What B2B Content Do You Trust?

Content is playing an increasingly large role in B2B decision making. The 2014 B2B Buyer Survey by DemandGen indicated that for 64 percent of B2B buyers, the winning vendor’s content had a significant influence on their decision. Additionally, a March 2014 study by the CMO Council and Netline expressed that “content sharing among buyers, specifiers, and influencers is widespread.”

Vendors spend a large amount of effort and money on creating content to influence buyers. Yet, the same CMO Council study indicated that just 9% think of vendors as a trusted source of content. A content area where vendors spend a great deal of effort is producing case studies. I recently wrote an article for the Content Marketing Institute, B2B Marketing: Why (and How) to Focus on Reviews, Not Case Studies, advocating that vendors should spend less time creating case studies that merely extol the benefits of their product, and instead invest energy inviting and sharing open, honest feedback in the form of in-depth reviews. I recognize this may seem self-serving as the CEO of a business software review site, but I sincerely believe that business software buyers prefer to access candid peer perspectives without filters and spin, especially having been one myself.

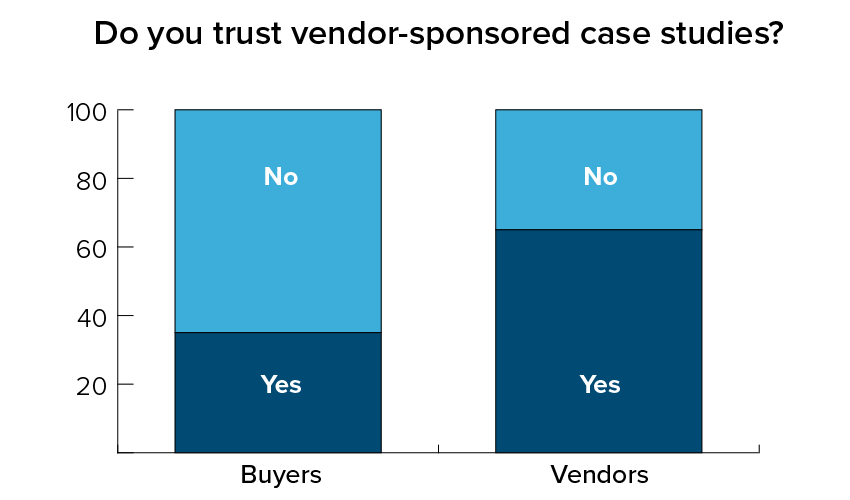

As a follow-up, we ran a simple poll on TrustRadius asking one question: “Do you trust vendor sponsored case studies?”. We had over 100 responses and segmented the respondents by whether they were a buyer or a technology vendor. Recognizing that people using a software review site may have some bias towards user-generated versus vendor-generated content, the data is still interesting.

- Just 35% percent of software buyers said they trusted vendor produced case studies

- 65% of vendor respondents do trust vendor case studies, implying that 35% do not

We also asked respondents to share one quote about the factors that influence their trust in content for product decision making and some very clear themes emerged:

1. They want to hear from independent users with similar experiences or credible profiles

- “Real user’s experience with the product.”

- “Knowing the source has first-hand knowledge of the product, along with real-world experience.”

- “The user profile.”

- “Known recognizable contributor not associated with company with good author rank and Klout scores.”

- “When a reviewer receives no funding at any time from any of the products being reviewed.”

2. They want to know both pros and cons without a sales pitch

- “Lists of pros and cons in comparison to competitors.”

- “Not being a sales pitch.”

- “When a company admits where it falls short and accepts that negative reviews exist. I will not buy from a company in denial.”

3. They appreciate depth and context about how a product is used and its impact

- “That it is thorough and touches on the points I care about.”

- “Being able to describe the business context and software relevance to that context.”

- “The impact of software or technology on a business – how does this translate to efficiency or sales?”

- “The kind of low level product feature details covered in reviews. It shows that the reviewer has actually used the product in a production environment.”

4. They value corroboration from multiple users

- “A broad viewpoint from more than three sources.”

- “Corroborated across multiple sources.”

If you’re a software buyer, what do you think? If you’re a software vendor, how are you responding to this data? Please take a moment to comment and share your experiences and perspective.