This indicates that accounting buyers are increasingly coming to TrustRadius due primarily to the high-quality content on our site. We have made significant SEO investments over the past year that have led to 10X traffic growth on our platform overall—and we’ve seen similar increases across other categories that indicate increased trust from both Google and software buyers across our community.

The Impact of COVID-19 on Accounting Software

Given that the U.S. tax season has been extended, the typical spike in interest we see in the first quarter of the year has kept up momentum into June. COVID-19 has also made many businesses consider adopting cloud-based accounting software as their workforce goes remote.

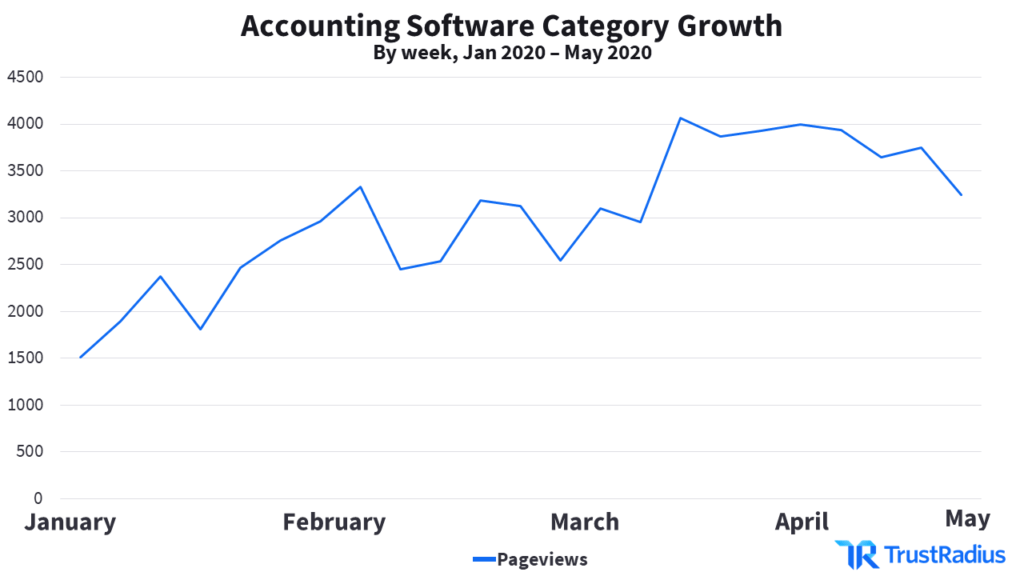

However, as many companies also rely on contract accountants, an important portion of accounting software buyers are self-employed individuals who have more flexibility with choosing their accounting software. They also have more motivation to reconsider their accounting software on more regular intervals than enterprise buyers. Their financial situations may also be continuing to change on an ongoing basis as they grapple with the effects of the pandemic on their business or freelance contracts. Looking at the accounting software category’s growth for the past few months, we see a steady increase in pageviews that gets a bit steeper with the institution of stricter quarantine policies worldwide.

Major players in the accounting software space like Sage Intacct and Intuit have published online resource centers to help accountants and financial managers navigate COVID-19. These resources help professionals navigate the challenges of a newly remote workforce and aim to help people understand recently-passed legislation that will affect business finances. By providing additional resources at no cost, accounting software vendors are not only assisting existing customers, but also signaling to potential buyers that they are responsive to changes in the market.

The Most Popular Accounting Software Right Now

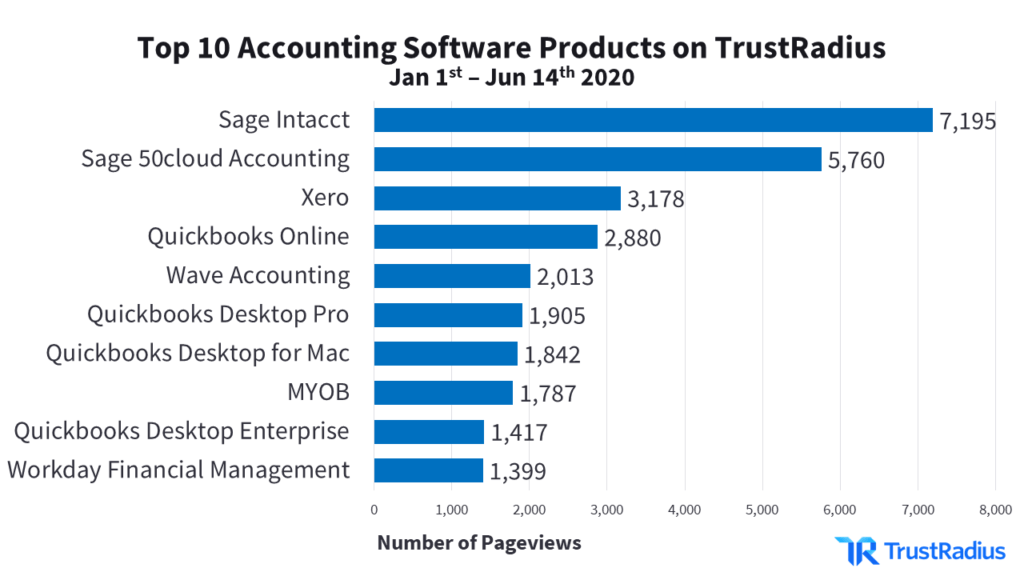

The most popular accounting software products on TrustRadius are a mix of cloud-based tools as well as those that are available as on-premise solutions. The graph below shows the top accounting software on TrustRadius this year so far.

| # | Product | Traffic |

| 1 | Sage Intacct | 7,195 |

| 2 | Sage 50cloud Accounting | 5,760 |

| 3 | Xero | 3,178 |

| 4 | Quickbooks Online | 2,880 |

| 5 | Wave Accounting | 2,013 |

| 6 | Quickbooks Desktop Pro | 1,905 |

| 7 | Quickbooks Desktop for Mac | 1,842 |

| 8 | MYOB | 1,787 |

| 9 | Quickbooks Desktop Enterprise | 1,417 |

| 10 | Workday Financial Management | 1,399 |

Sage Intacct leads the pack with nearly 1.5x as much traffic as its nearest competitors. However, Intuit’s Quickbook series of accounting tools makes up 40% of traffic among the top 10 products. Quickbooks is one of the most popular accounting suites around the world, and is extremely popular with small businesses and the self-employed.

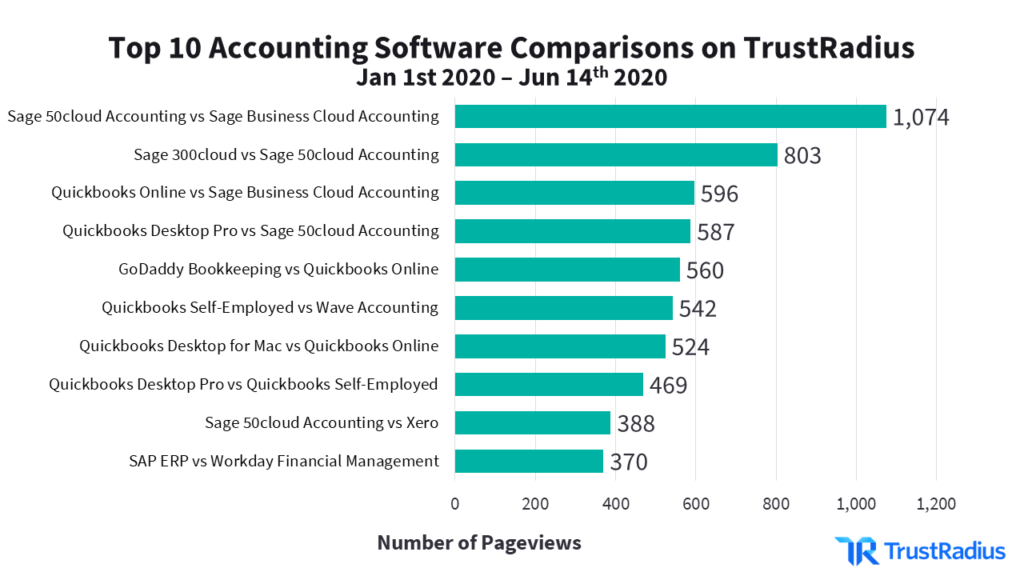

Products from the same vendors are also commonly compared to each other, rather than competing vendors’ products. This suggests that buyers can struggle to distinguish between different product lines and versions that the largest vendors offer. For example, the key difference between Sage 50cloud Accounting and Sage Business Cloud accounting is that one is better for “solopreneurs” and personal accountants, whereas the other is better for small businesses with multiple employees and an in-house finance department. With 71% of businesses still contracting out their accounting services, it’s important for personal accountants to ascertain whether a product is more suited to their multi-client workday versus focusing on one organization’s finances.

Who’s Shopping for Accounting Software?

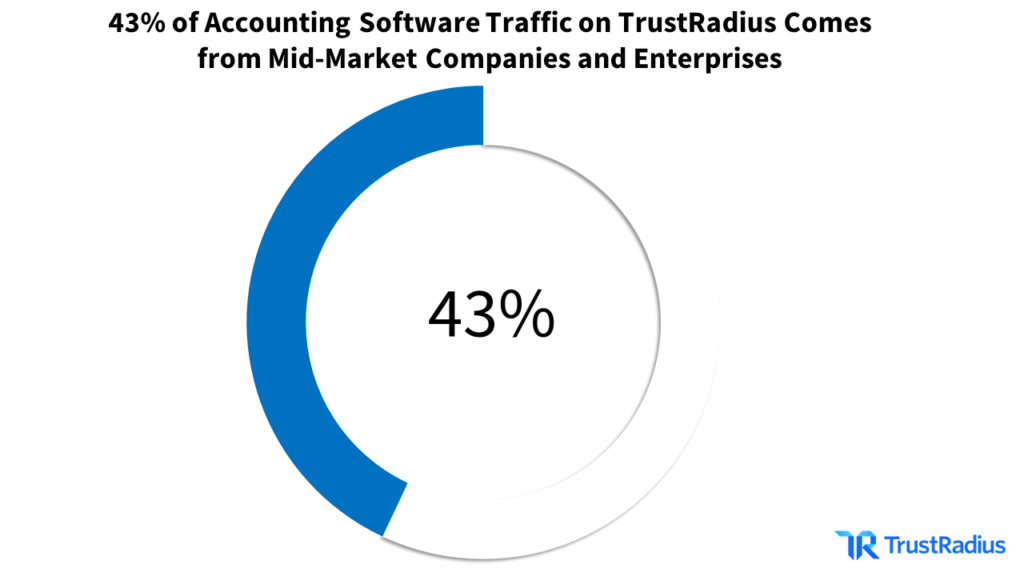

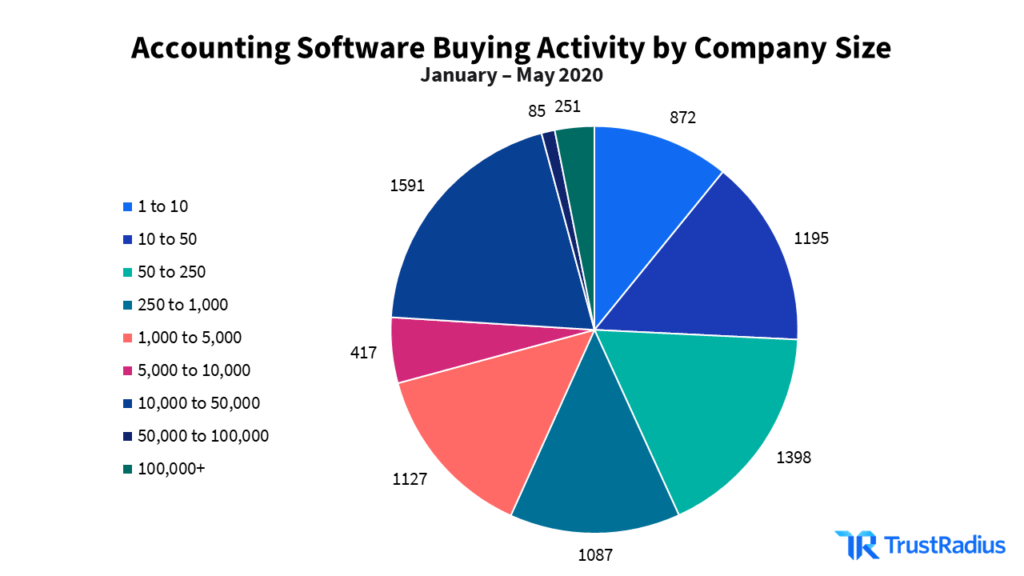

Since the beginning of 2020, 57% of traffic to the Accounting software category has come from small or midsize companies (1-1,000 employees). 43% of Accounting software traffic has come from enterprises (1,000+ employees).

Accounting Software Buying Activity by Company Size

The pie chart below shows an even more granular view of Accounting traffic from different company size segments, based on True Intent signals.

Accounting software is used consistently across small and mid-size businesses, which explains why our Top 10 list of most popular products in this category currently includes several designed for buyers in the SMB segment. However, “smaller” enterprises appear to be using accounting software at similar rates to SMBs. The fact that popular enterprise-level products like Quickbooks Desktop Enterprise, SAP ERP, and Workday Financial Management are also on this list reflect a strong presence of enterprise buyers.

Given the complexity of their business processes, many enterprises will opt for Enterprise Resource Planning (ERP) systems instead of dedicated accounting software. ERP systems provide enterprises with procurement, order management, CRM, supply chain management, inventory management, logistics, and human resource management functionality in addition to accounting features.

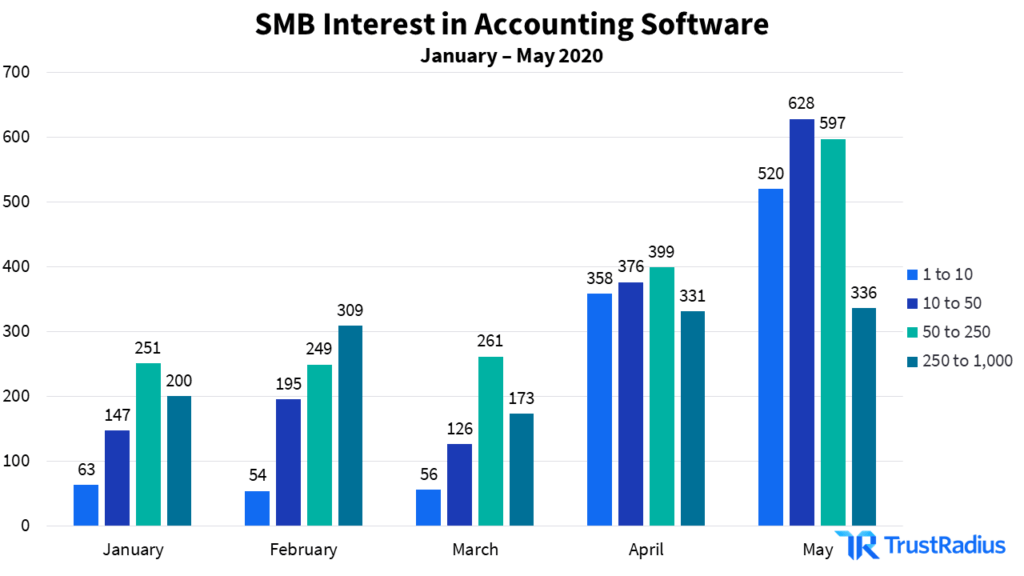

SMB Interest in Accounting Software

Interest in accounting software for May was nearly triple what it was in February. This can be attributed to the tax extension and COVID-19 motivating businesses to re-evaluate their current accounting software choice.

Accounting Software Trends

Facing a global recession and potential second waves of the COVID-19 pandemic, we assume that businesses will continue to invest in accounting software to meet demands for financial flexibility. Here are some of the most important news and key statistics from the accounting software space today:

- The global market for accounting software’s value is expected to reach $11.8 billion by 2028. (Accounting Today)

- In Quickbooks’ latest update, the company released its Paycheck Protection Program (PPP) Center to help employers set up and manage their own programs. (Accounting Web)

- H&R Block recently announced its acquisition of Wave Financial (“Wave”), parent company of Wave Accounting, for $405 million (Finextra)

- 67% of accountants prefer cloud accounting to traditional on-premises solutions (Sage Practice of Now report)

- 62% of finance and accounting software buyers use reviews to make a purchase decision (TrustRadius 2020 B2B Buying Disconnect)

Buyer Engagement on TrustRadius

Over the past few months as worldwide interest in accounting software has increased, TrustRadius traffic for this category has also significantly increased as buyers and vendors who seek high quality research and accurate insights on accounting software will find that both of these outcomes depend on a high volume of users and meaningful content.

The TrustRadius platform currently attracts over 1 million monthly visits, with monthly peaks of over 17,000 pageviews to the accounting software category in 2020. Not only have we seen a steady increase in overall traffic in the accounting software category this year—we’ve also seen a significant increase in buyer engagement. The average time spent on-page for the accounting software category was 4:46 in January 2020. This increased by 36% to 6:30 in March 2020.

Accounting software buyers are highly engaged on the TrustRadius platform because of the high-quality content we provide. Across the 2,125 reviews of accounting software on TrustRadius, the average review contains 272 words. G2 reviews average 130 words in comparison. Detailed answers to key questions, such as use cases, pros, cons, and ROI, make TrustRadius the most valuable resource for buyers seeking accounting software reviews.