The 2021 Ultimate Guide to B2B Intent Data

Please note: this post was updated on September 1, 2021, to include the Free. Intent Data Analysis offer.

Field sales were grounded in 2020. Conferences were canceled. 100% of buying decisions took place online. Yet B2B sellers still had to find a way to close deals and meet their quotas.

Intent data is a powerful strategy that could help make up that difference—if only more companies used it.

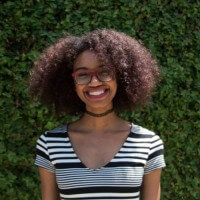

According to new research from TrustRadius, only 40% of software companies currently use buyer intent data for lead generation. This is a huge missed opportunity.

Why are we sleeping on intent data?

The strategy is still pretty new, so it’s possible that marketing and revenue leaders don’t quite grasp the value of intent data, or know how to make it work with their flow. Regardless, the ROI is so clear that we suggest getting on board now before your competition catches up and gains an advantage.

Here’s a map to help you navigate this ultimate guide:

| Don’t know how intent data works? Skim through our quick 101. | Not sure which provider to work with? Check out our ultimate comparison chart. | Need to level up your ABM strategy? See how successful marketers are doing it. |

Want the newest stats on intent data? Check out brand new TrustRadius research. | Looking for the strongest source of intent data? Customer reviews may be your next big strategy. | Want to speak to a member of our team about intent data? Request a demo. |

Intent Data is the Secret Weapon Most Marketers Miss

Here’s why intent data matters more than ever in 2021:

- 87% of buyers want to self-serve part or all of their buying journey.

- 57% of buyers already make decisions without ever talking with a vendor rep.

- Nearly 100% of purchases are made online, and most buyer research happens anonymously.

Despite the surge in buyers sticking strictly to online research during their software buying searches, 35% of vendors say they don’t work with an intent data provider at all.

Of the 40% of companies who do use intent data, we see an interesting trend when it comes to company size. We know that enterprises are very likely to use intent data due to their budget capacity and the sophistication of their ABM processes.

However, this year we learned that working with an intent data provider is also popular with mid-market companies. 47% of midsize businesses currently use intent data.

That could be because these companies are uniquely positioned to move quickly to adopt new lead generation methods. They’re often more flexible than enterprises, but have big enough budgets to fully invest in intent.

It’s also worth noting that 25% of the software vendors we surveyed weren’t sure if their company uses intent data or not. That makes sense, given that only 4% of our survey respondents worked directly in the demand generation department. It’s likely that more companies are using intent data than this data represents.

How Successful Marketers Use Intent Data to Drive Revenue

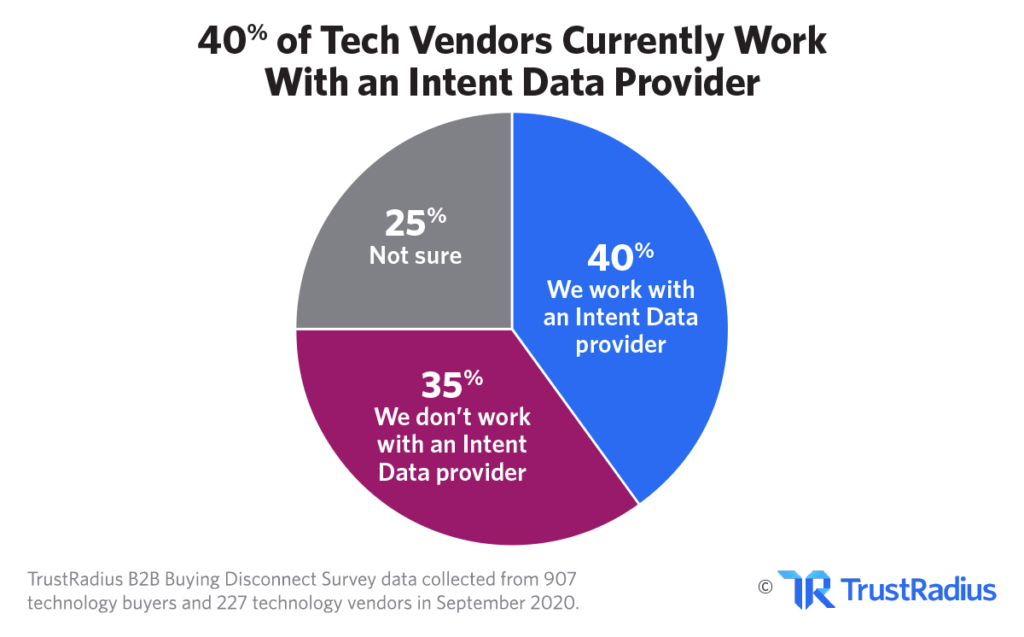

Out of the 40% of tech companies who use any type of intent data, 70% of them use it for prospecting. That’s an obvious use case, since the majority of buyer research happens online before a prospect ever talks to a sales rep.

However, the other use cases on the graph below are next-level strategies that only the most successful marketers lean into.

Tips from 6sense

According to TrustRadius research, only 52% of the companies who use buyer intent data apply it to ABM. And even less (46%) apply it to ad retargeting. But according to Latané Conant, CMO at 6sense:

“You don’t have a known marketing funnel, you have a dark funnel—all the activities that buyers are doing that you can’t see.”

Intent data lets you shine light on that dark funnel and uncover those anonymous prospects who are already interested in what you have to offer. It’s a solid way to build a more sustainable sales and marketing pipeline—especially when you choose a strong, low-funnel source of data.

Tips from WatchGuard

At WatchGuard, Sr. Manager of Demand Gen, Alex McWethy grew $1.1M in pipeline using downstream intent data—which is lower-funnel, indicating a stronger signal. Here’s Alex’s recipe for success:

- Discover buyers using intent data

- Engage key accounts

- Target key accounts

- Enable sales with what you find

When you light up your dark funnel and proactively target your Ideal Customer Profile (ICP), as Alex does, it’s much easier to fill your pipeline with quality prospects.

Tips from Optimizely

Jessica Brook, Sr. Demand Gen Manager at Optimizely, used downstream intent data to power Drift chatbots and provide buyers with unique messaging based on their profiles.

Starting with a list of over 1,000 accounts identified through intent data, Jessica focused on 176 target accounts to plug into the Drift chatbot. This test resulted in 11 meetings booked and 4 sales-accepted meetings for Optimizely. They also closed their fastest deal ever—in a single business day—thanks to downstream intent data catching prospects further down their buying journey.

According to Jessica, the success of this experiment was due to it being the right message, at the right time, in the right channel—a perfect storm. And that wouldn’t be possible without strong intent data. In her own words:

“This experiment completely validated my hypothesis that these people were ready to talk to sales, and even buy.”

Want to try a similar experiment on your own? Check out this post, where Jessica shows you how to set up your Drift chat bot for best results.

Tips from TechTarget

John Steinert is CMO of TechTarget and an industry-recognized expert in intent data. We asked how he’d advise CMOs—and practitioners—on getting started with intent data. He suggested three key tips:

- Do you want to invest wisely? Start with specific end goals in mind. Think through what use cases you want to support with intent data and how that informs your requirements for investment. Make sure your intent data supplier can explain how their data supports your specific needs.

- Do you want to drive global sales productivity? You’ll need solid account prioritization, clearly interested contacts, and opt-in permission to go after them.

- Do you want to drive engagement and conversion? Use very precise messaging for different groups of people across your marketing nurtures, sales cadences, or field sales multi-threading. This will help you connect better.

Why Reviews are Your Most Valuable Untapped Source of Intent Data

Customer reviews are unbelievably powerful in the hands of marketing and sales teams—especially when you use review platforms to generate downstream intent data, which is more lower-funnel, higher-intent data from prospects who are ready to buy your product.

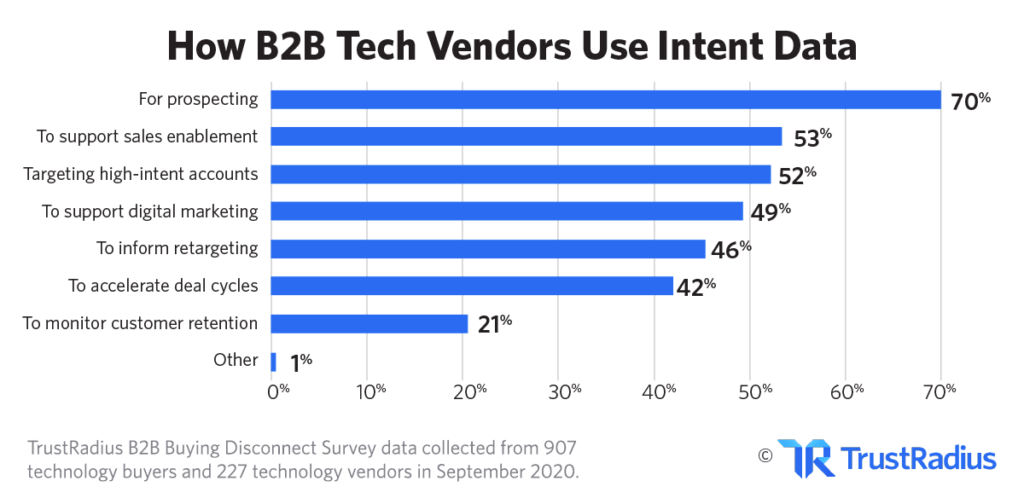

Only 26% of vendors who use review sites leverage their 2nd-party intent data.

But it’s really not that hard to see the connection. Of the 40% of tech vendors who have an intent data provider, 90% of them already work with review sites in a paid capacity. It only makes sense that you would extend that partnership to access high-value intent data.

Intent data from review sites can be your secret weapon for sourcing leads, increasing conversion, and influencing active, lower-funnel buyers.

At a basic level, here’s how to get the most out of your partnership with a review site:

- Use downstream intent data from review sites to target high-intent accounts.

- Place CTAs on review sites to attract buyers with high purchase intent to your site.

- Target ads toward buyers who read reviews in your category or for your competitors.

- Publish review snippets on your landing pages to increase conversion.

- Use rich review content in your sales outreach to accelerate the sales cycle.

“We are using TrustRadius to gain trust from our potential customers as they can see reviews from similar organizations in the same industry. TrustRadius has enabled us to take a targeted approach in finding enterprise customers. We can display relevant reviews in marketing material that we show them. We have seen success using TrustRadius reviews in ABM ads, email campaigns, and retargeting.”

– Zach Diamond, Demand Generation Manager at Social Solutions

Why You Can’t Ignore B2B Intent Data

Intent data is still fairly new in the B2B sales world. As such, you’ll find a lot of opinions circulating on social media about whether or not it’s effective. Before diving in, you need to understand exactly what intent data is and how it works. Here’s a quick 101.

What is B2B intent data?

Here’s a good intent data definition:

B2B buyer intent data is a collected set of data points that indicate that someone may be interested in buying your product. Websites collect intent signals from users—including the pages they visit, the links they click, and the resources they download—and they synthesize that data to share with marketers and salespeople.

A review site like TrustRadius, for example, might provide you with a list of companies who have researched your products this month. Or a list of companies who checked out your competitors’ products. Or people who are researching your category as a whole.

All of these signals indicate that these people have a strong intent to make a purchase.

Important note: The strength of intent data differs depending on whether the information comes from a first party, second party, or third party source. Learn more about that here.

How is intent data collected?

Websites collect intent data either at the IP level or via user registration and cookies. They gather a wide range of signals from user behavior, including their searches, downloads, pages visited, clicks, etc. Intent data providers synthesize that information into an actionable list of companies for you to target.

How does intent data work?

On a technical level, intent data is pretty simple.

Websites measure a whole host of intent signals every day. Intent data providers do the hard work of sifting through that data and figuring out which people and which companies have the strongest intent signals. Then they send that data to people like you via a list, a spreadsheet, or a direct API connection with a tool like Salesforce.

This typically happens on a monthly or weekly basis.

After that, it’s up to marketing and sales teams to use that intent data to your best advantage. Most people use it for prospecting, but we’ll get into a few other use cases below.

How do you use intent data?

Successful marketing and sales teams use intent data for a variety of activities, starting with prospecting. 70% of vendors we surveyed use intent data to find leads. Companies also use it for sales enablement, ABM, and to support digital marketing.

If you want to go deeper, we’ve got specific, actionable tips from marketing experts who use intent data every day. Jump to that section now.

The Ultimate Comparison Chart of B2B Intent Data Providers

In this year’s B2B Buying Disconnect survey, we asked 200+ software vendors what intent data providers they used. Here are the top 10 companies they mentioned. For more details on what each company offers, click their name.

| Intent Data Provider | trScore | Free to Try | Intent Data Source | Buying Journey Stage |

| 8.5 | Y | 3rd party | Top-funnel |

| 8.3 | N | 3rd party | Top-funnel |

| 8.1 | Y | 3rd party | Top-funnel |

| 7.9 | N | 3rd party | Top-mid funnel |

| 7.5 | N | 2nd party | Mid-funnel |

| N/A | N | 2nd party | Mid-bottom funnel |

| N/A | N | 3rd party | Top-funnel |

| 8.2 | N | 3rd party | Top-funnel |

| 9 | Y | 3rd party | Top-funnel |

| 8.9 | Y | 2nd party | Mid-bottom funnel |

Bombora

Bombora is primarily an intent data provider whose three main products can be used as Sales Intelligence and Sales Acceleration tools. What’s unique about Bombora is that its data is a co-operative of B2B media companies around the world. Members contribute content consumption and behavioral data about their audiences, and Bombora funnels that data to paying customers. Bombora is best for getting a large volume of very high-level data, as it typically doesn’t have robust filtering options like some other intent data providers do. If you require a more nuanced data set, Bombora may not be a great fit.

ZoomInfo

ZoomInfo competes as a leader in both the Marketing Intelligence and Sales Intelligence categories. ZoomInfo WebSights is a website visitor tracking tool that is designed to turn anonymous users on your own website into identifiable leads. While ZoomInfo has a really broad reach, users frequently complain that their data may not always be accurate. Successful marketers who use ZoomInfo typically have some kind of verification routine built into their data process.

6sense

6sense is a leading account engagement platform that excels at enabling Account-Based Marketing (ABM) by coupling intent data with customer data. This software is powerful and also tends to be a bit complex. Users mention a learning curve on navigating its features and user interface. 6sense may be somewhat of a challenge for those new to intent data or with fewer resources (and time) to get set up and get the most out of your intent data.

Demandbase

Similar to 6sense, Demandbase is designed to facilitate the account-based marketing process for B2B companies. Demandbase’s Real-Time Intent offering provides users with intent data gathered from users’ activities across the internet. Some users report that uploading account lists into Demandbase can be tedious, as the software doesn’t have, as of yet, a supportive system for dealing with data that hasn’t been pre-cleaned.

TechTarget

TechTarget’s Priority Engine is TechTarget’s primary intent data offering. TechTarget leverages its large internet footprint as a key selling point of its intent data as many prospective buyers turn to TechTarget when researching software. TechTarget also provides users with data on their current prospects and buyers who have self-identified as being interested in meeting with vendors. However, TechTarget may be limiting for teams looking for more targeted contact list-building, and more granular information.

G2

G2 is closer to TrustRadius than others as an intent data provider. As a review site provider, buyers on G2 are also signaling their intent to buy by wanting to get testimonials directly from existing customers themselves. G2 provides vendors with information on companies researching their product(s), competitors, and analytics into the state of software categories in which they compete. One of the observed downsides to G2, is that its review vetting processes is not as robust as alternatives, leading to inaccurate data. G2’s traffic is also driven by their blog content vs. review content – which tends to skew the efficacy of the resulting intent data.

Aberdeen

Aberdeen is a dedicated intent data provider for B2B marketers. Aberdeen is another platform that sources data from across the internet and digests that information for its users to identify the most ideal buyers. In addition to providing this level of insight, Aberdeen also offers prioritized call center services and advertising analytics. Given its complexity, it may not be as plug-and-play as alternatives.

Clearbit

Clearbit is a Sales Intelligence platform focused on B2B marketing and sales. They help users “unmask” anonymous web traffic and also help with targeted advertisements. Clearbit seems to shine at providing users with easily accessible data, but may be better suited for larger organizations versus small businesses. Other intent data providers may actually use underlying Clearbit software, so ask vendors about this, as going with Clearbit might just be the clearer option.

KickFire

KickFire is primarily an Intent Data provider focusing on enabling businesses to use intent data in a variety of ways using proprietary APIs and built-in integrations with Google Marketing Platform and Adobe Launch. Kickfire has great reporting features, but may struggle with providing accuracy with its data.

TrustRadius

TrustRadius helps technology buyers make better decisions and helps vendors tell their unique story, improve conversion, engage high-intent buyers, and gain customer insights. In addition to being an intent data provider, TrustRadius is also a review site provider which allows them to leverage customer voice. TrustRadius may not be suited for businesses looking for a one-stop-shop for intent data, as its data relies entirely on data from its own website.

Which Type of Intent Data is the Most Relevant?

That depends on what you’re looking for. As we mentioned above, there are three different types of intent data. They each reveal a different part of your “dark funnel”—and depending on what you use intent data for, some sources may be more relevant than others.

Here’s a quick breakdown of the types of data:

First Party Intent Data

First party intent data comes directly from your own web properties—your product websites, your blog, your subscription activity, etc. This data comes from users who interact with content that comes directly from you. You can measure first party data through tools like Google Analytics or your CRM software.

First party intent signals can be very strong, particularly when you measure intent signals from people who navigate directly to your site (direct traffic). These are people who already know about your brand and are actively looking to learn more about what you have to offer.

Surprisingly, most companies don’t squeeze enough value from their first party intent data—either because they don’t know how to measure it, or because they haven’t figured out how to arm their sales and marketing teams with a comprehensible stream of insights.

Those who do utilize their first party data typically find that it’s lacking in scale. This is especially true for midsize businesses who don’t attract thousands of web users per month. Those who want to scale up their ABM efforts will likely need to invest in additional intent data sources.

Second Party Intent Data

Second party intent data is first party intent data that comes from another company. As a marketer, you’re able to purchase this data directly from the source through an intent data partnership.

Second party intent data is fairly new, with relatively few companies offering intent data in the market. Right now the main second party intent offerings in the B2B world come from review platforms like TrustRadius and G2.

When second party intent data comes from sources like review sites (which collect lower-funnel signals from an audience of actual buyers), we refer to this type of data as downstream intent. This data is highly valuable and is often the next best thing (after your own data) in terms of quality and impact.

Third Party Intent Data

Third party intent data comes from large data conglomerates (like Bombora or Demandbase) who purchase intent signals from a variety of websites and package all of their data as a single product for sale. This results in a huge volume of top-funnel intent signals that can be quite helpful.

B2B marketers sometimes complain that intent data “doesn’t work” or is too “low quality”. That’s because only a small percentage of the data signals they receive from third party sellers are actually users looking to buy their product. The rest is noise.

Third party intent data is also publicly available to anyone who pays for it—which means you lose the exclusivity benefits that come with first party and second party intent. It’s likely that your competitors have access to the same account information and are targeting those accounts in a similar way.

If you’re looking to expand your reach to a large volume of top-funnel users, third party intent data is a good fit for your needs. Otherwise, you’ll want to consider more distilled options with higher data quality.

Intent Data at TrustRadius vs G2

Let’s dive a bit deeper into second party intent.

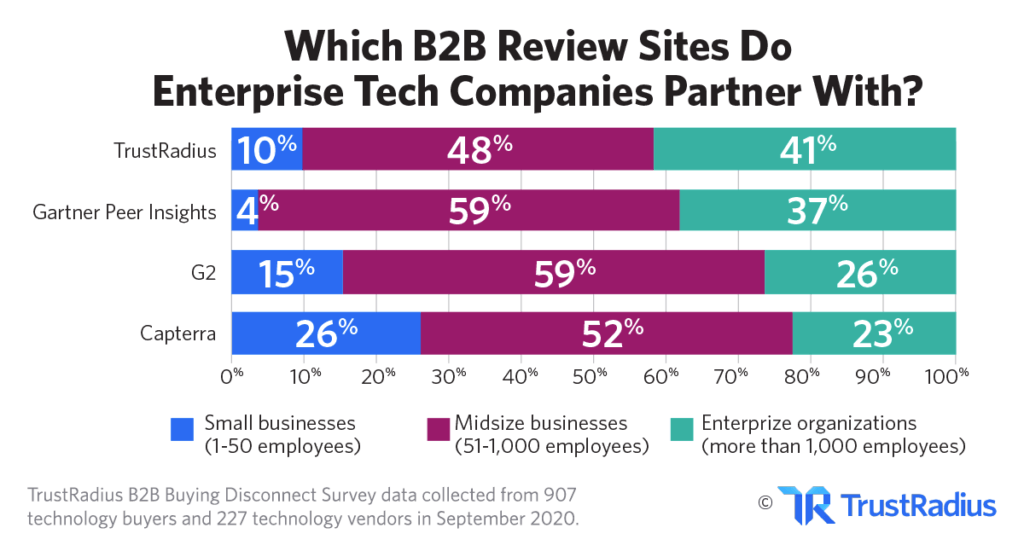

While both TrustRadius and G2 are review sites that offer intent data, we’re different in a couple of key ways. Most importantly, up to 60% of TrustRadius intent signals come from enterprise buyers—while G2’s site attracts more of an SMB audience. That’s why more enterprise software vendors tend to work with TrustRadius over other review sites.

According to G2, 47% of their reviews come from small businesses. This means you’re more likely to receive ABM lists of smaller companies if you purchase intent data from G2. If you’re more interested in knowing which large enterprises are looking at your product, you’ll want to purchase intent elsewhere.

Another important point to consider is the depth and breadth of the data review sites provide.

While G2 provides high-level intent data on who is researching you on their website and how often, TrustRadius can provide you with insights on whether buyers are reading reviews on your competitors, or whether they’re looking at your competitors and not you. That way you can tailor your marketing plays to what messaging they’ve already received.

Learn How to Use Buyer Intent Data to Reach Your Goals

Buyer intent data lets you see all of the anonymous people who are looking at your product right now. This is the secret weapon that could fill your entire pipeline for the 2021 year.

Still, many marketers are skeptical. Intent data is pretty new, and many companies have already partnered unsuccessfully with third party providers whose signals weren’t strong enough to be useful. We know that an intent data partnership is a big investment.

The TrustRadius team is here to help. We will walk you through our platform and show you how to activate downstream intent data. No strings attached.

We fully believe that intent data is the future of successful sales and marketing—especially now.