Top 10 Current eCommerce Statistics for 2021

Where some industries floundered as a result of Covid-19, eCommerce exploded. 90% of eCommerce companies saw double-digit growth, and the market as a whole smashed growth records.

Now eCommerce represents a higher share of the retail market than ever before. More people are shopping online, and they are spending a lot more money. Companies are investing huge amounts of money into the industry, and some juggernauts have risen.

These statistics show the current state of eCommerce and look into the future. The momentum of 2020 is going to be felt in the coming years and will shape the way we buy online.

Click on a Section to Explore:

10 Essential eCommerce Statistics for 2021

- The global eCommerce market size was valued at $4.213 trillion in 2020. (EMarketer 2021)

- The global eCommerce market size is projected to grow to $7.385 trillion in 2025. (EMarketer 2021)

- eCommerce sales grew 25.7% in 2020. (EMarketer 2021)

- China recorded 52.1% of its retail happening through eCommerce in 2021. They are the first country to ever see more than half of retail sales online. (EMarketer 2021)

- The United States eCommerce market reached $196.66 billion in Q1 2021, which is up 39.0% year over year from $141.52 billion. (DigitalCommerce 2021)

- COVID-19-related boosts in online shopping resulted in an additional $174.87 billion in eCommerce revenue in 2020. (DigitalCommerce 2020)

- Amazon alone represented 31.4% of all U.S. eCommerce sales growth in 2020. (DigitalCommerce 2020)

- 93.5% of global internet users have purchased products online. (OptInMonster 2019)

- 43% of eCommerce sales happened through mobile platforms. (Bigcommerce 2020)

- 70% of digital shopping carts are abandoned before purchase. (Baymard 2020)

Who’s Winning the eCommerce Market in 2021

Over 1.2 million software buyers use TrustRadius each month. Many of them are shopping for eCommerce software—so we took a closer look at our data to see which products attract the most attention.

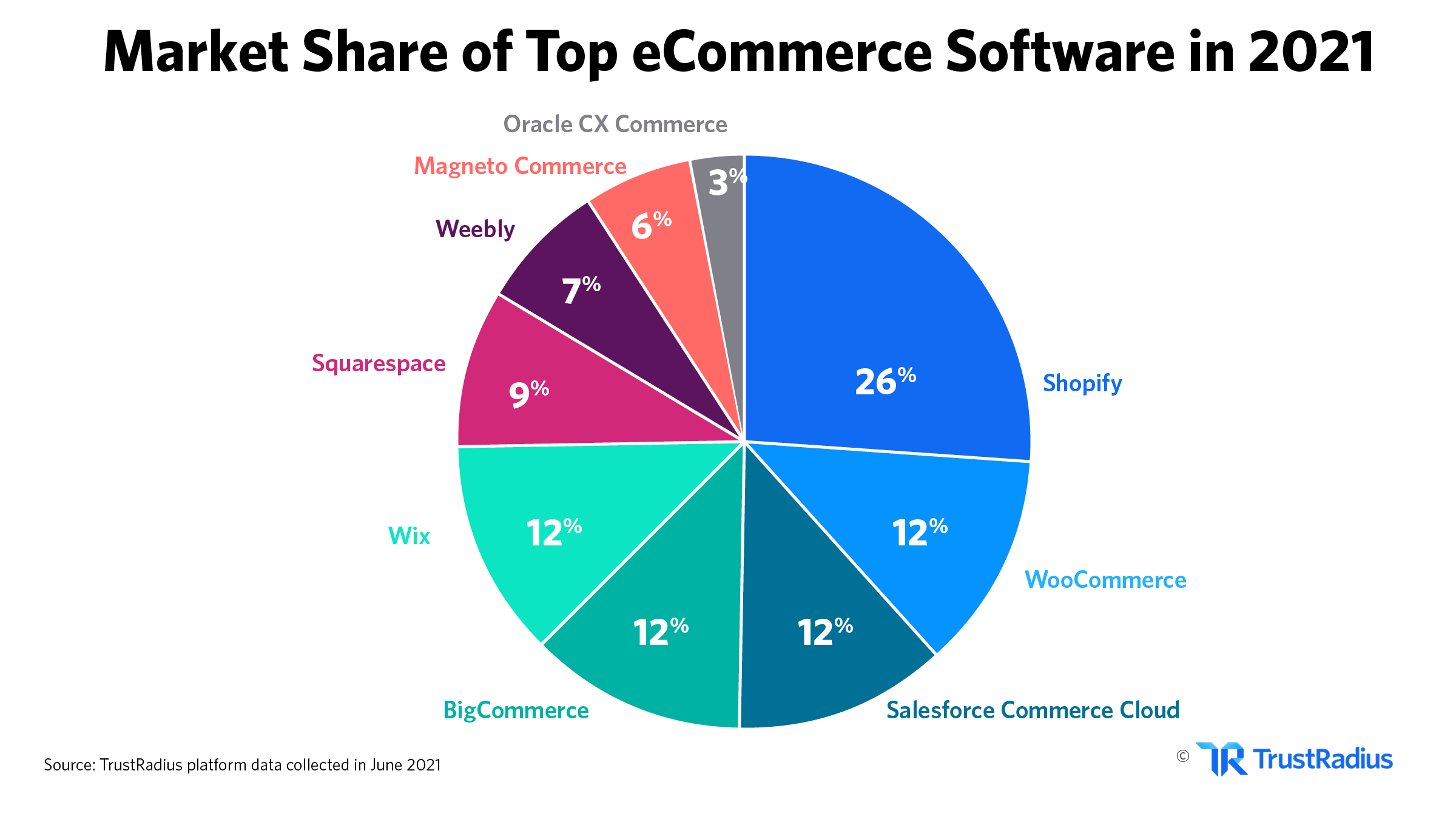

According to buyer interest, the top 9 leaders in today’s eCommerce market are:

- Shopify

- WooCommerce

- Salesforce Commerce Cloud

- BigCommerce

- Wix

- Squarespace

- Weebly

- Magneto Commerce

- Oracle CX Commerce

Out of those companies, we’re seeing clear winners when it comes to market share:

- Shopify is the eCommerce market leader in 2021, commanding 26% of the market share. (TrustRadius 2021)

- Salesforce Commerce Cloud commands 12% of the eCommerce market share. (TrustRadius 2021)

- WooCommerce commands 12% of the eCommerce market share. (TrustRadius 2021)

- BigCommerce commands 12% of the eCommerce market share. (TrustRadius 2021)

- Wix commands 12% of the eCommerce market share. (TrustRadius 2021)

- Squarespace commands 9% of the eCommerce market share. (TrustRadius 2021)

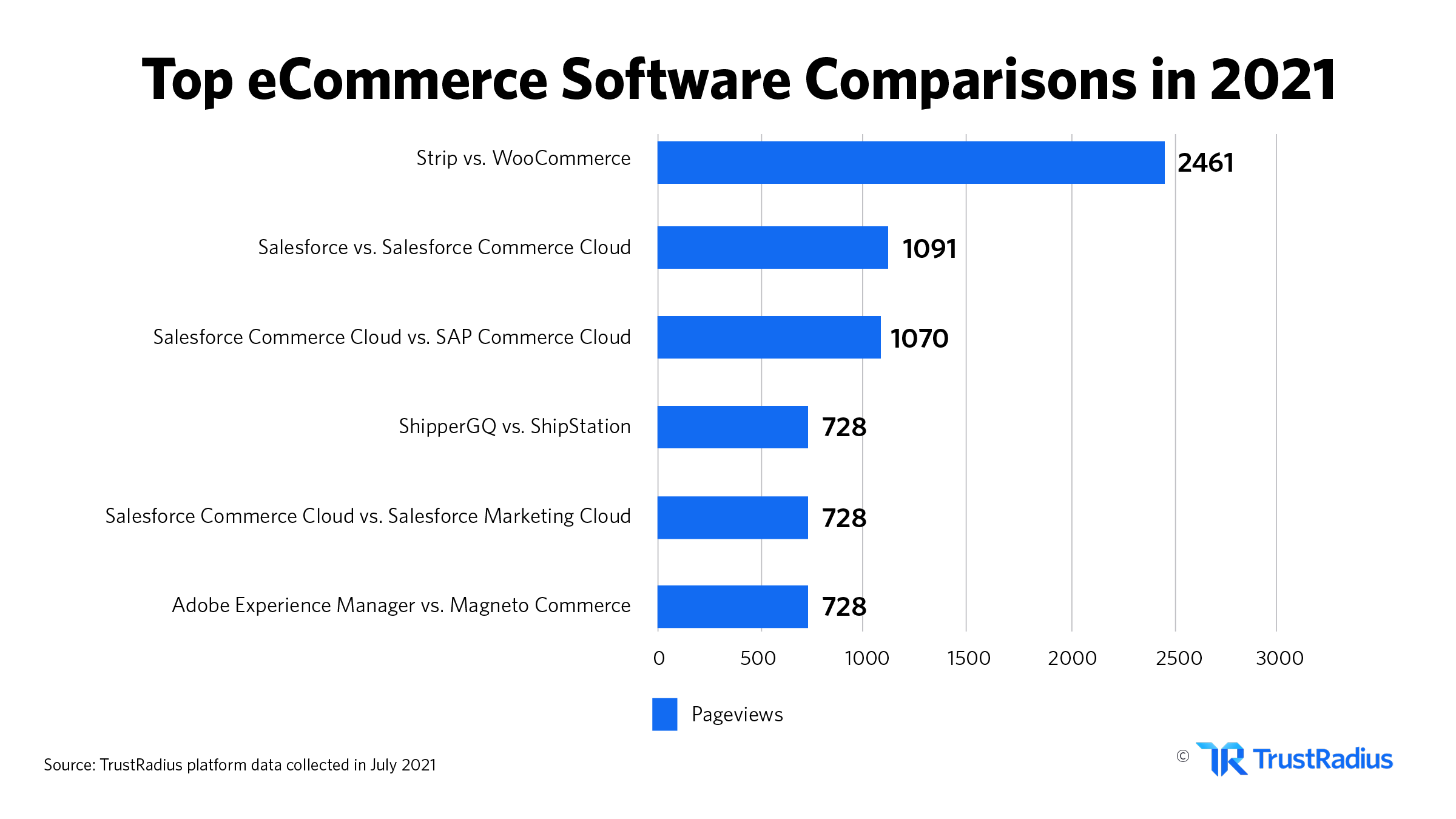

- Stripe and WooCommerce are compared more than any other eCommerce products. (TrustRadius 2021)

2021 Saw Huge Investment in eCommerce

The pandemic saw eCommerce grow like no other industry. This will surprise no one. What may surprise individuals is that this trend is likely to stay. 90% of customers expect to continue buying online for at least the next 6 months.

This explosive growth saw massive investment in eCommerce companies.

One of the most significant and recent fundraising events broke in mid-July 2021. Flipkart, the Indian online retail giant, announced they have raised $3.6 billion in fundraising. The Wal-Mart-backed company plans to invest in small-to-mid-sized business deliveries, as well as consumer markets.

Customers are looking for more than just eCommerce platforms: they are looking for design tools. Shogun is a tool that works with platforms like Shopify and WooCommerce, allowing users to create custom, responsive storefronts. The company has announced fundraising of $67.7 million.

Other significant fundraisers in the eCommerce market include:

Upcoming Trends in eCommerce

Post-Pandemic Growth is Here to Stay

While the ability to shop in person will return after the pandemic subsides, many eCommerce gains are likely to remain. Customers consistently report that they are likely to continue to shop online even post-pandemic. The investments made by both financiers and companies using lockdown money will see a foundation for future growth as well. Pandemic money has funded infrastructure and development.

Consumer knowledge, a limiting factor for some, has also grown. Older generations and those with fewer tech skills, previously wary, are now buying online. Finally, more than a few brick-and-mortar establishments have gone out of business. It’s fair to say that the eCommerce industry will continue to see the impacts of Covid-19 well into the future.

New Platforms and Algorithms

Content-based platforms are seeing marketing opportunities across industries. eCommerce is dominating the resulting benefits. Platforms like TikTok are using content-based algorithms to generate hyper-specific ad content. These are integrated directly into the user experience and are more targeted than nearly anything else present.

The fashion eCommerce market is a perfect example of the benefits of user-centric video content. Fashion is the largest B2C eCommerce market, and video ads and influencer marketing are perfectly suited to this industry.

While the algorithm of TikTok is a popular example, these smart content developments are becoming more popular. The app is investing in affiliate marketing and other programs as well, with most of the purchase opportunities being online. Data collection and algorithms are only going to get smarter. Customers can expect even more of those slightly creepy-accurate targeted ads.

Improved User Experience

User convenience is a natural barrier to online shopping. Returns, loading speed, shipping times and lack of personalization were major issues even 5 years ago. Amazon has led the charge in many of these areas, with 2-day shipping, better recommendations, and free returns. Other companies are working to implement many of the same standards.

Luis Catter, Conversion Rate Optimization Expert at Kensium Solutions, recently told BigCommerce that this trend will extend beyond “typical” eCommerce platforms. “As the tech giants continue to expand and bring more services in-house, personalization will eventually make its way to the internet of things. In addition to seeing suggestions on search engines or shopping platforms, we’ll also see them on our thermostats and our doorbell cameras.”

The trend towards ease of customer use is going nowhere, and its impacts will continue to be felt across the eCommerce competitive landscape.

Your Guide to eCommerce Pricing in 2021

| eCommerce | Starting Price | Starting Price | Free Trial | Free or Fremium | Premium Services | Setup Fee |

| Shopify | 8.7/10 | $29 | None | |||

| WooCommerce | 8.6/10 | Contact Vendor | None | |||

| Salesforce Commerce Cloud | 8.1/10 | $4 | Optional | |||

| Wix | 8.2/10 | $14 | None | |||

| BigCommerce | 8.5/10 | $29.95 | None | |||

| Squarespace |

8.4/10 | $12 | None | |||

| Weebly | 7.8/10 | $6 | None | |||

| Magneto Commerce |

7.7/10 | Contact Vendor | None | |||

| Oracle CX Commerce | 7.6/10 | Contact Vendor | None |

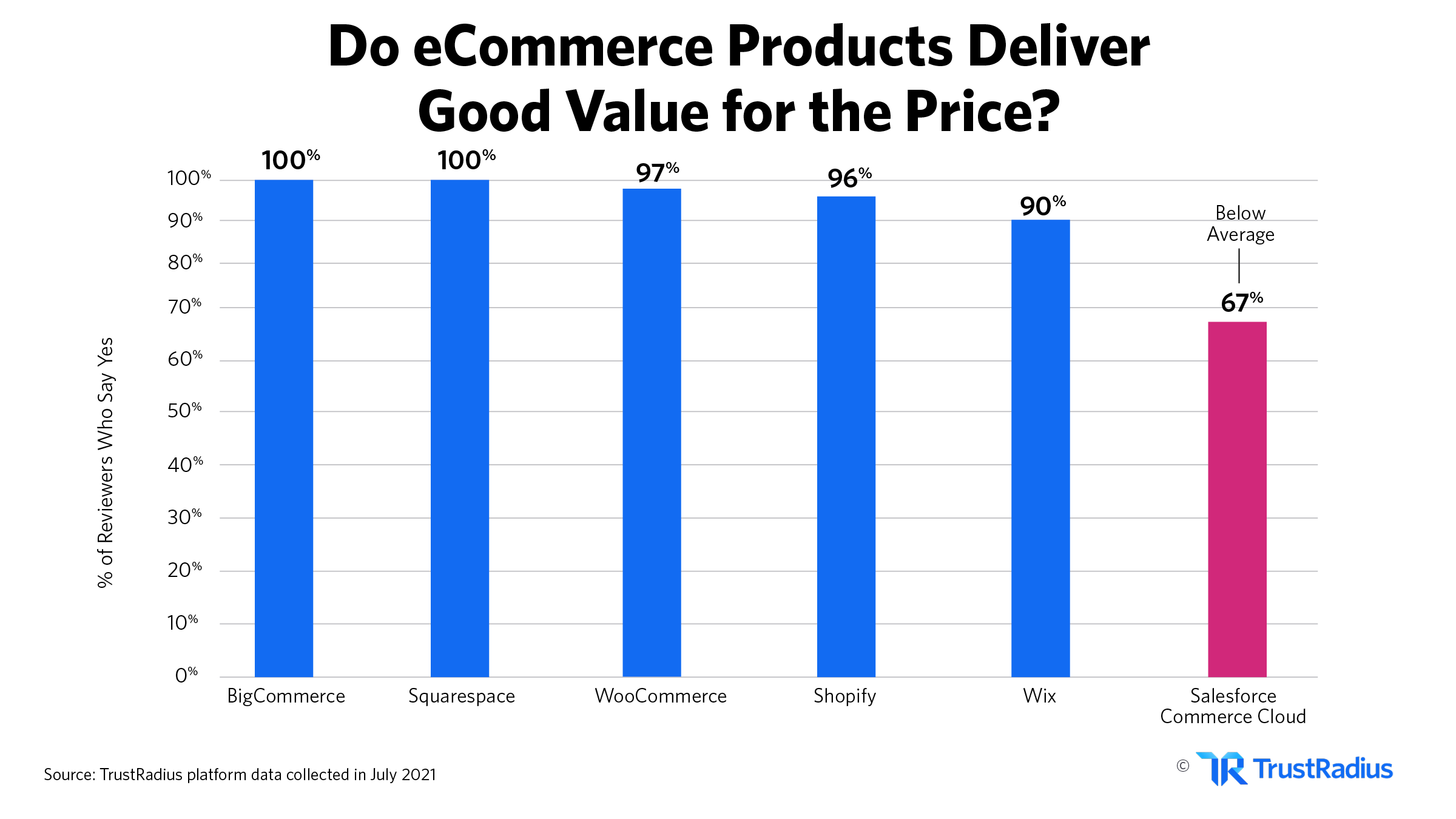

What do buyers say about the ROI across this price range?

Here are some stats from real buyers on TrustRadius:

- 99% of Shopify reviewers say they would buy this product again. That’s higher than the current eCommerce category average, which is 96%. (TrustRadius 2021)

- 97% of WooCommerce reviewers say they would buy the product again. (TrustRadius 2021)

- 90% of Squarespace reviewers and 88% of Shopify reviewers say the product lived up to its sales and marketing promises. Both are higher than the eCommerce category average of 80%. (TrustRadius 2021)

- 100% of Squarespace and BigCommerce reviewers say the product delivered good value for the price. 97% of WooCommerce reviewers and 96% of Shopify reviewers agree. (TrustRadius 2021)

- BigCommerce has the highest rated customer support of any eCommerce product, with a 9.6/10 rating. Wix comes in at second place with a customer support rating of 8.97/10. These ratings are well above the eCommerce category average of 7.86/10. (TrustRadius 2021)

If you’re looking for your next eCommerce solution, check out reviews on TrustRadius. You’ll see 100% authentic reviews from buyers just like you.

Sources

- Global eCommerce Forcast 2021 (EMarketer 2021)

- US ECommerce Grows by 44% in 2020 (DigitalCommerce 2020)

- US ECommerce Sales Climb 39% in Q1 of 2021 (DigitalCommerce 2021)

- 44 Cart Abandonment Rate Statistics (Baymard 2020)

- 2020 Cyber Week Report (BigCommerce 2020)

- Email Marketing vs. Social Marketing (OptInMonster 2019)

- 10 Vital eCommerce Statistics for 2021 (TrustRadius 2021)

2020 eCommerce Research

State and local economies are now reopening in the U.S., bringing shoppers back to storefronts and employees back to the office. However, the COVID-19 pandemic has caused deep and lasting changes in the retail industry over the past few months. Small businesses, local brick-and-mortar stores in particular, have been some of the most impacted during the global pandemic.

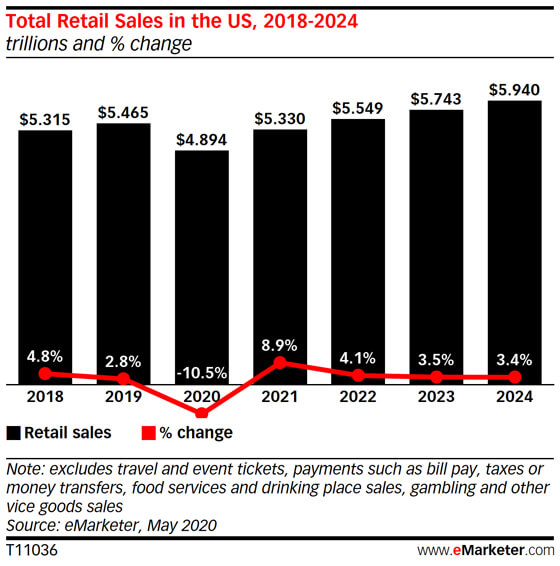

Many businesses have had to shut down operations temporarily, apply for loans, or close permanently due to lack of business during the virus outbreak. Predictions say that there could be between 20,000 - 25,000 storefront closures in the U.S. in 2020 as a result of the pandemic. As of June, total retail spending in the U.S. is expected to decline about 10.5% for 2020.

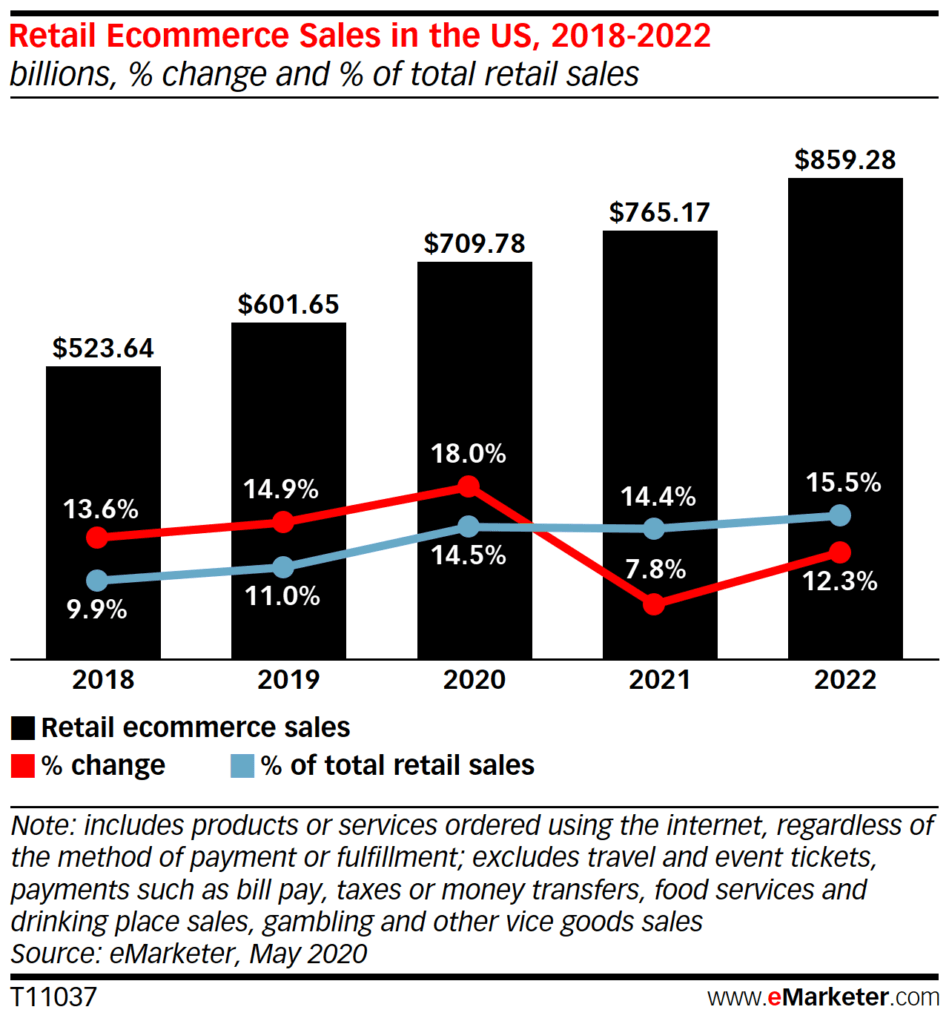

The two primary sales channels that make up ‘total retail spending’ have seen opposite trends during the COVID-19 pandemic. While brick-and-mortar retail sales are expected to decrease by 14%, eCommerce sales are predicted to increase by 18% to $709.78 billion in 2020.

Losses from in-person sales have made a large dent in the retail market. Online sales have soared as a result of the COVID-19 pandemic. Interest in eCommerce software—especially small business-friendly platforms like Shopify—has surged during this time. On TrustRadius, we’ve seen an 85% increase in traffic to the eCommerce software category from January - May 2020.

Below we’ll explore how the eCommerce software industry has changed as a result of the pandemic. We’ll also dive into the most popular eCommerce tools and product comparisons on TrustRadius right now and evaluate how trends in market share and buyer behavior continue to shift.

Quick Access

- A Year In Review

- The Impact of COVID-19

- Regional Interest in Ecommerce

- Top Ecommerce Products

- Ecommerce Buyer Behavior

- Ecommerce In The News

- Ecommerce on TrustRadius Vs. G2

Ecommerce Software: A Year in Review

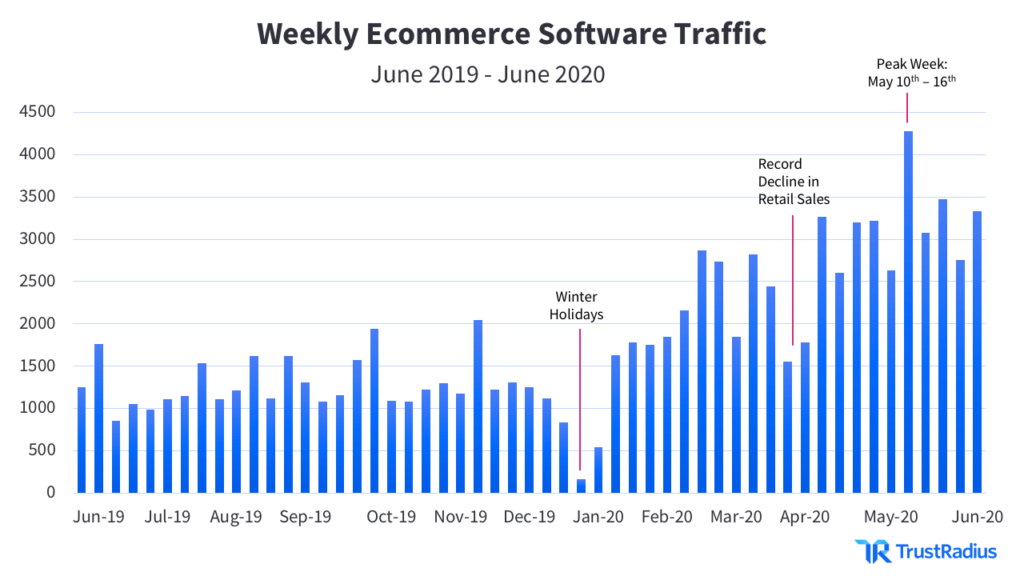

Over the past year, the eCommerce software category has experienced some volatility on TrustRadius. From June to December 2019, traffic to the category ranged anywhere from 1,000 to 2,000 pageviews per week. This was followed by a noticeable dip in traffic in late December, coinciding with the end of the year holidays.

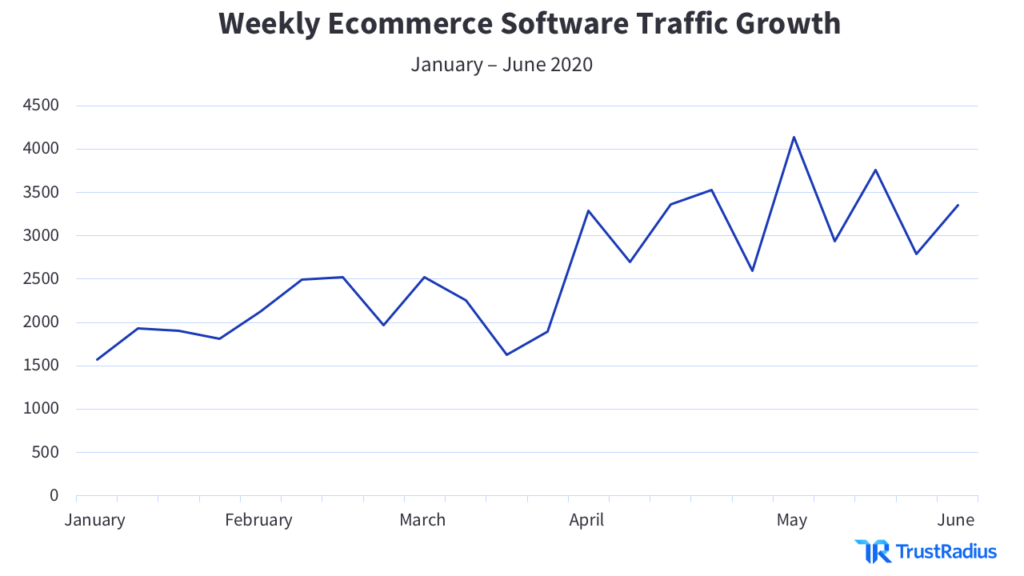

A sustained increase in buyer activity in the ecommerce software category can be seen starting in late February and continuing through May and into June. During this time, weekly traffic ranged from 1,500 - 4,500 pageviews per week.

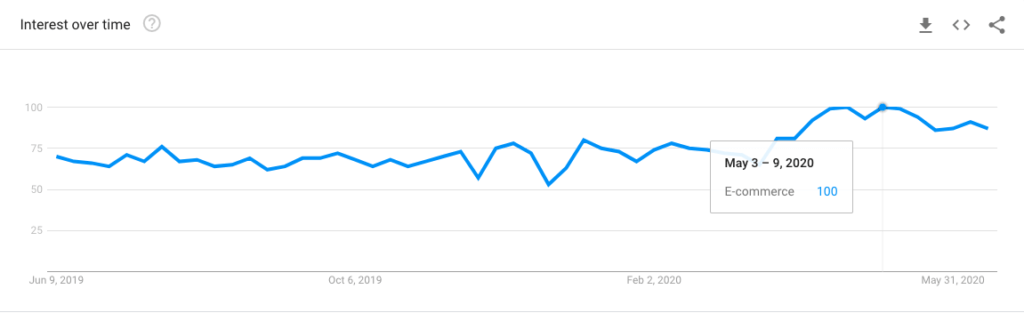

The traffic trends on TrustRadius for the eCommerce software category mirror the overall market trend identified by Google Trends. The peak week for the eCommerce topic on Google Trends (May 3rd - May 9th) is just one week before TrustRadius’ peak week (May 10th - May 16th).

One reason for the difference in peak activity identified by Google Trends compared to the TrustRadius platform is related to general interest in the topic of eCommerce versus the intent to purchase eCommerce software. Google's peak week may be slightly before peak activity on TrustRadius because software buyers were still in the early stages of learning about eCommerce software, displaying greater interest in buying eCommerce software the following week after doing initial research on the web.

Many software buyers start their purchasing journey by doing research on Google, and often move to review websites like TrustRadius for more product-specific information. On TrustRadius, users can read through individual reviews, compare products head-to-head, see features ratings, and find pricing information. The users on our platform are therefore lower in the funnel and much closer to making a purchasing decision.

The Impact of COVID-19 on Ecommerce Software

Despite the overall decrease in total U.S. retail spending, the ecommerce industry has been flourishing during the virus outbreak. Consumers everywhere have been turning to online websites to purchase goods ranging from groceries to apparel to electronics. Predictions from eMarketer place eCommerce spending growth at 18% year over year. Interest in ecommerce software has increased by several magnitudes more in just the past six months.

On TrustRadius, the eCommerce software category grew 85% from January to May 2020. This has likely been fueled by businesses of all sizes looking to purchase ecommerce platforms for the first time, or expanding the online selling tools they already have in place to meet the new and different demands of the pandemic.

The eCommerce software category had a much later peak in buyer interest than other categories like collaboration software, video conferencing software, and remote desktop software. These other categories peaked in March and April, while the eCommerce category peaked mid-May.

One possible explanation for this is that confidence in the retail market—both online and in-person—was low during the early months of the pandemic. Throughout March and April, 30.3 million Americans filed for unemployment and the U.S. economy entered a recession. These two important economic indicators mean that consumers were wary of spending money on non-essential goods and services.

In May, states started reopening their economies and consumers started spending more. Buyer interest in eCommerce software followed suit.

Regional Interest in Ecommerce Software

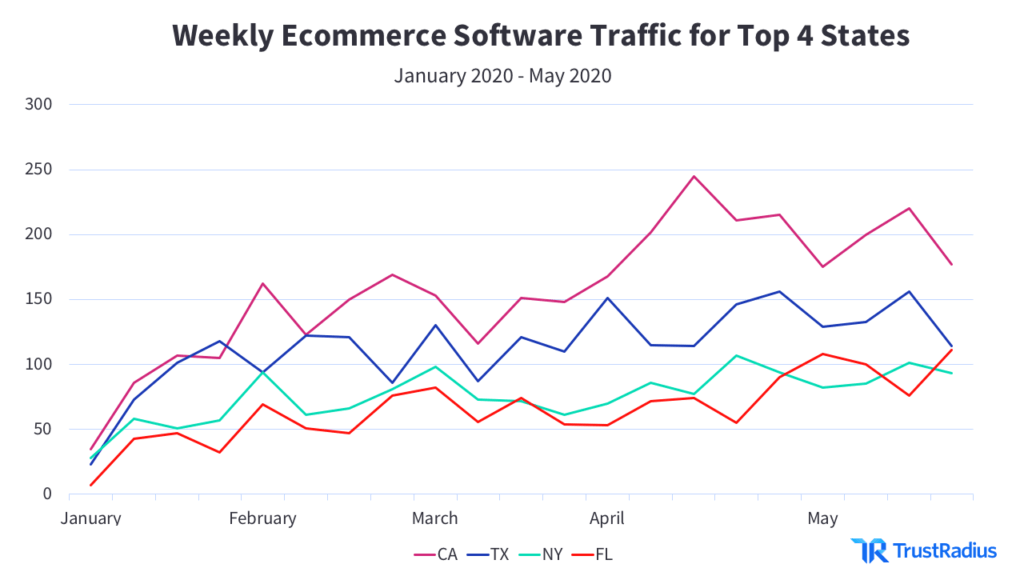

Buyer interest in eCommerce software followed a roughly similar pattern for the top 4 states (CA, TX, NY, and FL). California has the largest share of eCommerce traffic and the clearest peak point of interest in late April.

All four states started reopening their economies during May. Both Texas and Florida allowed restaurants and stores to open at limited capacity early in May, while California and New York both took regional reopening approaches later in May.

- Texas: state-wide May 1st

- Florida: most counties May 4th

- California: regional reopening May 12th

- New York: regional reopening May 15th

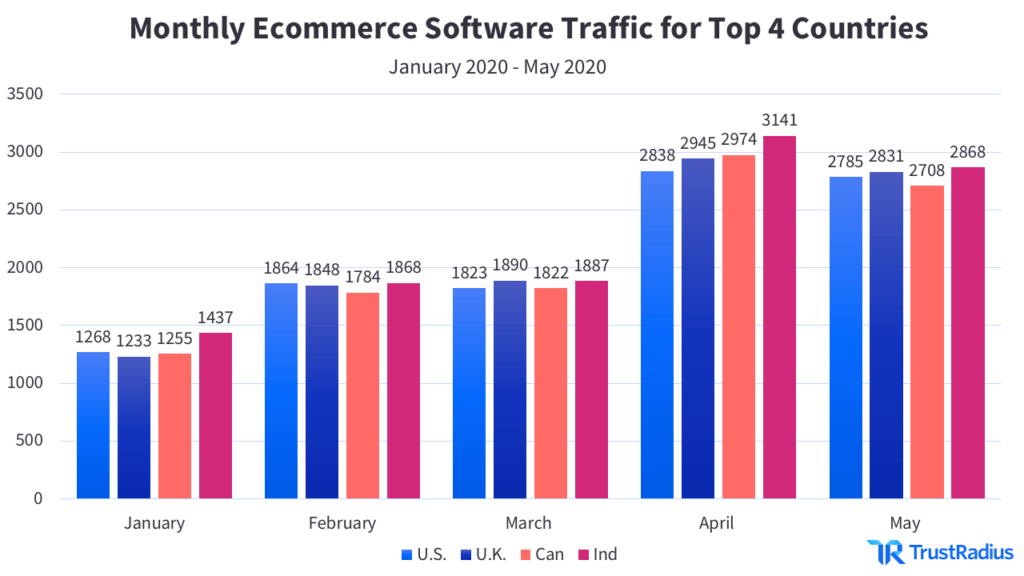

TrustRadius has seen similar traffic growth from ecommerce software buyers in the top four countries since the beginning of 2020. This helps illustrate how essential eCommerce software is around the world. TrustRadius usually has a larger share of traffic coming from the U.S., but this is not the case for eCommerce platforms.

Notably, India has slightly higher traffic than the three other countries for each month except March. Of these four countries, India and the U.S. have been the hardest-hit countries in terms of number of COVID-19 cases. India has also experienced a recent surge in cases, potentially due to the reopening of its economy after having a strict lockdown in place for weeks.

The Most Popular Ecommerce Platforms Today

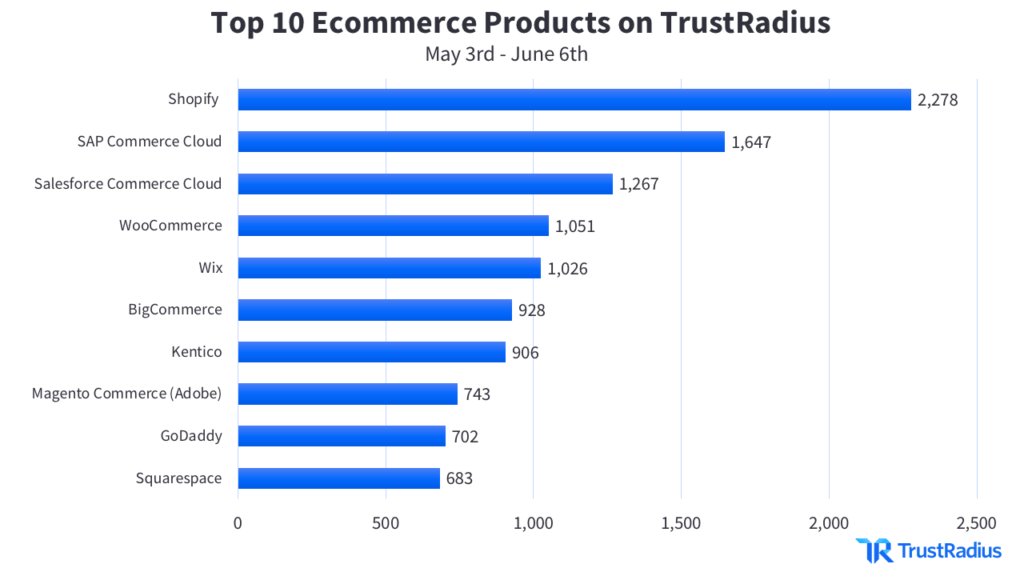

On TrustRadius, eCommerce products for both small and large businesses have seen significant growth over the past month. Shopify leads the pack, closely followed by SAP Commerce Cloud (formerly SAP Hybris) and Salesforce Commerce Cloud.

| # | Product | Traffic |

| 1 | Shopify | 2,278 |

| 2 | SAP Commerce Cloud | 1,647 |

| 3 | Salesforce Commerce Cloud | 1,267 |

| 4 | WooCommerce | 1,051 |

| 5 | Wix | 1,026 |

| 6 | BigCommerce | 928 |

| 7 | Kentico | 906 |

| 8 | Magento Commerce(owned by Adobe) | 743 |

| 9 | GoDaddy | 702 |

| 10 | Squarespace | 683 |

Interestingly, some of these products are content management systems, rather than dedicated ecommerce platforms. For example, Kentico, Wix, and Squarespace are all website building platforms that are frequently used to create online stores. But they are also commonly used to set up other types of websites and blogs.

These types of tools tend to be preferred by SMBs due to their user-friendliness and low cost. However, a tradeoff of using lightweight website builders is decreased eCommerce-specific functionality. Especially for enterprise-level organizations that need the ability to deeply customize their online store, larger eCommerce platforms may be a better option.

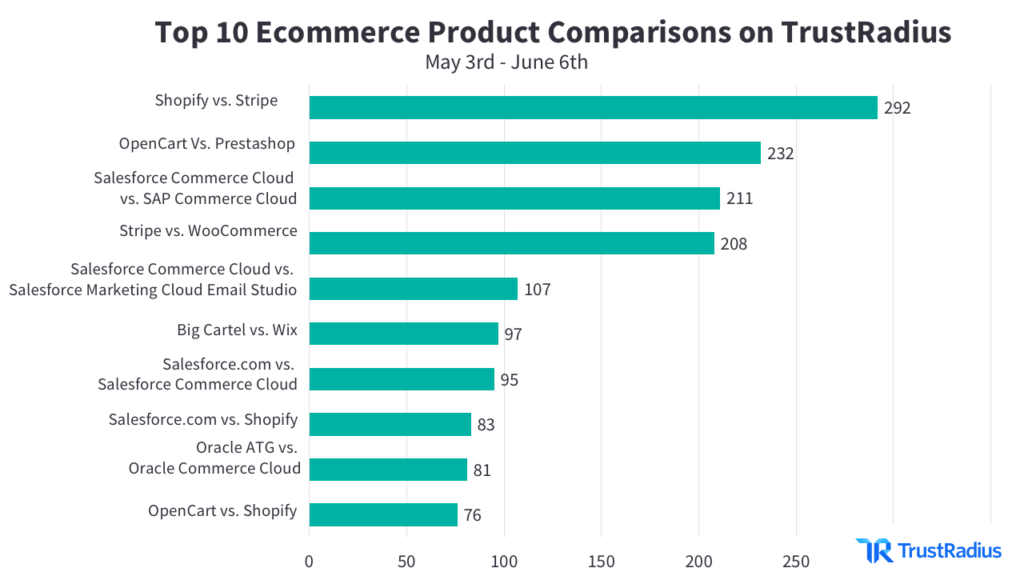

Over the past month, there have been over 6,400 views of eCommerce product comparisons on TrustRadius. Here are the 10 most popular comparisons right now:

Both Shopify and Salesforce Commerce Cloud are included in 3 out of the top 10 comparisons. On TrustRadius, Salesforce Commerce Cloud and Shopify have some of the highest traffic numbers of the whole eCommerce category (2,278 and 1,267 pageviews, respectively). Salesforce also recently released four new commerce solutions to help businesses adjust to online selling during a pandemic.

However, two out of the three Salesforce Commerce Cloud comparisons are against other Salesforce products. This indicates that buyers might be interested in better understanding the differences between different Salesforce products, like their CRM and Commerce Cloud. Or, some users may already be part of the Salesforce ecosystem of products, and are curious about the quality of integration between other Salesforce products and Salesforce Commerce Cloud.

Who’s Searching for Ecommerce Platforms?

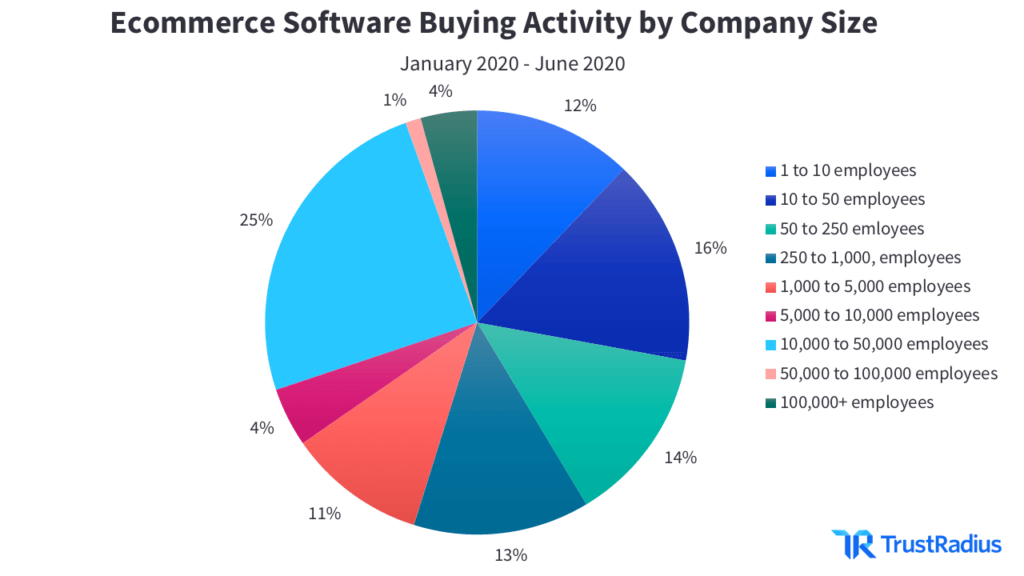

Since the beginning of 2020, 45% of traffic to the eCommerce software category has come from enterprise size companies (1,000+ employees), while 55% of traffic has come from SMBs (less than 1,000 employees). The pie chart below shows an even more granular view of eCommerce traffic from different company size segments, based on True Intent signals.

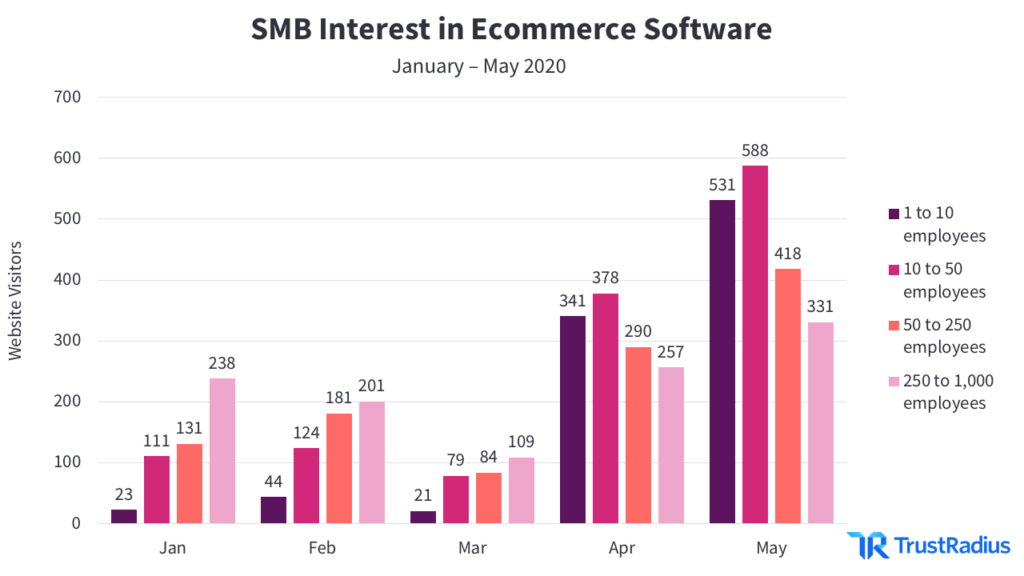

Looking at traffic from enterprise-level corporations, companies with 10K - 50K employees peaked in February while traffic from companies with over 100K employees peaked much later in May. The SMB eCommerce traffic chart below paints a very different picture. Traffic from all SMB company size segments peaked in May. On TrustRadius, the eCommerce software category received the most SMB traffic from companies with between 10-50 employees during this time.

One potential explanation for these trends is the differential effects the pandemic has had on small vs. large businesses. Enterprises may be better able to absorb large market shocks (e.g. supply chain disruption, decreased demand, and restricted cash flow) brought on by the virus outbreak than smaller companies. Smaller businesses may have needed to wait to purchase new ecommerce technology until they made financial adjustments like applying for a small business loan or laying off some of their employees.

Ecommerce In the News

As the COVID-19 pandemic continues to unfold, the overall impact on eCommerce software vendors and the market itself has increased. Here are some of the most important news stories as of today:

- From TechCrunch and eMarketer, there has been a big spike (18% increase) in online consumer spending, but not enough to offset total retail spending losses (10.5% decrease).

- The New York Times stated that total retail sales has increased 17.7% in May after a 14.7% decline in April of this year.

- According to eMarketer, Amazon holds the dominant share (38.7%) of total retail ecommerce sales within the U.S. as of June 2020.

- While Amazon is a giant in the eCommerce space right now, Shopify’s platform has seen rapid growth during the global pandemic—its share price has almost doubled, reports Bloomberg.

- Larger eCommerce platforms from vendors like Salesforce, Oracle, SAP, and Adobe have received attention in recent analyst reports. Salesforce and Adobe were both listed as Leaders in the Q2 2020 B2B Commerce Suites Forrester Wave.

- Forbes announced the launch of ‘Facebook Shops’ in late May. It allows online businesses to both advertise and sell their goods and services online, allowing shoppers to complete their customer journey without ever leaving the platform.

- Walmart recently partnered with Shopify to include thousands of small businesses in the Walmart Marketplace. According to E-Commerce Times, this integrative approach is already supported by companies like BigCommerce and provides a competitive alternative to Amazon.

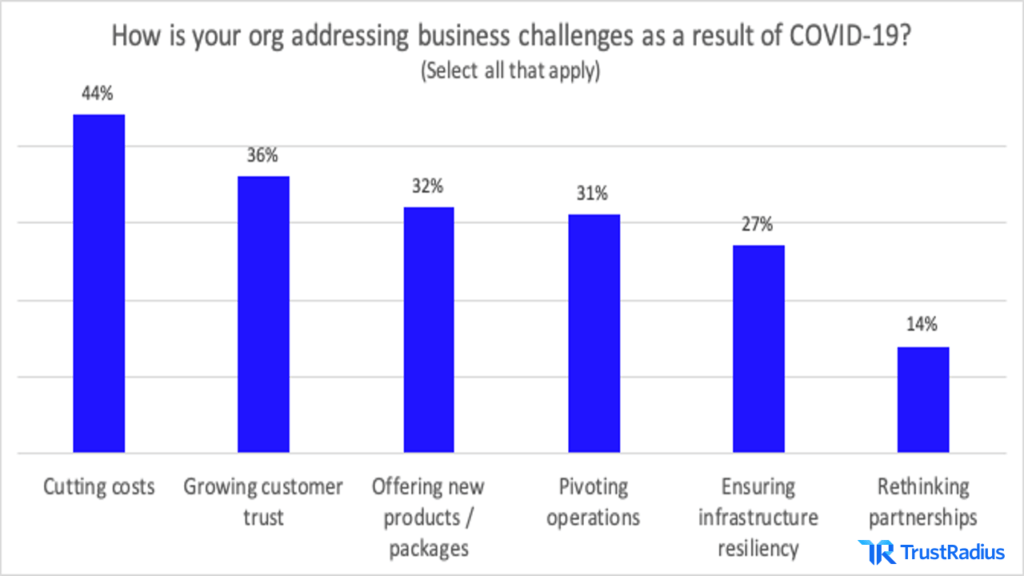

- Salesforce has launched four new ‘quick start commerce solutions’ designed to help companies conduct business during the COVID-19 pandemic, according to TechCrunch. This is a fairly common strategy for businesses coping with the pandemic, based on recent research we conducted for a digital even series with analyst firm IDC. In a recent poll of the TrustRadius community, 32% of respondents said their business was responding to the pandemic by offering new software products or packages.

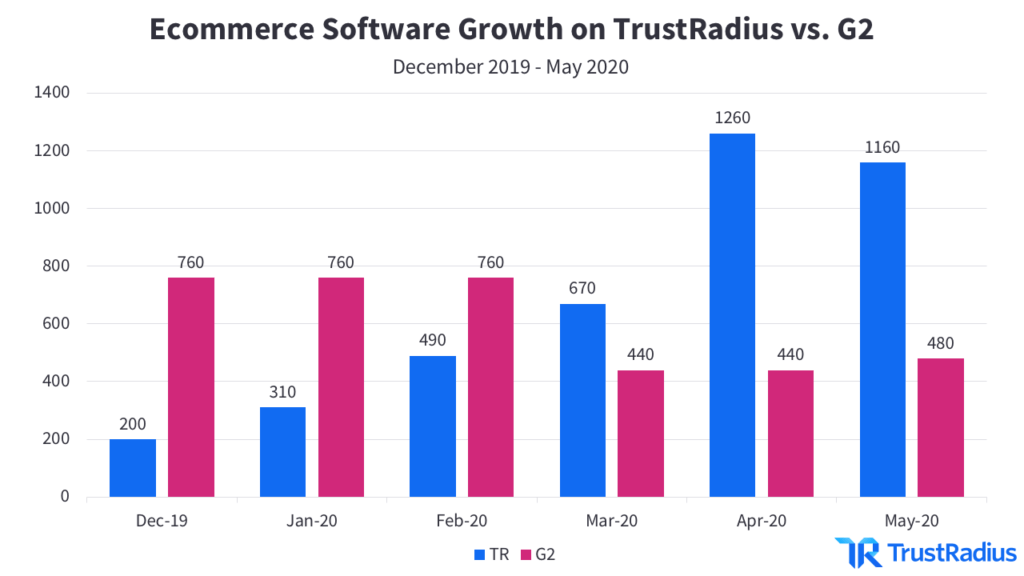

Ecommerce Software on TrustRadius vs. G2

As the impact of the COVID-19 pandemic on the eCommerce market deepens, software buyers turn towards TrustRadius to provide them with high-quality customer feedback. Interest in eCommerce software has risen consistently since December 2019 on the TrustRadius platform, increasing sharply from March to April.

In contrast, traffic for eCommerce software on other review websites, like G2, has decreased during the later months of the pandemic.

This indicates that TrustRadius has become the preferred review platform for evaluating eCommerce software during this time. While G2 has an average word count of 130 per review, TrustRadius has an average word count of 353 per review in the eCommerce software category. Software buyers are also highly engaged on TrustRadius, spending an average of 5 minutes and 53 seconds per page within the eCommerce software category.

With retail and online spending increasing again, making a smart decision about purchasing a new eCommerce platform is crucial. Stakes are high for many online businesses, and they can’t afford to have eCommerce software that doesn’t work the way they need it to. User reviews are one of the best ways to make sure you’re making a good investment. Our detailed answers to key questions, such as use case, pros, cons, and ROI, make TrustRadius the most valuable resource for buyers seeking collaboration software reviews.