COVID-19 Software Industry Statistics

*Updated on April 9, 2020

The coronavirus pandemic continues to have a tragic impact on our community. According to Splunk’s interactive COVID-19 dashboard, over 1,446,242 cases of COVID-19 have been reported worldwide as of today. The most important areas of focus right now are slowing the spread of the virus and saving lives.

As conditions continue to be unpredictable, TrustRadius is committed to monitoring changes in the B2B tech industry and helping software vendors stay abreast of the ever-shifting market.

Below you’ll find the fourth weekly installment in our COVID-19 Impacts series. This data comes directly from Google search impressions observed via the TrustRadius platform in Google Search Console and reflects the most significant week-over-week changes among high-searched categories and products.

Quick Access

Rising Software Categories

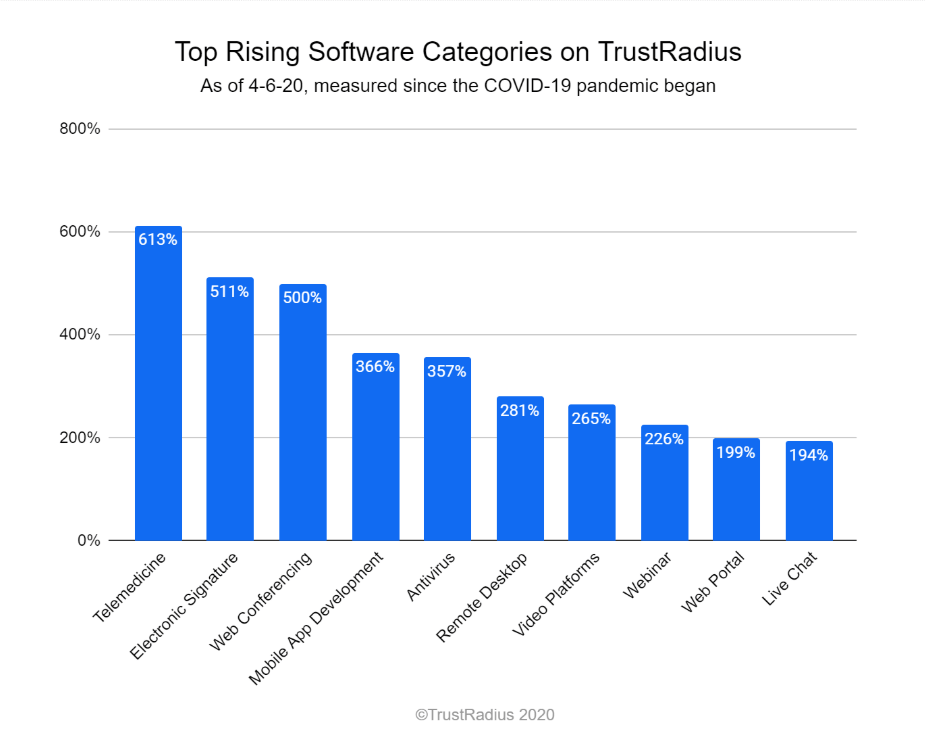

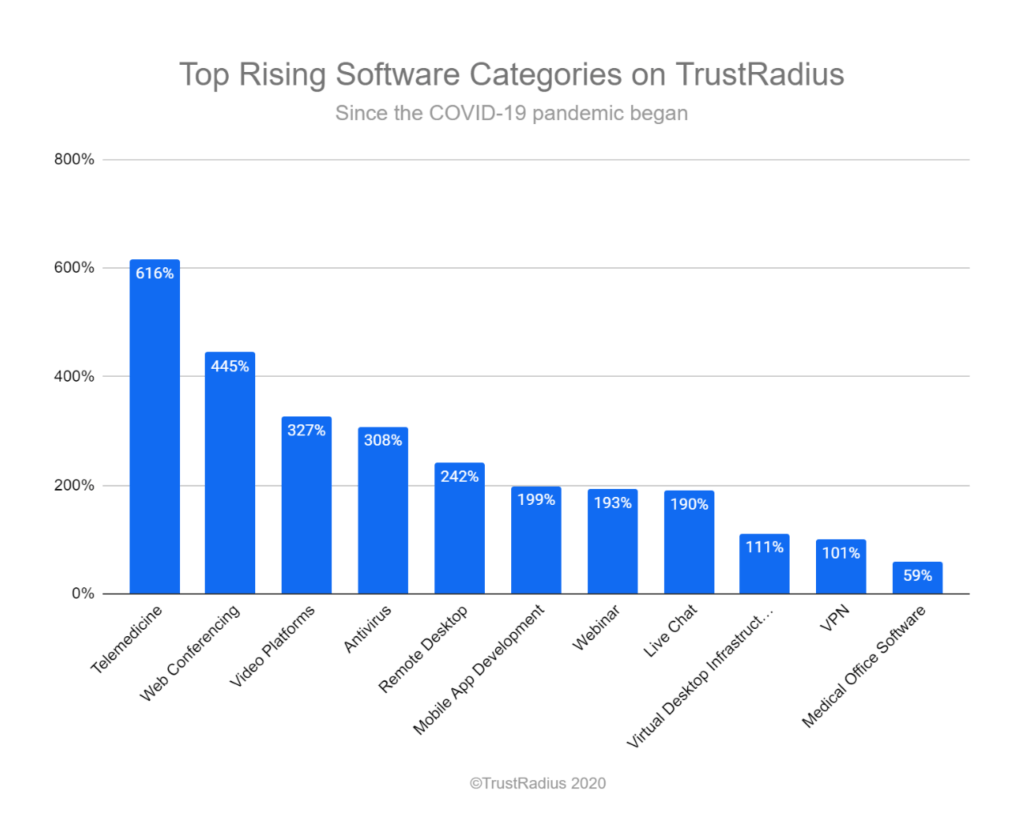

Many software categories have seen uncharacteristic increases in impressions in response to COVID-19. Here are the top rising categories since the beginning of the coronavirus pandemic, as measured on April 6, 2020:

| # | Category | Growth |

| 1 | Telemedicine | 613% |

| 2 | Electronic Signature | 511% |

| 3 | Web Conferencing | 500% |

| 4 | Mobile App Development | 366% |

| 5 | Antivirus | 357% |

| 6 | Remote Desktop | 281% |

| 7 | Video Platforms | 265% |

| 8 | Webinar | 226% |

| 9 | Web Portal | 199% |

| 10 | Live Chat | 194% |

*Figures over 100% indicate that impressions have more than doubled.

Category-Level Insights as of April 6

Compared with last week’s top categories, we’re seeing only a couple of new categories on this week’s list. Electronic Signature and Web Portal are both new for this week, displacing Virtual Desktop Infrastructure and VPN at the bottom of last week’s list.

Here are deeper insights into the category movement we’re seeing:

The Reigning Category: Telemedicine

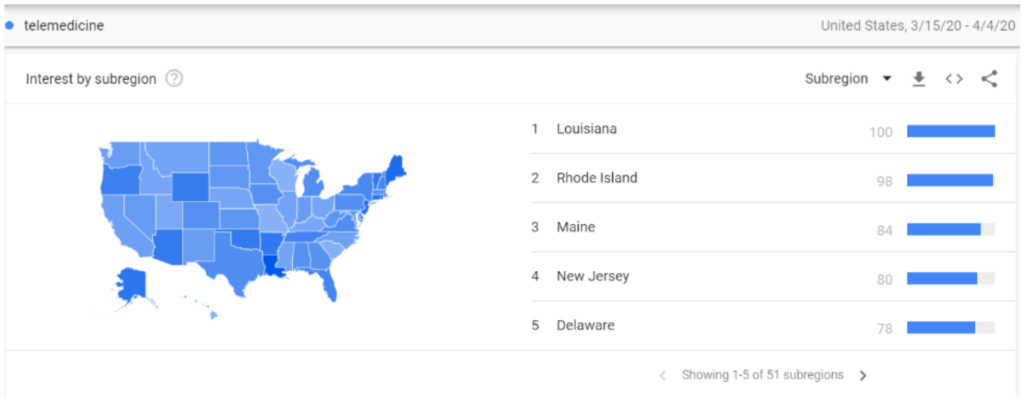

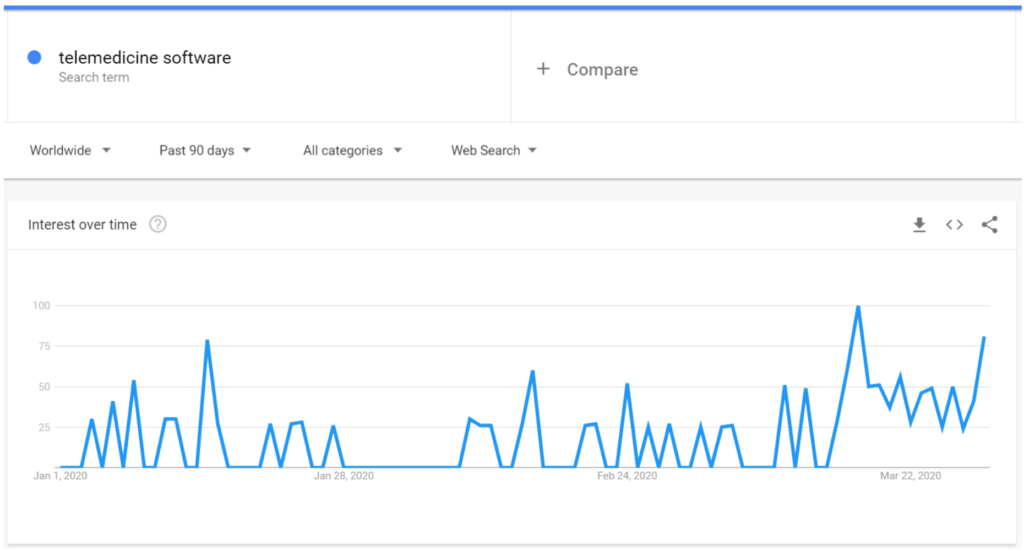

Telemedicine is the top growing category on the TrustRadius platform during the COVID-19 pandemic time period with more than 6X impressions as before the pandemic began. We’re seeing a -1% decrease in Telemedicine impressions week-over-week, which indicates that this category has officially peaked.

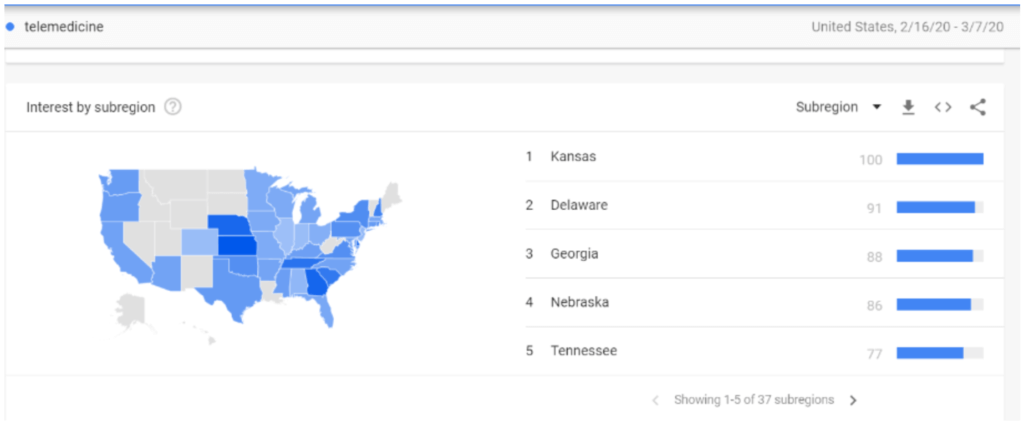

According to data from Google Trends, the rising interest in the telemedicine category started in the Midwest and Southern states (including Kansas, Omaha, Georgia, and Tennessee). In recent weeks we’re seeing growth across the entire United States—even in states where this category wasn’t even on the radar before COVID-19 hit.

Other Categories That Have Already Peaked

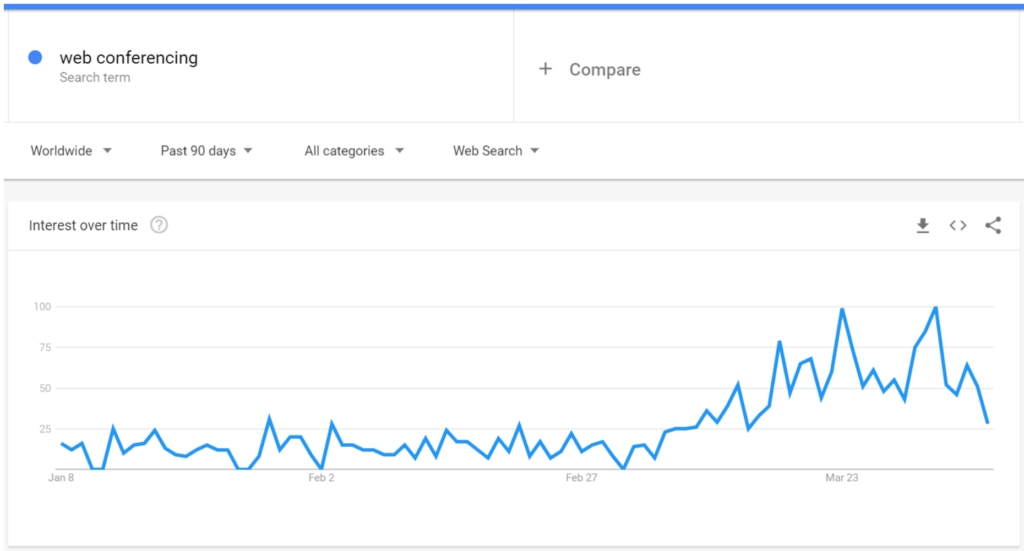

After three weeks of solid and unprecedented growth, several key categories hit their peak and have proceeded to fall. Web Conferencing is one of them.

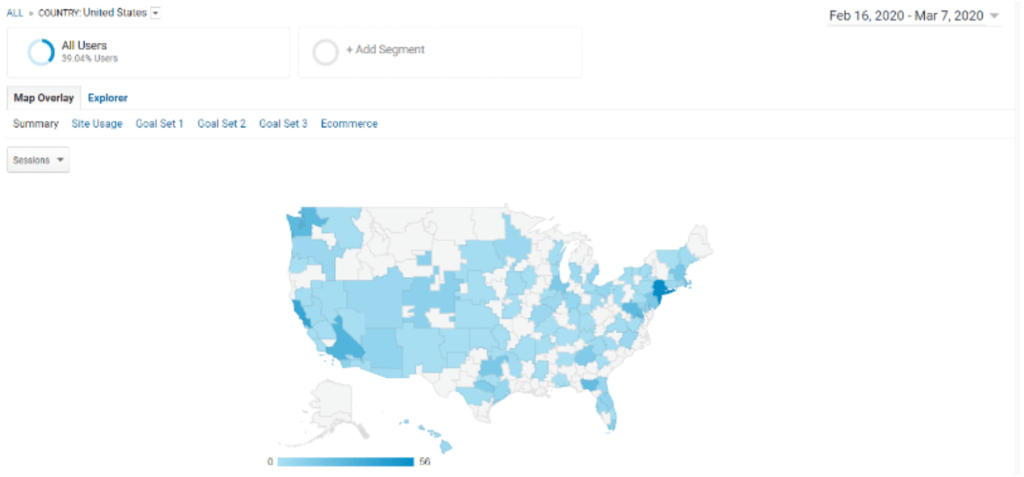

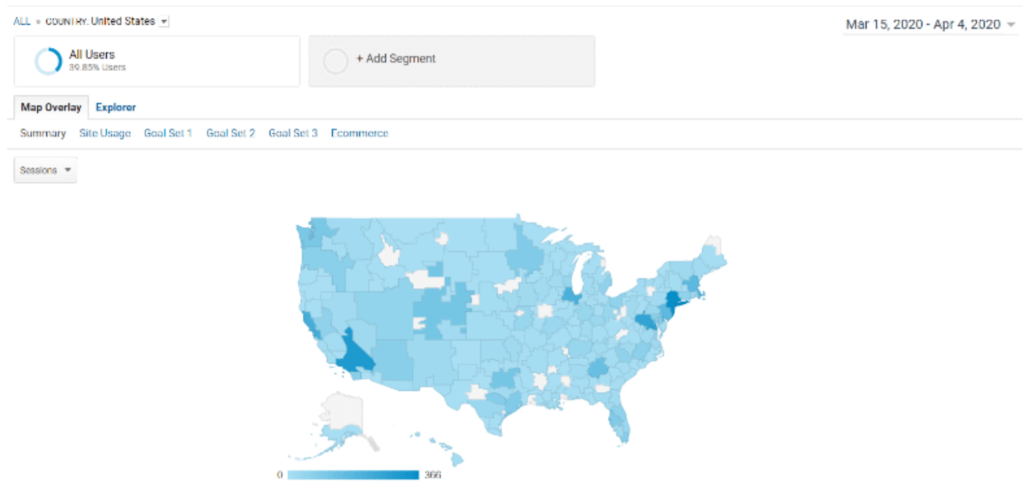

Looking at our Google Analytics data for Web Conferencing, we see that the Seattle metro area had a surge in the early days of COVID-19. In later weeks, we saw hot spots popping up in southern California, the NY metro area, and Chicago. The metros with the largest growth in sessions include New York, Los Angeles, Washington D.C., Chicago, and San-Francisco.

The most recent map from Google Trends shows a decrease in searches for the web conferencing term, which confirms the stagnation we see on the TrustRadius platform. Now that companies have had the time to set up their remote workforce, we assume that interest is declining and will continue to fall over time.

Other categories that have peaked include Electronic Signature, Remote Desktop, Video Platforms, and Live Chat.

Categories Still On The Rise

There are several categories that saw massive growth due to COVID-19 that are still rising today. These categories have not peaked or plateaued—rather, we expect them to continue growing for at least another week or more. Those categories are:

Mobile App Development

Antivirus

Webinar

Network Security

Learning Management (LMS)

Content Management (CMS)

eCommerce

Managed IT

John Koetsier was particularly interested to see Mobile App Development on this list. He comments for Forbes:

“One category that’s interesting is Mobile App Development, which is getting [366%] more traffic and attention now. We’ve seen that Coronavirus boosted mobile app spend to the highest quarterly revenue in history and that e-commerce—often consummated on mobile—is up 25% across the U.S., followed by growth in ad-spend in key mobile categories.”

We’re also seeing small but steady increases in the eCommerce category. Shopify, for instance, is seeing higher traffic now than in the past six months. This may or may not be COVID-19 related, but several sources including Economic Times and eMarketer have asserted that the eCommerce industry is likely to grow in response to the coronavirus pandemic.

Category-Level Insights as of March 30

Here are the top rising categories as measured during the week of March 24-30:

| # | Category | Growth |

| 1 | Telemedicine | 616% |

| 2 | Web Conferencing | 445% |

| 3 | Video Platforms | 327% |

| 4 | Antivirus | 308% |

| 5 | Remote Desktop | 242% |

| 6 | Mobile App Development | 199% |

| 7 | Webinar | 193% |

| 8 | Live Chat | 190% |

| 9 | Virtual Desktop Infrastructure | 111% |

| 10 | VPN | 101% |

| 11 | Medical Office Software | 59% |

From the beginning of the pandemic time period (roughly March 9, 2020), here are the biggest changes we observed:

- March 9-15: Appointment Scheduling software saw the highest change at 351%—more than 4x the normal amount of impressions.

- March 17-23: Antivirus rose to the top spot on our Top 10 list. Telemedicine rose to #2, which was interesting given that this category routinely saw little interest before March 2020.

In those weeks, buyers were highly concerned with building out software for a remote workforce. Companies worked quickly to set up antivirus software, VPNs, and remote desktop software tools for secure remote workstations. As more and more companies moved to remote work, we weren’t surprised to see the categories of Web Conferencing, Webinar, Video Platforms, and Video Conferencing Equipment rising steadily.

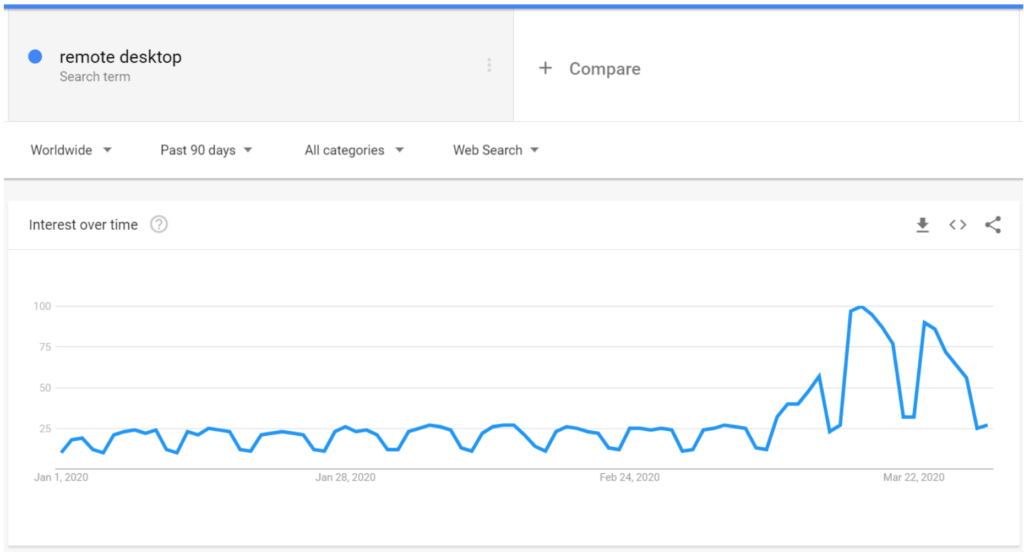

As expected, Web Conferencing continued to rise week-over-week and month-over-month as measured during the week of March 24-30, both on the TrustRadius platform and according to Google Trends.

Since the beginning of the pandemic, we also observed significant growth in the Telemedicine software category that seems to be continuing into next week. Google Trends reports volume for this search term to have peaked once on March 17, but was still rising on March 30:

And, as of March 30, we started to notice that certain categories have peaked and are now starting a gradual decline.

Remote Desktop, Virtual Desktop Infrastructure, and Video Platforms were all slightly down week-over-week, but still earned significantly higher impressions than previous months. Our trendlines for these categories were nearly identical to the below data from Google Trends:

Weekly Product Hot Spots

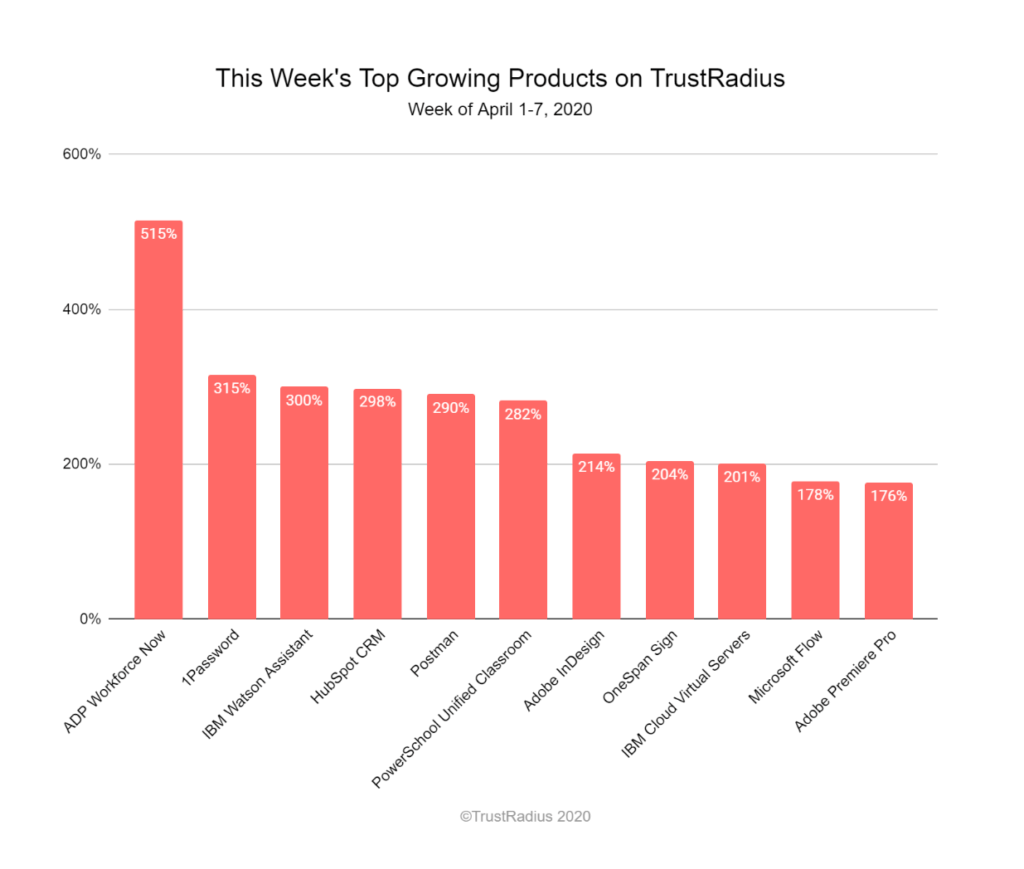

This week we’re continuing to see lower growth numbers across products and categories, which indicates that the peak software purchasing activity of COVID-19 has officially plateaued. Still, the following software products have seen significant increases in impressions over the past seven days:

Once again, we’re seeing an almost entirely new list of products rising this week on the TrustRadius platform. Now that most companies have implemented the tools they need to launch a fully remote workforce, it appears that buyers are searching for more use-case-specific solutions like Electronic Signature and IaaS.

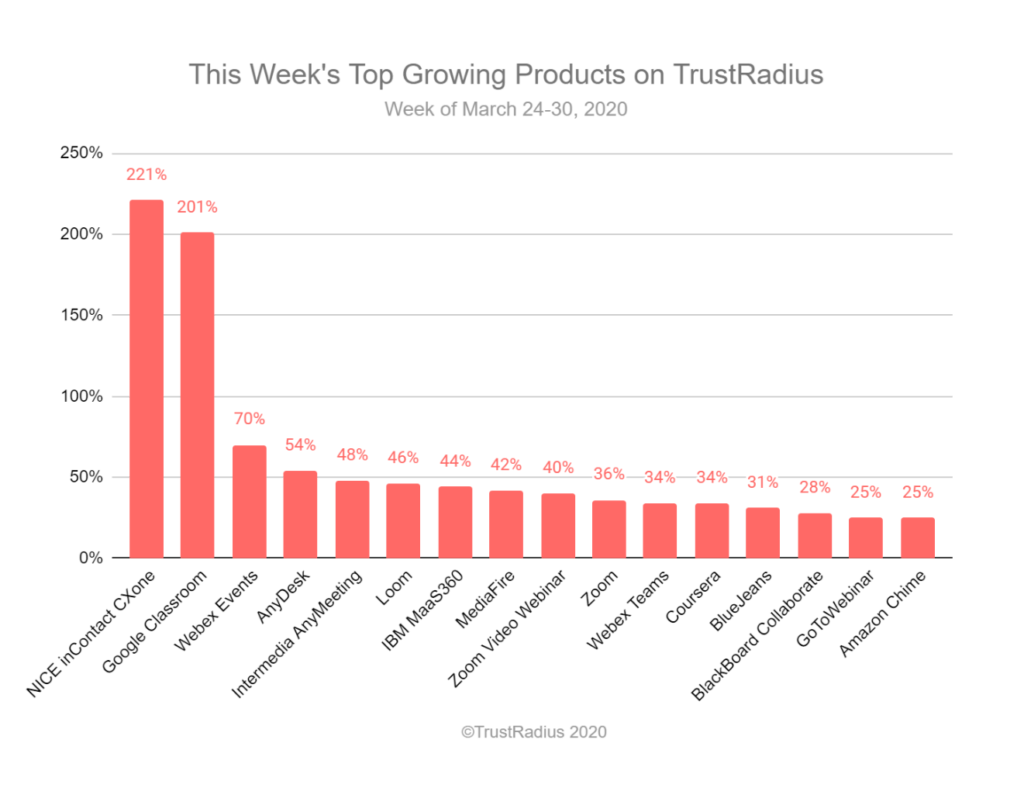

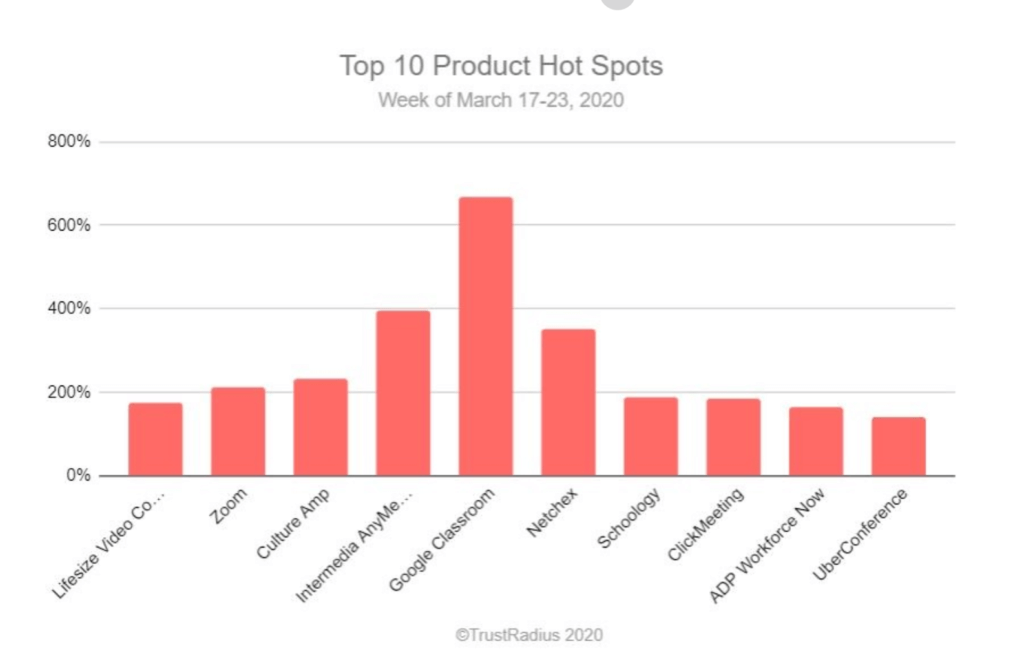

Here are previous weeks’ top products for comparison, where we saw more products from remote-work-related categories:

Because we saw top products change dramatically week-to-week, we weren’t surprised to see many new products on this list during each subsequent update. The only products we saw carried over from previous weeks were Google Classroom and Zoom—industry-leading products that continue to be hyper-relevant in today’s climate of remote learning and remote working.

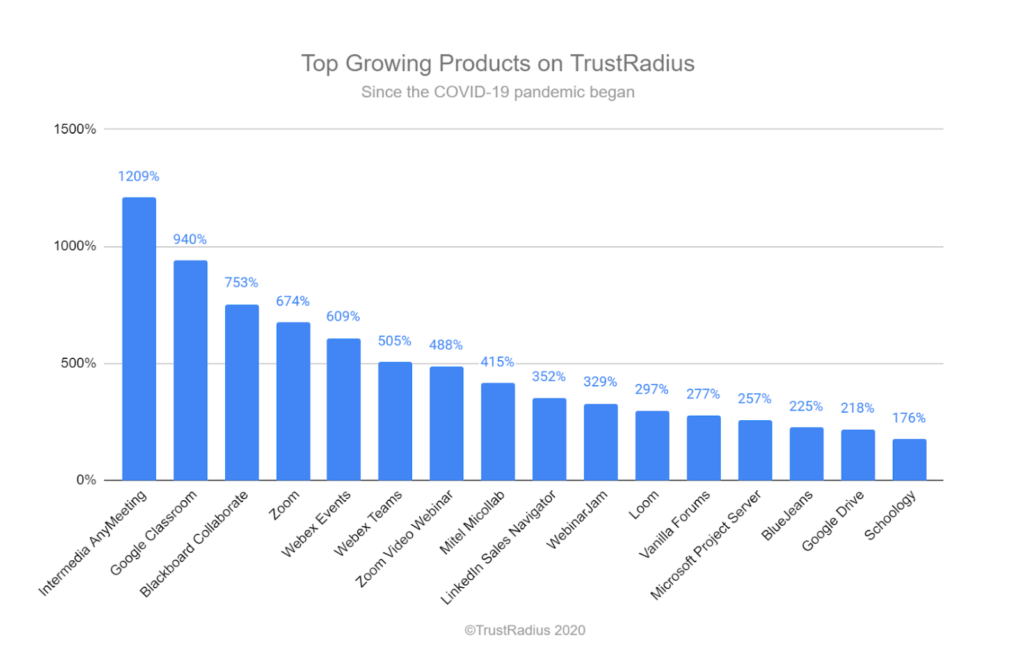

Product Growth Since The Pandemic Began

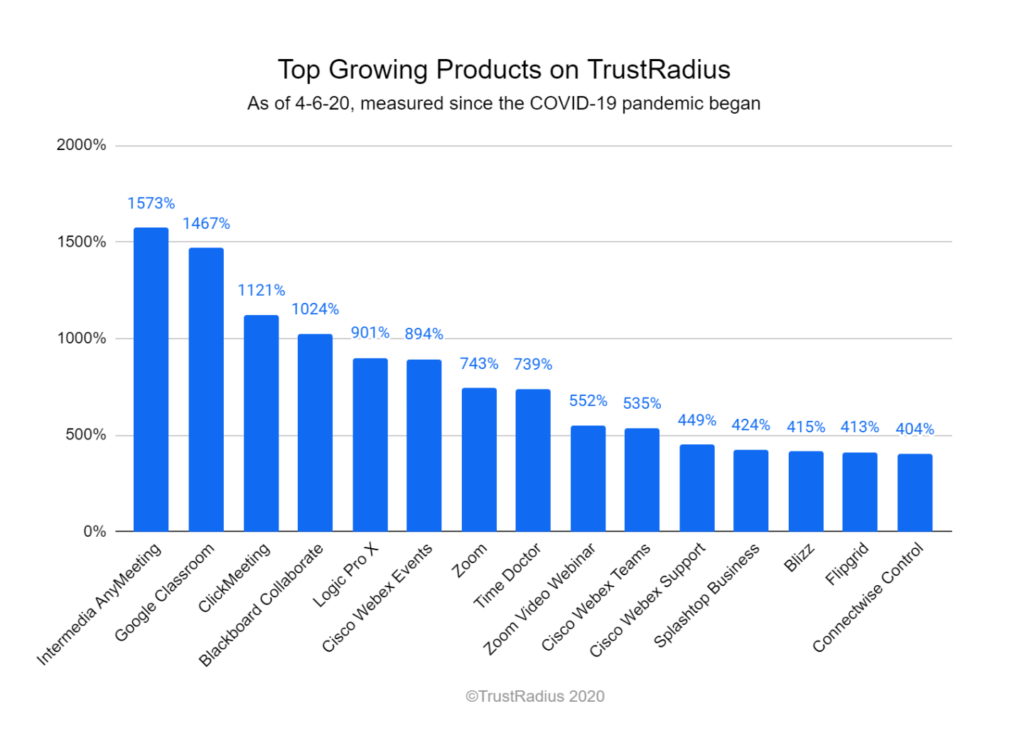

The products listed above grew the most during individual weeks following March 9. However, we also found it interesting to compare the products that have grown overall since COVID-19 hit the United States. All of the products below have seen significant growth in response to this crisis:

*new products to this list

While many of the products on this list remain the same from last week, we do see four new products emerge (starred in the table above) from predictable categories related to remote work.

Logic Pro X is an interesting contender on this week’s list because audio editing software has so far seemed unaffected by COVID-19 related activity. However, they recently released a 90-day free trial as a good-will offering for buyers who are social distancing—which shows the potential power of initiatives like this in today’s world.

Intermedia AnyMeeting leads once again this week with even more growth than before (+300% over last week), followed again by Google Classroom in spot #2.

Here’s last week’s lineup for comparison:

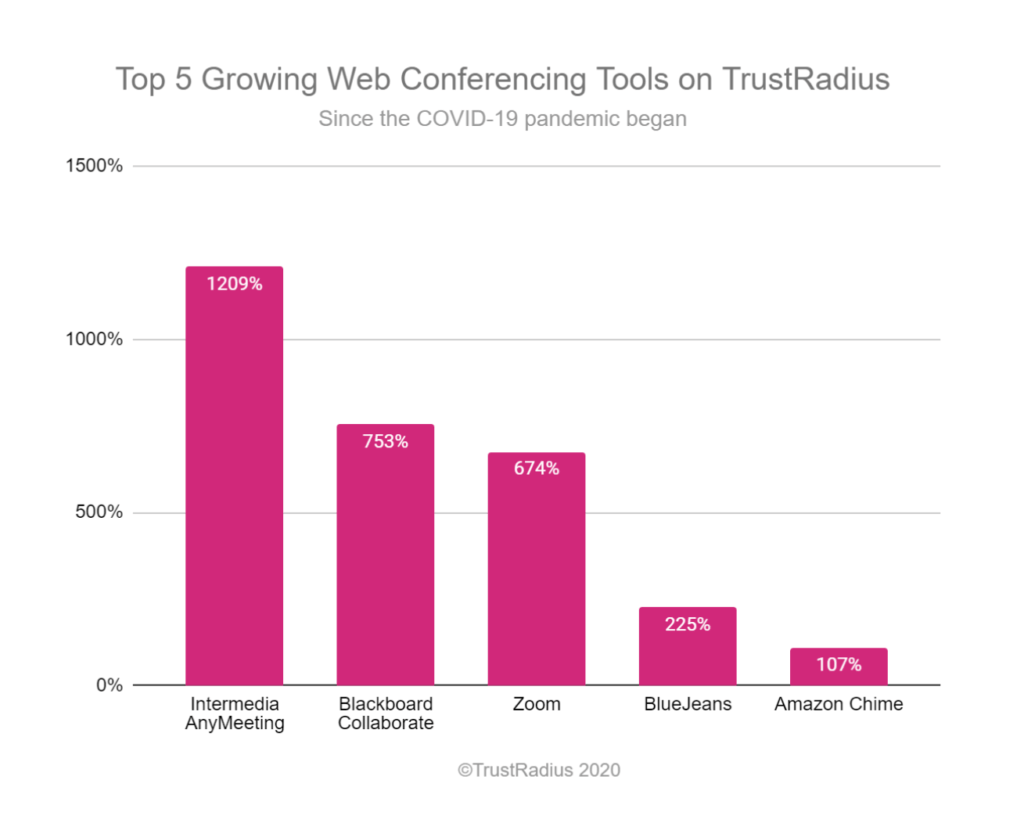

Growth in Web Conferencing Software

Because most companies are now working from home, we’ve also been closely monitoring how the TrustRadius community compares web conferencing solutions.

Our data shows that the fastest growing conferencing tool on the TrustRadius platform is Intermedia AnyMeeting (with 13X growth), followed by Blackboard Collaborate, Zoom, BlueJeans, and Amazon Chime. All of the products listed below have more than doubled with uncharacteristic growth since the coronavirus pandemic began:

| # | Web Conferencing Tool | Growth |

| 1 | Intermedia AnyMeeting | 1209% |

| 2 | Blackboard Collaborate | 753% |

| 3 | Zoom | 674% |

| 4 | BlueJeans | 225% |

| 5 | Amazon Chime | 107% |

While all of the products above have grown significantly due to COVID-19, it’s important to observe these data points within a broader context.

As John Koetsier comments for Forbes,

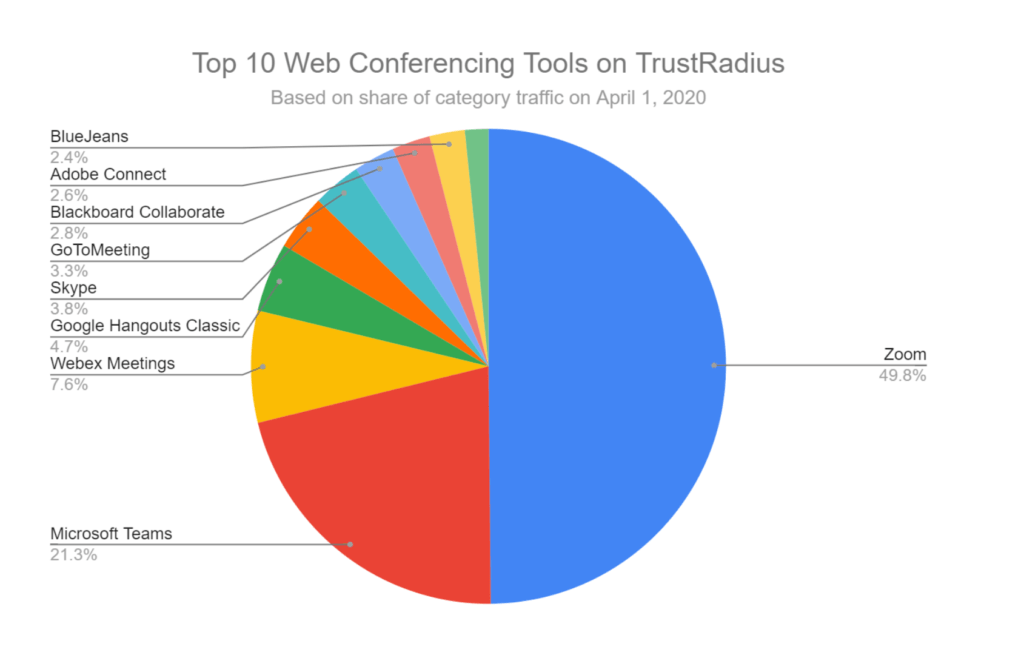

“Interestingly, given Zoom’s massive growth from 10 million users per month in December to 200 million in March, it’s not the fastest-growing video conferencing platform in terms of TrustRadius views — probably because it already was a category leader. But it currently captures almost 50% of all category interest, trailed by Microsoft Teams at 21.3%.”

When comparing total impressions of all the products in the Web Conferencing category on TrustRadius this month, Zoom still clearly leads the pack as the most researched product. Buyers have been considering Intermedia AnyMeeting more than ever before, but that particular product still only owns <1% of the total share of the influence in this category:

This data agrees with what we’re seeing in the broader market for Web Conferencing software. According to SEG’s Public Market Update, Zoom stock is up over 90% YTD—leading the pack of remote collaboration companies who have seen remarkably positive returns despite the current economic crisis.

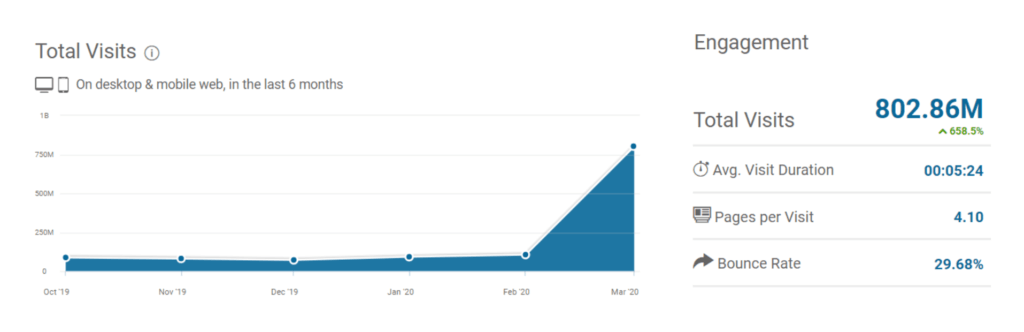

It’s also worth noting that according to SimilarWeb, Zoom is now the 35th most popular site in the world. They earned an estimated 800M visits to their site in March, up from about 106M in February. Zoom will likely see over 1 billion views in April as interest continues to climb.

With the influx of traffic to Zoom’s platform, users have also experienced serious data privacy and security breaches that resulted in a class-action lawsuit and investigation from New York Attorney General Letitia James. “Zoombombing” may be one reason why thousands of enterprise software buyers are actively comparing a full list of alternative software options this month.

Given the drama currently surrounding Zoom, it’s also interesting to note that Skype falls decidedly in the bottom of the pack as far as category influence is concerned. Tom Warren from The Verge has an interesting take on why that might be:

“Like Microsoft said, ‘For now, Skype will remain a great option for customers who love it and want to connect with basic chat and video calling capabilities.’ The ‘for now’ part of that statement is a telling sign that Microsoft’s focus is now Teams, not Skype.”

Booming Software Product Comparisons

Certain comparison pages on TrustRadius.com have received even more extreme increases in impressions due to COVID-19.

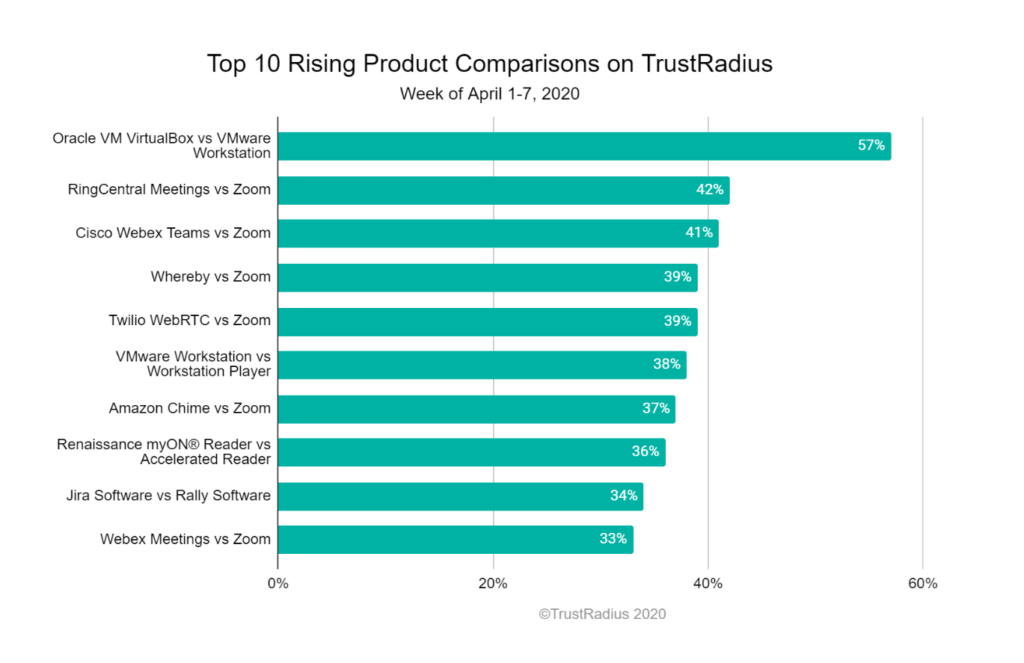

In previous weeks, buyers were desperately seeking web conferencing tools and comparing many alternatives to Zoom in order to form their shortlists. That trend continues today.

Interest is also holding for distance learning platforms and learning management systems. We assume that schools and universities have already purchased and implemented their tools by now, but may be considering alternatives as challenges arise.

Again, growth numbers here are lower than they have been in previous weeks. None of the comparison pages on this week’s list came close to doubling their growth—whereas last week we saw growth numbers as large as 3X. This indicates again that the “boom” we’ve seen with software purchasing activity is continuing to decrease week-over-week.

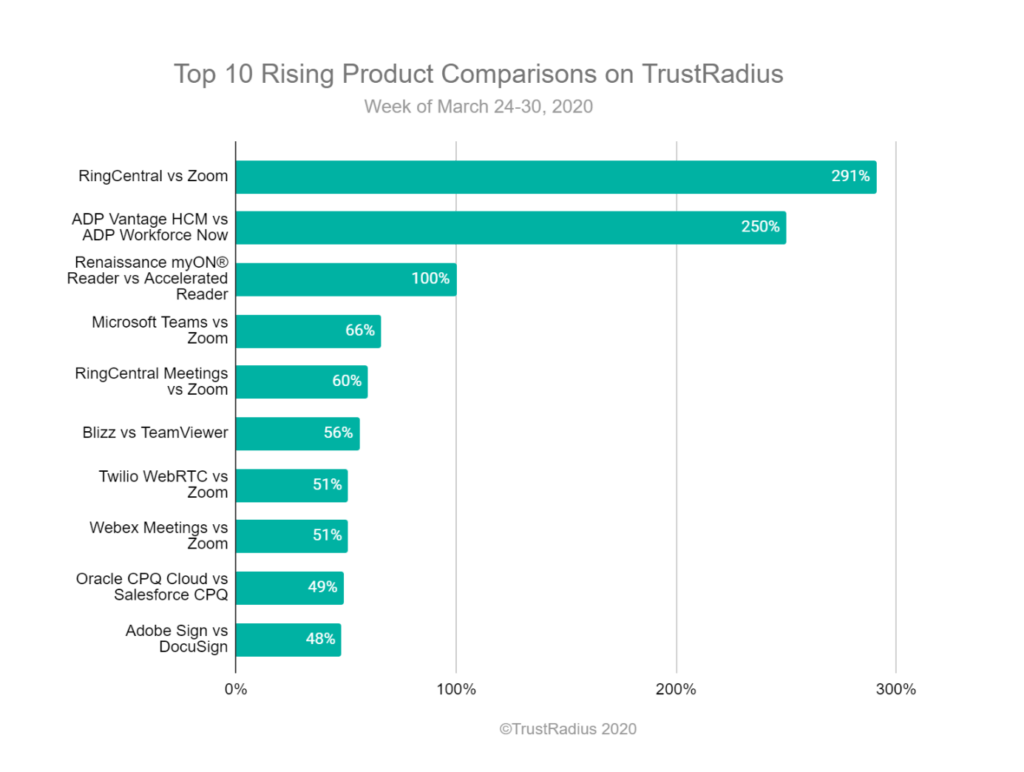

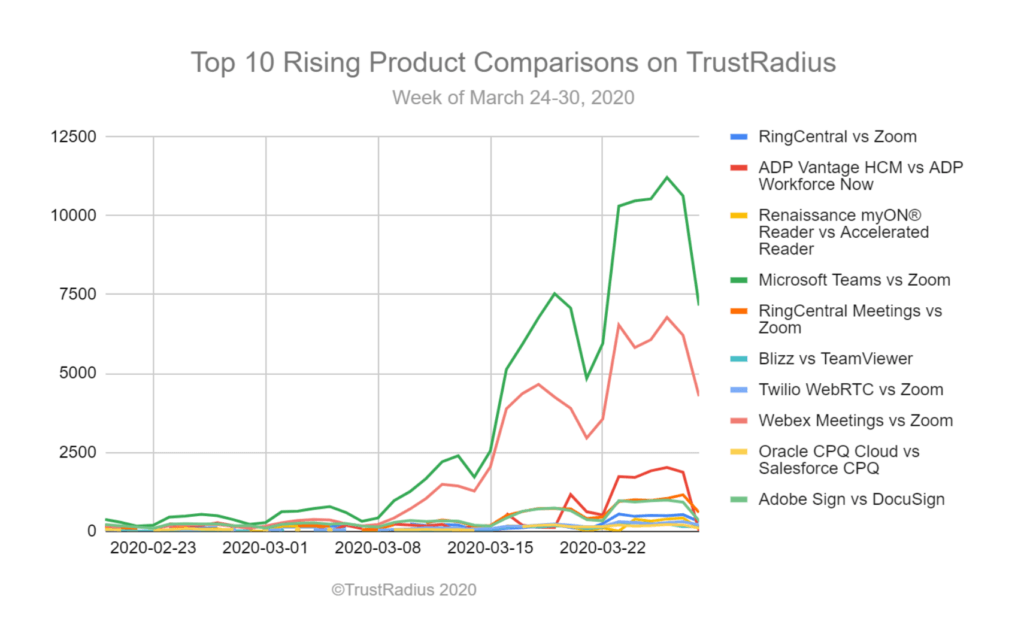

Comparison Insights as of March 30

For comparison’s sake, below are the comparison pages that saw the most overall growth during the week of March 24-30:

9 out of 10 comparisons on the Top 10 list above were new for the week of March 24-30, though most still fall within the predictable category of Web Conferencing. The only lingering page seeing significant growth week-over-week is Blizz vs TeamViewer, which was still growing at 56% (on top of 560% the week before). As of April 6, this comparison page is no longer booming.

Below you’ll see that while these comparison pages did grow week-over-week, their trend lines are now presenting a steady decline. This is another indicator that the peak software purchasing activity caused by COVID-19 appeared to have peaked as of March 30.

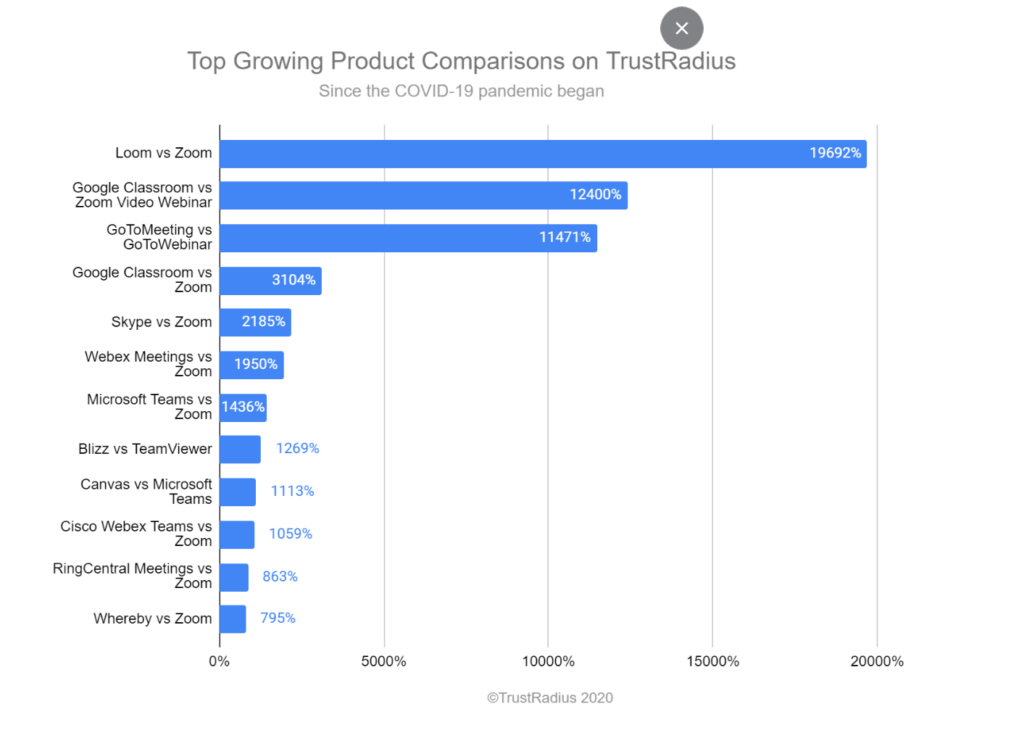

Finally, below are the top growing product comparisons overall (not just week-over-week) as measured on March 30:

| Product Comparison | Growth | |

| 1 | Loom vs Zoom | 19692% |

| 2 | Google Classroom vs Zoom Video Webinar | 12400% |

| 3 | GoToMeeting vs GoToWebinar | 11471% |

| 4 | Google Classroom vs Zoom | 3104% |

| 5 | Skype vs Zoom | 2185% |

| 6 | Cisco Webex Meetings vs Zoom | 1950% |

| 7 | Microsoft Teams vs Zoom | 1436% |

| 8 | Blizz vs TeamViewer | 1269% |

| 9 | Canvas vs Microsoft Teams | 1113% |

| 10 | Cisco Webex Teams vs Zoom | 1059% |

| 11 | RingCentral Meetings vs Zoom | 863% |

| 12 | Whereby vs Zoom | 795% |

Falling Software Categories and Products

As expected, impressions have also declined for certain categories in response to coronavirus. While we are seeing a slow-and-steady decline in most of the categories that peaked in response to COVID-19, we haven’t seen steep declines across many categories on the TrustRadius platform overall. This is good news. Software buyers are still considering products in strong categories and haven’t altered their purchasing behavior too significantly.

That being said, we have observed a few distinct instances of decline as a result of the pandemic.

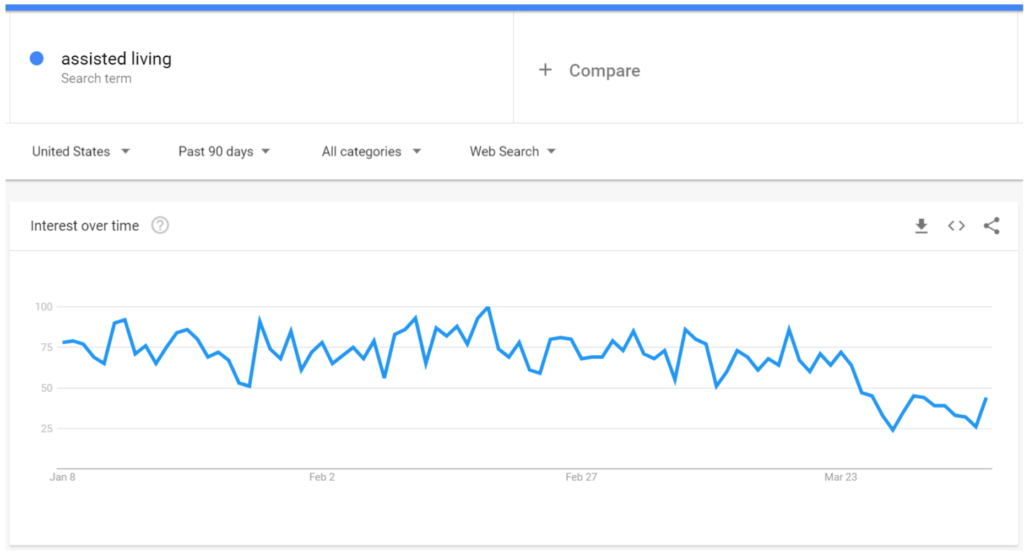

Falling Insights as of April 6

This week we observed a sudden and severe decline in the Assisted Living Software category, which correlates with a decline in search volume for the subject area as a whole. We assume that as assisted living facilities are significantly challenged by taking precautions against coronavirus, they’re left with little to no need (or resources) for new software solutions. The public is also likely not searching to locate services like these for their loved ones due to the severe risk of community spread at this time.

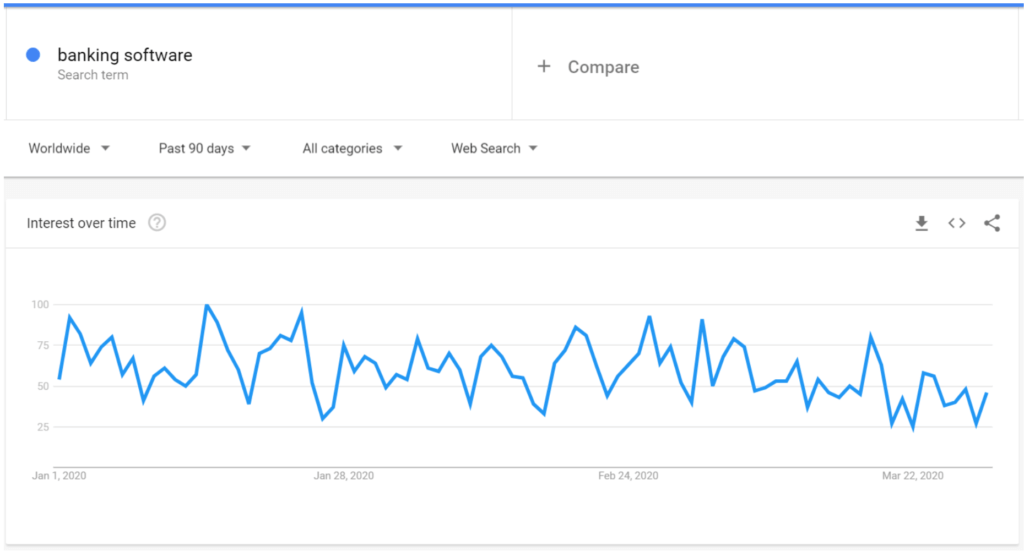

Falling Insights as of March 30

The Banking Software category took a steep and unprecedented dive over the last few weeks (-31%) on the TrustRadius platform. We assume that the harsh impact of COVID-19 on bank stock could be decreasing the amount that banking professionals plan to spend on tech. According to Google Trends data, search volume is slightly down for this term worldwide:

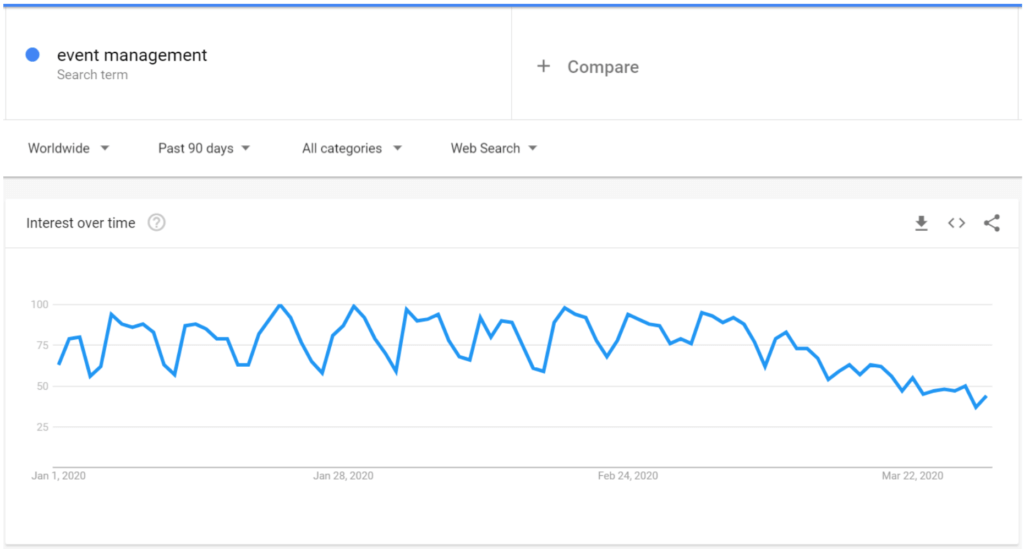

We also observed declines in Event Management Software, particularly with the products Eventbrite (-42%) and Splash Event Marketing (-40%). This coincides with a clear decrease in search volume for the search term “event management” beginning around March 8, 2020 according to Google Trends data:

We also saw several individual declines in products in Recruiting Software, including talentReef (-80%). We assume that recruiting software tools may be falling in direct correlation with rising unemployment rates in the United States. According to the Department of Labor, 3.28 million Americans filed for unemployment during the week ending March 21. This number shattered previous records, representing more than 5X the number of initial claims recorded during the Great Recession.

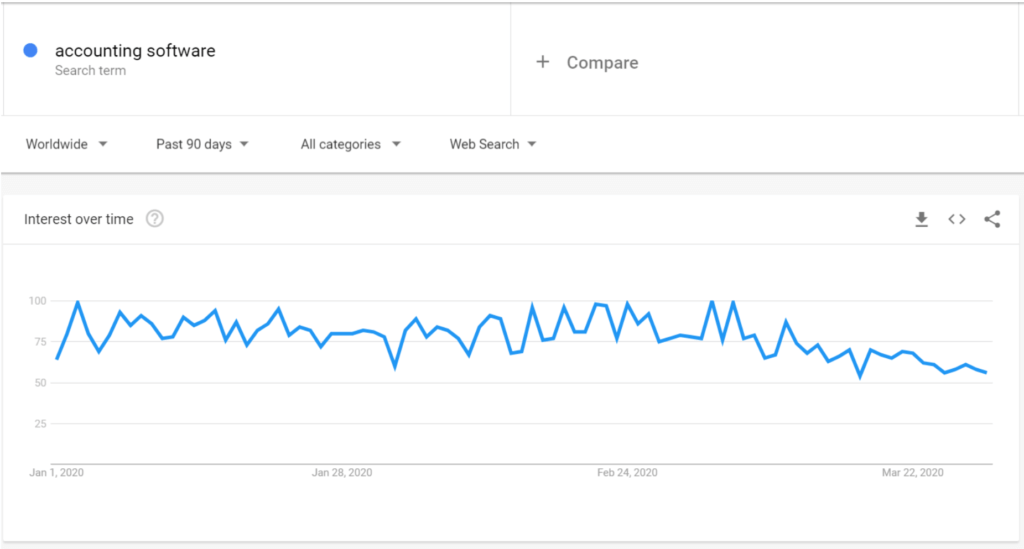

We observed unusual declines for products in the Accounting Software category—Wave Accounting (-24%) Sage 50cloud Accounting (-22%) and QuickBooks Self-Employed (-22%)—presumably because the United States tax deadlines have been moved, and so the seasonal increases we’d normally see within this category may be shifted.

Trends in Buyer Spending

While we know that many companies are tightening their budgets to weather the economic storm of COVID-19, this data suggests that buyers haven’t ceased purchasing software altogether.

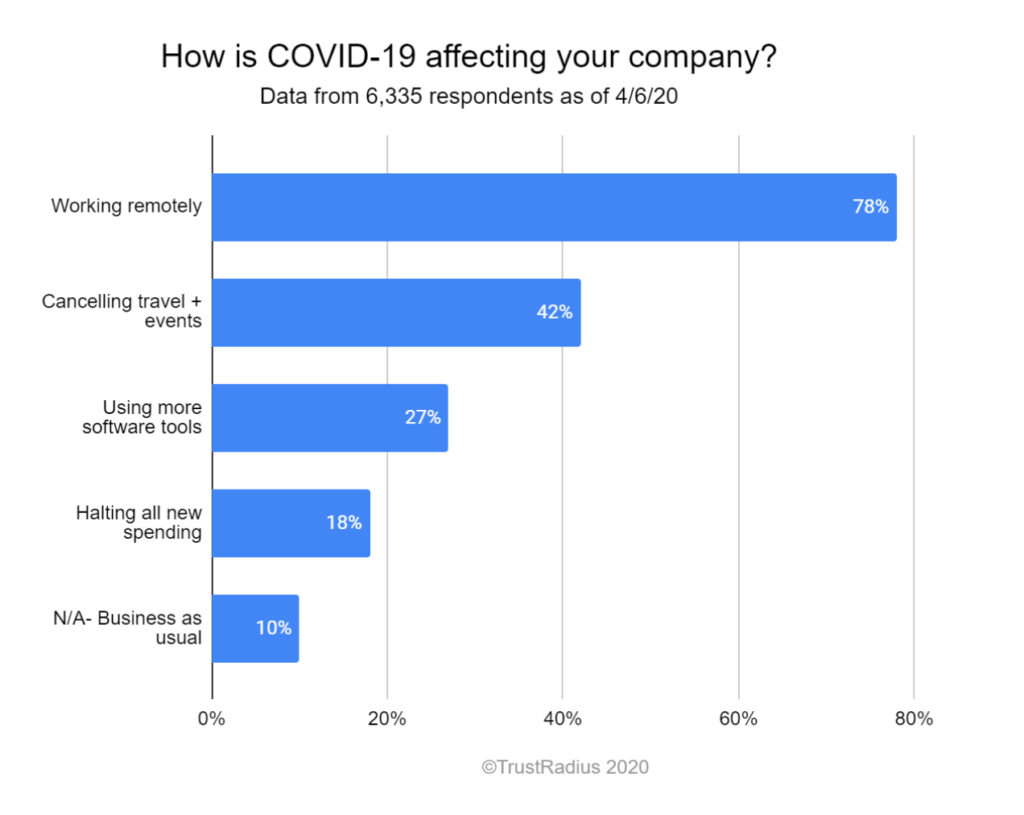

When we surveyed over 6,300 members of the TrustRadius community on this topic, we found that only 18% of software buyers say they are halting all new spending. 27% are using more software now in light of the pandemic. Most companies are taking measures to work from home (78%) and reduce corporate travel (42%). Those numbers are relatively low compared to what we might expect, with nearly the entire nation under CDC stay-at-home orders.

However, we were even more surprised to see that 10% of buyers admit that their companies are continuing to operate with business as usual.

More Coronavirus Statistics

- Internet Traffic: According to Akamai, internet traffic is up more than 50% overall. According to CEO Tom Leighton, 2020 traffic so far has more than doubled what Akamai’s networks saw in Q1 of 2019.

- Reddit Traffic: Reddit is reporting a 20-50% increase in traffic across certain subreddits in response to coronavirus. r/wallstreetbets received 11.7 million pageviews on March 12, representing more than 9X growth.

- Software Reviews: Traffic on the TrustRadius platform has increased 20% in response to COVID-19, primarily due to companies seeking remote workforce tools.

- Internet Speeds: Speedtest has observed a distinct degradation in internet speeds worldwide in response to increased internet usage. They’re also reporting a 50% increase in global test volume.

- Network Usage: According to Verizon, daily VPN traffic on their network is up 52% in response to COVID-19. They’ve also observed a 47% week-over-week increase in the use of collaboration tools on their network, primarily on weekdays.

- Weekend Browsing: Weekend sessions on TrustRadius are up by 83% (compared to weekends in February), and our bounce rate has also decreased to 16%. This means more buyers are more engaged with reading reviews and comparing products during their weekend hours.

- Category Searches: Data from SimilarWeb states that the growth rate of the global “Events” category is down nearly 40% overall, even more than “Online Travel” which sits just under -30%. Grocery delivery is up 45%.

- Organic Search: PathInteractive reports that the CDC and WHO have moved solidly into the top 4 organic search spots throughout the month of March for the query “coronavirus”. Interestingly, WebMD, Medical News Today, Healthline, and Wikipedia have all fallen completely off the first page.

- Google Ads: Conversion rates have dropped 21% on average across multiple industries, according to WordStream. However, sites in the Nonprofit, Health, Business Management, and Finance sectors (among others) have seen an increase in both impressions and clicks.

Get Access to the Experts

On April 2, 2020, TrustRadius CEO Vinay Bhagat met virtually with Matt Heinz of Heinz Marketing to discuss these data points in detail.

Here are three major takeaways from that conversation:

- Now is the time for tech marketers to “win the race at the curve.” Slow down just a little, and then double down on the essentials to pass your competition.

- Before, you were focused on trade shows. Now, you should be focused on intent data, account engagement, and keeping up the virtual energy for sales, BDRs, and SDRs.

- Markets are adjusting, and the messages with clearest value-add will win.