The Impact of COVID-19 on the B2B Software Buying Process

Will technology purchase power revert to execs in the wake of COVID-19?

As global coronavirus pandemic reshapes the workforce and the economy, business forecasts, budgets, priorities, and management styles are transitioning to the “next normal.” We’ve observed data that shows COVID-19 has impacted business technology purchasing behavior. When we look at that data by job title, we suspect that the buyer’s journey is changing.

What used to be a collaborative purchasing process that included end-users, managers, and directors may now be handled by executives. While we don’t know yet whether this change is temporary or reflects a lasting shift in strategy, we do know that it’s a high stakes question for software vendors working to keep up B2B sales.

COVID-19 Has Already Impacted B2B Software Sales

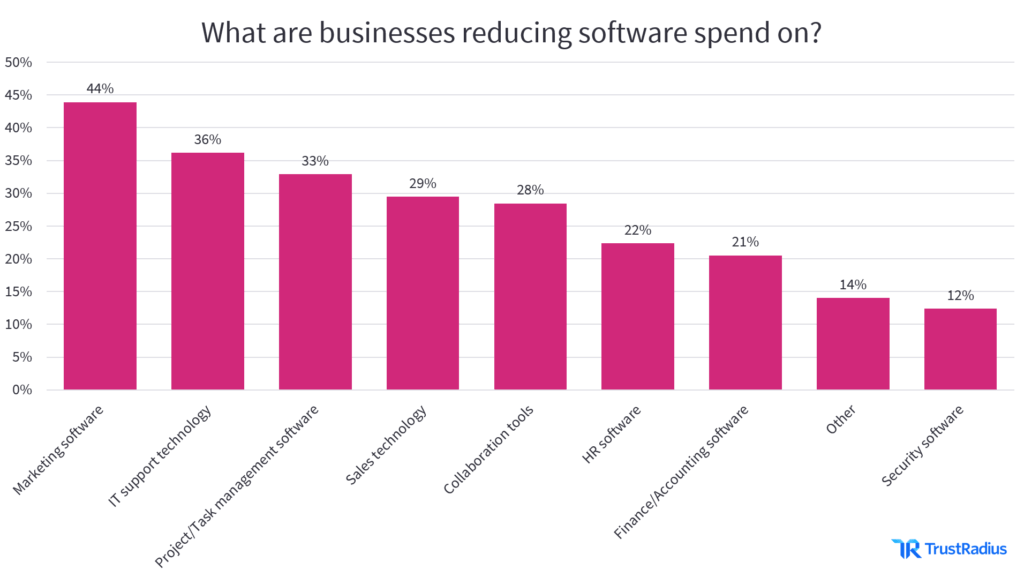

We’ve already begun to see the impact of COVID-19 on software purchasing behavior. A survey of 2,168 buyers revealed investment in certain technologies, especially those needed to support remote work such as video conferencing and VPN, is increasing. Investment in other technologies, like marketing software and IT support technology, is decreasing for some companies.

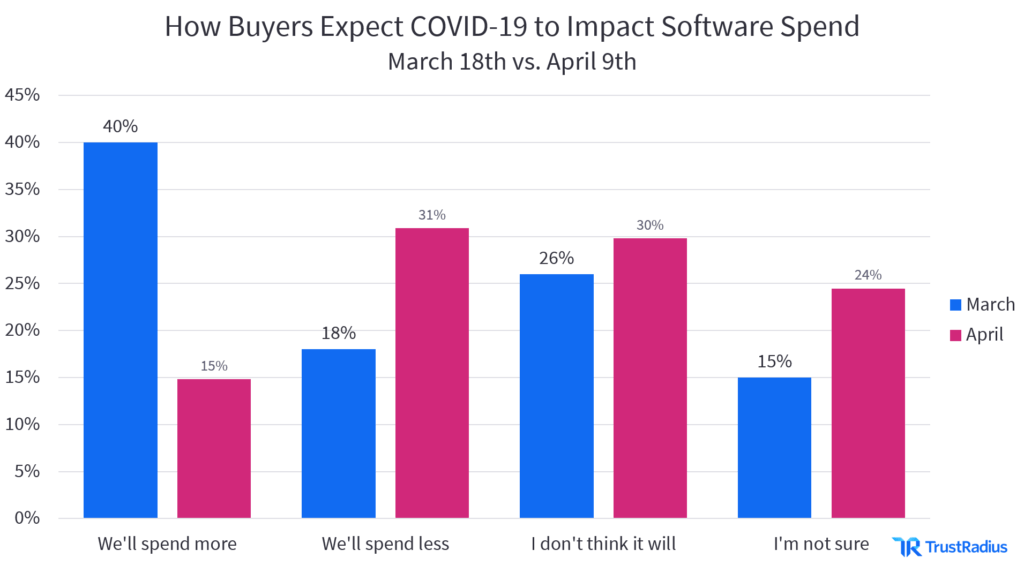

As stay-at-home orders took effect in March, 40% of buyers said their businesses would be increasing spend due to the pandemic and 26% expected no change in spending. That outlook changed in the span of a few weeks, as the degree and duration of economic impact became clearer. By April, 31% of buyers said their businesses would be decreasing spend.

Other experts are tracking similar downturns. Based on economic changes over the first quarter, Forrester research revised its tech market forecast for 2020 downward, projecting a 50% likelihood of a tech market decline this year. Other research firms have pointed out declining job postings in the tech industry, as the effects of the pandemic on the tech industry have continued to unfold.

How Software Spending Has Changed By Job Title

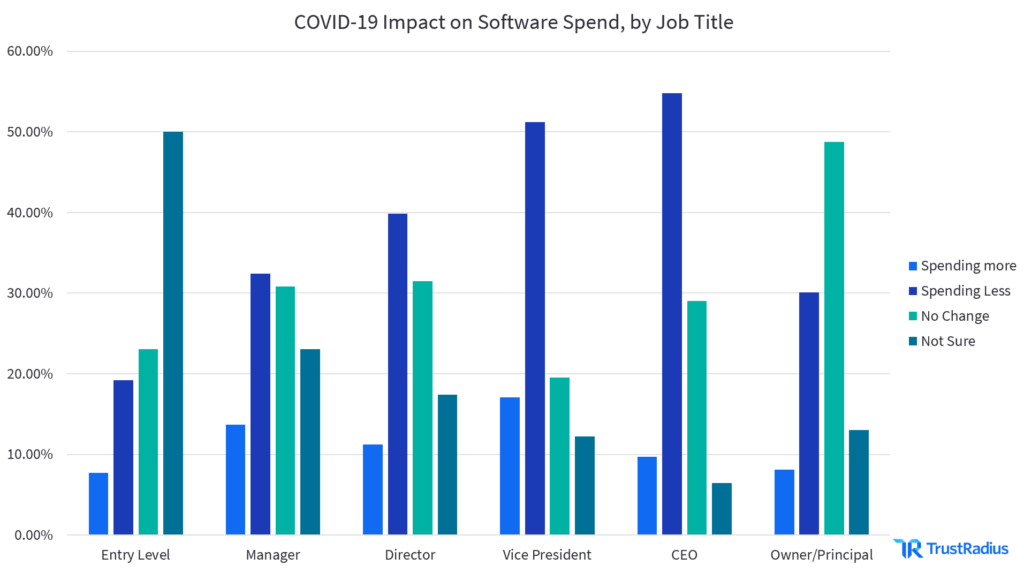

Along with these changes, uncertainty is growing. According to our most recent survey, 1 in 4 buyers say they’re not sure how spend on technology will be affected by the pandemic.

Executives buyers are more certain about their organization’s response. 94% of CEOs, 84% of other C-Suite executives, and 88% of VP-level executives know the impact to technology strategy—whether spend will increase or decrease. Only 12% of executive buyers were uncertain, compared to 18% of directors, 23% of managers and 50% of entry-level employees who help buy software and hardware for their companies.

The Customer Journey We Used to Know

Business technology purchases weren’t always as collaborative. In the not-too-distant past individual contributors, managers, and even directors weren’t involved in decisions about which software tools their organization should buy. 10 years ago, purchase decisions were handled by leaders in the IT department. 5 years ago, most decisions were made by department leaders—so that a CMO could buy marketing software for their own team, for example.

Policies and procedures for acquiring new software and hardware products differ from company to company. Company size, industry, and even culture shape the way purchases are handled. But across segments, there has been a trend towards distributed, collaborative decision-making.

The TrustRadius B2B Buying Disconnect research initiative tracked changing B2B buyer behavior over the past four years to help tech marketers and salespeople adapt to committee-style purchases. Demand Gen Report, Forbes, LinkedIn, and many others have reported on this change as well.

As recently as Q4 2019, TrustRadius research showed 61% of buying decisions were made by groups of 2-5 stakeholders. 22% of purchases were made by larger groups, with 15% involving 11 or more people. 46% of buying committees used either a collaborative recommendation or a consensus decision dynamic in their purchase process. Only 26% of committees appointed a single decision maker, and a mere 6% of purchases were made by one buyer working alone.

COVID-19 and the New Buyer’s Journey

COVID-19 ushered in sudden, sweeping changes for many organizations. For the time being, software spend has decreased. Buyers in less senior roles are uncertain about the path forward. Executive buyers are making decisions based on corporate strategy. As organizations model possible financial scenarios, leaders are charged with responsible stewardship of resources— from budget to employees to technology infrastructure.

Which tools are essential, and which should be cut? Where must spend increase to weather the storm?

Right now, executive buyers appear to be making these decisions themselves, rather than delegating purchase power or assembling a committee to help evaluate products. Gartner’s advice for business and technology management in the face of COVID-19 notes that during this time, decisions will and should be made by senior leadership.

As a researcher who has been following these trends for years, the question on my mind is: how long will this last? Is this a stop-gap measure to combat rapid market changes? Or has the pandemic revealed underlying risk in technology expenditure, and which providers businesses rely on? Just as we’re asking questions about whether consumer behavior will ever return to “normal” when it comes to flights, restaurants, and movie theatres, we should consider the possibility of a shift in business software and hardware purchasing.

Tracking Upcoming Changes in the B2B Buying Process

For the foreseeable future, spend of any kind will likely be under close executive scrutiny. We may find that collaborative buying resumes as restrictions are lifted and the economy picks back up. (After all, collaboration has been shown to result in more satisfying product purchases.) But we should also prepare for a future that looks more like our industry’s past, with executive buyers taking the lead.

TrustRadius will continue to track developments in buyer behavior, tech spend, and executive vs. committee dynamics. In the meantime, technology vendors should make sure to get in touch with at least one executive buyer at every account. Deals without executive buy-in are higher risk right now.

We can help you learn how your own product(s) are performing, so that you can react quickly. Our True Intent data program provides exclusive data on bottom-of-the-funnel decision makers. Find out which companies are reading reviews of your products today, so you can get in touch with executive buyers at the right accounts. Contact us here to learn more.