Corporate LMS Software Market Update (2021)

12.5 million software buyers use TrustRadius each year—and over 650,000 of them are exploring HR software. Corporate LMS commands a healthy share of that attention.

Many of us have spent the last 18 months in an online-only workspace. Everything went digital: recruiting, interviews, onboarding, training, compliance.

Corporate learning management software was perfectly poised to meet those needs. Now the market is booming, projected to reach $7.5 billion by 2026.

To understand the state of today’s market, we took a closer look at our data to see which products attract the most attention. This is the 2021 corporate LMS market update.

Click on a Section to Explore:

Quick Snapshot of the Corporate LMS Market

- The global Corporate learning management system market size was valued at $1.777 Billion in 2019. It’s projected to reach $7.570 Billion by 2026. (Cision 2021)

- 57% of organizations are looking to make a large or moderate investment in Learning and Development in the next year. (Docebo 2020)

- From 2019 to 2020, the number of enterprise learners more than doubled, and the amount of learning has also increased by 58% more hours per learner. (LinkedIn 2021)

- By the end of 2021, 50% of enterprises will offer a learning assistant to help employees and customers with their training needs. (Metargo 2019)

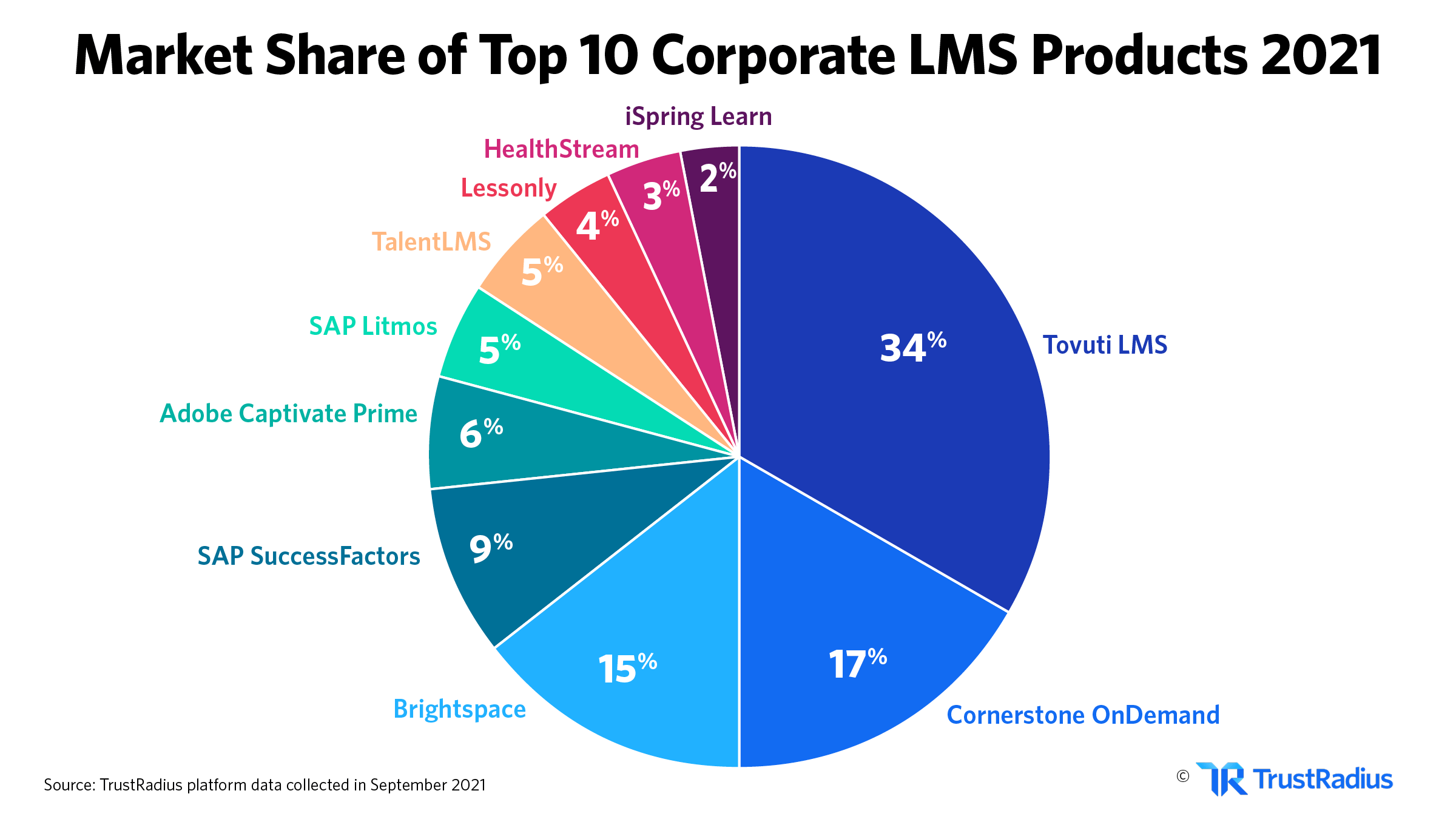

- Tovuti LMS is the leading corporate LMS in 2021, commanding 33% of the top 10 market on TrustRadius. Cornerstone OnDemand (17%) and Brightspace (15%) follow. (TrustRadius 2021)

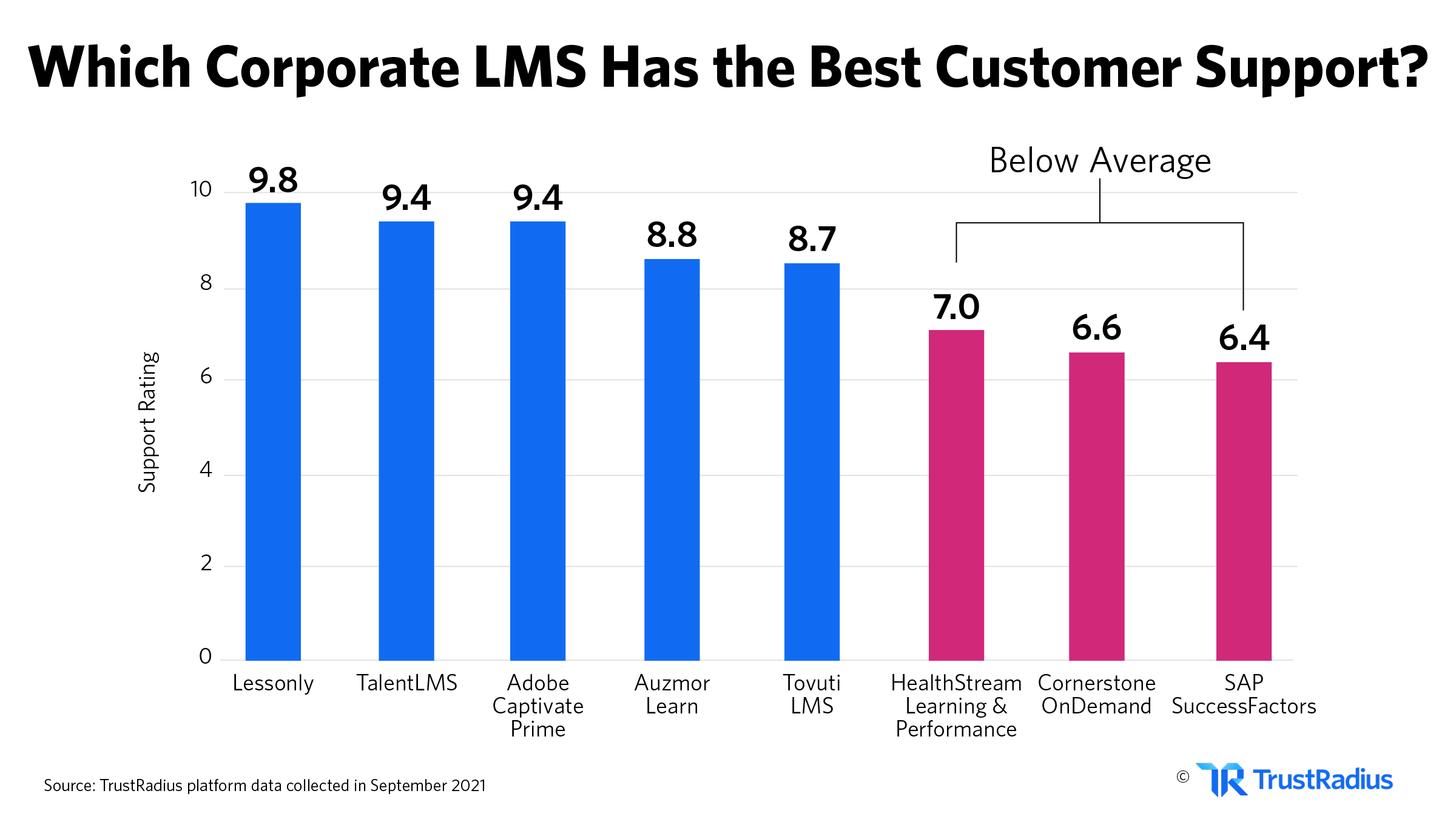

- Lessonly has the best customer support in the corporate LMS market, with a support score of 9.7 out of 10. (TrustRadius 2021)

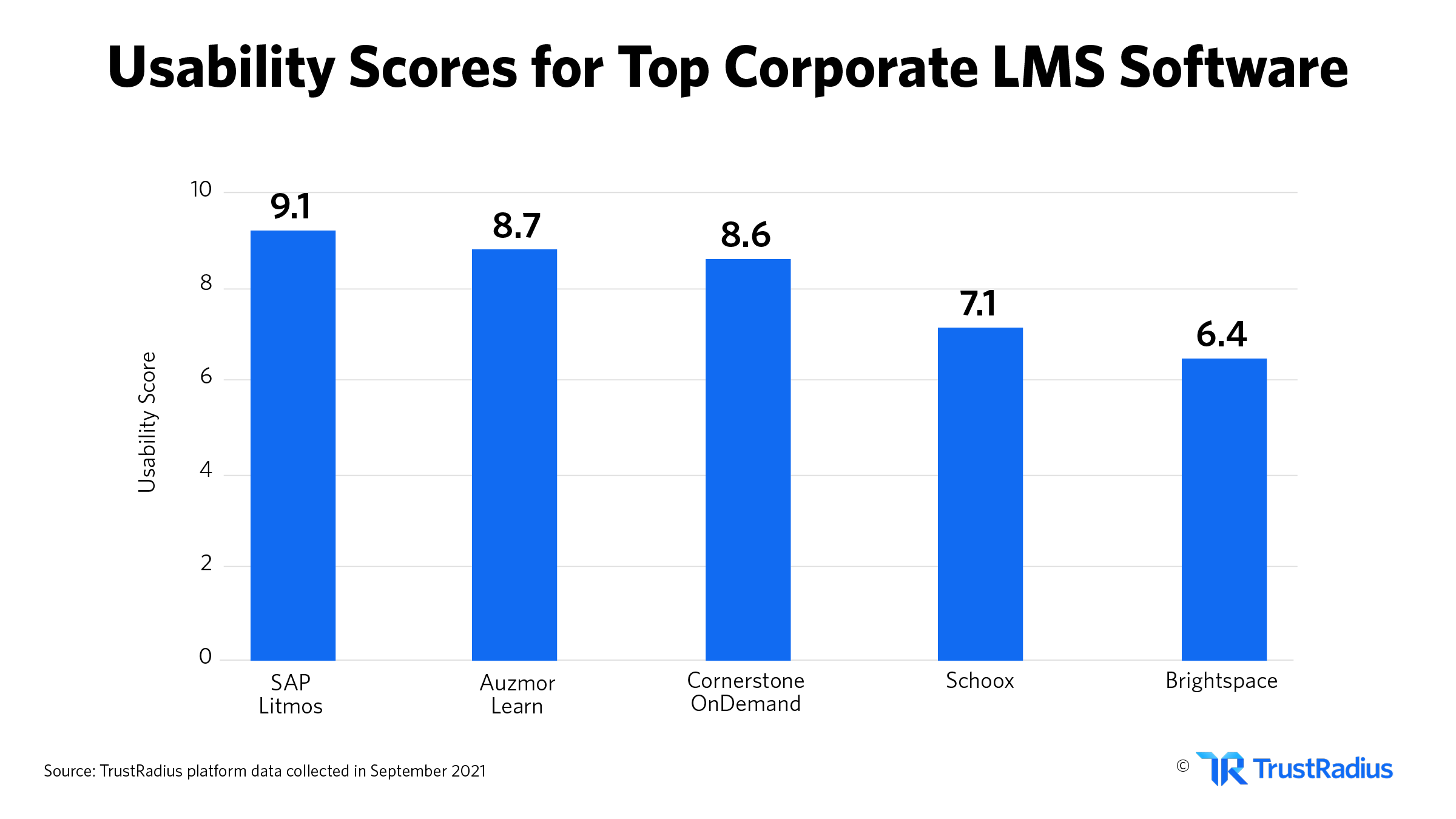

- SAP Litmos is the most user-friendly corporate LMS in 2021, with a usability score of 9.1 out of 10. (TrustRadius 2021)

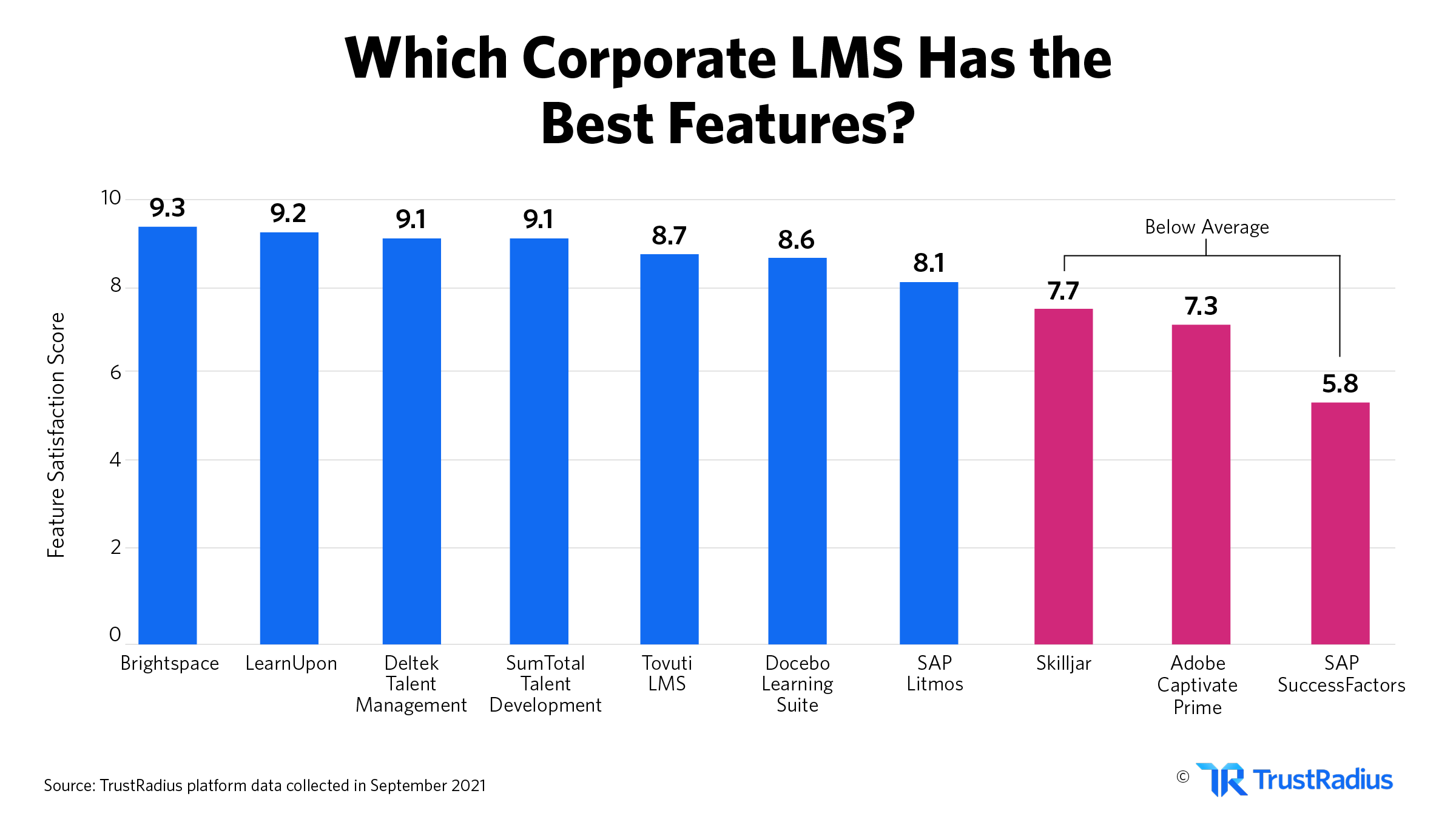

- Brightspace has the highest feature satisfaction score (9.3 out of 10) in today’s corporate LMS market. (TrustRadius 2021)

Who’s Winning Corporate LMS Market Share In 2021?

According to buyer interest (measured by total pageviews on TrustRadius), the top 10 leaders in today’s corporate LMS market are:

- Tovuti LMS

- Cornerstone OnDemand

- Brightspace

- SAP SuccessFactors

- Adobe Captivate Prime

- SAP Litmos

- TalentLMS

- Lessonly

- HealthStream Learning & Performance

- iSpring Learn

Tovuti LMS takes the top spot this year—which is quite a feat for a smaller company.

Tovuti was founded in 2017 and just raised $8 million in Series A funding. Yet they already contest the market attention of legacy and enterprise players like Cornerstone and SAP.

This is a huge win for Tovuti and shows that disruptions are fair game in the 2021 market.

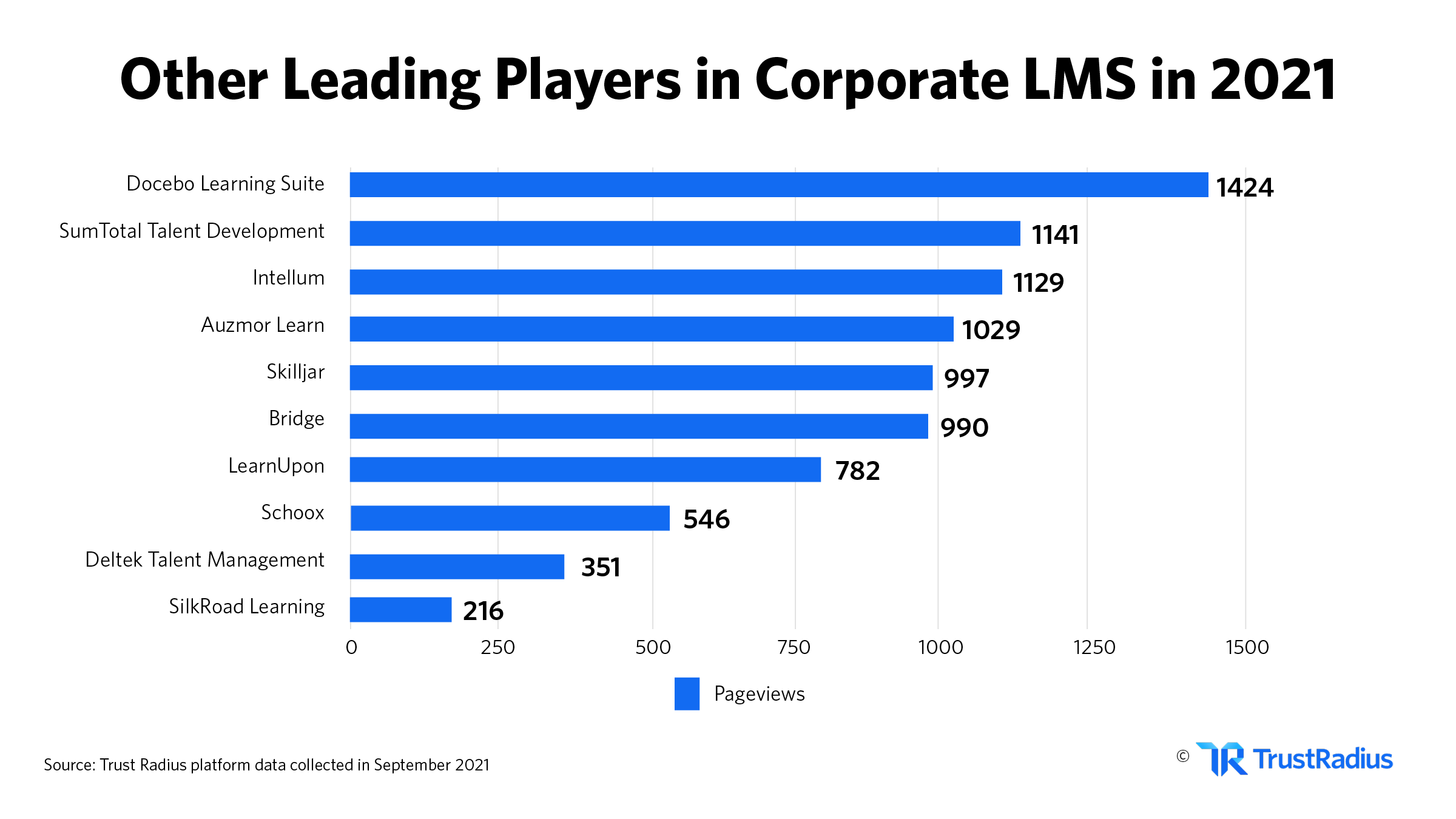

Other Key Players in Corporate Learning Software

There’s a lot more to this market beyond the top 10 companies.

The players who currently sit at #11-20 on TrustRadius command an additional 8600 page views per year. Those page views come from buyers who are actively comparing software beyond the top market share leaders.

Those products under consideration include:

- Docebo Learning Suite

- SumTotal Talent Development

- Intellum

- Auzmor Learn

- Skilljar

- Bridge

- LearnUpon

- Schoox

- Deltek Talent Management

- SilkRoad Learning

This list has plenty of variety as well. We see legacy players like Deltek and SumTotal mixed with newer contenders like Skilljar and Schoox.

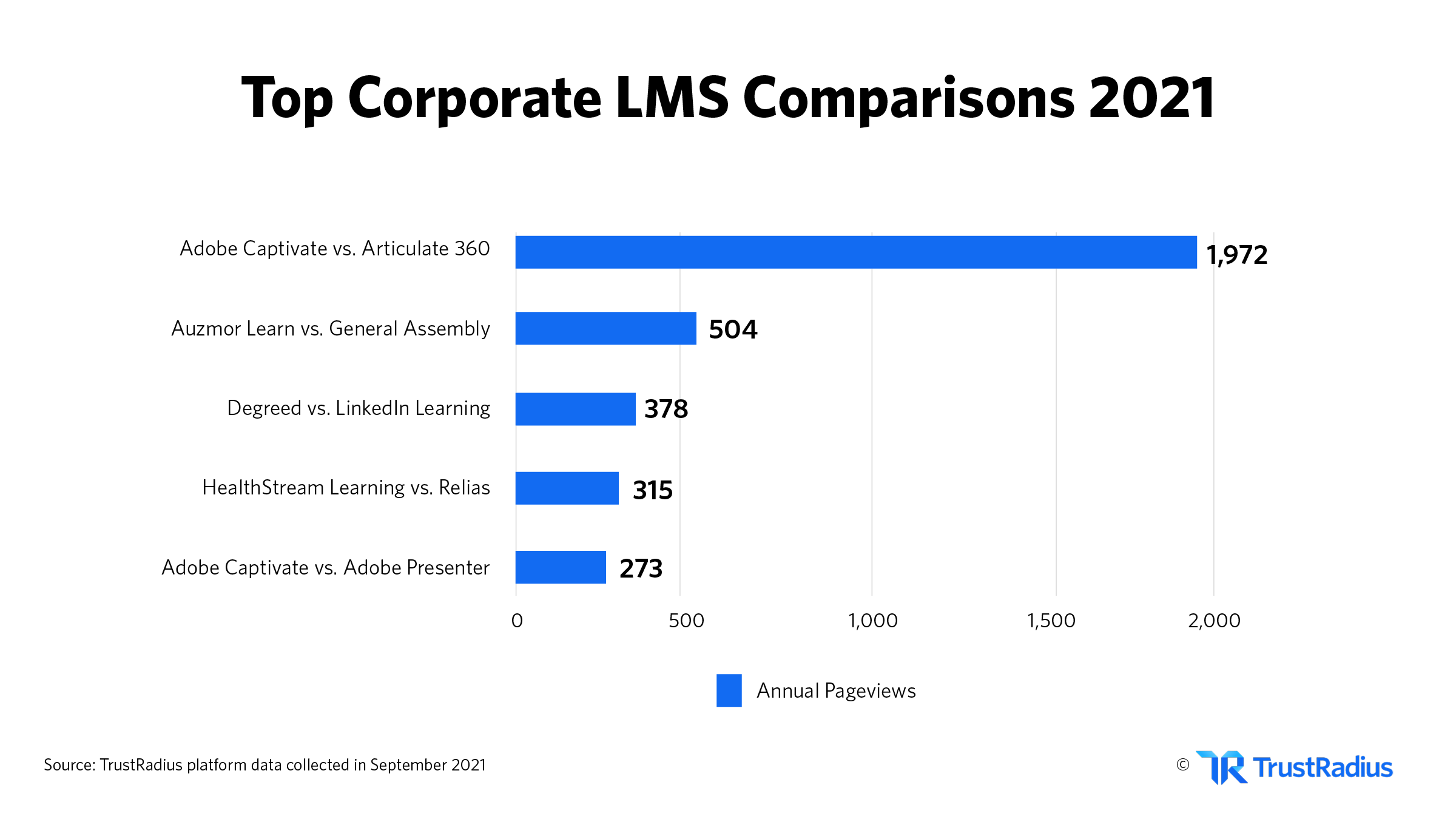

The Top Corporate LMS Comparisons in 2021

Buyers spend an average of 12 minutes comparing products side-by-side on TrustRadius—which indicates that they’re very close to making a purchase.

In the corporate LMS space, most buyers spend time comparing Adobe Captivate Prime vs Articulate 360.

This is an interesting comparison, because Articulate 360 focuses primarily on course authoring. This feature often comes included with many larger corporate LMS platforms.

The fact that this comparison far outstrips the #2 spot indicates that course authoring is a top priority for buyers in 2021.

How Top Corporate LMS Software Stack Up

Since the corporate LMS market is so varied, we pay close attention to how these products differentiate themselves. The corporate LMS leaders of the past and present are fighting for mindshare in a hot market with plenty of disruption.

That’s why we collect feedback from real buyers about their experience with corporate LMS software.

Below you’ll see how these products stack up in terms of customer support, usability, and key features.

You may be surprised to see which products rise to the top.

Lessonly Excels at Customer Support

Out of all the players in today’s corporate LMS market, Lessonly makes the most noise.

They’re well known for being a cloud-based, easy-to-use, modern LMS that’s challenging legacy players like SAP. And they recently got acquired by Seismic—a leading sales enablement platform.

Lessonly claims to have over 4 million learners who use their sales training, coaching, and enablement solutions.

The fact that such a large percentage of them are highly satisfied with Lessonly’s customer support is a huge accomplishment.

It’s also worth noting that two of our leading enterprise legacy players, SAP and Cornerstone OnDemand, are at the very bottom of this list. This could be a potential lever for growth as we continue to move into an increasingly competitive market.

SAP Litmos Wins in Usability

Litmos is SAP’s standalone LMS product, and apparently, this separation really works.

Since Litmos primarily serves large enterprises, it’s not surprising that they excel in usability. Only a very easy-to-use platform would succeed at that scale.

Auzmor Learn comes in second place here—possibly because of their focus on providing easy-to-use reporting and analytics features.

Brightspace Has the Best Features Overall

The corporate LMS market currently has a healthy feature satisfaction score of 7.8 out of 10. This means that most buyers are fairly satisfied with the features of their corporate LMS.

However, we’re seeing a very wide range of scores on either end of that average.

Brightspace comes in first with the highest feature satisfaction score of 9.3 out of 10.

This is really interesting because Brightspace serves both academic and corporate clients. It’s rare to find an LMS product that adequately meets the needs of both audiences. But clearly users of Brightspace are very satisfied with the features they offer.

At the other end, SAP SuccessFactors has the lowest features score on our list with 5.8 out of 10. That’s surprisingly low compared to other products in this category.

SuccessFactors is a broader HCM suite by SAP that happens to have an LMS included. It’s clear that buyers aren’t quite satisfied with the features here—especially when compared to Litmos, the SAP standalone LMS product.

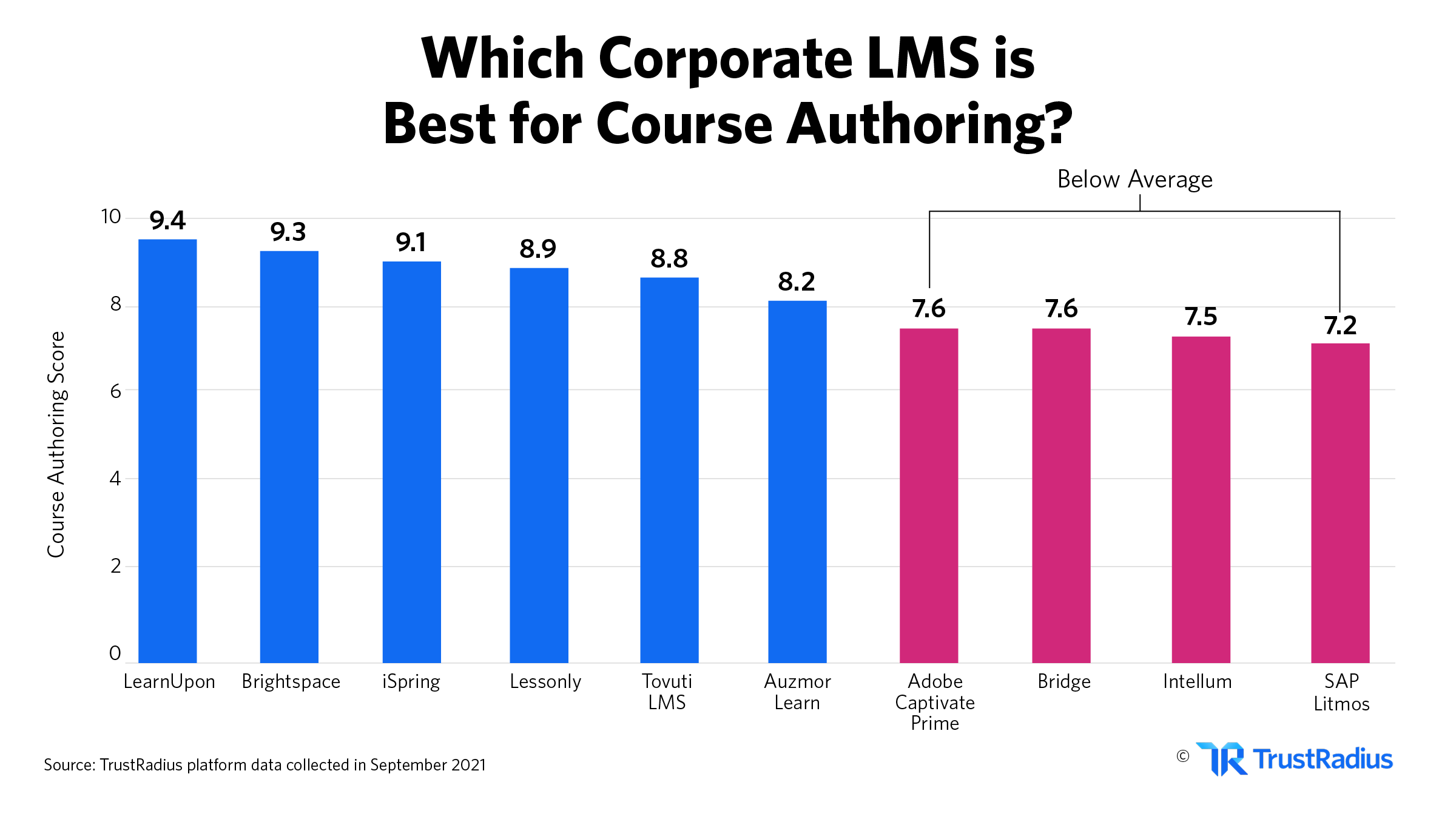

LearnUpon Wins at Course Authoring

Buyers are pretty satisfied with course authoring features across the corporate LMS category.

LearnUpon comes in first place with a course authoring score of 9.4 out of 10.

Since LearnUpon focuses on streamlined enterprise training, it makes sense for them to prioritize course authoring features.

It’s also interesting to note that the most popular corporate LMS comparison is between Adobe Captivate Prime and Articulate 360. Articulate is a point solution for course authoring. Yet Adobe sits solidly in the middle of the pack when it comes to course authoring features.

We might expect to see a comparison between LearnUpon and Articulate 360 rise to the top instead.

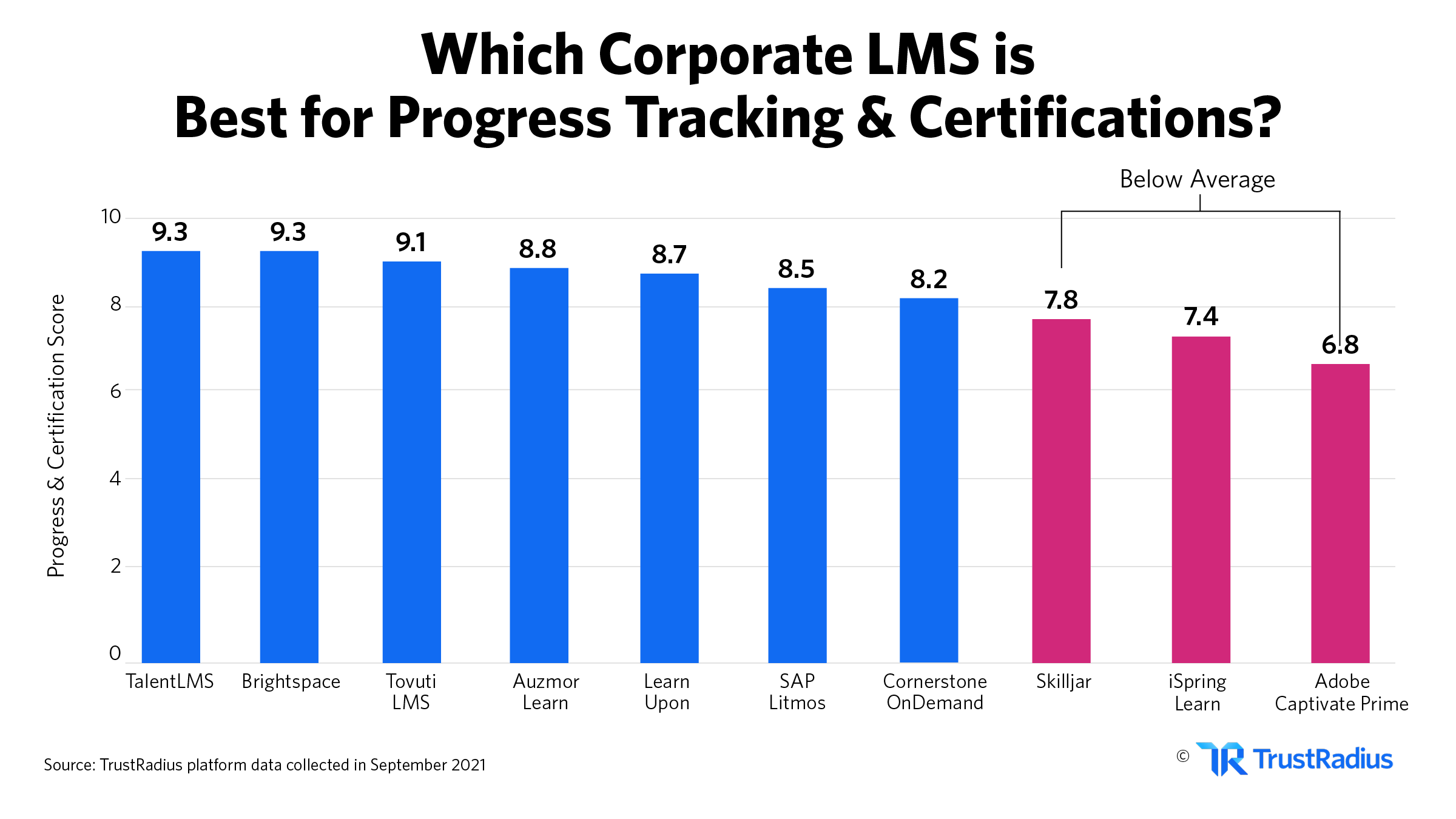

TalentLMS is the Best for Progress Tracking & Certifications

TalentLMS focuses on certification and compliance training for smaller organizations—so this win isn’t too surprising.

What is surprising is how low the scores go on the opposite end.

Adobe Captivate Prime has the lowest progress tracking & certification score at 6.8 out of 10. While this product is a staple player in the industry, its more basic features may not be optimized for tracking completion at scale. Some reviewers also point to broader reporting difficulties, which helps explain a lower progress tracking rating.

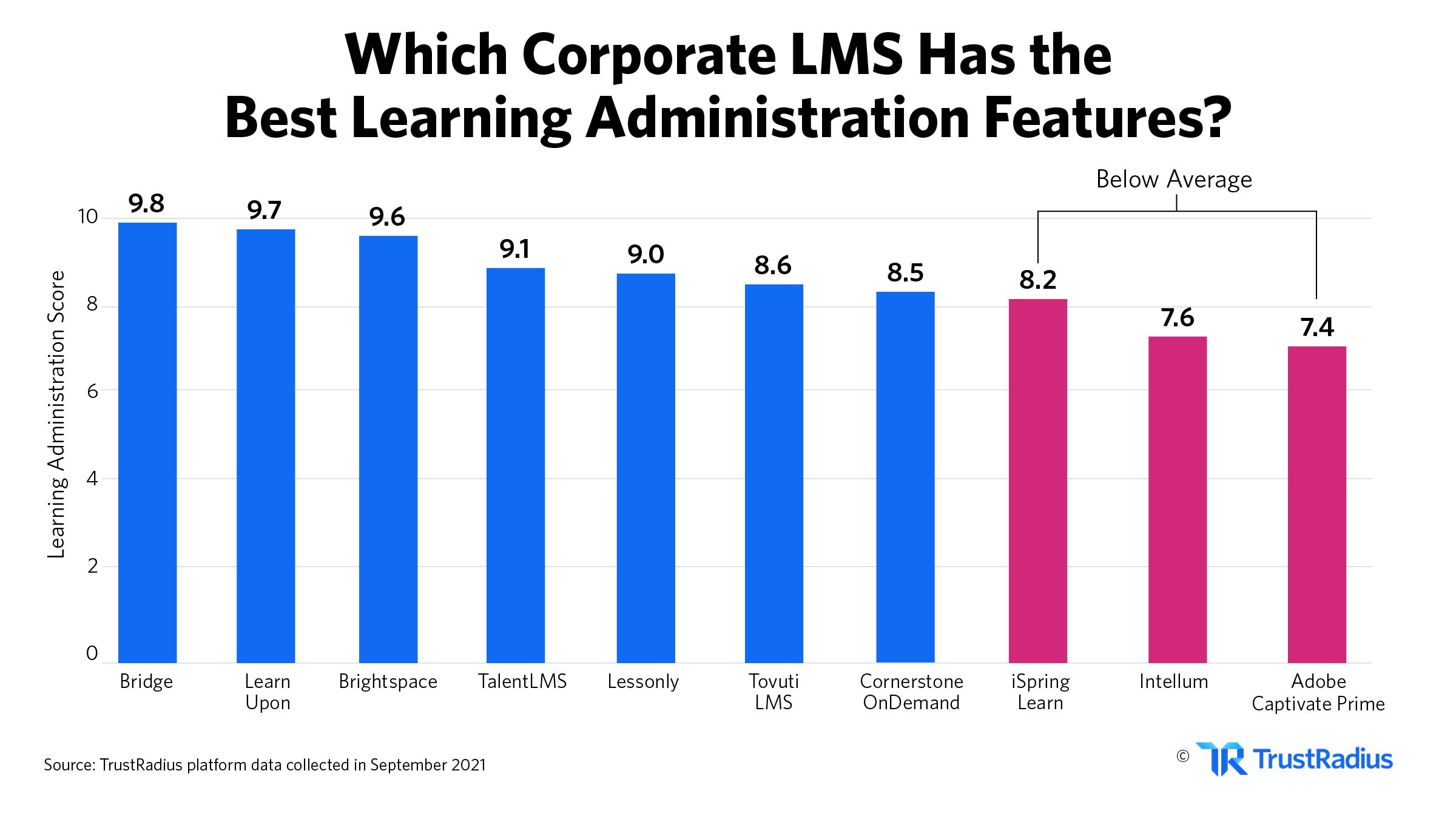

Bridge Excels in Learning Administration

Learning administration features are crucial for a corporate LMS. And out of all competitors in the market today, Bridge almost has a perfect score (9.8 out of 10).

Instructure (Bridge’s parent company) is well known for having two highly popular LMS products. Bridge is the corporate option, mirrored by Canvas on the academic side.

While Canvas is more well-known, it’s clear that Bridge users are highly satisfied with their corporate learning features.

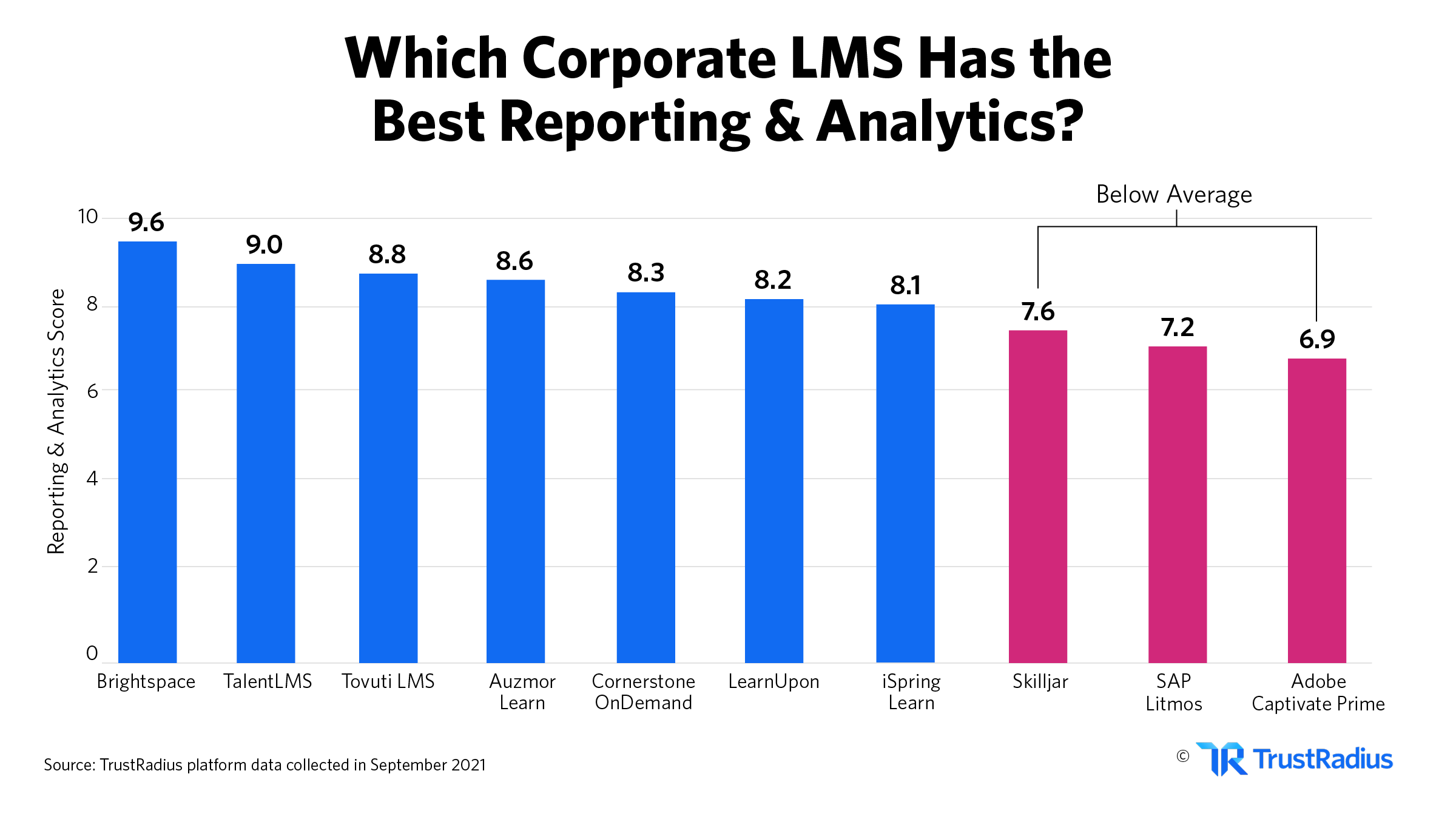

Brightspace Dominates in Reporting & Analytics

Brightspace won our first place spot for best features overall— and they take another win for reporting & analytics. Reviewers say that Brightspace’s reporting features make learner communication easier and more accurate.

We’re seeing a pretty wide gap between Brightspace and TalentLMS, which currently holds the #2 spot.

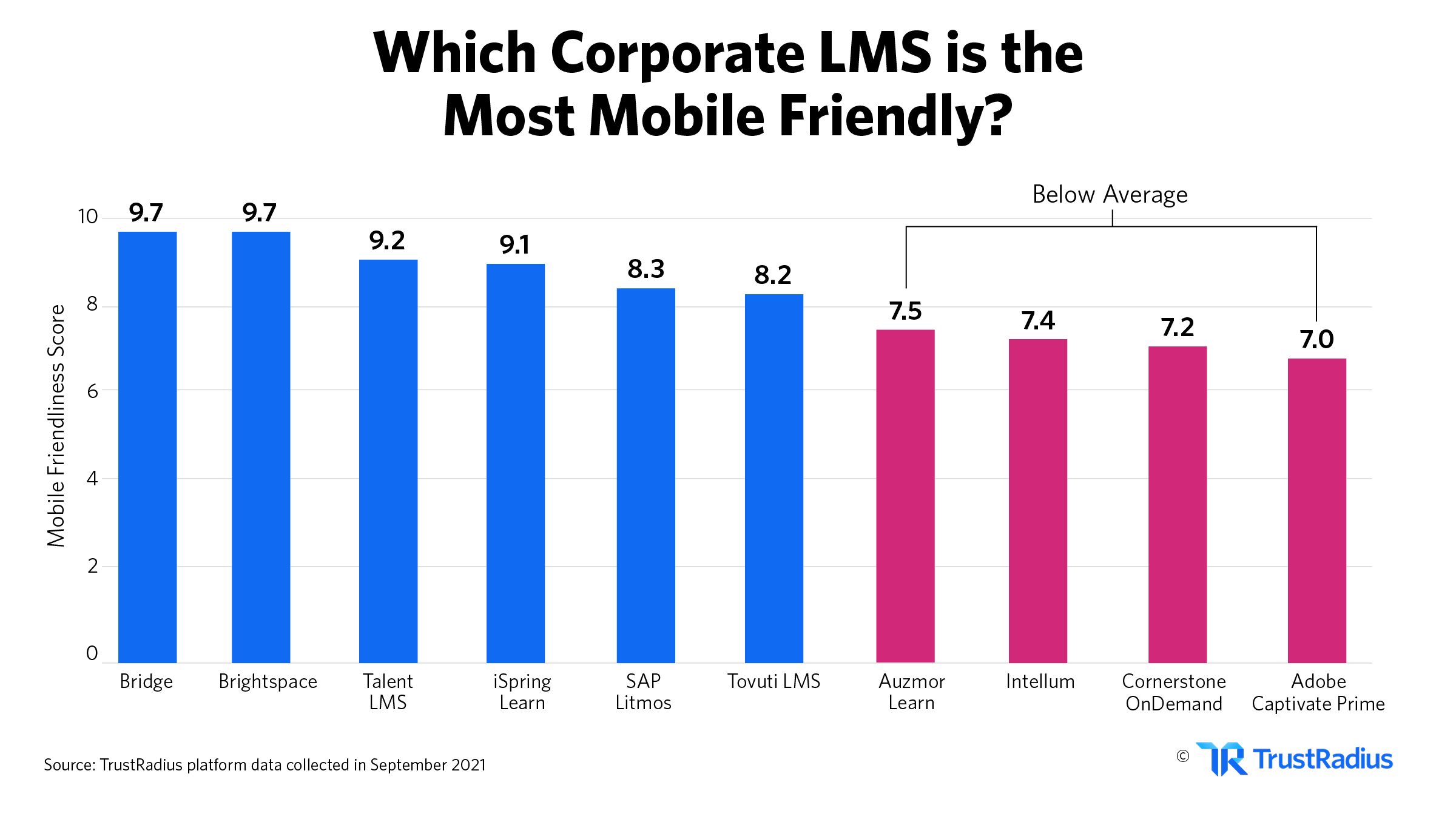

Bridge and Brightspace are the Most Mobile Friendly

The future is mobile-friendly, especially in the LMS world.

In this case, it’s clear that legacy player Bridge is well ahead of the curve. They’re tied with Brightspace for the most mobile-friendly corporate LMS.

They’re also well ahead of newer companies like Tovuti—who we might expect to see higher in these results.

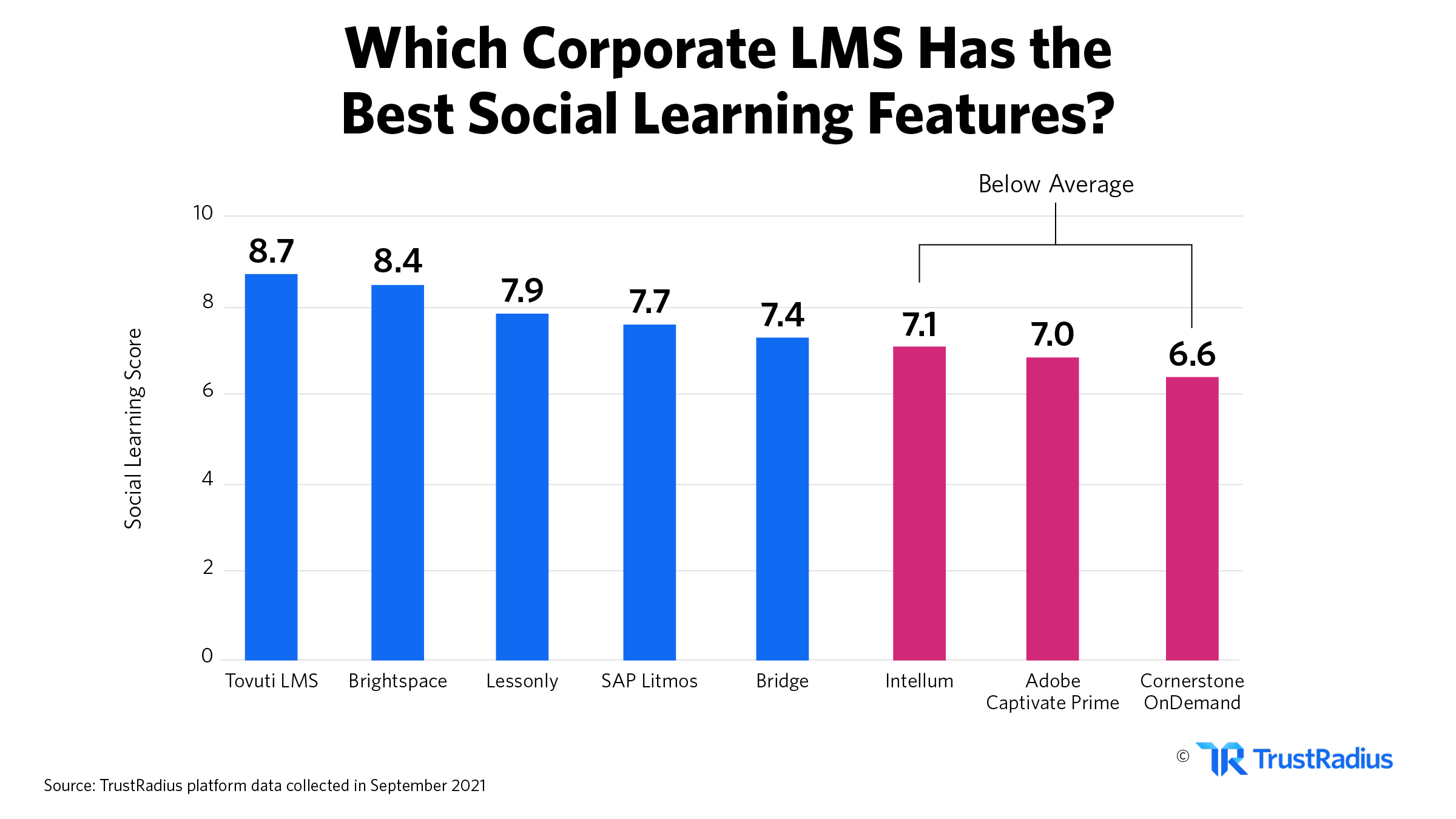

Tovuti LMS Has the Best Social Learning Features

We’re seeing a lot of parity in social learning features for today’s corporate LMS market. Most competitors are pretty close across the board, which leads to a flat graph.

However, the average here is lower than for some of the other insights we’ve highlighted in this report. That means that corporate LMS providers don’t do a stellar job at social learning across the board.

That’s odd to see, especially given how social learning is one of the biggest trends in LMS today.

Savvy vendors could take this as an opportunity for differentiation—because nobody really stands out here beyond Tovuti in the top spot.

Your Guide to Corporate LMS Pricing in 2021

| Corporate LMS Software | trScore | Starting Price | Free Trial | Free or Fremium | Premium Services | Setup Fee |

| Tovuti LMS | 8.9/10 | $4,500 | Optional | |||

| Cornerstone OnDemand | 8.4/10 | Contact Vendor | Required | |||

| Brightspace | 7.9/10 | Contact Vendor | None | |||

| SAP SuccessFactors | 7.1/10 | Contact Vendor | None | |||

| Adobe Captivate Prime | 7.6/10 | Contact Vendor | None | |||

| SAP Litmos | 8.4/10 | Contact Vendor | None | |||

| TalentLMS | 9.0/10 | $0 | None | |||

| Lessonly | 9.2/10 | Contact Vendor | None | |||

| HealthStream Learning & Performance | 7.4/10 | Contact Vendor | None | |||

| iSpring Learn | 9.8/10 | $2.82 | Optional | |||

| Docebo Learning Suite | 8.3/10 | Contact Vendor | None | |||

| SumTotal Talent Development | 6.5/10 | Contact Vendor | None | |||

| Intellum | 7.8/10 | Contact Vendor | None | |||

| Auzmor Learn | 8.9/10 | Contact Vendor | Required | |||

| Skilljar | 8.2/10 | Contact Vendor | None | |||

| Bridge | 7.7/10 | Contact Vendor | Required | |||

| LearnUpoBridge Reviews & Ratings 2021 | 7.7/10 | Contact Vendor | Required | |||

| Schoox | 8.2/10 | Contact Vendor | None | |||

| Deltek Talent Management | 7.1/10 | Contact Vendor | None | |||

| SilkRoad Learning | 6.5/10 | Contact Vendor | None |

If you’re looking for your next Corporate LMS solution, check out reviews on TrustRadius. You’ll see 100% authentic reviews from buyers just like you.

Investment News in the Corporate LMS Market

TrustRadius Top-Rated award winner Tovuti LMS raised $8 million in funding this June. The company saw 3x year-over-year growth, and plans to use the money to continue to advance its modern LMS products.

SumTotal saw its eLearning offerings explode after announcing a partnership with OpenSesame. Together the companies are delivering 20,000+ courses to create an end-to-end talent development solution.

SkillJar secured $33 million in additional funding last year and planned to grow its team and fund go-to-market programs. Since then, the company has made moves, hiring new executives to bolster its staff.

LearnUpon raised $56 million and hired an additional 100 staff members in 2020. They aren’t finished with growth any time soon and plan to use the investment to grow their team even further.

In a deal with stunning financial numbers, Cornerstone OnDemand reached a privatization agreement. Clearstone Capitol group has finalized a deal worth $5.2 billion to acquire the learning technology company.

D2L, owners of the LMS Brightspace, have announced a partnership with Crystal Delta. The LMS company plans to bring its ease-of-use expertise and help improve overall course design and user experience.

Finally, Lessonly recently announced their acquisition by Seismic, a leading sales enablement platform. This news comes quickly after Lessonly announced their own acquisition of Obie with the goal of helping customers work with remote and hybrid teams in the post-COVID age.

LMS Trends to Watch in 2021

Explosive Growth in Corporate Learning

Of all the trends to watch in Corporate LMS, perhaps the most impactful is the sheer rate of growth of this market. With a predicted CAGR of 22.6% over the coming 5 years, this is an area worth paying close attention to.

More and more companies are recognizing the benefits of development over hiring. Even beyond saving recruitment costs and effort, training programs can make far more efficient employees. In a rapidly changing, tech-driven economy, evolution and adaptation are key for both companies and their teams. Corporate LMS provides the ability to change with the world, meet compliance requirements, and reskill employees to new objectives.

UGC To Center Stage

User-Generated Content is a gold mine for many industries, including corporate LMS. UGC increases relevance and relatability, while encouraging participation. 86% of millennials find UGC particularly engaging.

Perhaps the most appealing aspect of UGC to cash-strapped training departments is cost. UGC is often entirely free. Many training departments can find free training resources already existing from other users in the marketplace. For Corporate LMS vendors, this means adapting to and incorporating this content into their platforms.

Training On The Go

Gone are the days where the majority of employee training happens in conference rooms. The COVID-19 pandemic accelerated and cemented the trend to working remotely. Now, up to 30% of Americans will permanently work from home.

Mobile learning allows for quick training on a warehouse floor or courses taken in an airport. New research into microlearning, or quick, sharp lessons, shows strong results.

Today’s corporate LMS developers are quickly adapting to the reality of learning from anywhere.

Learning in the Moment

Sitting through hours of training is not only agony: it can be ineffective. Studies show that people rapidly forget training material. Training in-the-moment works to address this.

Corporate LMS applications are quickly incorporating the 5 moments of learning philosophy. Learning at the moment of need is a trend being seen throughout the professional learning community. Organizations that are effective at integrating learning into day-to-day work have a 61% higher likelihood of applying virtual learning.

While base training is still vital, this trend may streamline the initial education process and improve results for staff.

10 More Corporate LMS Statistics

- From 2019 to 2020, the number of enterprise learners more than doubled, and the amount of learning has also increased by 58% more hours per learner. (LinkedIn 2021)

- 83% of online learning happens during the workweek. (LinkedIn 2020)

- The global Corporate learning management system market size was valued at $1.777 billion in 2019 (Cision 2021)

- The global Corporate Learning Management System (LMS) Market size is projected to reach $7.570 billion by 2026. (Cision 2021)

- 40% of employees go to Google before asking a co-worker or using their employer’s learning technology. (Docebo 2020)

- 87% of Millennials say professional development is very important to them in a job. (Docebo 2020)

- 57% of organizations are looking to make a large or moderate investment in Learning and Development in the next year. (Docebo 2020)

- By the end of 2021, 50% of enterprises will offer a learning assistant to help employees and customers with their training needs. (Metargo 2019)

- 73% of talent developers say they use externally created content to train employees. (LinkedIn 2020)

- 74% of employees want to learn during spare time at work. (LinkedIn 2020)

Sources

- 2021 Workplace Learning Report (LinkedIn 2021)

- 2020 Workplace Learning Report (LinkedIn 2020)

- Corporate Learning Management System Market Size is Projected to Reach USD 7570 Million by 2026 at CAGR 22.8% | Valuates Reports (Valuates 2021)

- Enterprise E-Learning Trends 2020 | A New Era of Learning (Docebo 2020)

- The Aragon Research Globe™ for Corporate Learning, 2019 (Metargo 2019)

- Corporate LMS Software Market Update (2021) (TrustRadius 2021)