The Power of Peers: 3 key marketing insights from the 2017 B2B Buyer’s Survey

Peer reviews have reached a historic level of importance in the buying process, according to Demand Gen Report’s seventh annual B2B Buyer’s Survey. The independent publication polled 283 C-level executives, vice presidents and directors who were involved in a B2B purchasing decision in the past year. They found that as decision makers become more risk averse and purchases become more complex, trusted insights from real users are a critical component of the buyer’s journey.

This shift continues to create opportunities for vendors who align with today’s buyers. Here are some of the key data points from the survey and what they mean for your marketing strategy.

1. Buyers are spending more time researching, with more committee members, using more sources of information

Buyers are stepping up their due diligence to contend with the multitude of solutions that are available to them. Their goal is to understand the differences between competitors and determine the right fit for their use case, as well as manage the risk of picking the wrong solution. As one respondent put it, “as the company grows and our goals become loftier, each purchase carries more weight, more risk and costs more.”

This year, 78% of buyers said they spend more time researching purchases. 75% said that they use more sources to research and evaluate purchases, and 52% said more people are helping to make purchase decisions for their company.

This growing scope means vendors need to move beyond gated white papers and glossy sales decks if they want buyers to consider their products. As buyers bring a greater number of questions and perspectives to the table, vendors must make it easy for buyers to access the resources they want by providing more information across more channels.

2. Vendors have limited control over buyers’ first impressions, so embrace the conversation

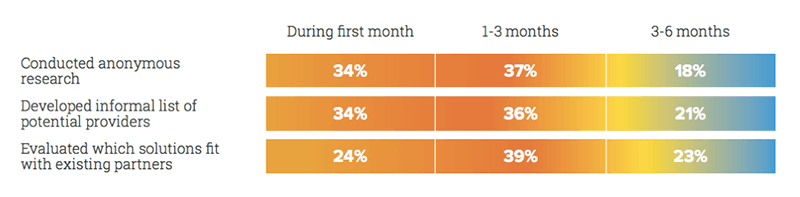

The early buyer’s journey can be difficult to pin down. Not only are multiple committee members with different priorities conducting their own research, 89% of buyers said they conducted research anonymously sometime during the first six months of the buying process. Demand Gen Report notes that during this time, “B2B buyers are still largely operating under the radar, gathering intelligence on their options and forming opinions long before they are filling out any forms or talking with a salesperson.”

Source: Demand Gen Report’s 2017 B2B Buyer’s Survey Report

But buyers are still engaging with vendor representatives during this period, particularly to get pricing information and watch demos — 92% of buyers said they reached out to a sales rep from the vendor they selected within the first six months of the buying process. However their anonymous research, as well as their access to analysts, consultant, user reviews, and competitors’ pitches, makes it difficult for vendors to maintain fine-grained control over discovery and initial evaluation.

As a vendor, there are a few things you can do to ensure your product stands out during independent research phase. Typically, buyers will create a shortlist of vendors they see as trustworthy and relevant, as well as vendors who successfully serve their peers and can cater to their specific requirements. The first step is making sure your products are represented on B2B reviews sites and other places where buyers are likely to conduct their initial research. Next, make sure your marketing material is easy to access and easy to digest so they can self-serve when visiting your site.

When buyers do reach out, acknowledge that your voice as the vendor is only one part of the conversation. For example, talk about your customers and share their feedback directly with your buyers. Ask your buyers about the other sources of information they’ve consulted already, so that you can proactively recommend any they make have missed. Your goal is to create a high-value dialog about your product, both with you and within their committee.

3. Peer perspectives have a rising influence on final purchase decisions

In addition to bringing in other team members, for most buyers the expanded buying process now includes consulting peer reviews. This trend isn’t surprising, as research shows buyers consider user reviews one of the most helpful and trustworthy sources of information on B2B products.

This year, 84% of buyers said they seek input from peers/existing users, and 57% do so within the first three months of the buying process. One survey respondent said, “We have changed the way we do B2B buying by looking at highly regarded recommendations to help in influence decisions. This helps the initial determination of purchasing a particular product from a vendor.”

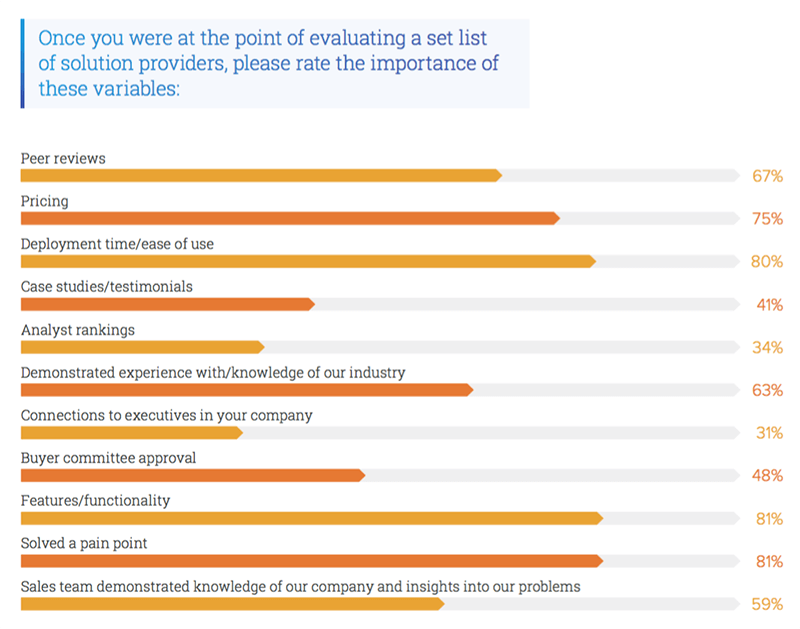

Overall, reviews in particular are have an increasing influence on buyers. 67% of respondents said reviews were a “very important” consideration, up from 55% in last year’s survey. Even case studies received a slight bump from last year, up to 41% from 38%.

Source: Demand Gen Report’s 2017 B2B Buyer’s Survey Report

In addition to being trustworthy, reviews are powerful because they demonstrate a product’s value through real-world use cases. According to the report, “89% of respondents stated that winning vendors provided content that made it easier to show ROI and/or build a business case for the purchase.” Feedback from people with first-hand experience on issues like deployment time and ease of use is far more useful than a carefully curated list of benefits.

Given these trends, scaling and leveraging reviews is a critical initiative for B2B marketers. The more you can get customers to speak on your behalf, on third-party sites as well as in your own channels, the more opportunities you will have to stand out from the competition and prove your value to buyers. To learn how TrustRadius can help you build an arsenal of impactful customer content, request a demo today.