The 2021 B2B Buying Disconnect

Hey! We’ve got new research to share.

2020 is Changing How People Buy Software

The coronavirus pandemic sparked severe changes in the B2B tech world. Marketers at software companies already saw a gap between the way they market technology and the way buyers want to engage with them. COVID-19 intensified that disconnect.

Buyers are now demanding self-service options that not all vendors offer. In a market where most interactions are online, buyers are increasingly concerned about data privacy and security—enough to ruthlessly cut products from their shortlist. They’re also frustrated by the marketing tactics that vendors love to use.

The B2B Buying Disconnect exposes these gaps and helps vendors learn how to market better in the ever-changing world of 2021.

10 Key Takeaways From the Report:

![]() Millennials are changing the B2B tech market.

Millennials are changing the B2B tech market.

![]() Tech buyers really hate B2B marketing tactics.

Tech buyers really hate B2B marketing tactics.

![]() Here are the marketing tactics that actually work.

Here are the marketing tactics that actually work.

![]() Buyers use 5 main info sources to make decisions.

Buyers use 5 main info sources to make decisions.

![]() Today’s buyers demand self-service options.

Today’s buyers demand self-service options.

![]() Data security concerns are having a big impact.

Data security concerns are having a big impact.

![]() Covid-19 changed the buyer’s journey.

Covid-19 changed the buyer’s journey.

![]() The 2021 tech spending forecast looks pretty good.

The 2021 tech spending forecast looks pretty good.

What is the B2B Buying Disconnect?

The TrustRadius B2B Buying Disconnect is an annual research report that reveals year-over-year changes in business technology buying and selling. The data in this year’s study comes from a survey of 1,134 technology buyers and vendors conducted in September 2020.

Click here for more information on the report’s methodology and demographics.

New B2B Marketing Statistics For 2021

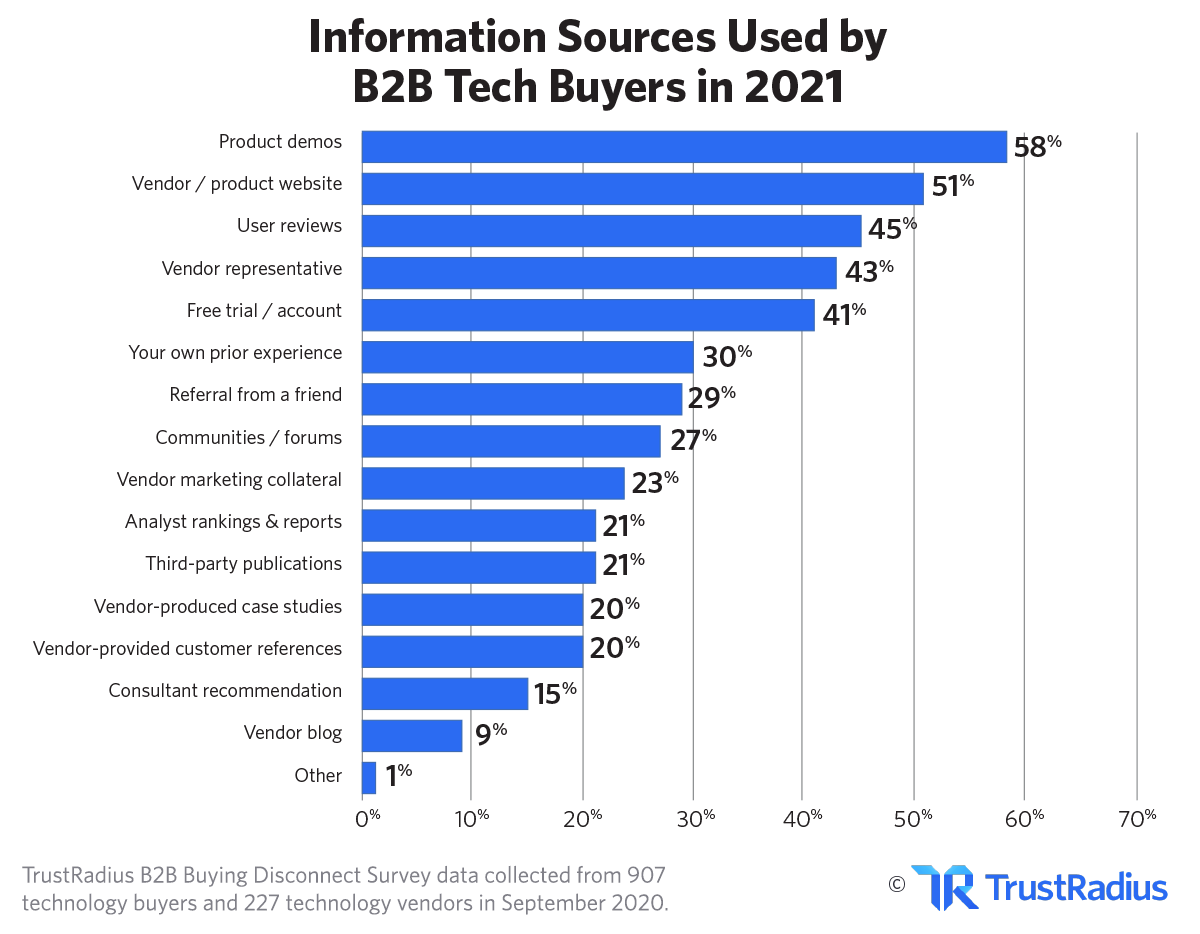

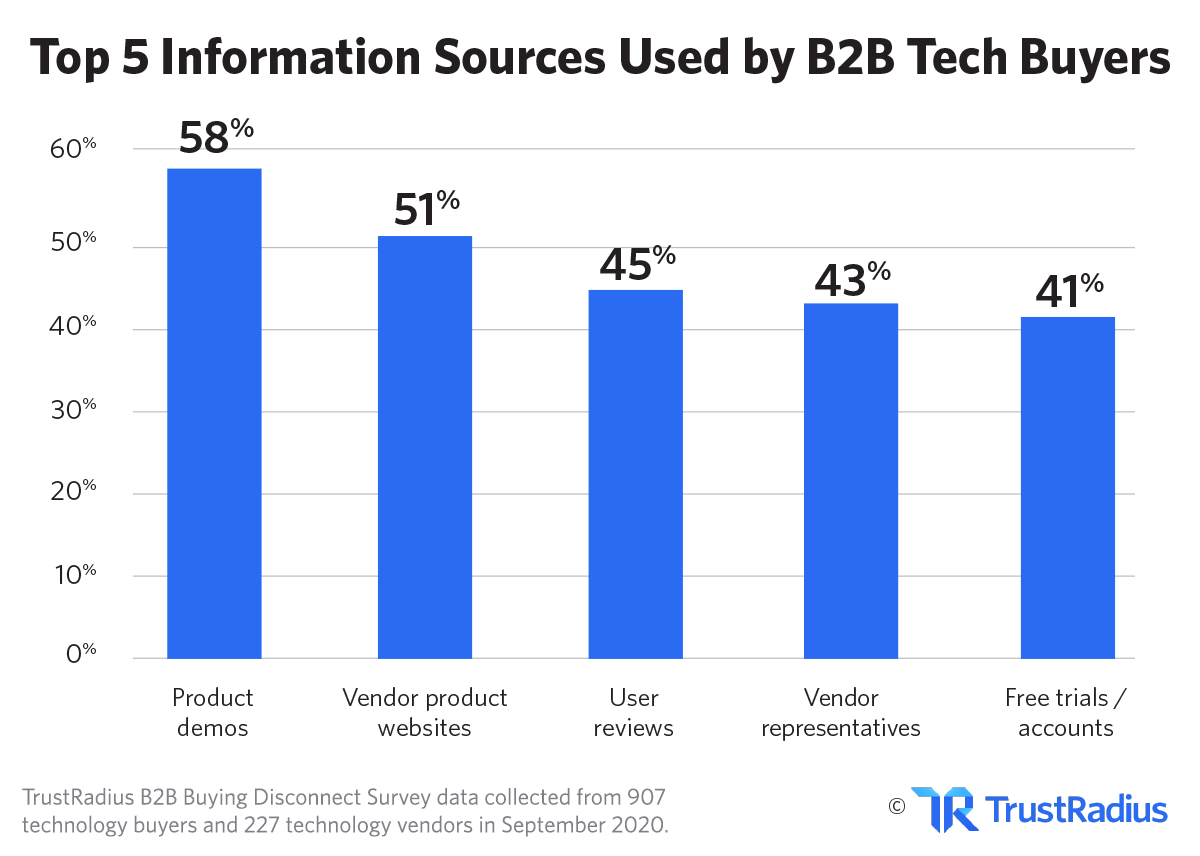

- Buyers consistently use these top 5 information sources to make purchasing decisions: Product demos, Vendor/product websites, User reviews, Vendor reps, and Free trials/accounts.

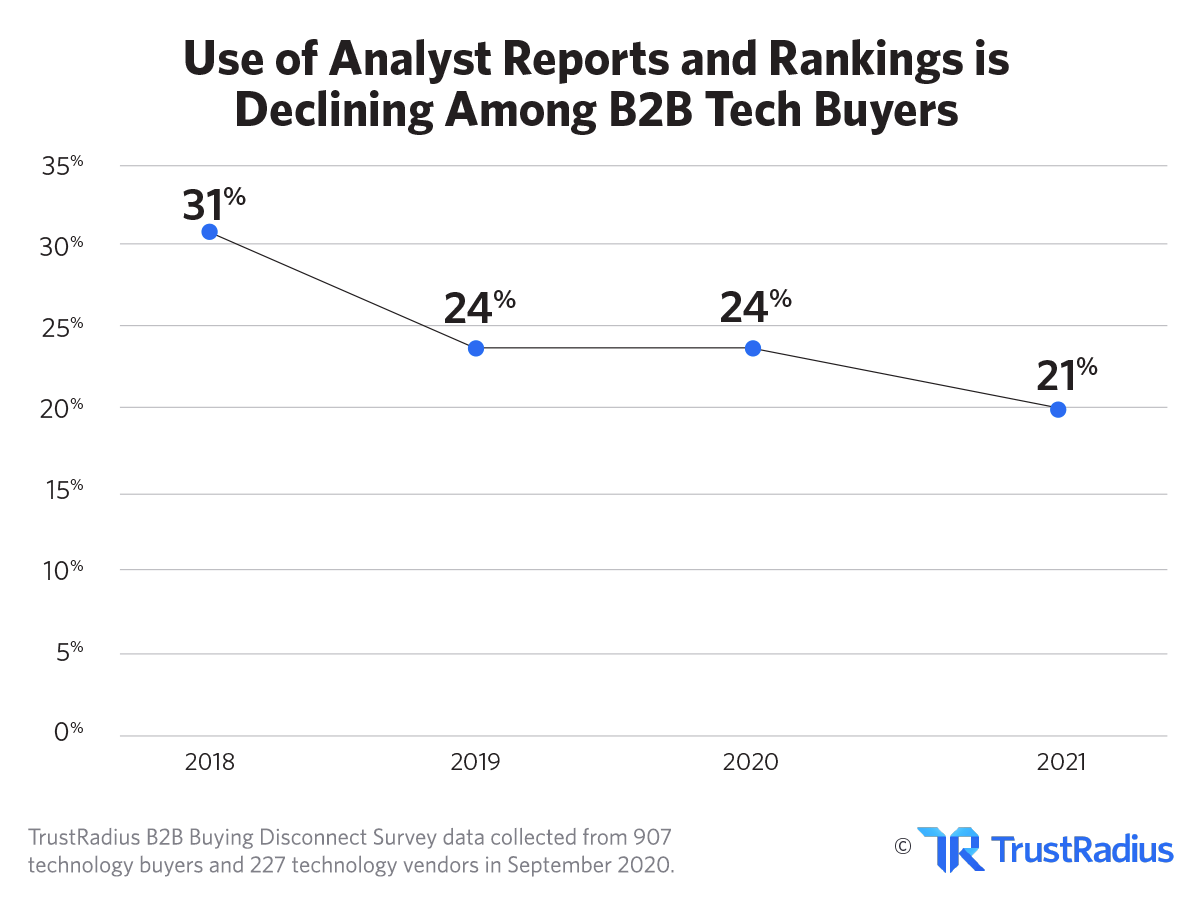

- 45% of buyers use reviews during their purchase process. Less than half that number (21%) use analyst rankings and reports.

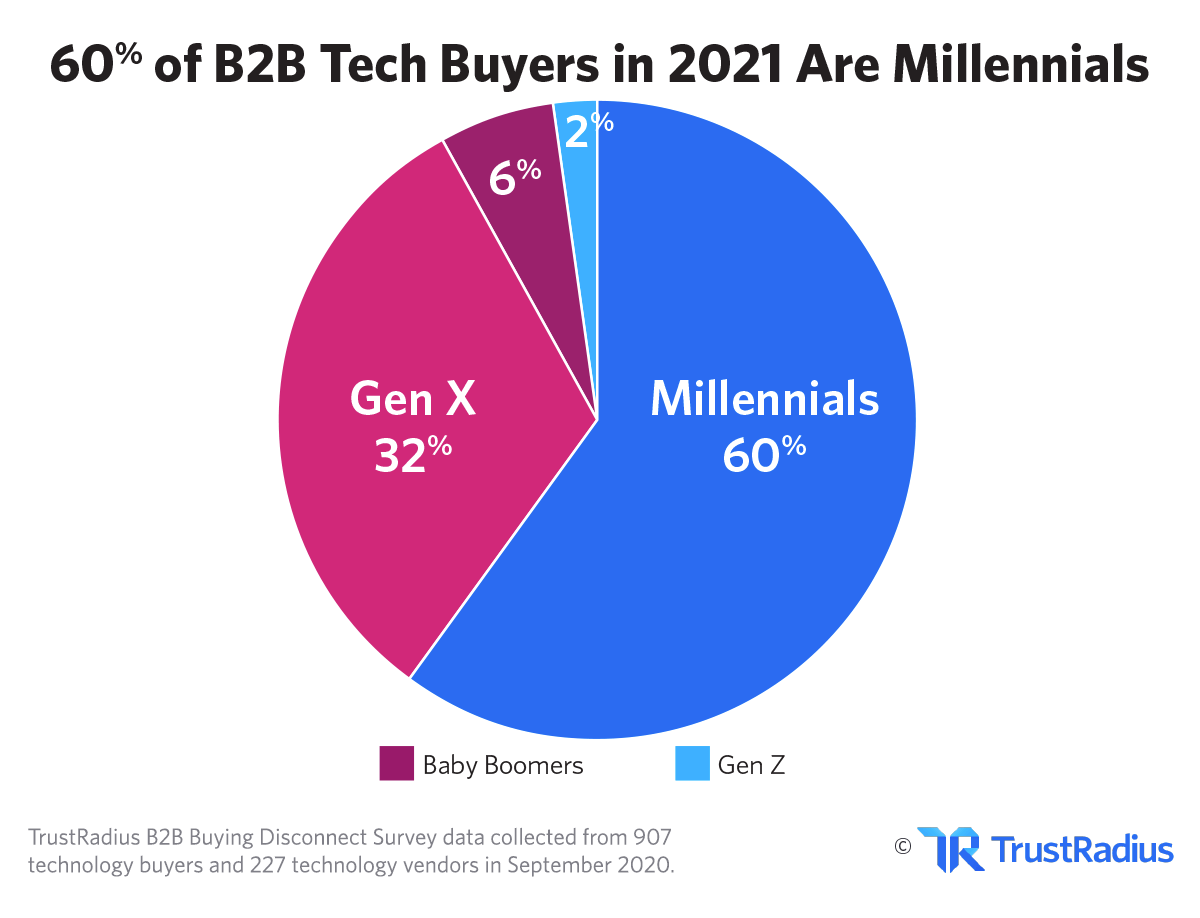

- 60% of all B2B tech buyers are millennials (age 25 – 39), and 2% are from Generation Z (24 and younger).

- 87% of buyers want to self-serve part or all of their buying journey. 57% of buyers already make purchase decisions without ever talking with a vendor representative.

- Gen Z and Millennial buyers are 2X more likely than older generations to discover a product by searching online.

- The average buyer uses 6.9 information sources to make a purchase decision, which is a 35% increase from last year.

- Due to the pandemic, 33% of buyers spent more time researching products before making a purchase this year. 49% of buyers spent time doing extra research because of data security concerns.

- Nearly half of buyers (49%) report decreased tech spending in 2020 due to the pandemic. Most of those buyers plan to spend more on video conferencing solutions (64%) and online collaboration software (53%) in 2020.

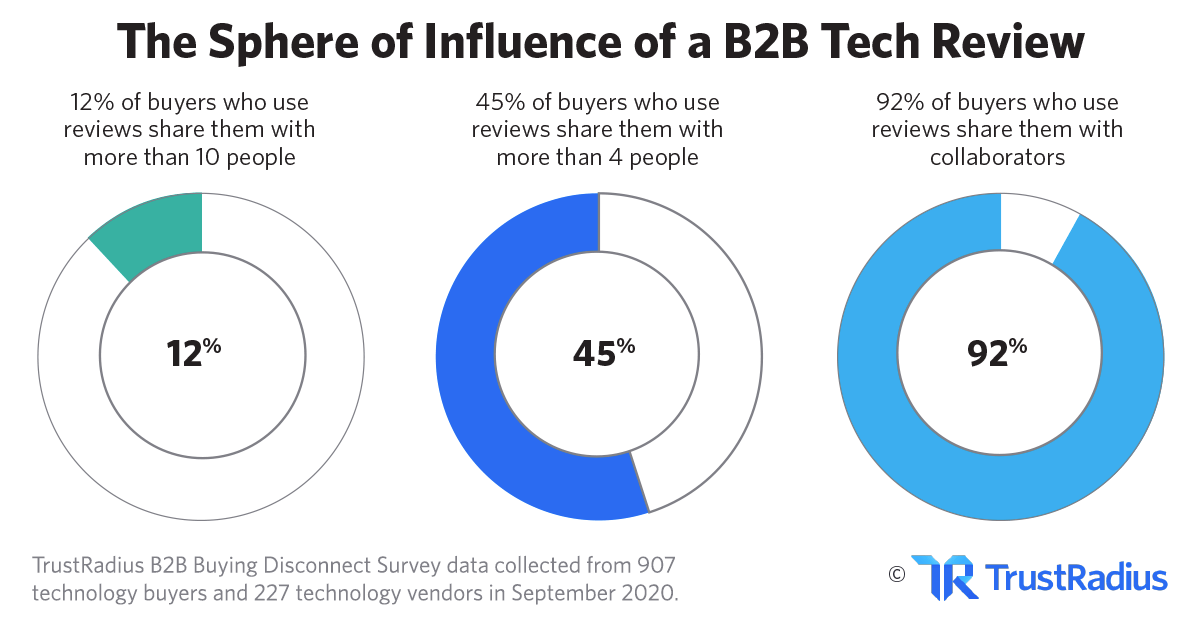

- 92% of buyers who use reviews share them with at least one other person. 2 out of 5 buyers share B2B tech reviews with four or more other buying committee members.

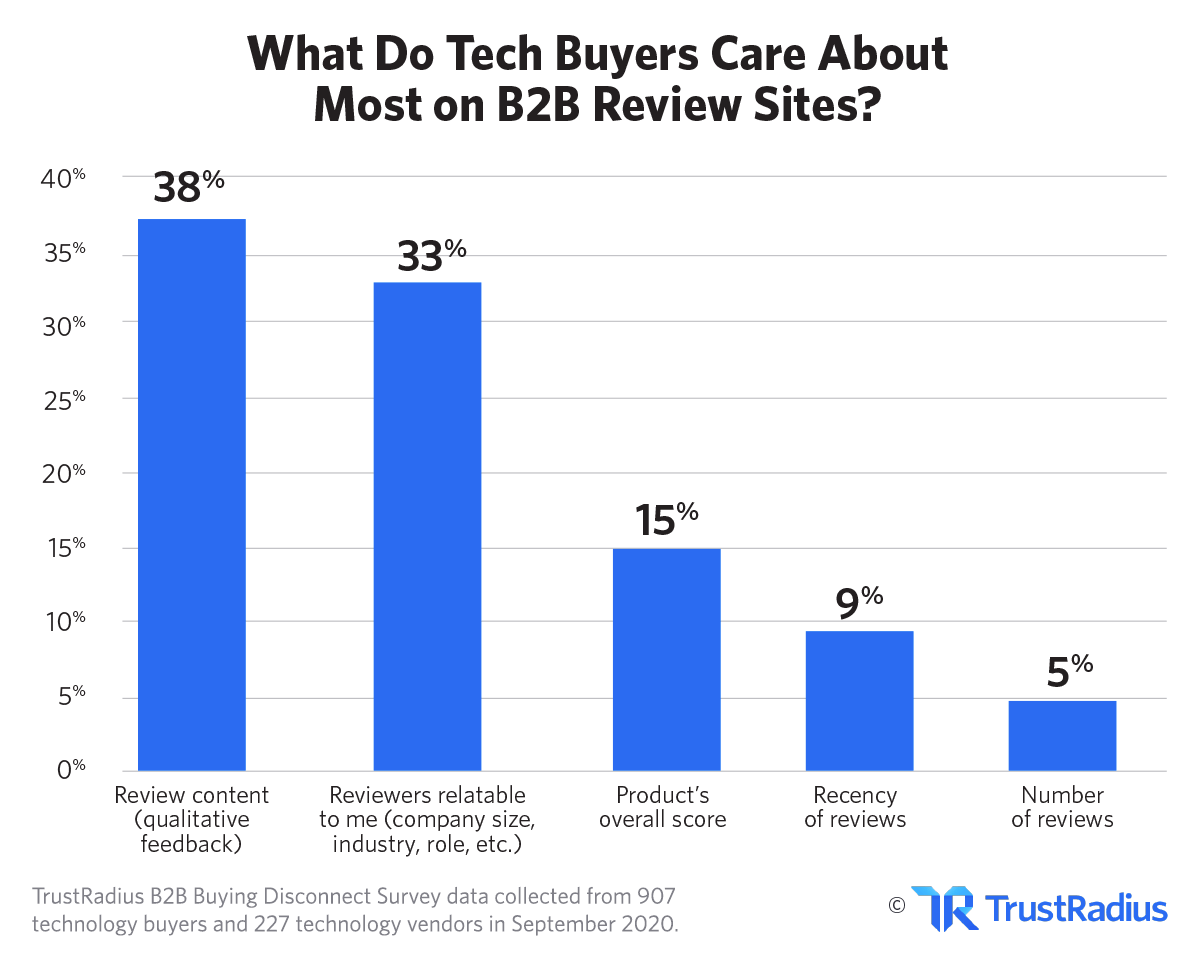

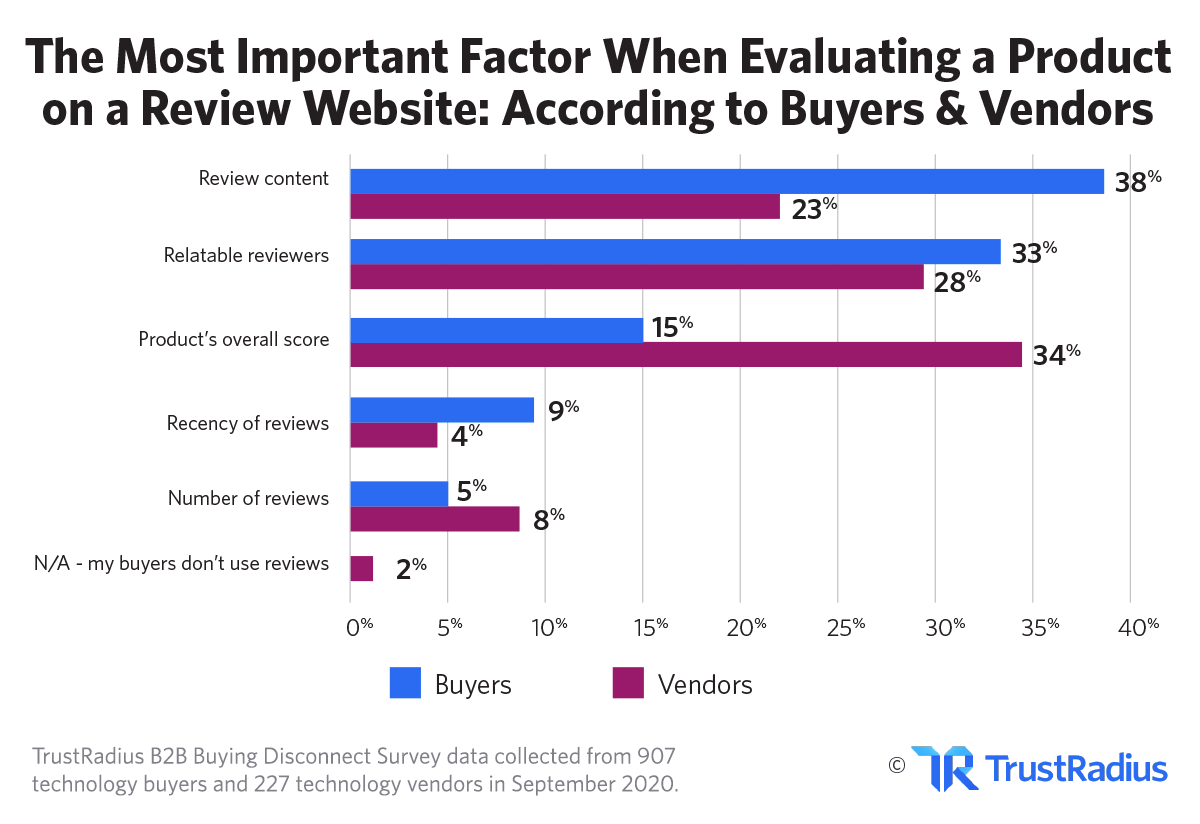

- The number one thing buyers care about on B2B review sites is review content. However, vendors believe the number one thing buyers care about is a product’s score.

Learn how to build a B2B review program

1. Millennials are changing the B2B tech market.

Millennials now make up the biggest demographic of tech buyers, representing 60% and growing fast. Gen X currently represents 32% and Baby Boomers represent only 6% of tech buyers. Gen Z makes up 2% of buyers right now, but that number will increase rapidly.

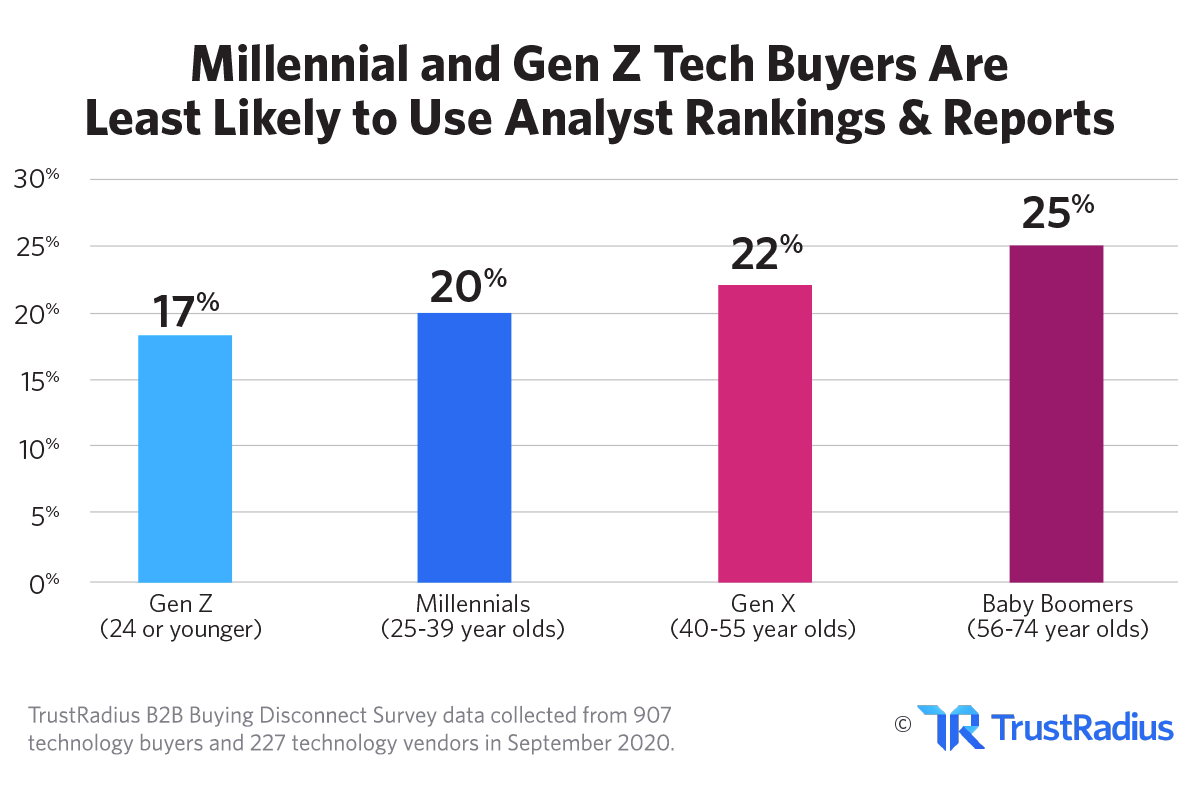

Our data shows that millennials and Gen Z buyers are less likely than older generations to use analyst rankings and reports while purchasing business technology. Over the past few years, buyer usage of analyst rankings and reports has steadily decreased. This year only 21% of buyers say they’re using analyst rankings and reports, which represents a 15% decrease from last year. This is a serious concern for traditional analyst firms.

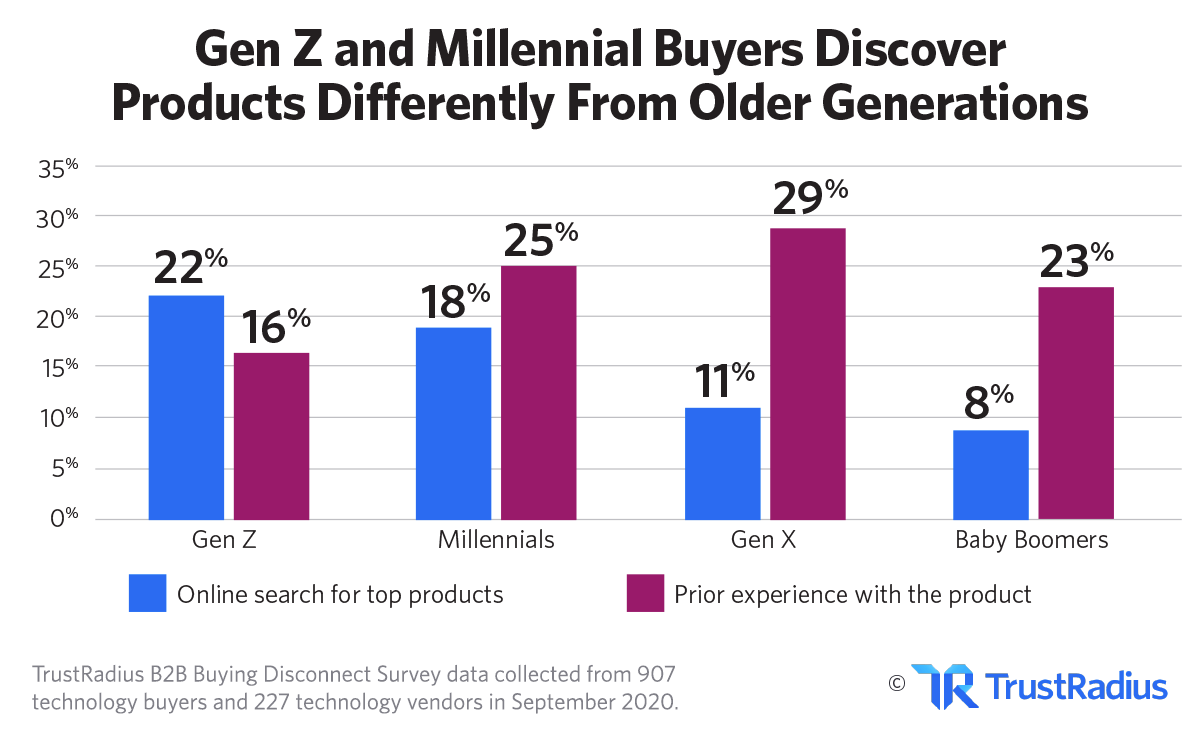

Gen Z (24 and younger) and Millennial buyers (age 25-39) are also more likely than older generations to first find out about a product by searching online. Baby boomers are more likely to hear about tech products from their own prior experience.

2. Tech buyers really hate B2B marketing tactics

When asked what their marketing pet peeves were, buyers’ number one and two responses were marketing emails and sales cold calls. While this isn’t exactly surprising (who loves cold calls?), it highlights the growing disconnect between tech marketers and their buyers.

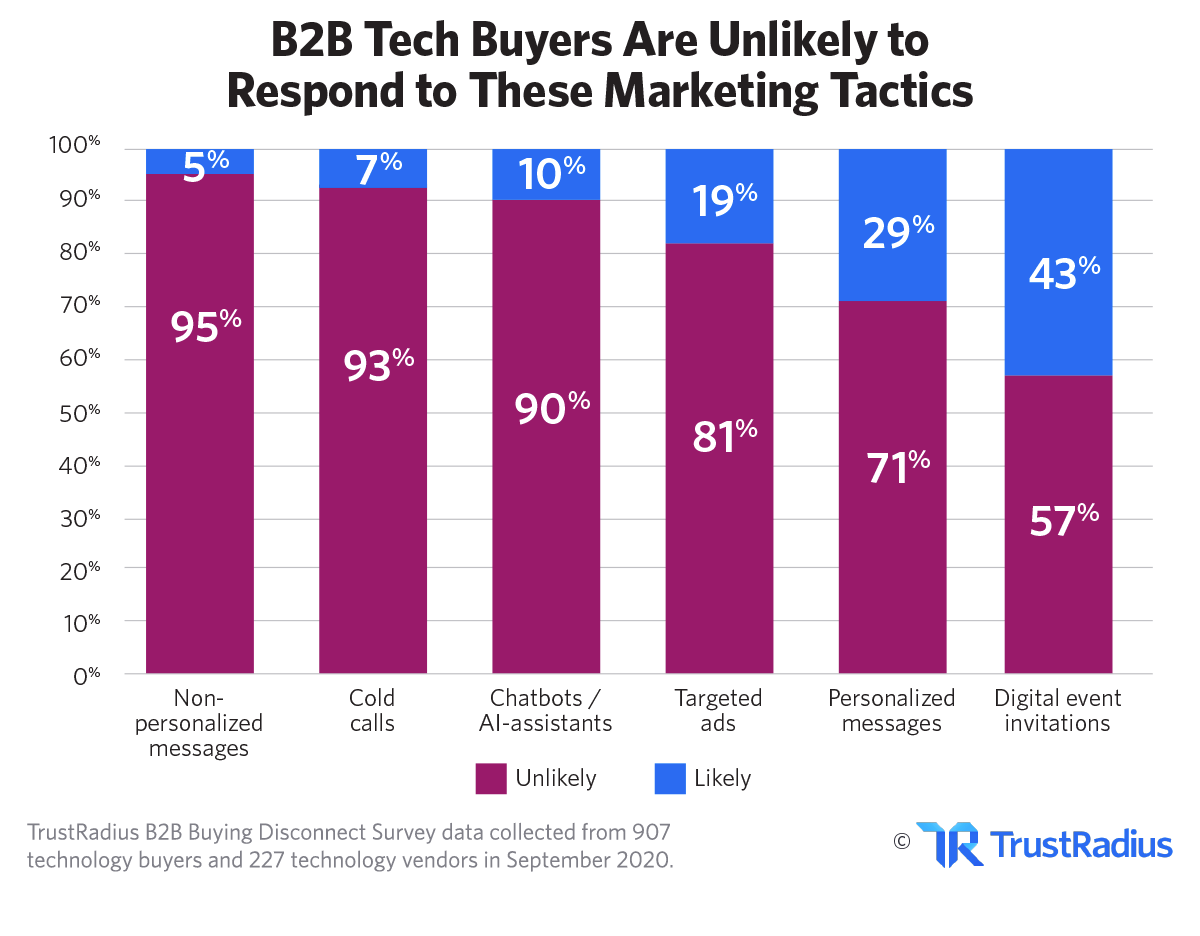

Digging deeper, we asked buyers how likely they would be to respond to these tactics. Unsurprisingly, over 90% of buyers say they are “not likely at all” to respond to non-personalized messages and cold calls.

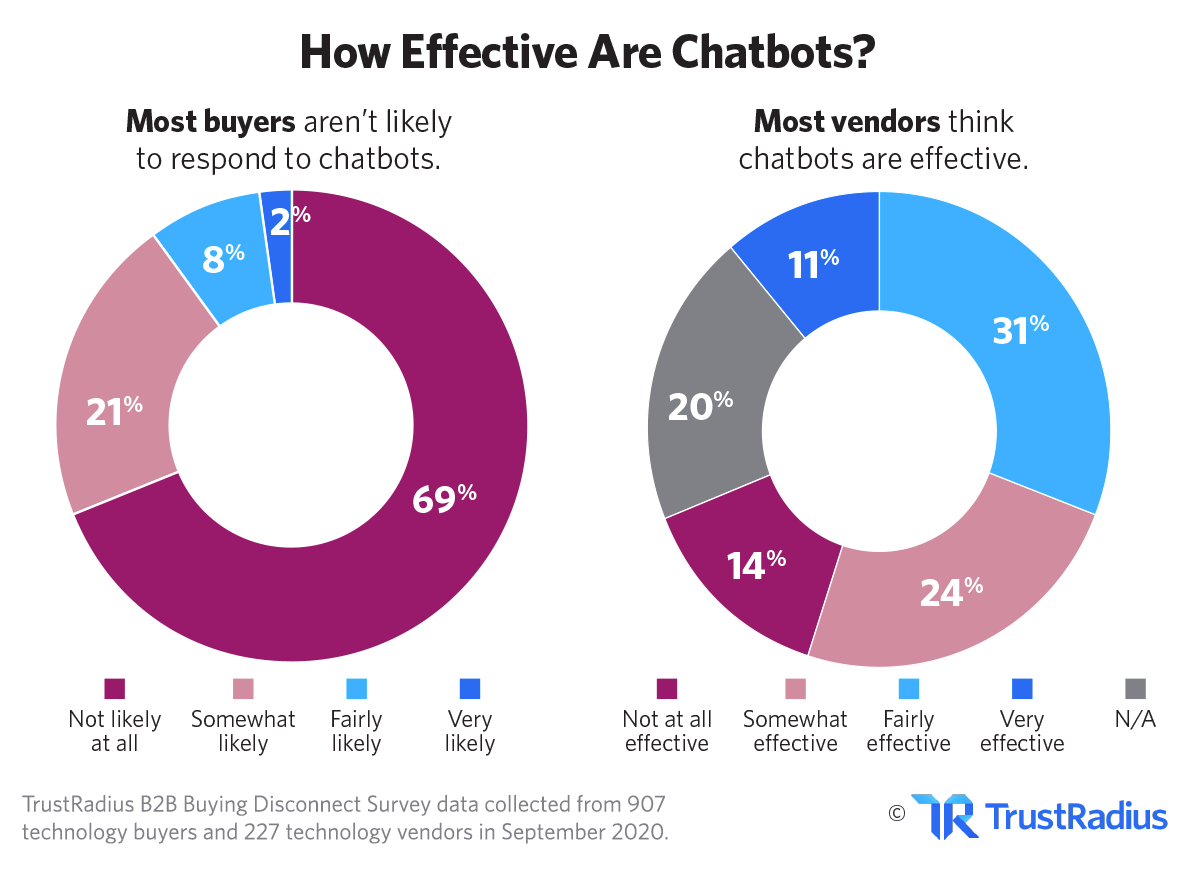

According to our survey results, vendors generally perceive these tactics to be more effective than they are. Take chatbots for example. 42% of vendors believe they are an effective marketing strategy, but only 10% of buyers are likely to respond to a chatbot. This data is shocking, especially in light of the increasing popularity of chatbot and virtual assistant software platforms.

Only 10% of B2B tech buyers are likely to respond to a chatbot (when the message is relevant). @TrustRadius #B2BDisconnect

![]()

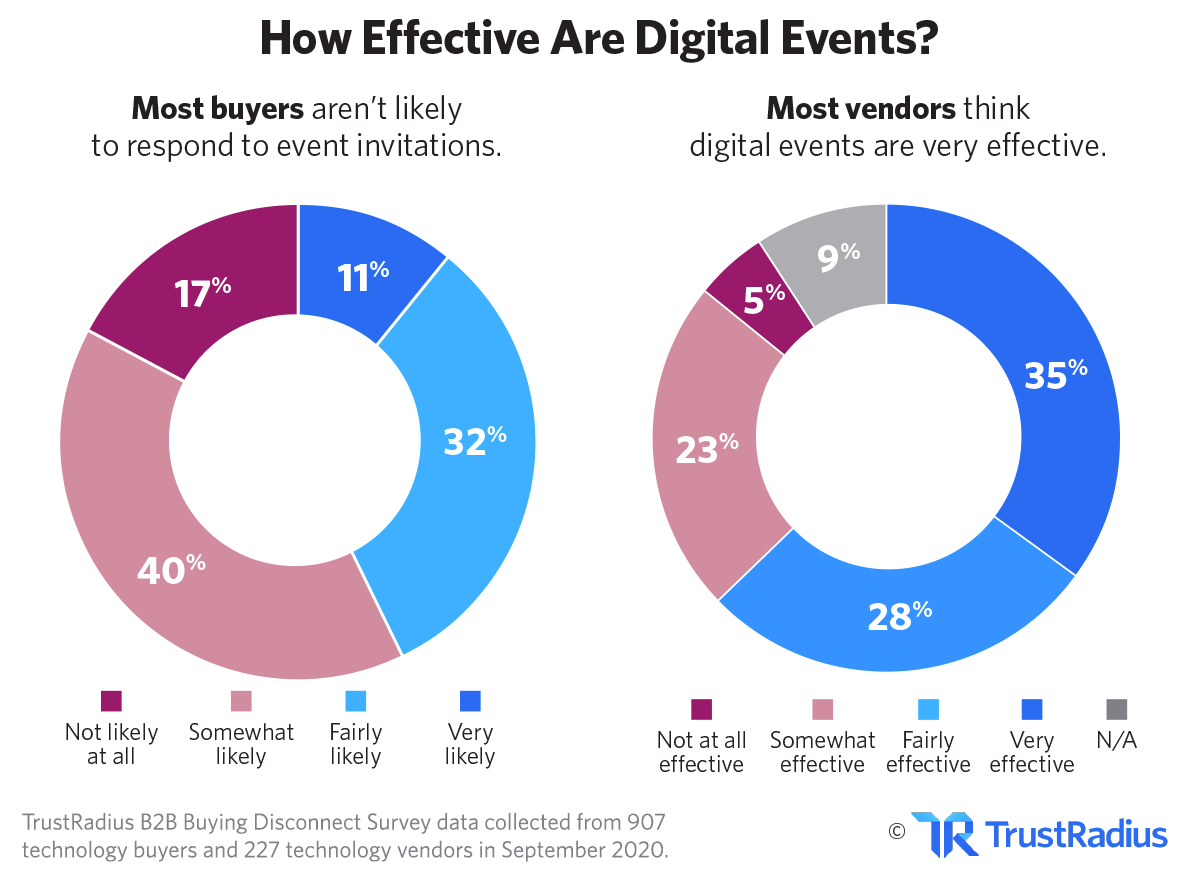

There is also a smaller, but still visible gap surrounding digital events. 63% of vendors believe hosting digital events is effective. But 57% of buyers say they’re unlikely to respond to digital event invitations.

In July 2020, TrustRadius conducted a study on the impact of COVID-19 on digital events and found that 53% of people felt there were too many virtual events. Our research also found that close to 50% were receiving more than four digital event invitations per week.

3. Here are the marketing tactics that actually work.

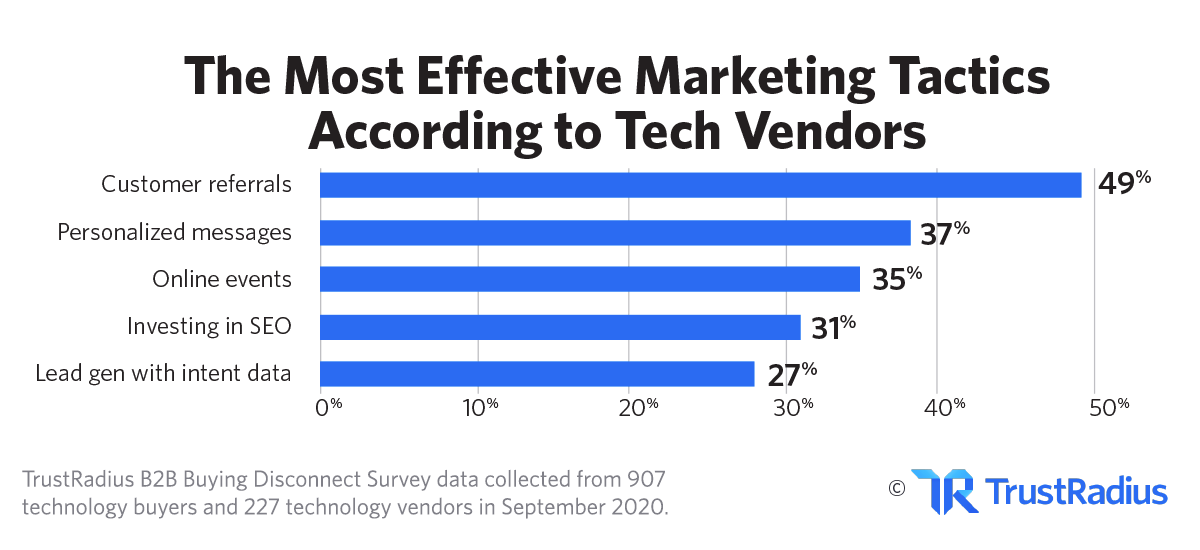

According to software vendors, the top 5 B2B marketing tactics during the pandemic are customer referrals, personalized messages, online events, investing in SEO, and lead generation with intent data.

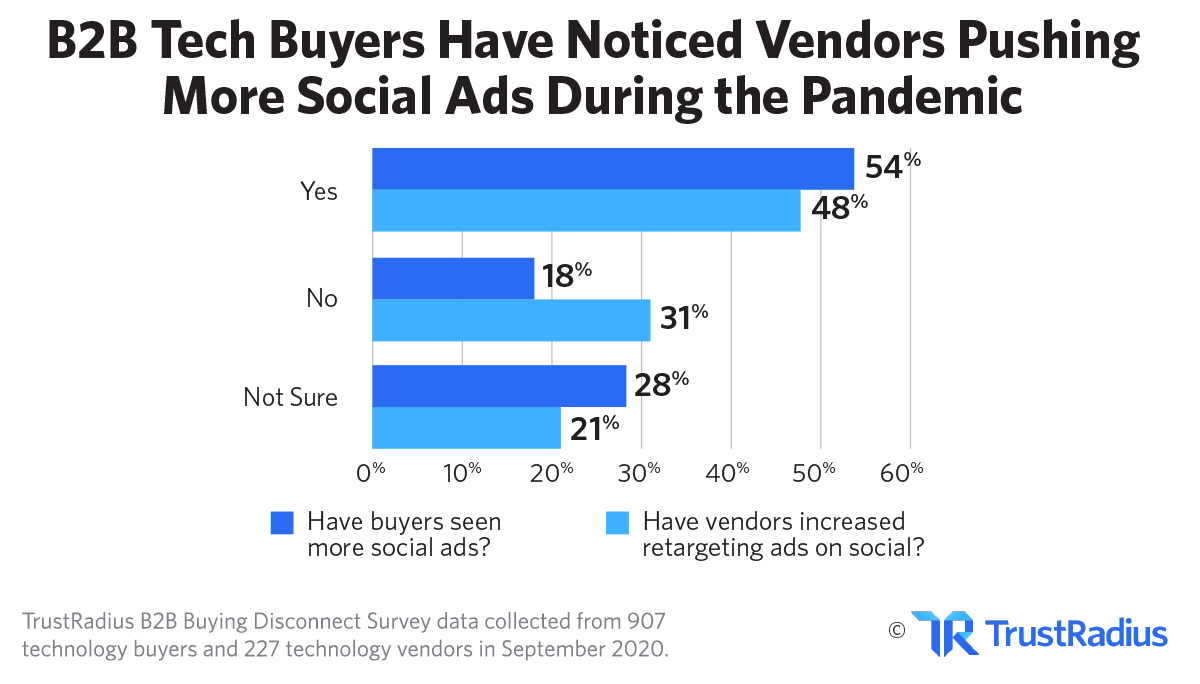

A majority (55%) of vendors also think retargeting ads are an effective marketing strategy. 48% have increased targeted advertising on social platforms since the start of the pandemic.

54% of buyers report seeing more advertisements on social platforms during this timeframe.

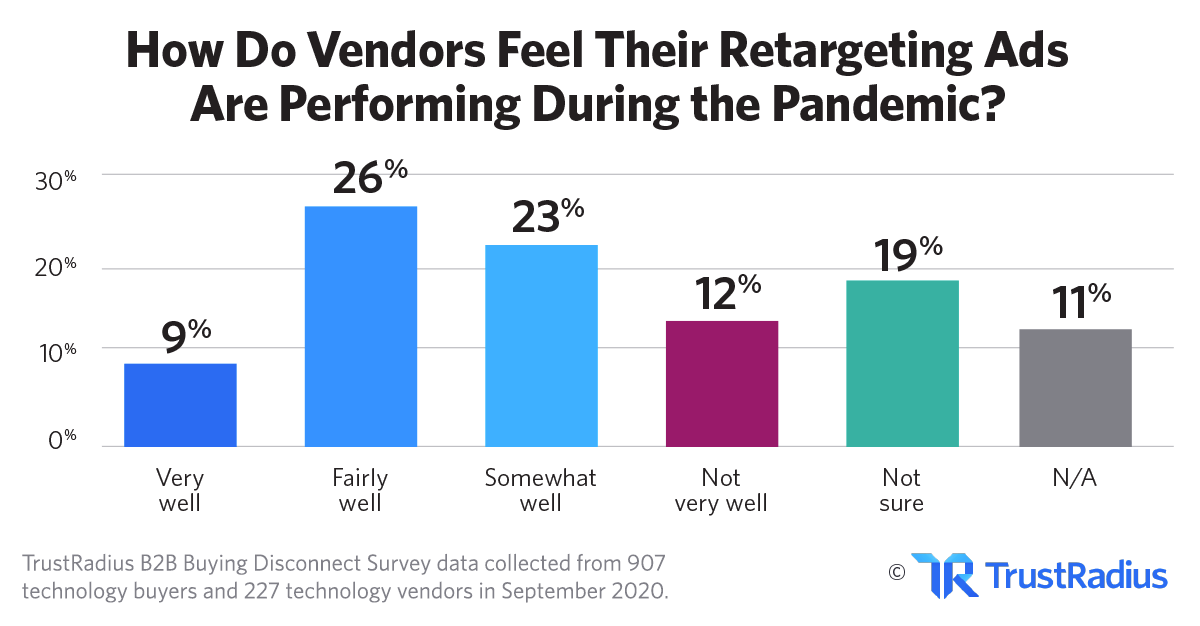

When asked how well their retargeting ads have been performing, about 35% of vendors said either fairly well or very well. 12% of tech vendors feel these ads are not performing well.

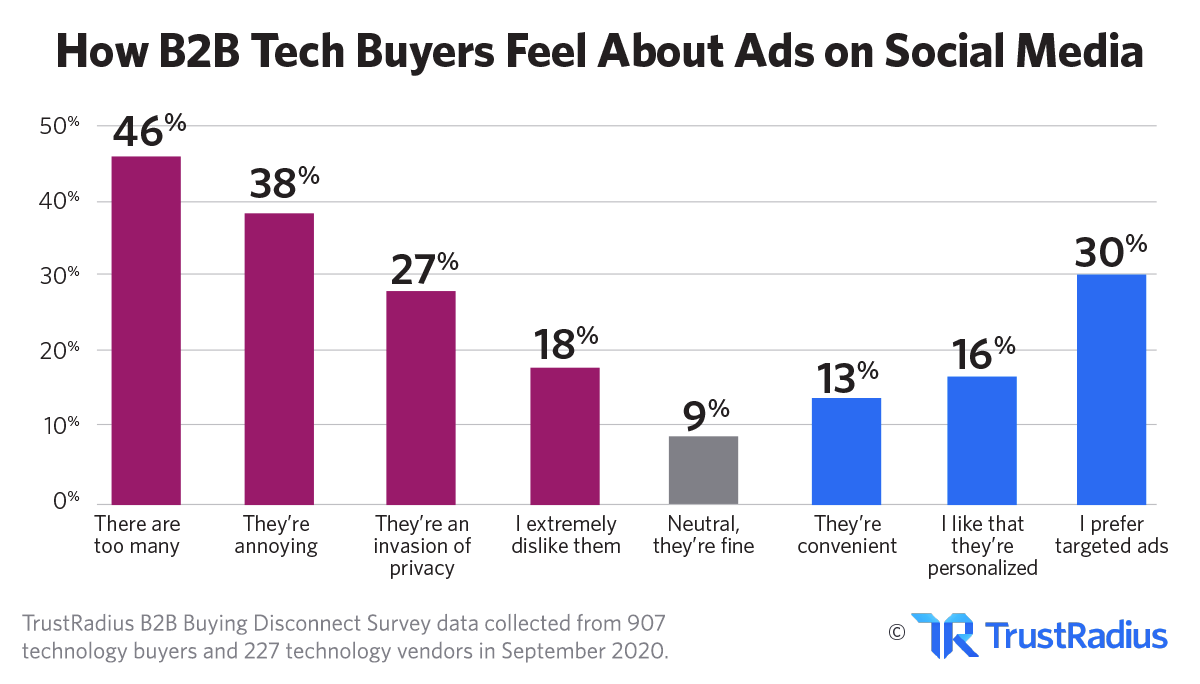

While retargeting ads may be effective for now, the average buyer has mixed feelings about seeing more advertisements on social media.

- About 2 out of 5 buyers think there are too many online ads

- 38% find them annoying

- Over a quarter of buyers feel they are an invasion of privacy

- About 1 out of 3 would rather receive targeted than non-targeted advertisements

- 13% of buyers think online ads are convenient

- 16% like when ads are personalized

4. Buyers use 5 main info sources to make decisions.

The average B2B tech buyer today consults 6.9 information sources before making a purchase. That’s a 35% increase from last year, when buyers consulted an average of 5.1 information sources.

The average B2B tech buyer consults 6.9 information sources before making a purchase. @TrustRadius #B2BDisconnect

![]()

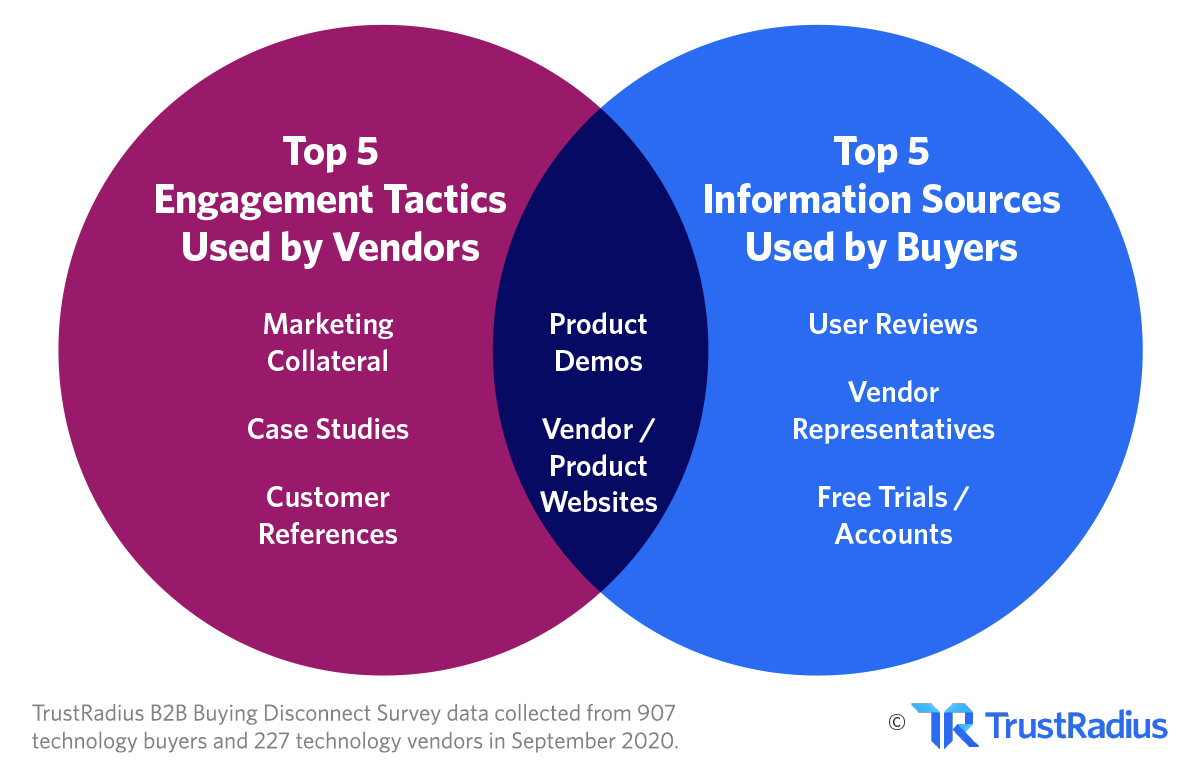

For five years in a row, B2B tech buyers have relied on the same top five resources to help them make purchasing decisions:

- Product demos

- Vendor/product website

- User reviews

- Vendor reps

- Free trial/account

There’s a big disconnect between the resources buyers rely on and tactics vendors use. Both vendors and buyers use demos and vendor/product websites. Beyond that, buyers see user reviews, vendor representatives, and free trials/accounts as the next most critical sources of information. Vendors are more focused on marketing collateral, case studies, and customer references.

The graphic below illustrates the disconnect between what customers care about and what B2B companies talk about in their marketing. To make the most out of their marketing budgets and remove friction for buyers, vendors should invest more in user reviews, rep enablement, and product-led growth.

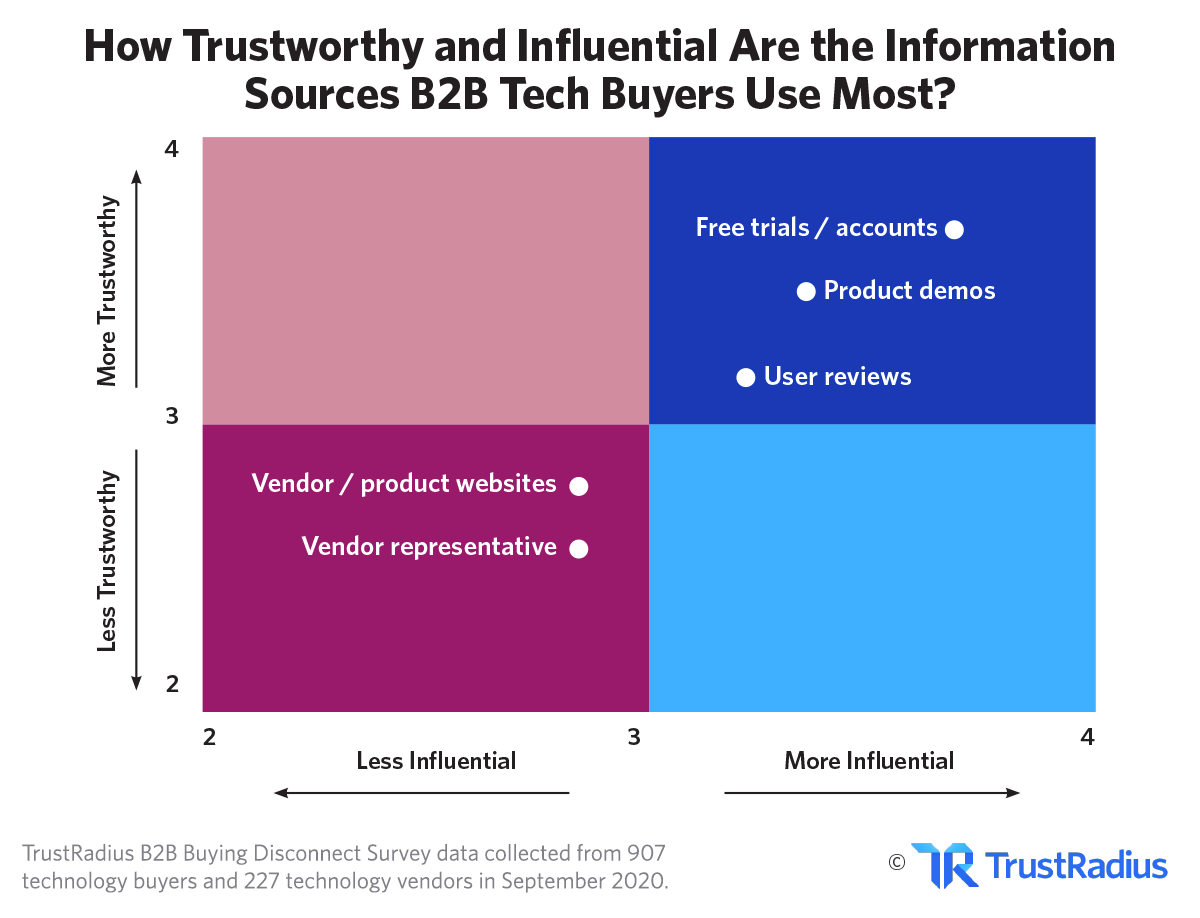

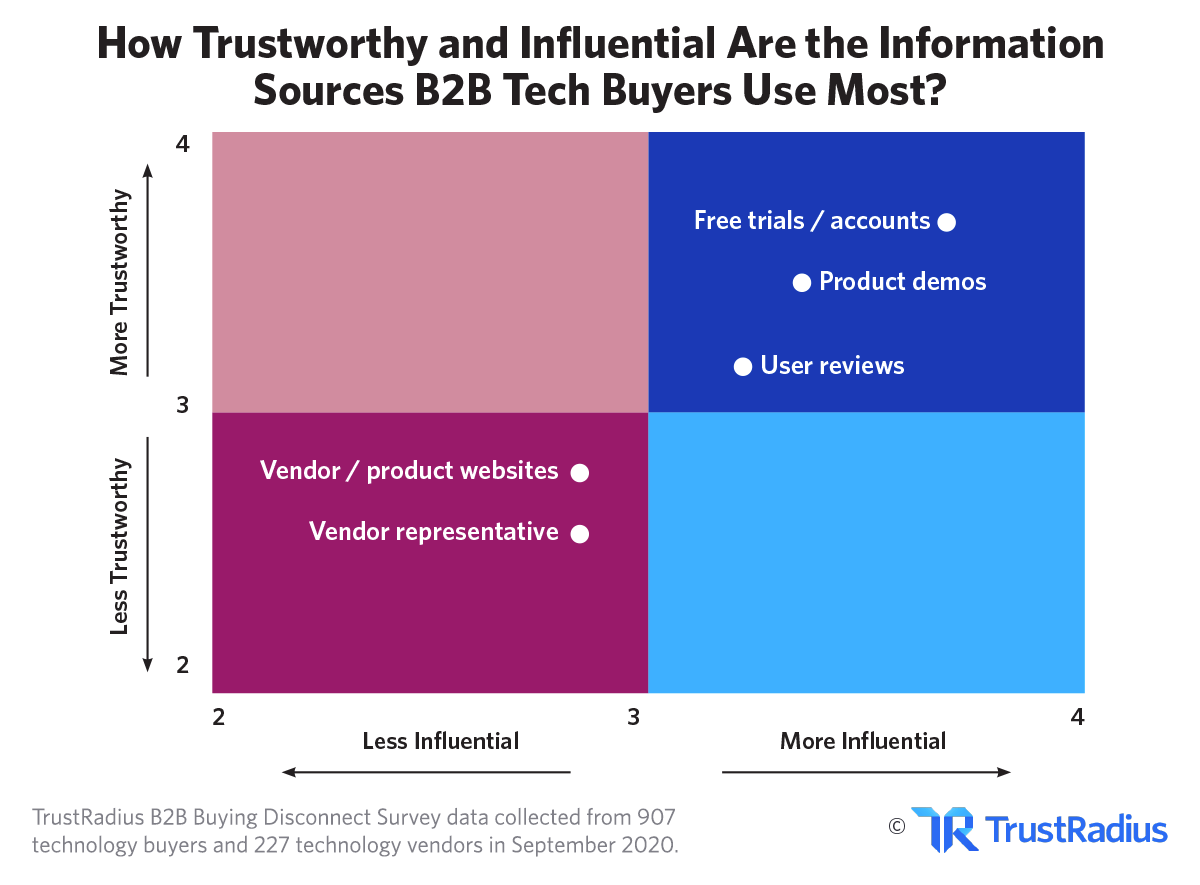

When it comes to trustworthiness and influence, not all information sources or engagement tactics are created equal.

The graph below shows that three out of the top five information sources used by buyers—free trial/account, product demos, and user reviews—lead in terms of their level of trustworthiness and influence over purchasing decisions. Only one of these, product demos, is on the list of the top five engagement tactics used by vendors.

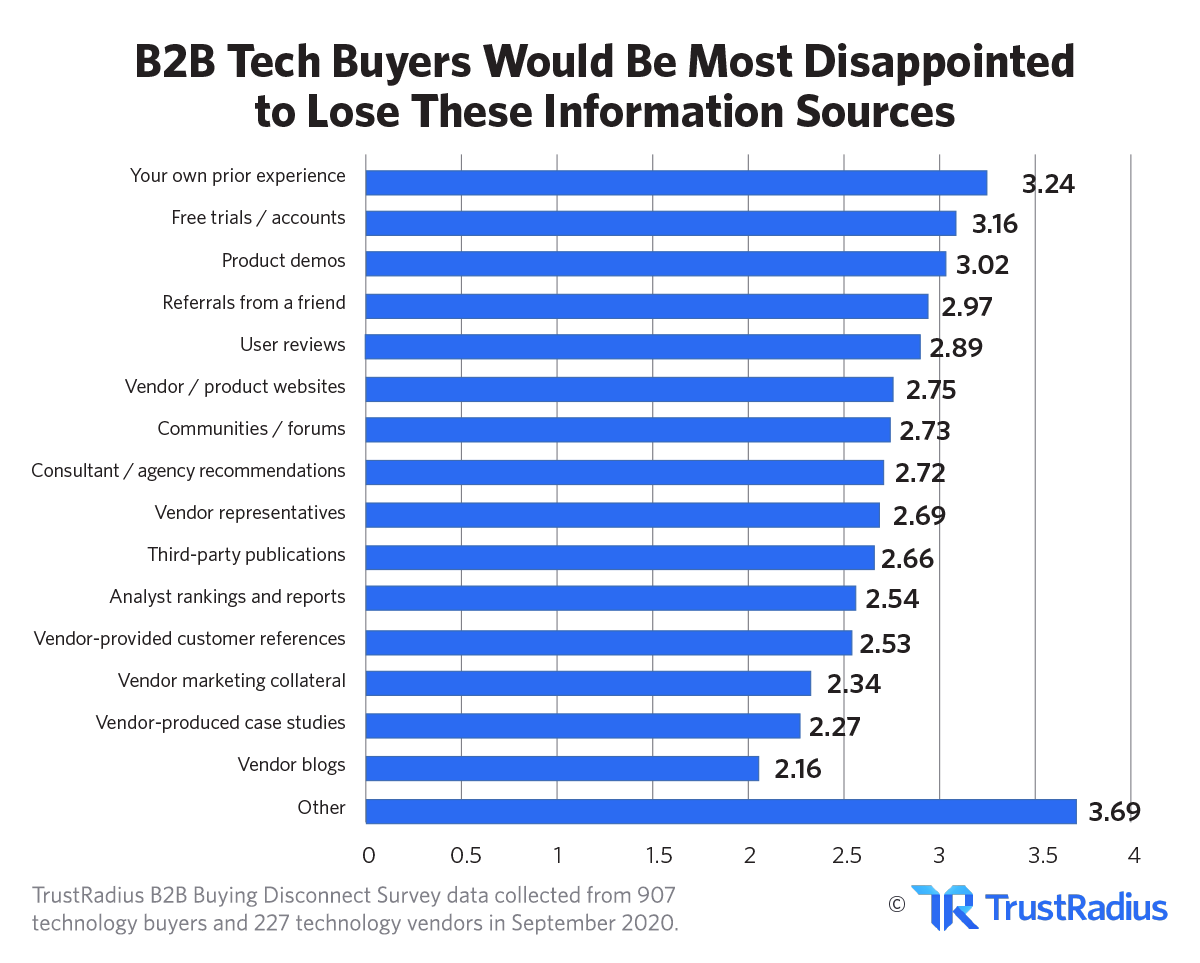

Out of all the resources that buyers use to make decisions, we asked them which they would miss the most if they were taken away. In order of disappointment, those resources are:

- Prior experience

- Free trial / account

- Product demos

- Referral from a friend

- User reviews

Software marketers should note the following key takeaways from this data:

- Reviews are one of the top five information sources that buyers would be most disappointed to lose.

- Buyers would be less upset if the following resources were taken away: analyst rankings & reports, vendor representatives, communities and forums, and a vendor/product website.

- Buyers would be least disappointed if they no longer had access to 3 out of 5 of vendors’ most crucial engagement tactics: vendor-provided customer references, marketing collateral, and case studies.

Start driving high-quality reviews on TrustRadius

Claim your free profile today

5. Today’s buyers demand self-service options.

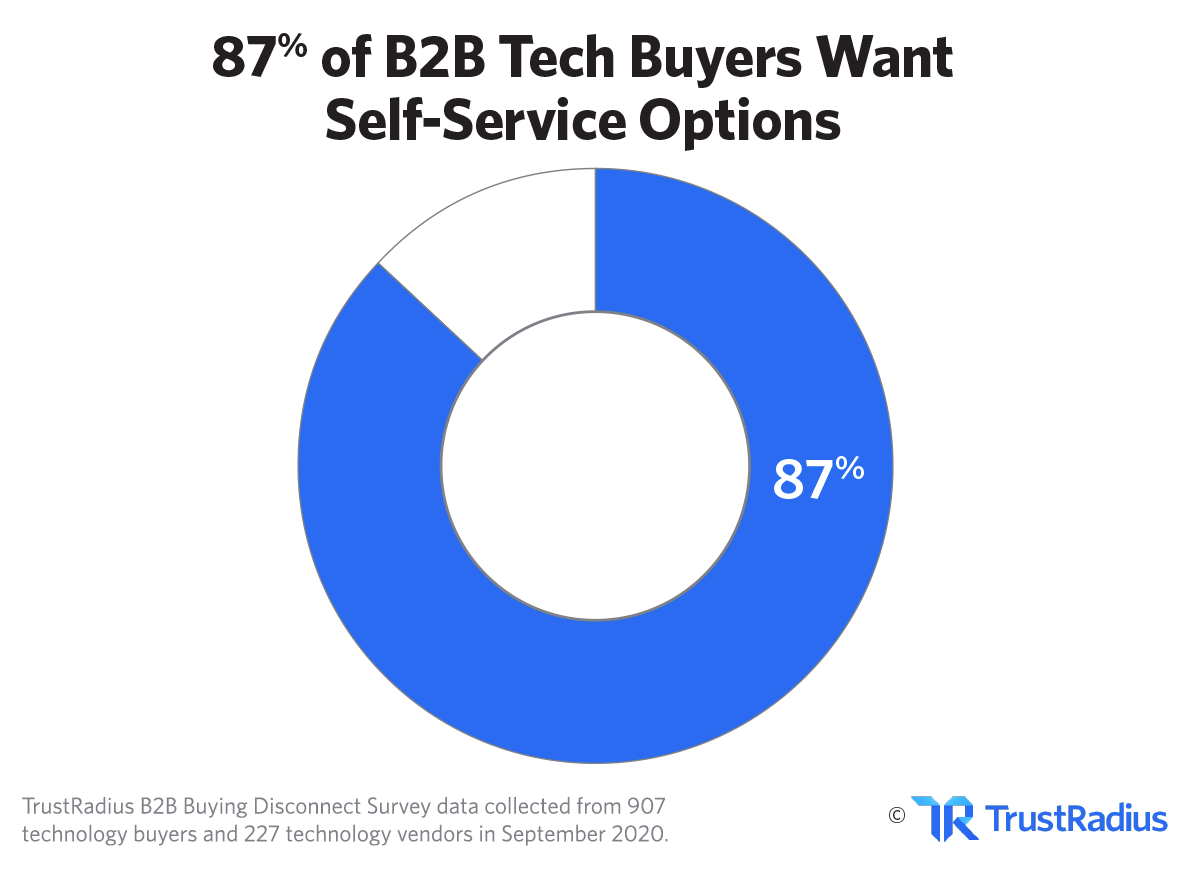

Buyers absolutely want more self-service options in 2021. Whether that’s getting a free trial of the product, having a DIY product demo, and making a purchase online with just a credit card, they’re desperate to make decisions on their own.

Our survey data shows that 87% of buyers want the ability to self-serve part or all of their buying journey. This is in line with recent research from McKinsey, which found that “70%-80% of B2B decision makers prefer remote human interactions or digital self-service.”

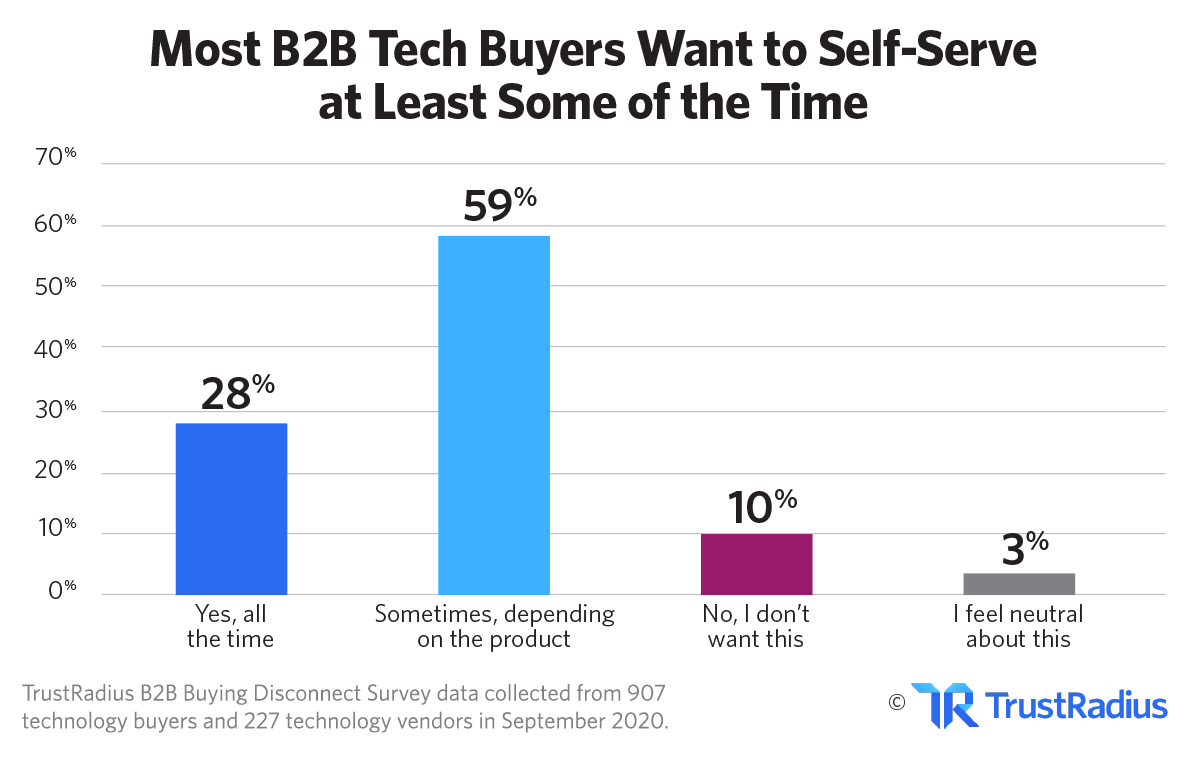

A majority of buyers (59%) would like access to self-service buying options at least some of the time, depending on the product. 28% want access to self-service options all the time. Only 10% of buyers say they would not want access to self-service options.

It’s tempting to view ‘self-service options’ as only applicable to individual users or small businesses. However, we found that enterprise buyers care about self-service options just as much as SMB buyers do. For example, 77% of buyers from companies with 1,000-5,000 employees want to self-serve their buying journey, while 89% of buyers from companies with 5,001-10,000 want the same.

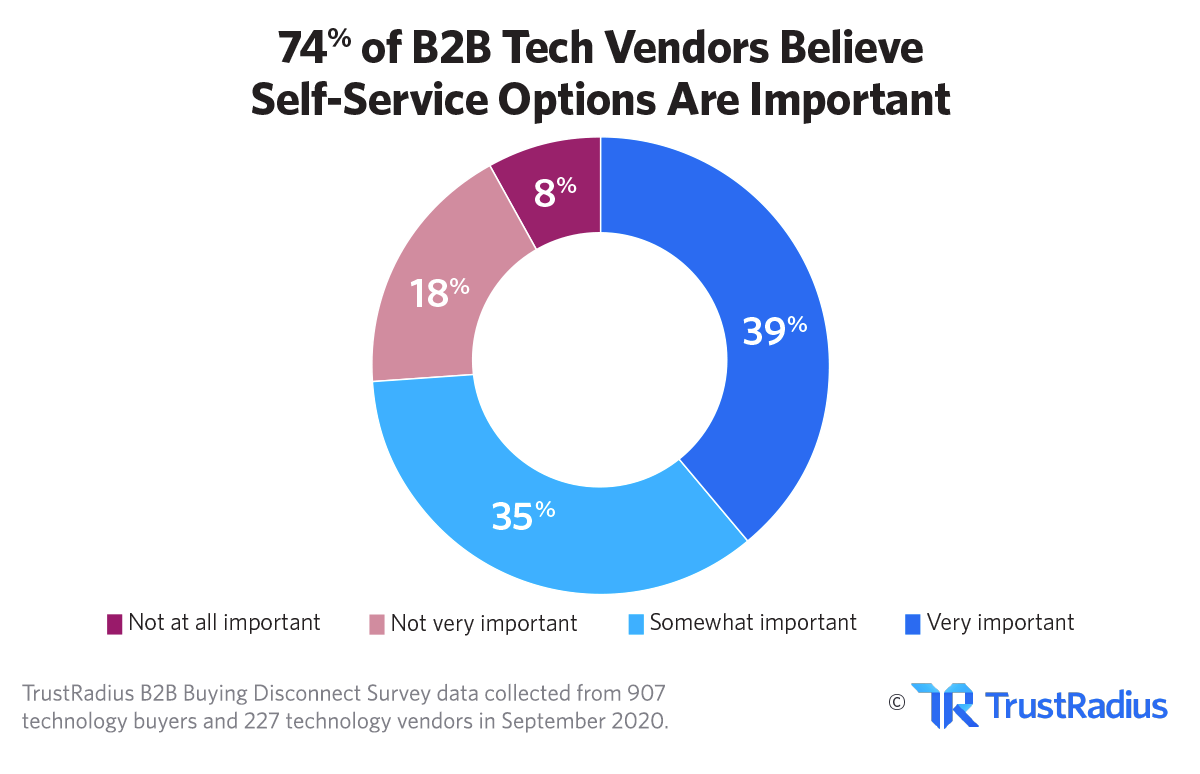

On the vendor side, a majority of tech companies (74%) believe self-service options are important to buyers.

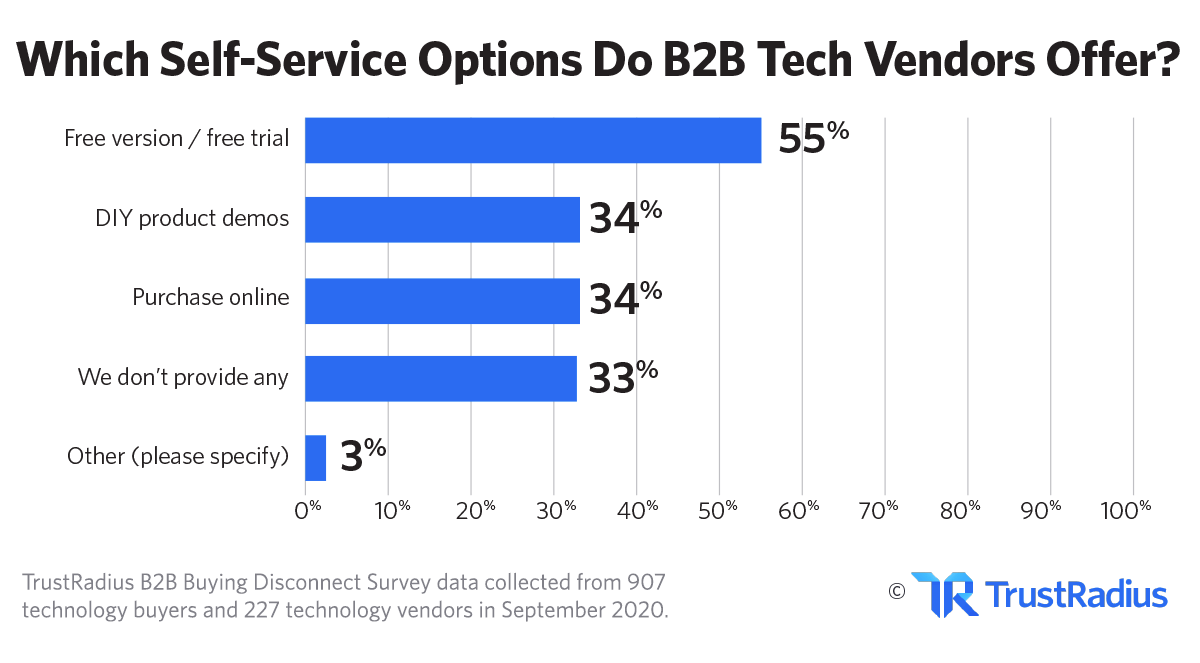

Given that such a large percentage of buyers want the ability to evaluate and purchase products by themselves—how many vendors already offer self-service features? According to the TrustRadius B2B Buying Disconnect survey, 67% of B2B tech vendors currently offer their buyers some form of self-service option. 33% of vendors do not.

Of the vendors who offer self-service options, 50% offer a free trial of their products.

6. Data security concerns are having a big impact.

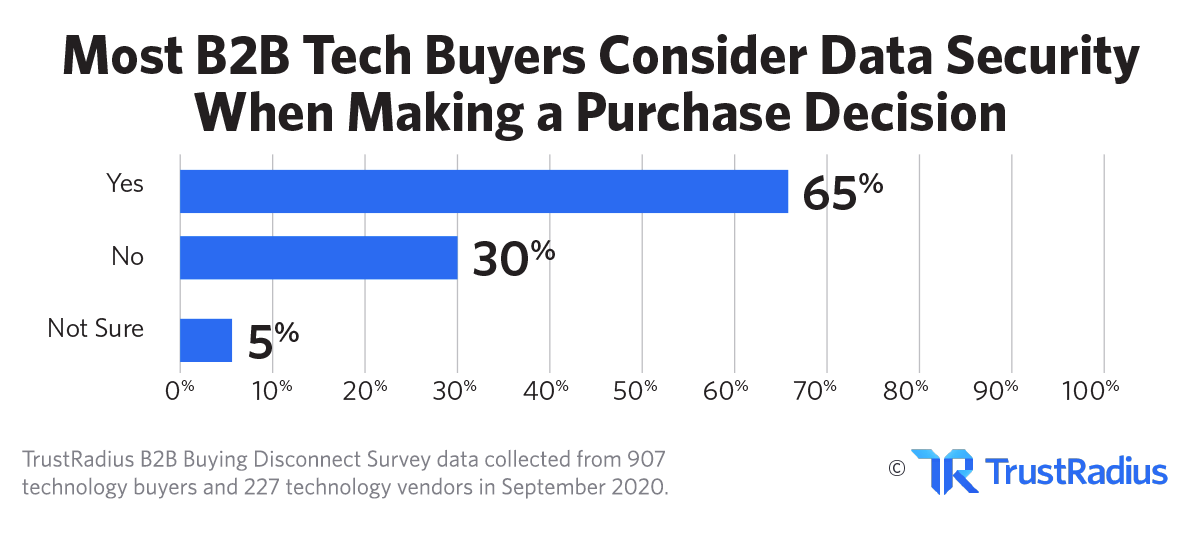

In recent years, data security and privacy requirements have become more standardized and more strict. This has had a major impact on the way technology vendors do business.

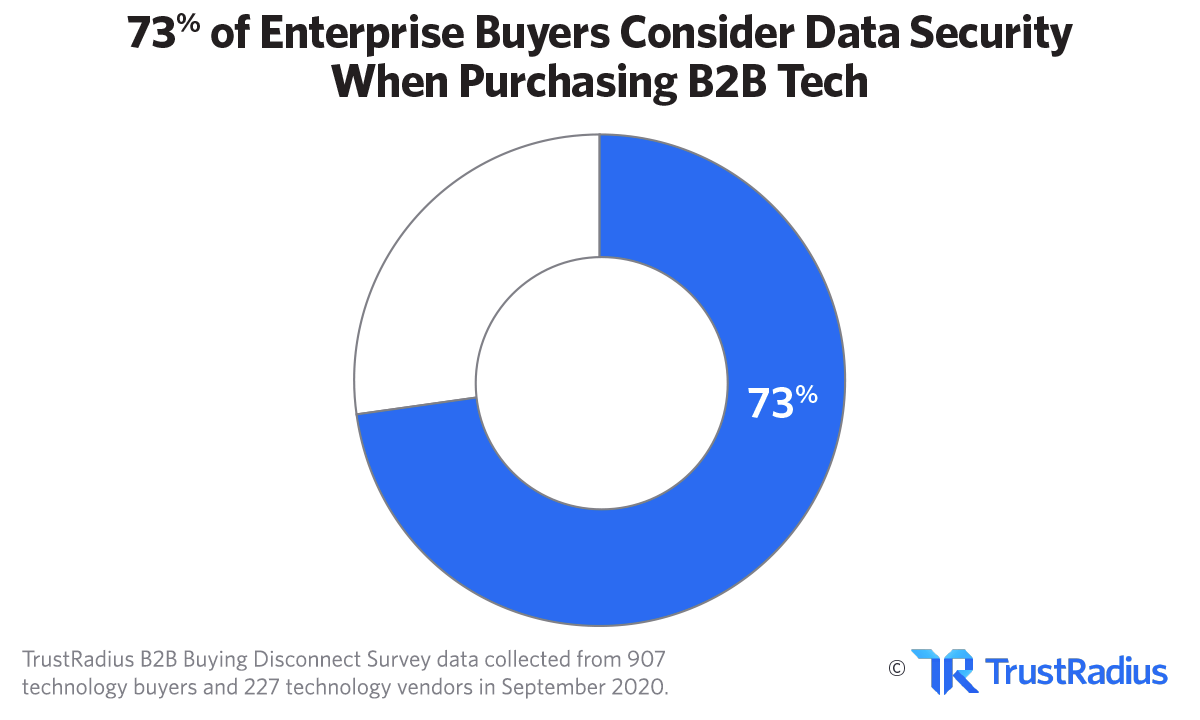

This year, a majority of buyers (65%) said concerns about data privacy and security factored into their tech purchase decisions. This percentage increases to 73% for enterprise organizations with 1,000+ employees.

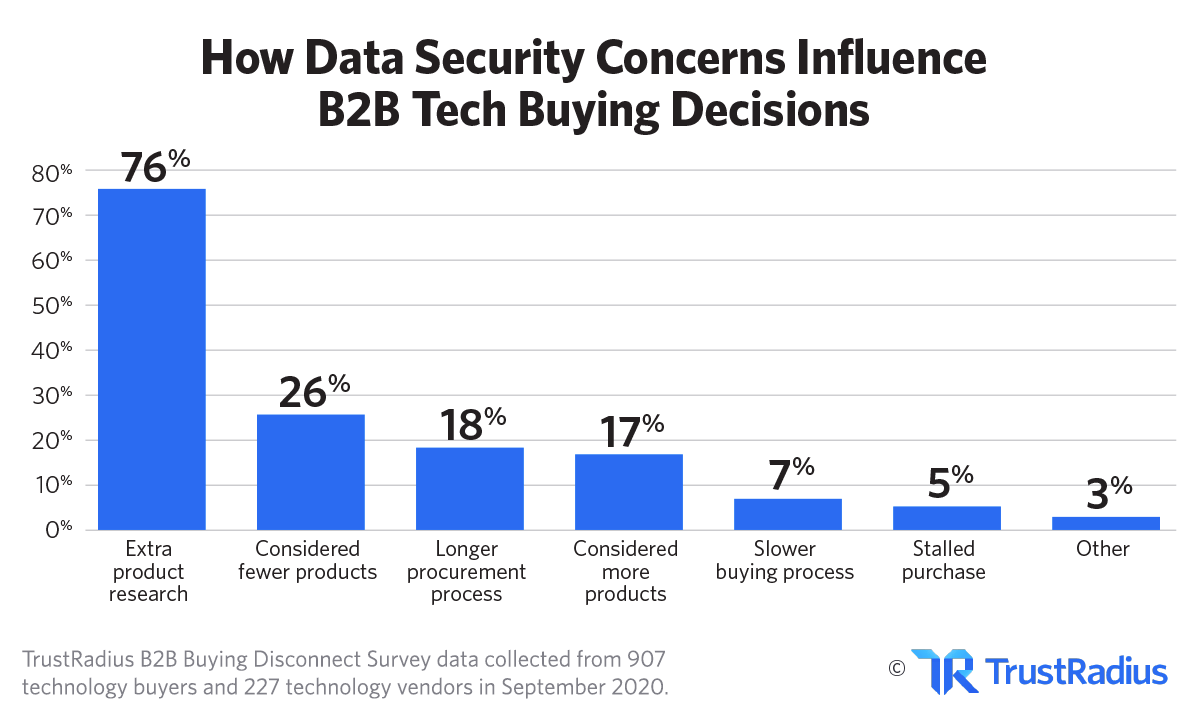

Of the buyers that said data security was a concern, 3 out of 4 spent more time researching products during their purchasing process to account for their data security criteria. 1 out of 4 buyers eliminated more products from their shortlist due to concerns about data security compliance.

18% of buyers reported having a longer procurement process because of these concerns. Very few buyers (5%) report data privacy concerns completely holding up purchasing decisions.

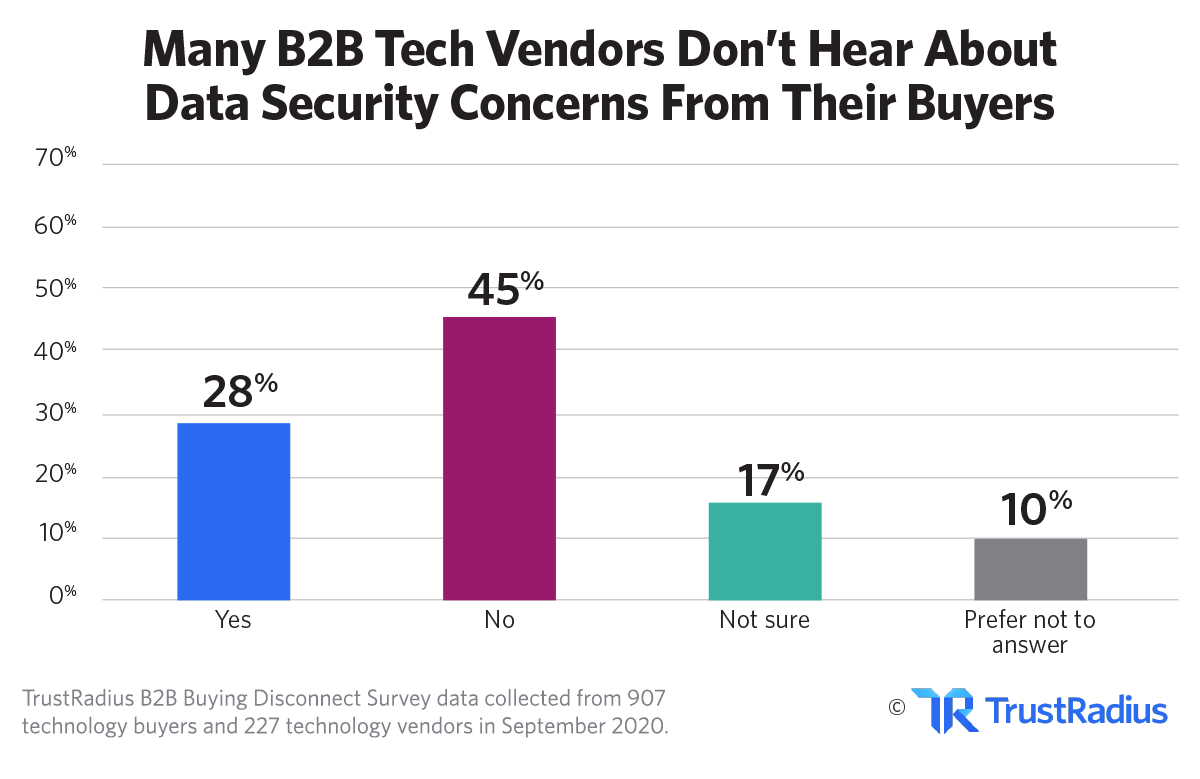

On the other hand, only 28% of vendors report hearing about data security concerns from buyers in recent deal cycles. 45% say buyers have not voiced these worries, while 17% are unsure and 10% prefer not to say.

65% of vendors say their products are already compliant with data security concerns.

7. Covid-19 changed the buyer’s journey.

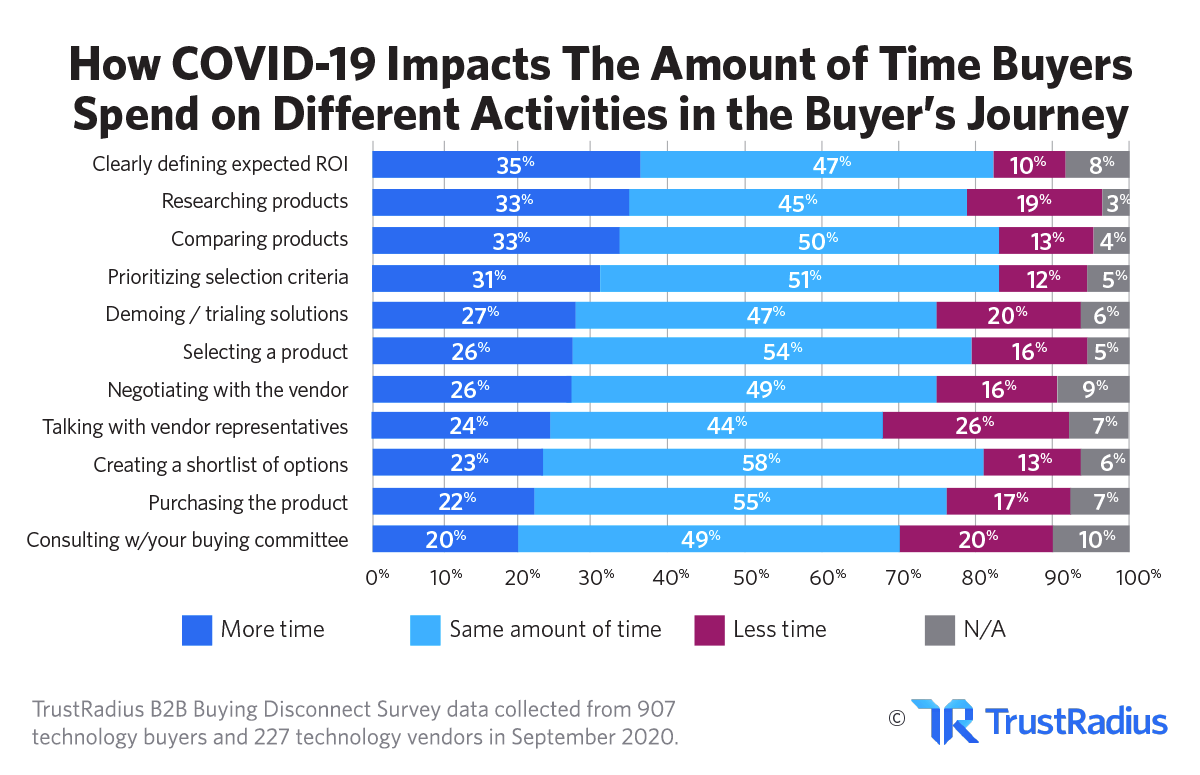

The pandemic has changed how much time buyers devote to different parts of the buying journey. We found that:

- 33% of buyers spend more time researching products now than before the pandemic.

- 35% of buyers spend more time clearly defining ROI than they did before the pandemic.

- 25% of buyers spend less time talking with vendor representatives than they did before the pandemic.

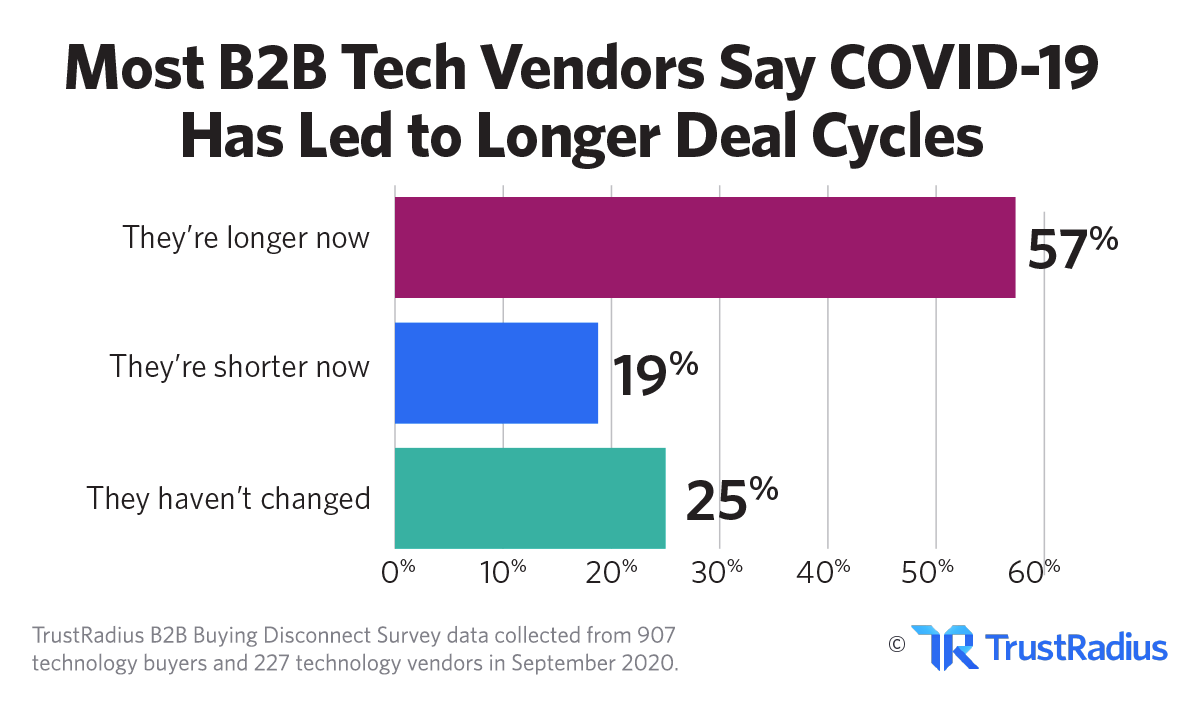

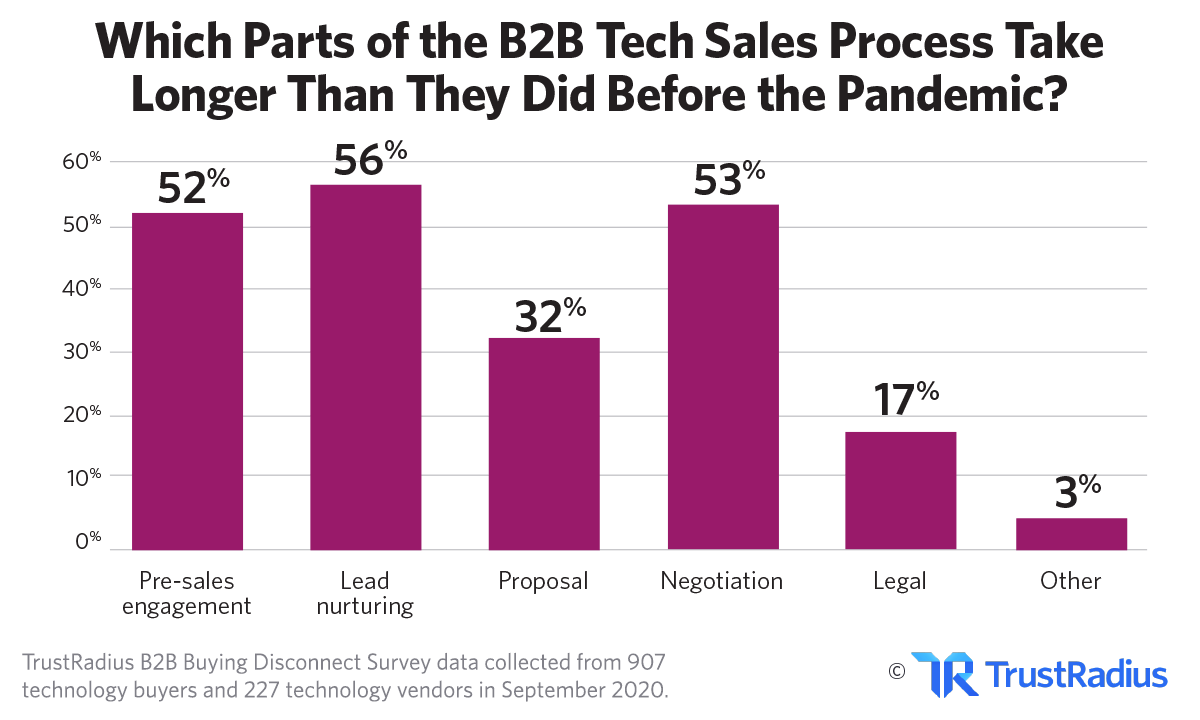

As a result, a majority of vendors (57%) report that deal cycles are now longer than they were before the pandemic. Of the vendors that have had longer deal cycles since the beginning of the pandemic, over half say that pre-sales engagement, lead nurturing, and negotiation take longer than they did before.

57% of vendors report that deal cycles are longer now than they were before the pandemic. @TrustRadius #B2BDisconnect

![]()

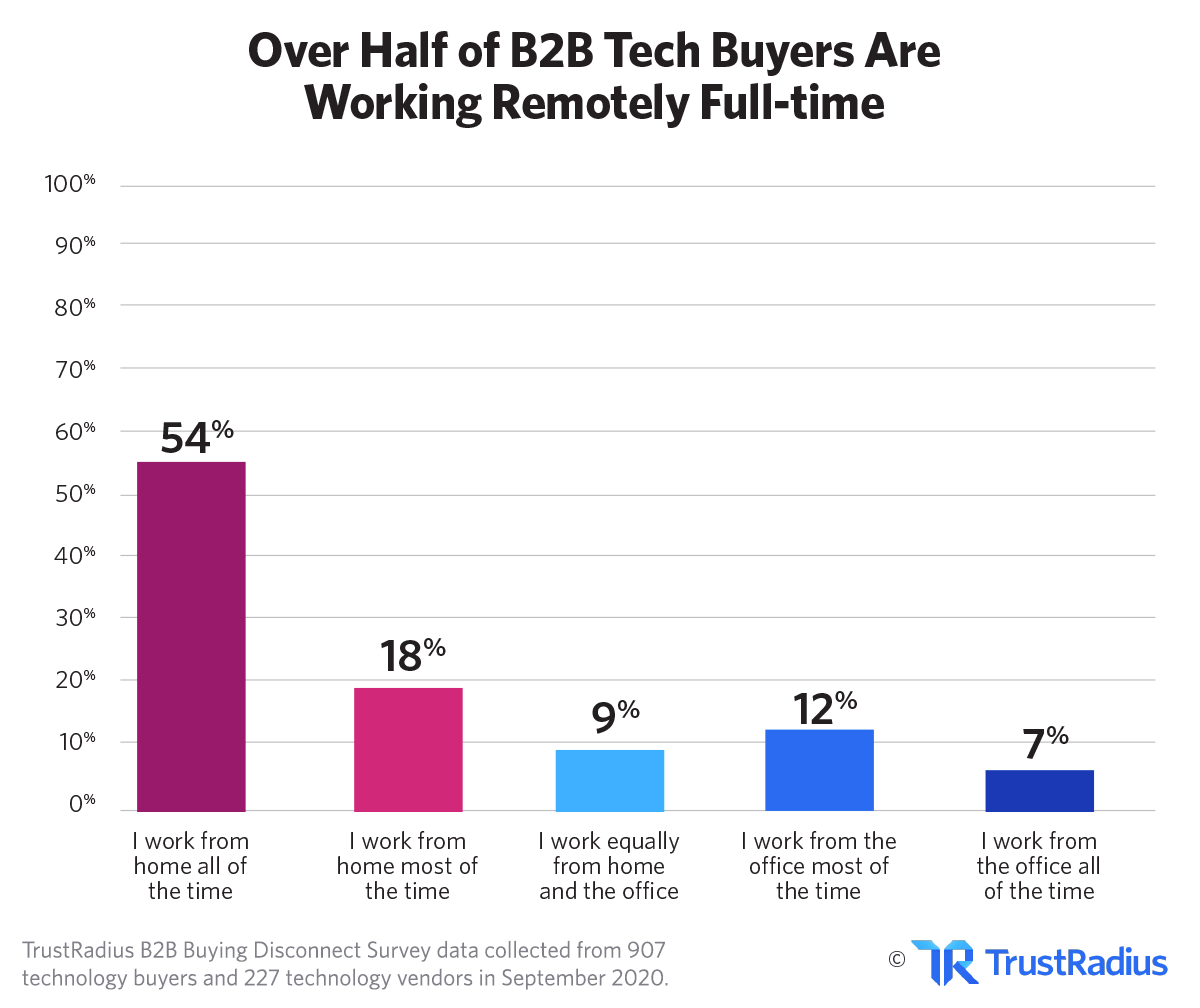

The buyer’s journey is further muddied by the fact that the majority of tech professionals are still working from home.

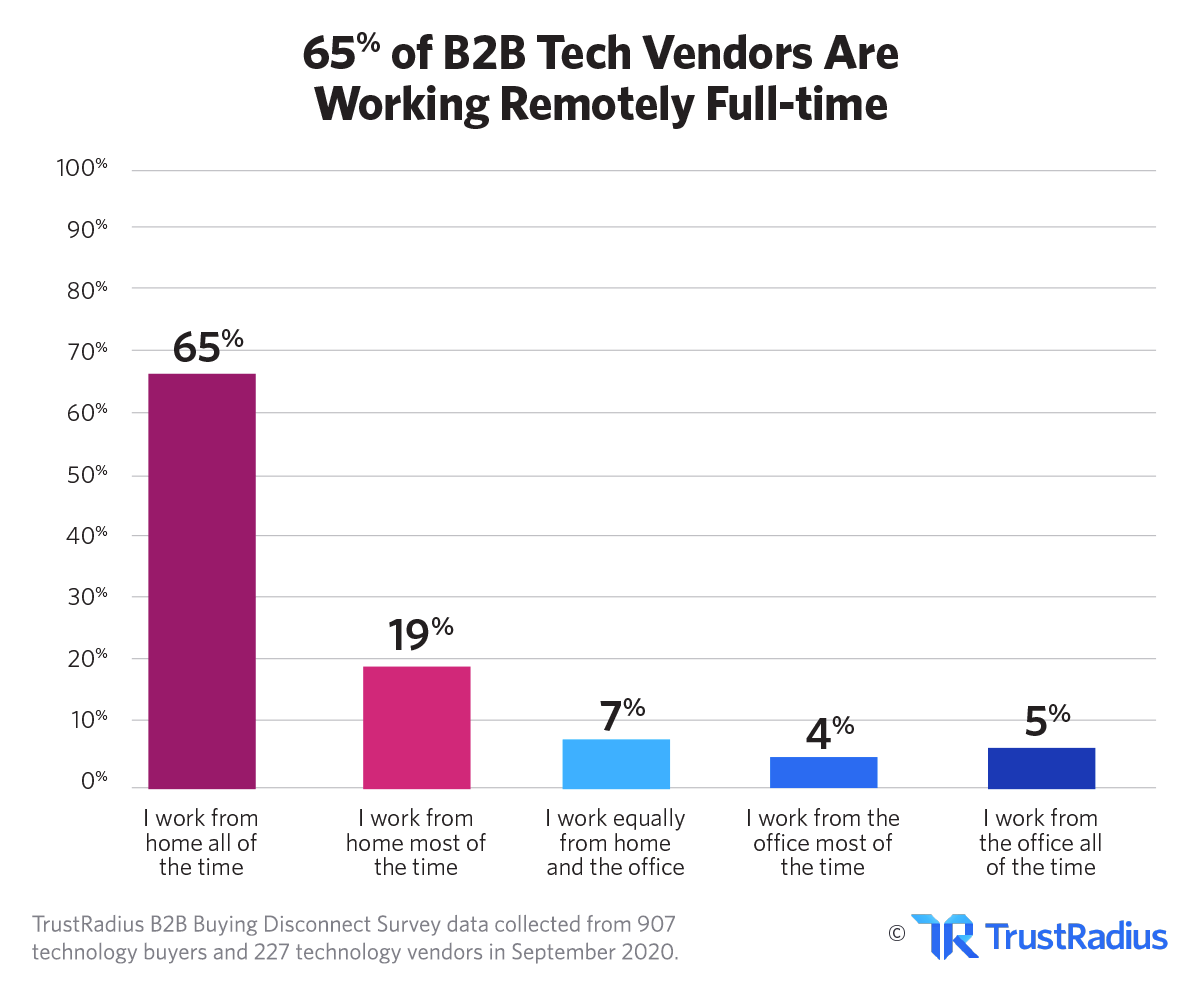

An even larger percentage of B2B tech vendors (66%) report working from home all of the time. Compared with the statistics from Gallup, employees working for a technology vendor are 3X as likely to be fully remote than the average American worker.

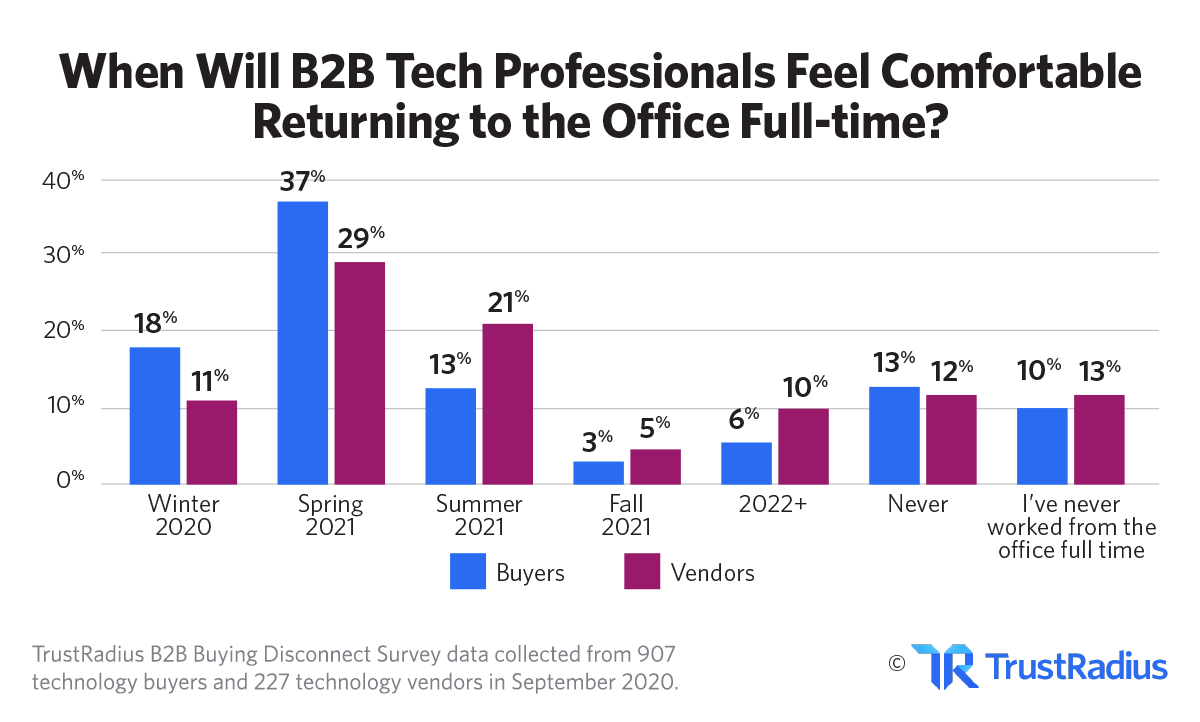

Tech buyers and sellers still feel uncertain about when they will feel comfortable returning to office work full-time. A majority of both buyers (72%) and vendors (76%) would not want to return to full-time office work until Spring 2021 or later.

It’s worth noting that 13% of buyers and 12% of vendors say they would never feel comfortable working from the office full-time again. This is big news for enterprise software companies who previously depended on field sales reps to close deals. That era may be coming to a swift close.

One aspect of the buyer’s journey that remains the same is the collaborative nature of the tech purchasing process. In 2020, about 95% of buying decisions were made collaboratively, consistent with the trend over the past 5+ years. In 2020, 67% of tech buying decisions were made by committees of between 2-5 people. Only 4% of purchases were made by a single buyer.

Your buyers are now 100% online

Learn how to win at B2B software SEO

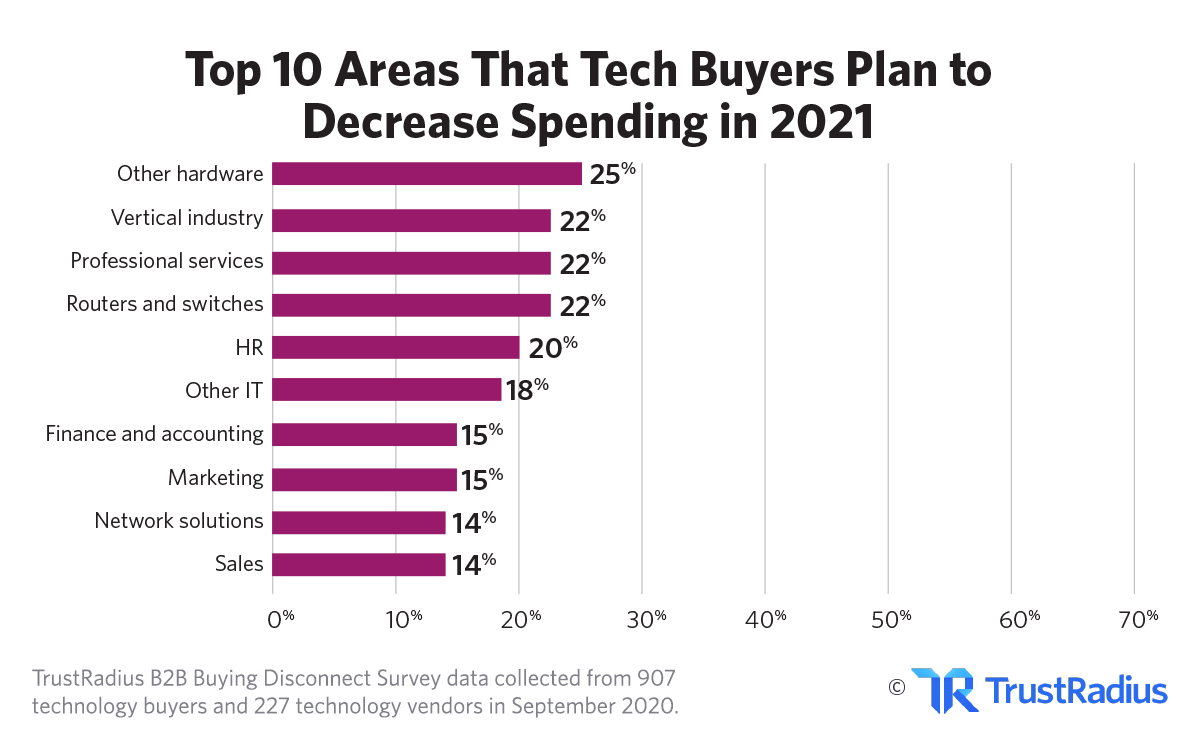

8. The 2021 tech spending forecast looks pretty good.

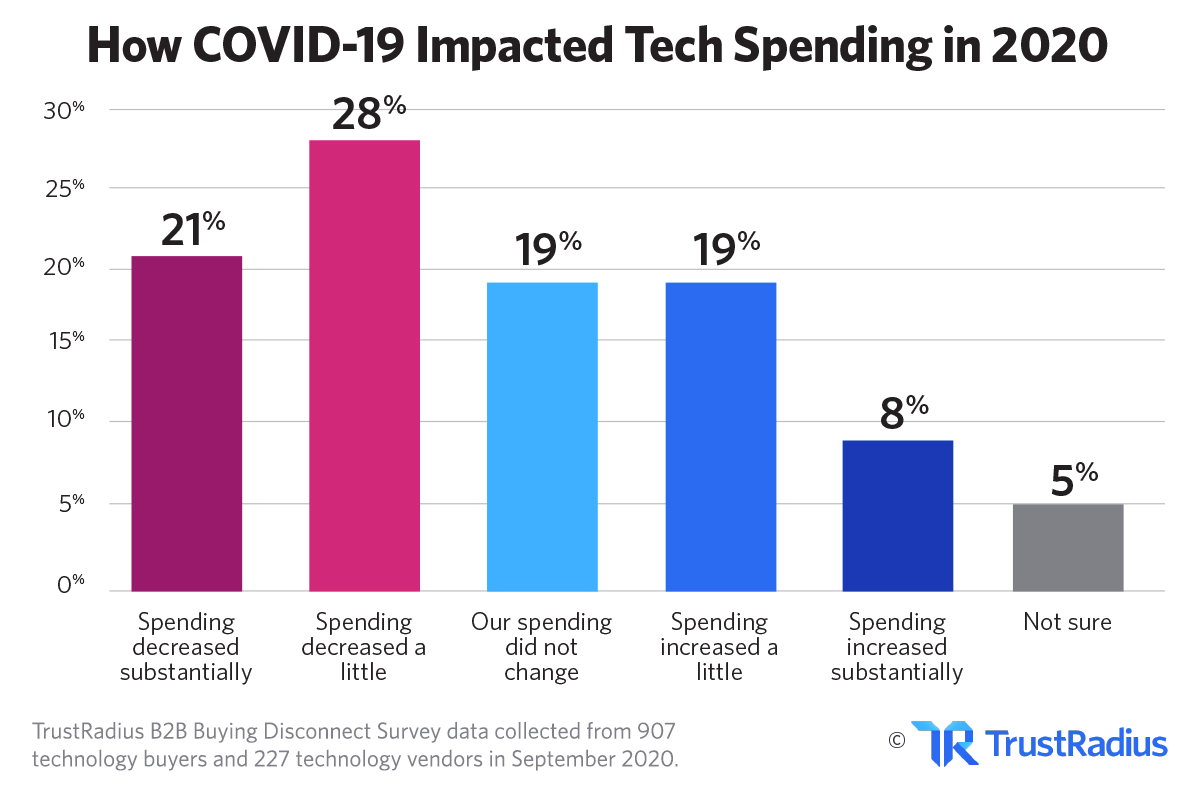

TrustRadius has been monitoring how the pandemic has impacted tech spending for many months now. Most recently, when we asked our buyer community how the pandemic impacted their overall tech spending in 2020, 49% of buyers reported decreased spending. About 1 out of 5 said their spending had not changed, and 27% said spending had increased during 2020.

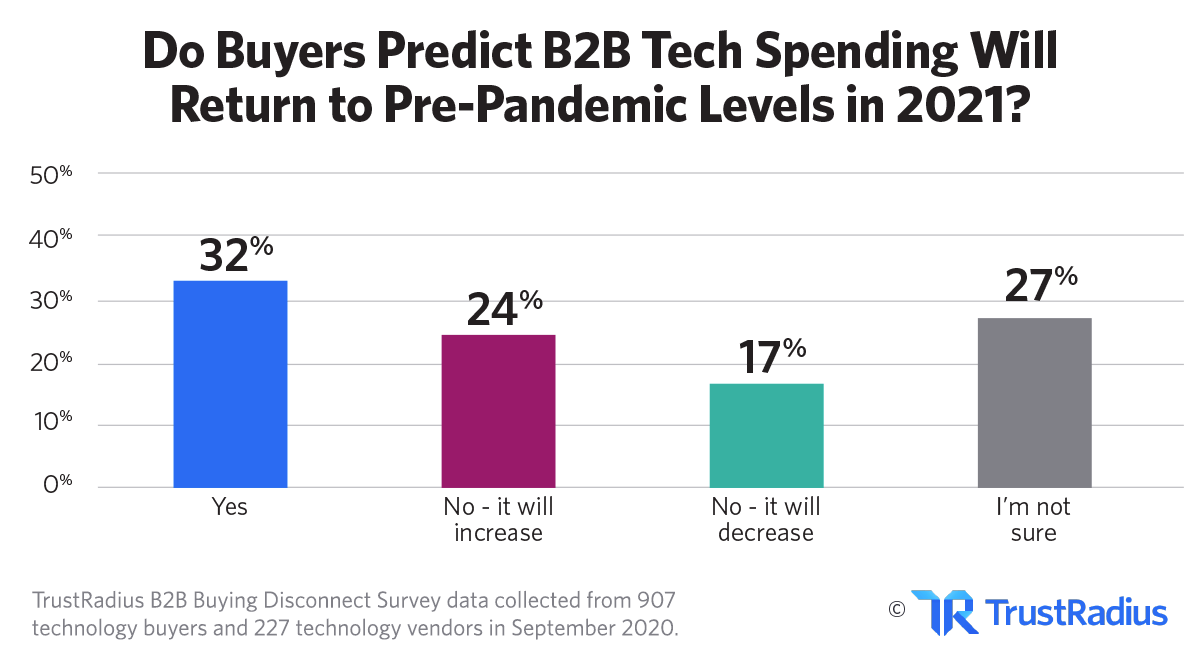

Of the buyers who said their overall tech spending had changed due to the pandemic, 56% predict that spend will return to previous levels or increase in 2021. However, 16% think spending will decrease in 2021. About 27% of buyer respondents were not sure what tech spending in 2021 would look like for their organization. Optimism and pessimism about 2021 spending levels are consistent across company sizes.

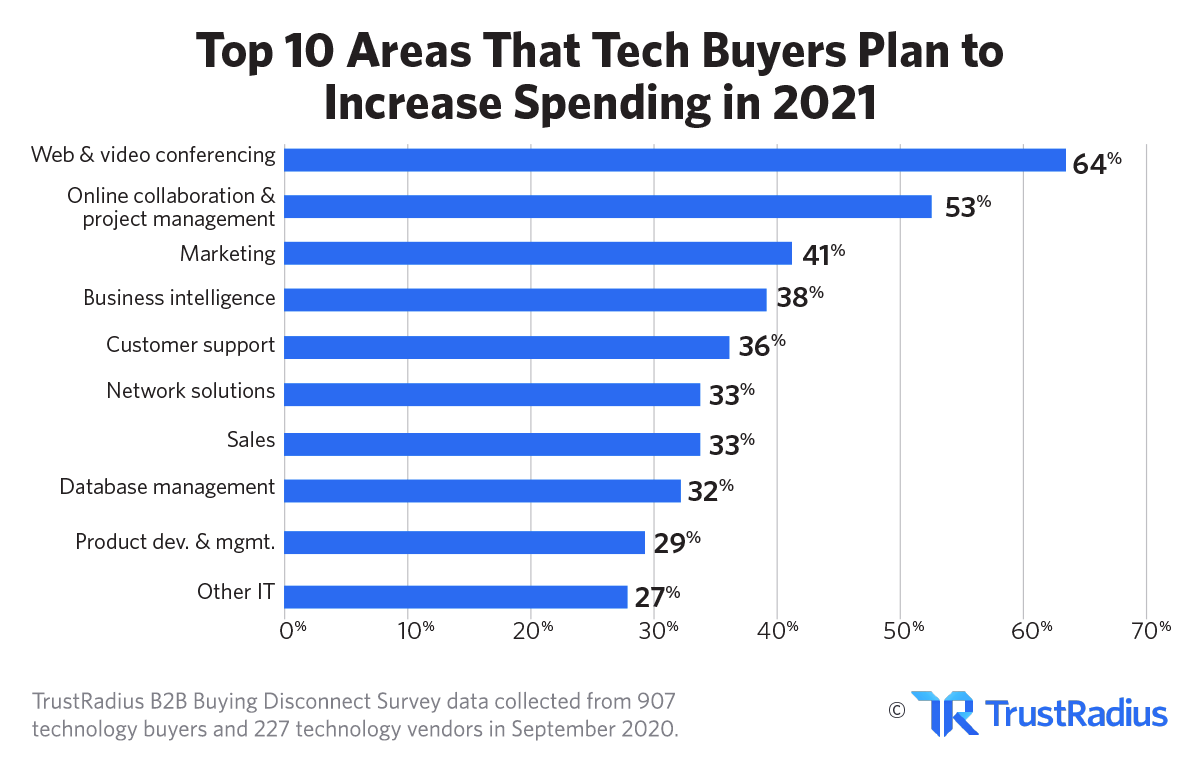

Where will buyers increase their spending? In our most recent survey, over half of buyers expect to spend more on web conferencing software (64%) and online collaboration & project management software (53%) in 2021.

Conversely, buyers predict that hardware products, professional services, HR software, and vertical-specific technology will be areas of low investment for 2021. About 1 out of 5 buyers said they expected spending to decrease for each of these areas.

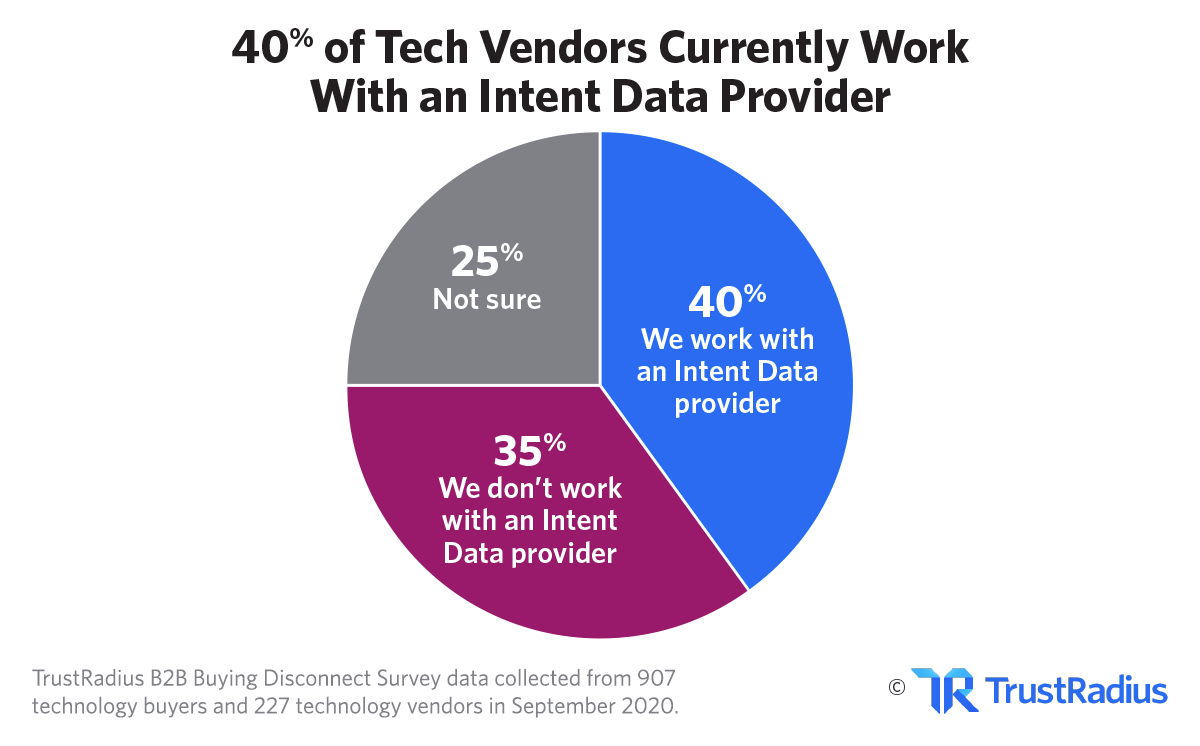

9. Few software marketers use the power of intent data.

Buyer intent data can help replace some of the lost intent signals that were previously gained from in-person meetings, field marketing, sales events, and industry conferences. It makes sense that the intent data market is experiencing incredible growth. However, different sources deliver different insights.

For example, vendors that offer more top-of-the-funnel intent rely on signals from search queries or ad clicks, while more bottom-of-the-funnel providers show more granular purchase intent. While many vendors (40%) have already started leveraging intent data to help achieve their sales and marketing goals, about a third of vendors still do not use intent data.

Currently, 2 out of 5 software companies use buyer intent data. @TrustRadius #B2BDisconnect

![]()

Here are the intent data providers that vendors in our study work with today:

- Aberdeen

- Bombora

- Clearbit

- Demandbase

- G2

- KickFire

- TechTarget

- TrustRadius

- ZoomInfo

- 6sense

There is also a sizable percentage of vendors who work with review websites but have not yet taken advantage of the intent data that review websites generate. Only 26% of vendors who use review websites leverage them to obtain intent data.

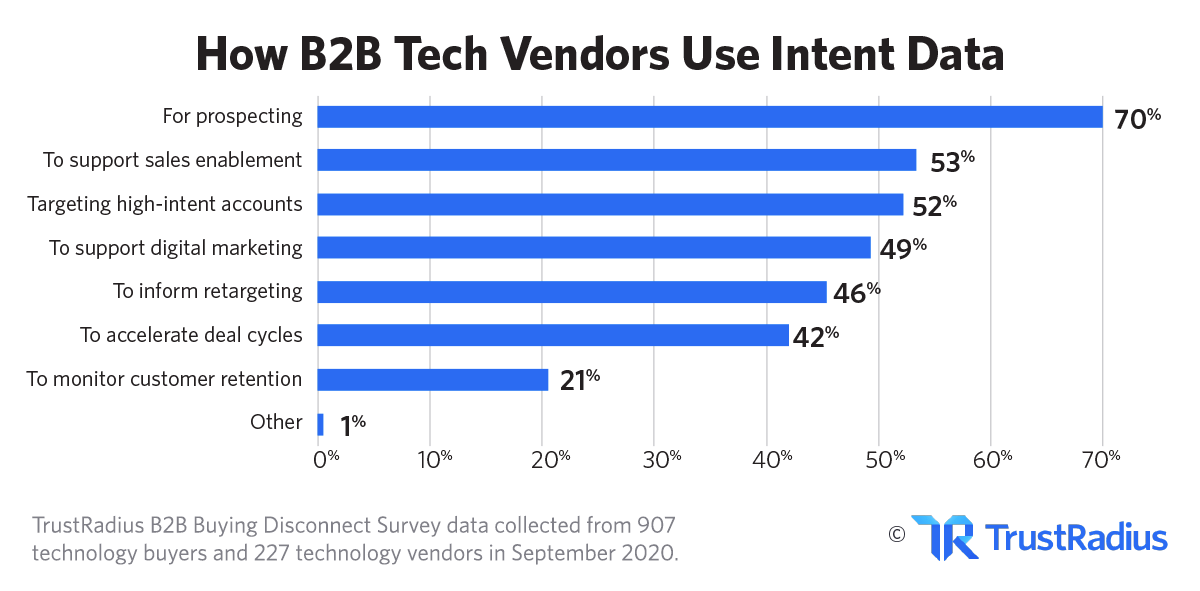

Of the vendors who are already working with an intent data provider, a majority (61%) have increased their investment this past year. 71% of these vendors use intent data for prospecting. Other popular use cases for intent data include supporting sales enablement and targeting known high-intent accounts to help vendors optimize their ABM spend.

Of the vendors who are already working with an intent data provider, a majority (61%) have increased their investment this past year. 71% of these vendors use intent data for prospecting. Other popular use cases for intent data include supporting sales enablement and targeting known high-intent accounts to help vendors optimize their ABM spend.

10. B2B reviews have a strong influence on buyers.

According to buyers, user reviews are one of the top 3 most trustworthy and influential information sources when making a purchasing decision.

This year, user reviews are used by 45% of buyers—a slight decrease from last year when 52% of buyers used reviews.

Even though we have seen a small decline in buyers’ self-reported review usage since last year, TrustRadius has experienced the opposite trend. According to website traffic data, B2B tech buyer usage of TrustRadius has grown steadily over the past year. TrustRadius saw a particularly sharp spike in traffic during the months of March and April, when many companies researched new software tools to help with the work-from-home transition.

Of the buyers who use reviews during product selection:

- 92% share reviews with other collaborators.

- 45% share reviews or learnings from reviews with 4 or more other stakeholders.

- About 12% of buyers share reviews with more than 10 other people.

For buyers, the most important factor when evaluating products on a review website is the review content. Vendors mistakenly believe their product’s score is most important.

About 2 out of 5 buyers say review content is the most important factor when evaluating a product on a review website. @TrustRadius #B2BDisconnect

![]()

While buyers care most about the qualitative feedback, vendors think the most important factor is a product’s overall score or star rating. In reality, vendors underestimate the importance of review content by about 61%. Vendors also inflate the significance of a product’s overall score by about 2X.

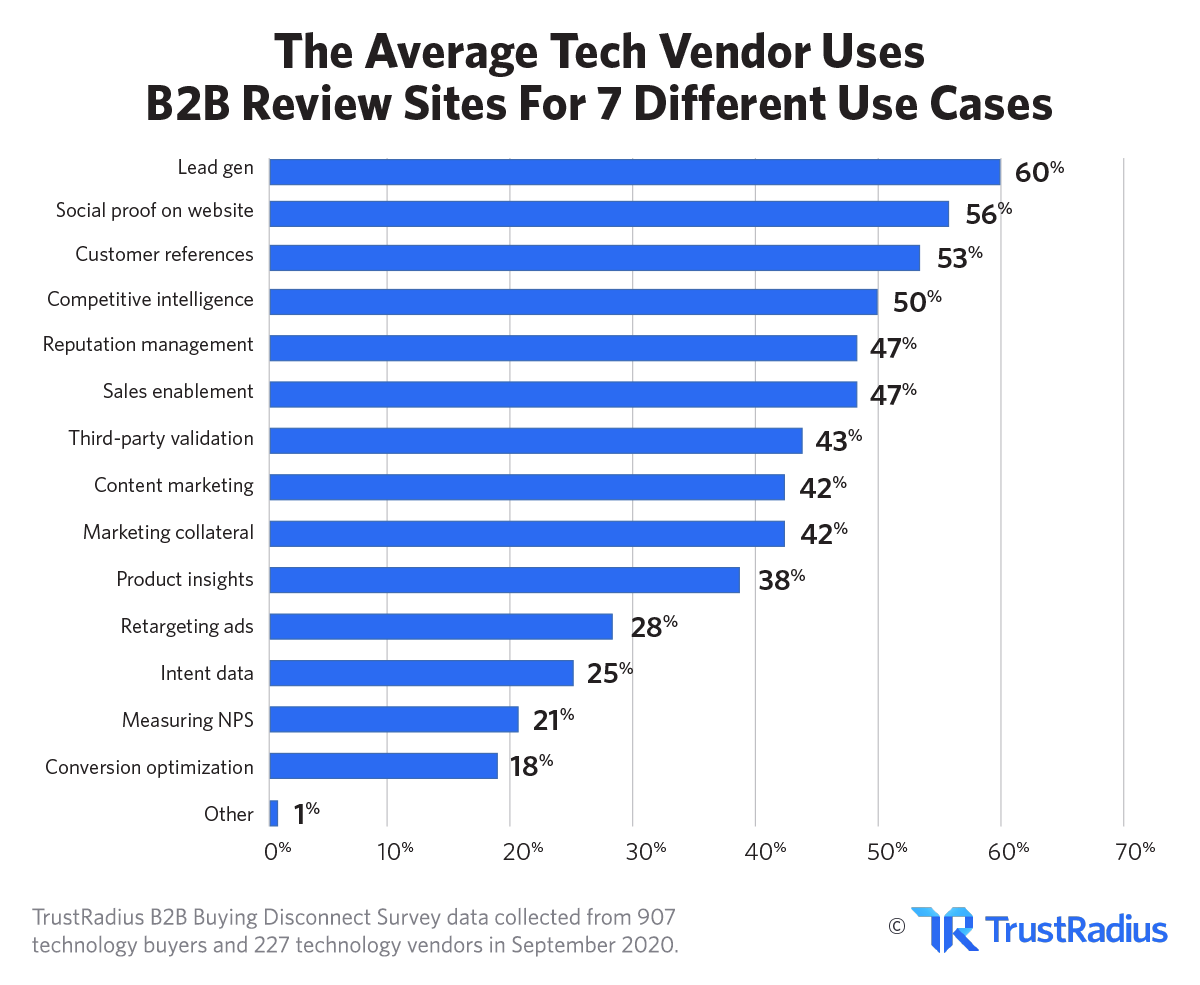

46% of vendors use reviews as a way to engage their buyers. Of vendors who use reviews, a large majority (86%) work with one or more review websites in a paid capacity. The average vendor in this group uses review websites for seven different use cases.

Want to influence buyers in credible ways? Invest in reviews.

Read the ebook or request a demo of TrustRadius

Along with generating leads and using reviews as social proof, some of the most popular use cases for review websites are:

- Access to customer references

- Competitive intelligence

- Reputation management

- Sales enablement

The 4 most common review platforms are Capterra, Gartner Peer Insights (GPI), G2, and TrustRadius. TrustRadius is the most popular among enterprise organizations while Capterra is the most popular among small businesses.

Methodology

Data for the TrustRadius 2021 B2B Buying Disconnect was sourced from the TrustRadius global network of contacts via an online survey in September 2020. We received responses from 907 technology buyers and 227 technology vendors, for a total of 1,134 survey respondents. All respondents were offered a nominal incentive ($15 gift card) as a thank-you for their time.

The majority of respondents work for organizations based in the United States. Other demographic information about company size, age, job title, and department can be found at the end of the full report here.

About TrustRadius

TrustRadius helps technology buyers make better decisions and helps vendors tell their unique story, improve conversion, engage high-intent buyers, and gain customer insights. Each month over 1 million B2B technology buyers, over 50% from large enterprises, use verified reviews and ratings on TrustRadius.com to make informed purchasing decisions. Headquartered in Austin, TX, TrustRadius was founded by successful entrepreneurs and is backed by Mayfield Fund, LiveOak Venture Partners and Next Coast Ventures.

If you’re interested in how B2B marketing has changed over time, check out previous B2B Buying Disconnect reports published by TrustRadius: