Remote Desktop Software Statistics and Trends

The COVID-19 pandemic has brought a previously unimaginable level of chaos and uncertainty. It has also catalyzed one of the largest work from home experiments the world has ever seen. In 2012, Gallup reported that 39% of the American workforce worked remotely, at least part of the time. This number has now increased to 62% as of the first half of April 2020.

As a result, technology like remote desktop software that allows teams to stay connected and productive while in a remote environment has been in high demand. On TrustRadius, the remote desktop software category saw a 281% increase in traffic from the beginning of the pandemic to early April.

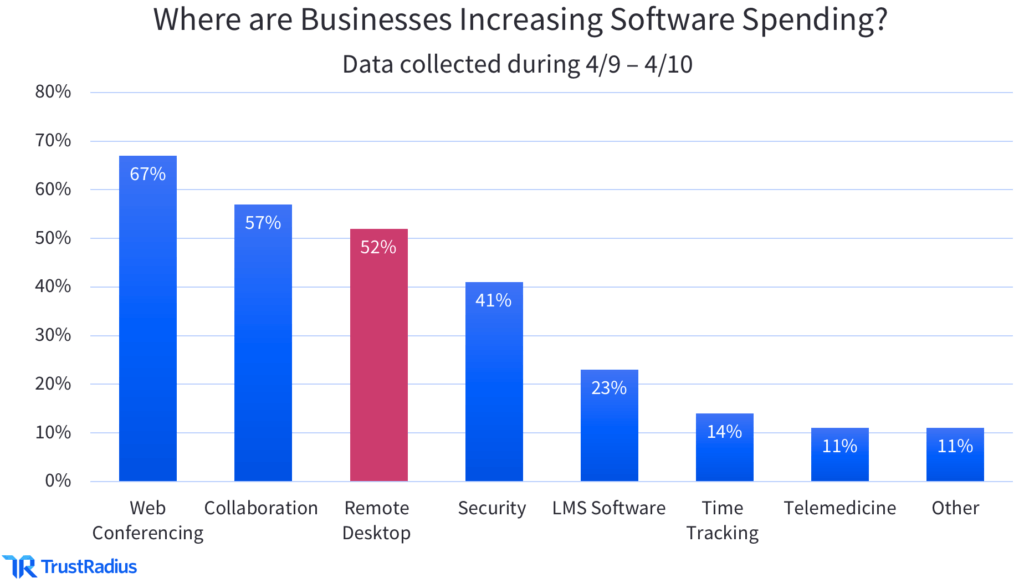

Software spending data from April 2020 shows the increasing importance of remote desktop tools. Other connective technologies like web conferencing software and learning management systems (LMS) have seen similar growth. According to a survey of over 2,000 members of the TrustRadius community, over 50% of businesses expected to increase their spending on remote desktop software.

The rest of this article details historical and real-time trends for remote desktop software, including analysis of how the COVID-19 pandemic has impacted purchase patterns and the most popular tools and comparisons.

Quick Access

Historical Interest in Remote Desktop Software

While there was consistent interest in remote desktop tools prior to the COVID-19 pandemic, the need for this type of technology has increased dramatically over the past few months.

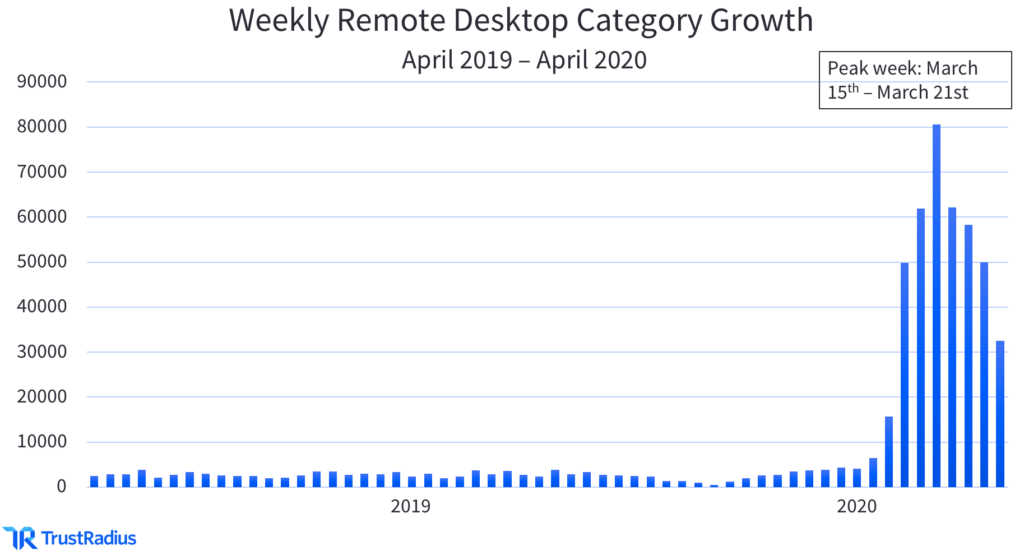

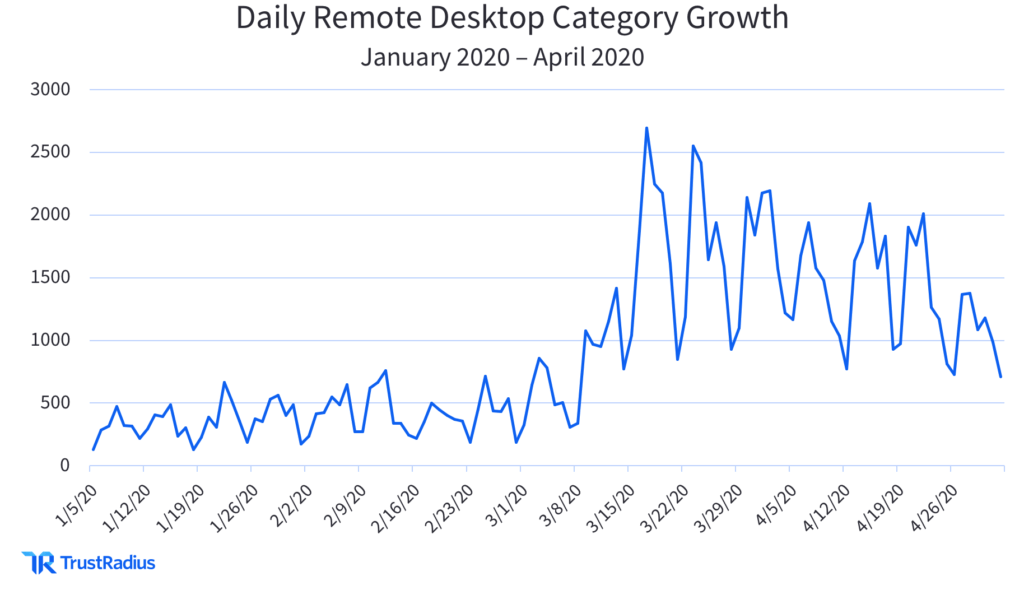

Looking at website traffic for the remote desktop software category on TrustRadius over the past year, there was a giant spike in activity that started in early March and peaked on March 17th as the COVID-19 pandemic began to take hold in the U.S.

Between April 2019 – February 2020, the average traffic per week for the remote desktop category was 2,749 pageviews. This increased nearly 16X during March – April 2020. This amounted to a 1,587% increase in average traffic per week with 46,363 pageviews.

Another key takeaway from this data is that we have passed the ‘peak point of interest’ for remote desktop technology. Traffic to this category on TrustRadius started to decline after March 17th and continued falling in April, as can be seen in the graph above.

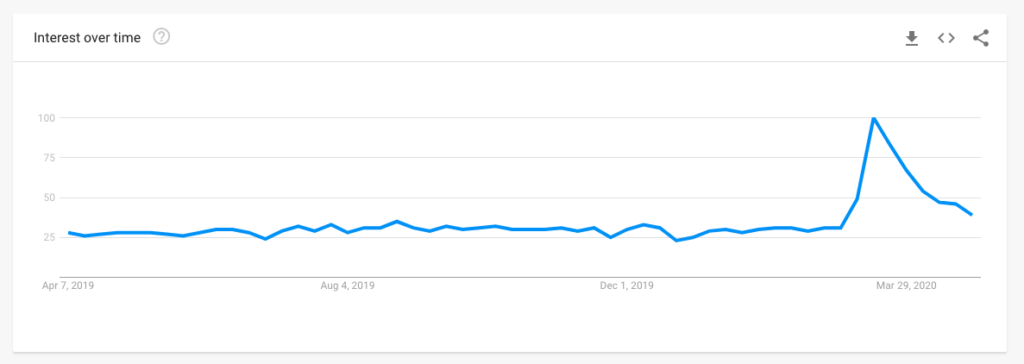

This trend is confirmed by third-party data from Google Trends. The graph below gauges interest in the term ‘Remote Desktop Software’ from April 2019 to today, and displays a clear peak-and-fall scenario.

The Impact of COVID-19 on Remote Desktop Software

As organizations transitioned to WFH environments due to the COVID-19 pandemic, the need for technologies like remote desktop tools increased by several magnitudes.

Companies that were previously able to resolve IT problems in the context of the office needed a solution that allowed them to do this remotely. Remote desktop tools provide a way for organizations to provide assistance to employees and customers, even when they’re not on-site. Using this software, IT professionals are able to diagnose and fix technical problems end-users are experiencing from the safety of their own homes.

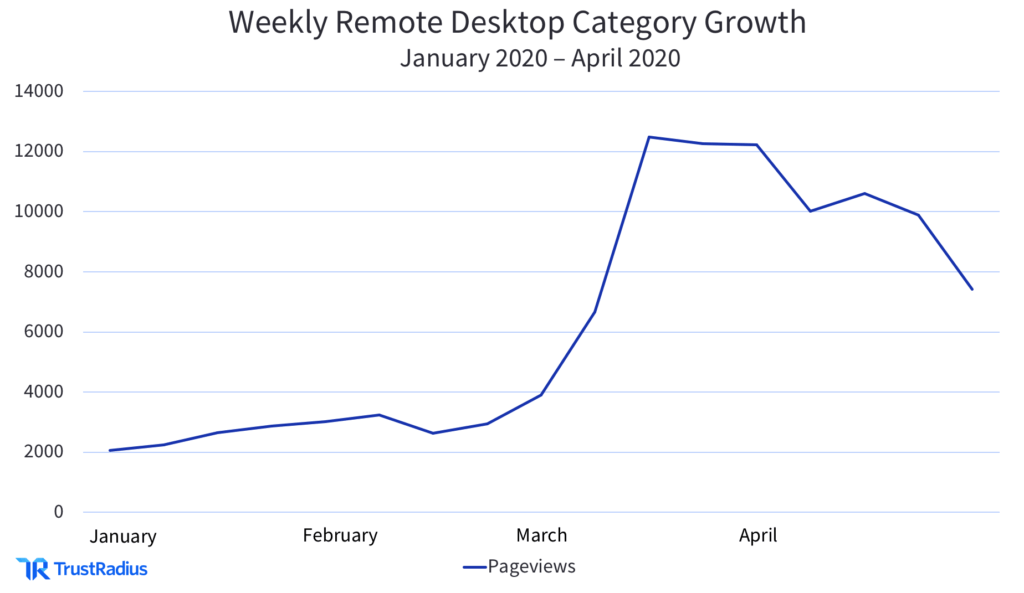

The graph below shows the impact the pandemic has had on demand for remote desktop tools right before and during the pandemic. While we saw normal year-over-year traffic to the remote desktop software category in February, traffic started increasing beyond normal levels in early March. The pandemic-induced increase in traffic peaked not long after, in mid-March.

This graph also shows the sudden interest in remote desktop tools began declining in late March. It’s likely the case that large and small companies alike rushed to purchase and implement remote desktop tools during the month of March, and are now effectively supporting their remote users.

Taking a closer look at the daily patterns of buyer activity for remote desktop software, we’re able to identify the peak day of interest on March 17th.

The day of peak interest identified by TrustRadius (March 17th) also matches the day with the highest level of interest according to Google Trends.

Daily trends reveal that the rise, peak, and fall in traffic for remote desktop software happened over the month of March. However, the decline in interest for remote desktop solutions is gradual. This signals that some organizations are still searching for and evaluating these types of tools.

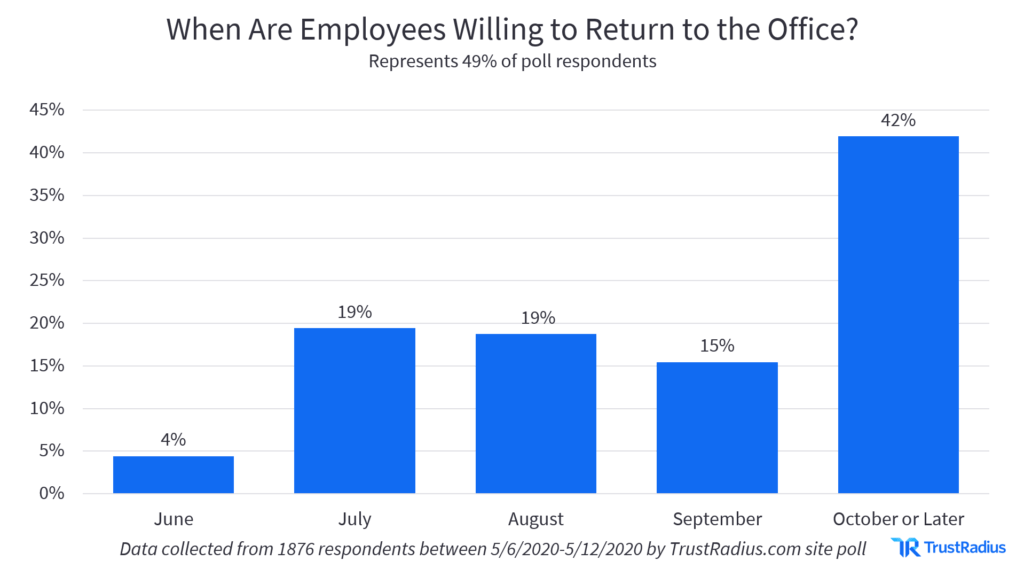

For example, businesses that plan on riding out the rest of the year remotely will likely continue searching for and investing in remote desktop solutions. According to new data collected in early May, 42% of tech professionals say they wouldn’t feel comfortable returning to the office until October 2020 or later.

Regional Interest in Remote Desktop Software

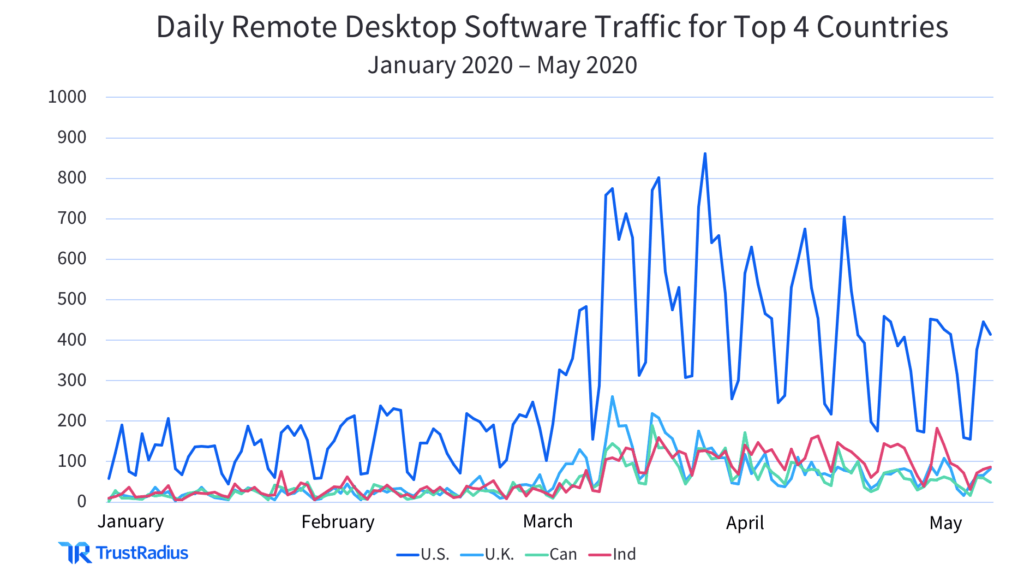

Remote desktop software has been increasing in importance around the world.The average daily traffic on TrustRadius between Jan. – Feb. and March – Mid-May increased by at least 200% for each of the top four countries (the U.S., U.K., Canada, and India).

However, the four countries below have different peak points of buyer activity. For example, interest in the U.K peaked earlier in March than the U.S., with India reaching its peak point of interest much later on May 5th. According to Google Analytics data for TrustRadius, Canada saw the highest amount of daily traffic about a week later than the U.S., on March 23rd. The spike in buyer activity is most pronounced within the U.S.

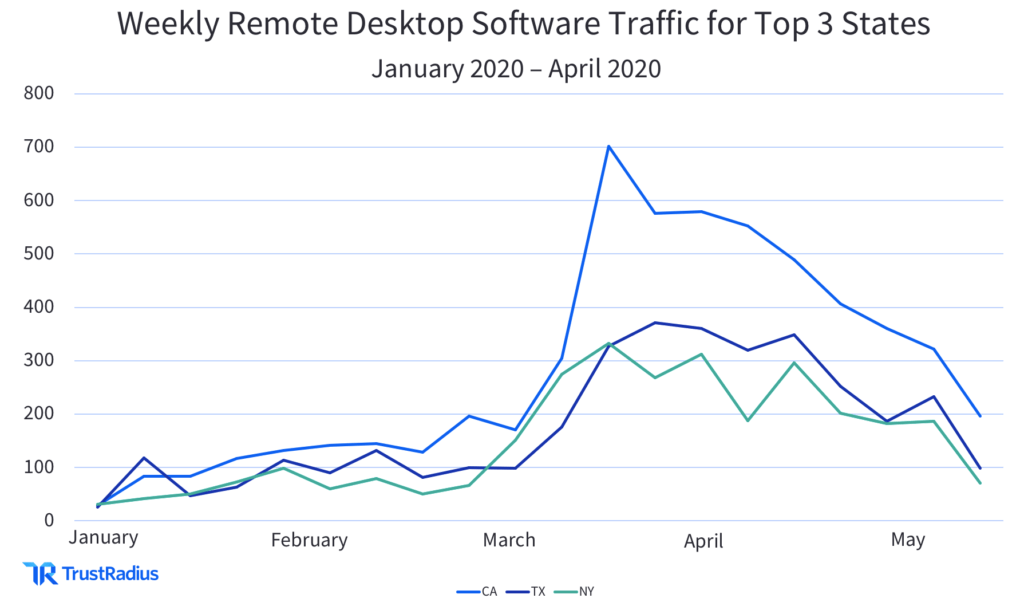

Buyer activity surrounding remote desktop technology within the U.S.has varied across state lines as well. Interestingly, New York—which has one of the largest epicenters of the COVID-19 pandemic in the U.S.—isn’t the state with the highest amount of remote desktop software traffic.

Instead, software buyers and users in California have been searching for this type of software the most. One potential explanation for this is that California is home to one of the nation’s most well-established technology hubs, Silicon Valley. Another contributing factor is likely the difference in population size between the two states: New York state has a population of roughly 19.5 million, while California has a population of about 39.5 million. A final consideration is that New York may have seen a greater degree of disruption of businesses to the larger number of infections and hospitalizations.

Similarly to the graph showing traffic from the top four countries, the top three states all have a different point of peak interest. For example, California hit its peak-day on March 16th, while New York and Texas both had theirs on April 15th. The need for businesses to adopt WFH technology was also likely impacted by if and when individual states have been put under lockdown. For example, New York and California’s Governors put a ‘stay at home’ order in place on March 20th, while Texas’ Governor waited till March 31st to put a similar order in place.

Who’s Searching for Remote Desktop Tools?

For vendors in the remote desktop software industry, one of the biggest questions is: which companies are looking for remote desktop tools right now? Another key concern is how the pandemic has impacted the market landscape.

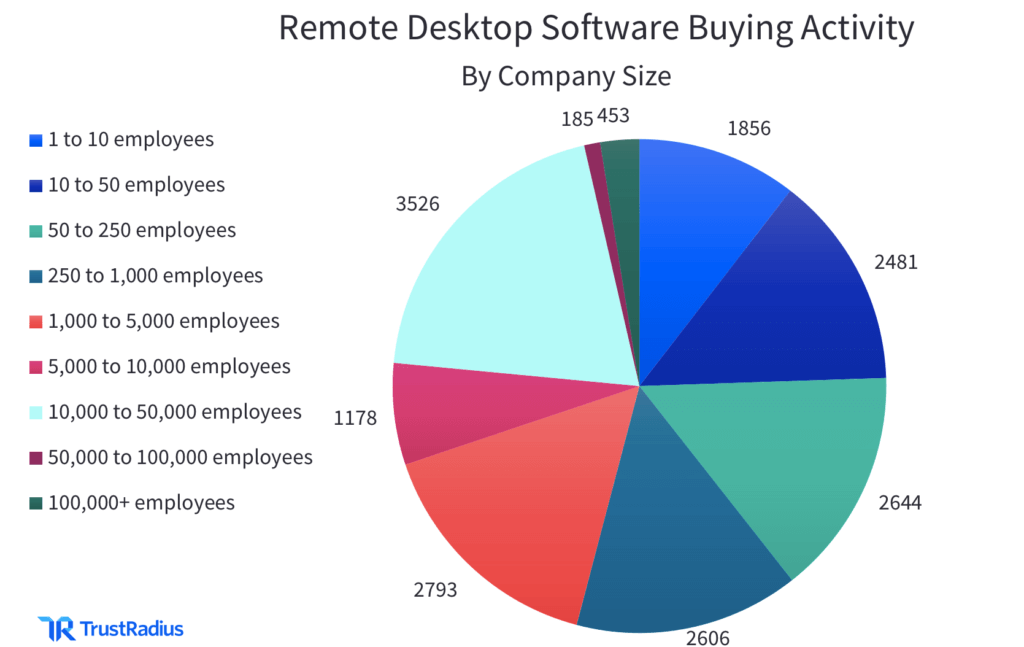

Based on True Intent signals, we have identified the different company size segments researching remote desktop tools on TrustRadius from January 1st to May 18th, 2020. The pie chart below shows the number of visitors from each segment size.

This data shows that enterprise organizations with at least 1,000 employees made up 46% of traffic to the remote desktop tools category on TrustRadius during this time.

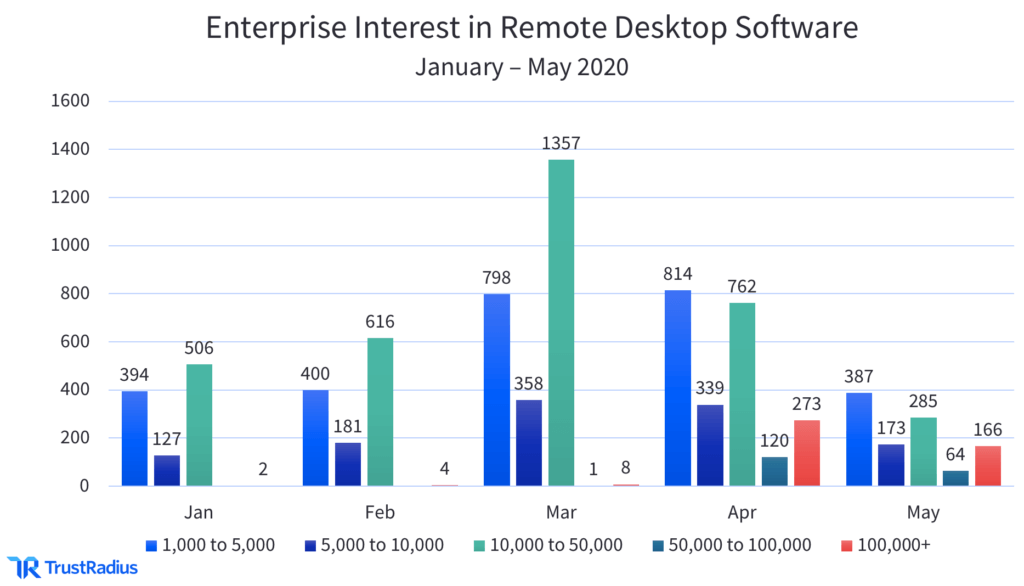

Remote desktop technology has always garnered strong adoption among enterprise organizations, where IT teams are responsible for supporting many employees and customers, often across multiple locations. However, during the early months of the pandemic, we saw a spike in enterprise buyer activity. The number of enterprise buyers evaluating remote desktop software on TrustRadius surged during March, increasing 110% between February and March. Traffic from enterprise buyers then returned to pre-pandemic levels in April and May. Overall, this is in line with broader trends in traffic as confirmed by Google Trends data.

A notable exception is that April and May saw increased interest in remote desktop software among very large enterprises with 50K-100K+ employees. While the remote desktop software category has passed the ‘peak point of interest’ brought on by the pandemic, enterprises’ need for remote desktop technology isn’t going away anytime soon.

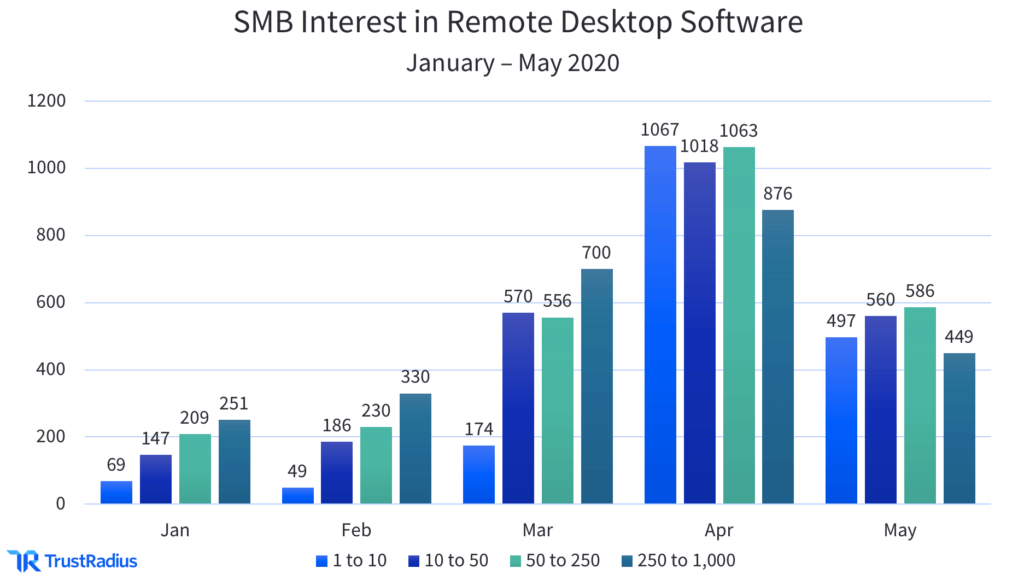

Our True Intent data shows a similar increase in traffic from small and midsize businesses—organizations with less than 1,000 employees. While enterprise activity in this category peaked in March, buyer activity for small and midsize businesses peaked a month later in April. This may be a signal that many SMBs are still searching for the right remote desktop tool for their business.

A key takeaway for vendors in the remote desktop space is that the opportunity to sell to enterprises persists, especially large accounts with 50K + employees. There is also a greater opportunity for vendors to sell to small business mid-market segments than before the COVID-19 pandemic began.

The Top Tools in Today’s Remote Desktop Market

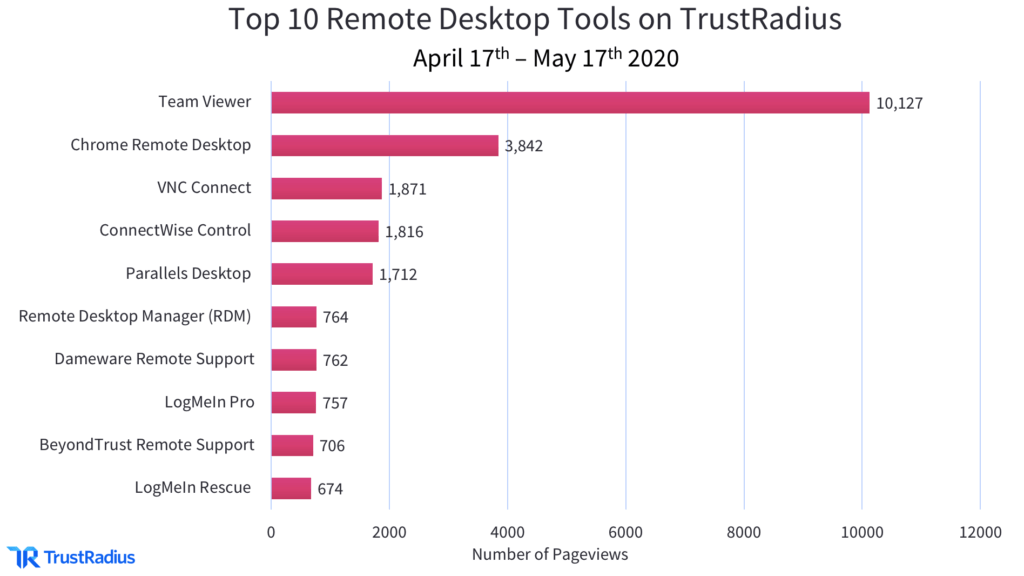

A few key products stand out as the most popular remote desktop tools, and are featured in many of the comparisons researched by buyers on TrustRadius over the past month. TeamViewer leads the pack in terms of buyer interest, at least 4X the amount of traffic of other top products in the category (excluding Chrome Remote Desktop)

According to Reuters, TeamViewer’s surge in growth has been helped by the global transition to WFH due to the Coronavirus pandemic. The company “reported a 75% jump in first-quarter billings” on May 12th. TeamViewer is ideal for small and large companies alike, including features like remote access and support, online meetings, and other collaboration features. It is also available to download for free, though with limited access to advanced features.

Chrome Remote Desktop is currently the second most popular remote desktop solution on TrustRadius and has been picking up extra attention from sources like TechRadar and ComputerWorld. This tool is especially useful for micro and small businesses that may not have experience supporting remote employees. Chrome Remote Desktop is free and primarily allows individuals to access applications and files on a separate computer via Google’s Chrome Remote Desktop application.

| # | Product | Traffic |

| 1 | TeamViewer | 10,127 |

| 2 | Chrome Remote Desktop | 3,842 |

| 3 | VNC Connect | 1,871 |

| 4 | ConnectWise Control | 1,816 |

| 5 | Parallels Desktop | 1,712 |

| 6 | Remote Desktop Manager | 764 |

| 7 | Dameware Remote Support | 762 |

| 8 | LogMeIn Pro | 757 |

| 9 | BeyondTrust Remote Support | 706 |

| 10 | LogMeIn Rescue | 674 |

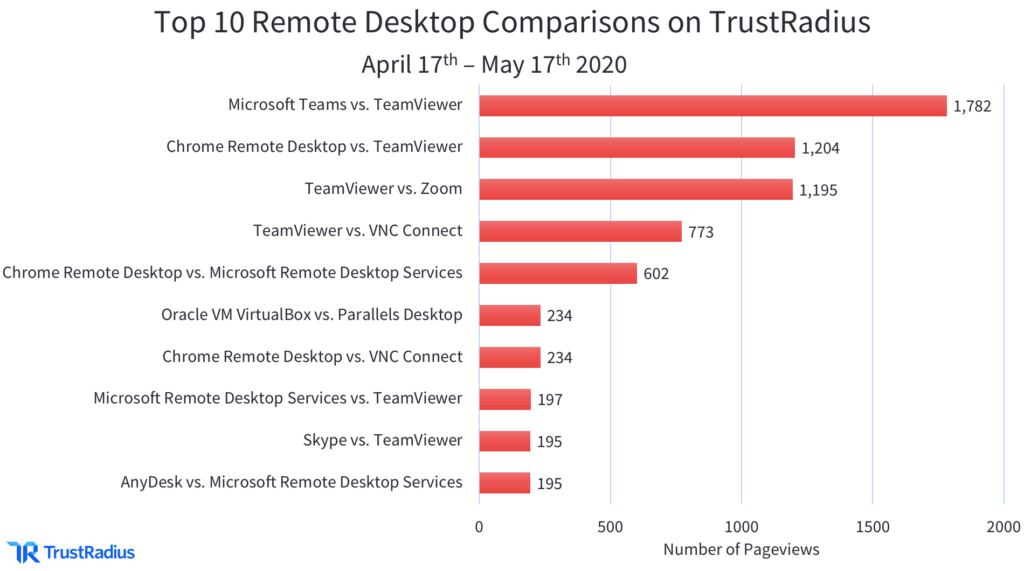

TeamViewer is also heavily represented in the top 10 remote desktop software comparisons on TrustRadius over the past month. 6 out of 10 of the comparisons feature TeamViewer against another product.

One interesting thing to note is that 2 of the top 3 comparisons are between TeamViewer and two other products, Microsoft Teams and Zoom, which are primarily known as web conferencing tools. There is overlap between these two types of software. Some remote desktop activities can be done using a traditional web conferencing solution, though a remote desktop-first product will have more advanced remote support capabilities.

Remote Desktop Market Growth on TrustRadius vs. G2

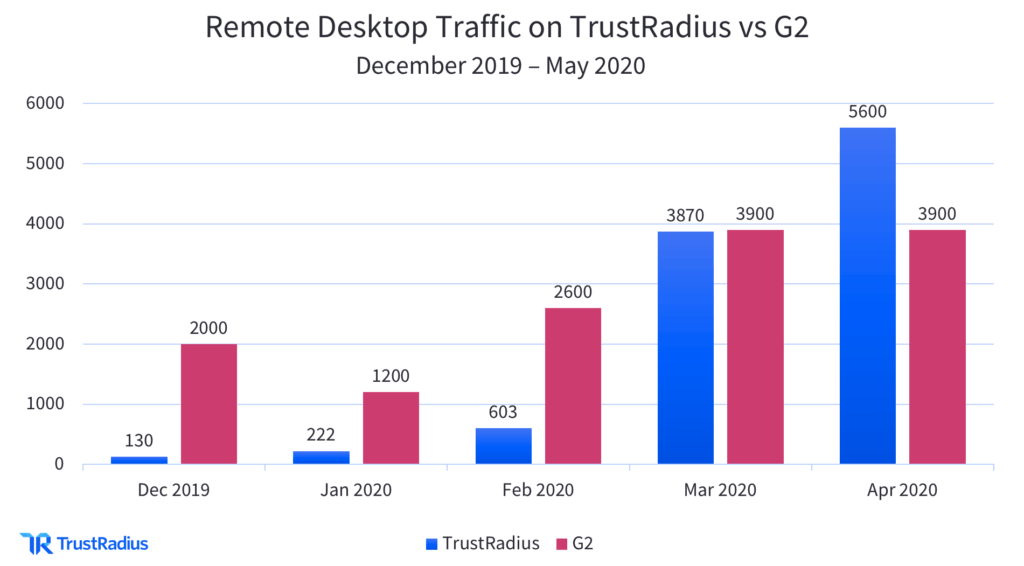

In the past few months, a significant and growing number of software buyers have chosen TrustRadius as the most trusted site for researching remote desktop products. When looking at total traffic, the number of buyers searching for the term ‘Remote Desktop Software’ and visiting this category on TrustRadius started increasing in earnest between January – February 2020 and kept rising the following months. In contrast, remote desktop traffic on other popular B2B software review websites—like G2—has seen more fluctuation.

These results indicate that TrustRadius has become the leading source for remote desktop reviews in today’s market.

We know that reviews are the #1 resource buyers use to get independent, unbiased information about the products on their list. Buyers use reviews to validate the information remote desktop vendors provide in order to get a complete picture of how products will work in their environment. And because TrustRadius provides more detailed, trusted, and verified content than any other review site, the results speak for themselves.

Not only have we seen a steady increase in overall traffic in the remote desktop category this year—we’ve also seen a significant increase in buyer engagement. The average time spent on page for the remote desktop software category was 6 minutes 12 seconds in January 2020. This increased by 45% to 9 minutes in April 2020.

Remote desktop buyers are highly engaged on the TrustRadius platform because of the high-quality content we provide. Across the 4,180 reviews of remote desktop software on TrustRadius, the average review contains 307 words. For comparison’s sake, G2 reviews average 130 words. Detailed answers to key questions, such as use case, pros, cons, and ROI, make TrustRadius the most valuable resource for buyers seeking remote desktop software reviews.