Media Kit for Powerhouse Marketers

Download, share, and customize these at-a-glance tools to spread the word about how today’s enterprise buyers make their technology purchase decisions.

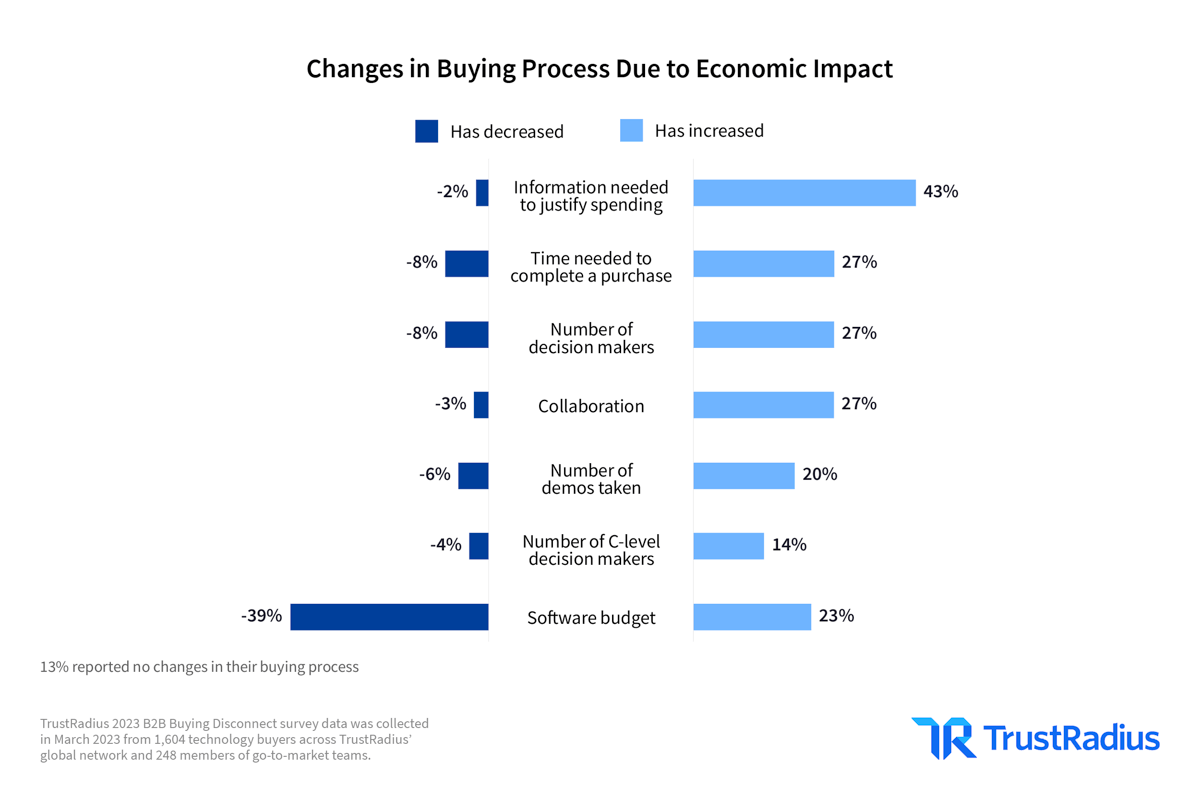

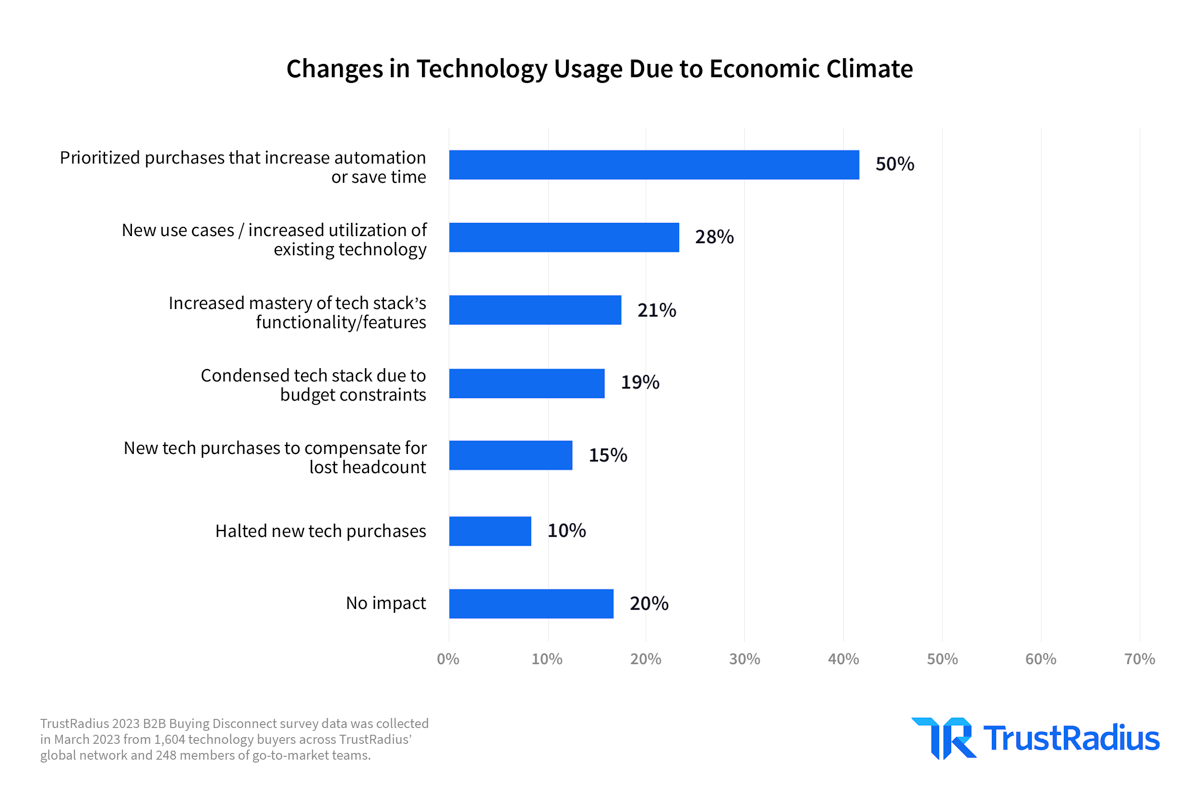

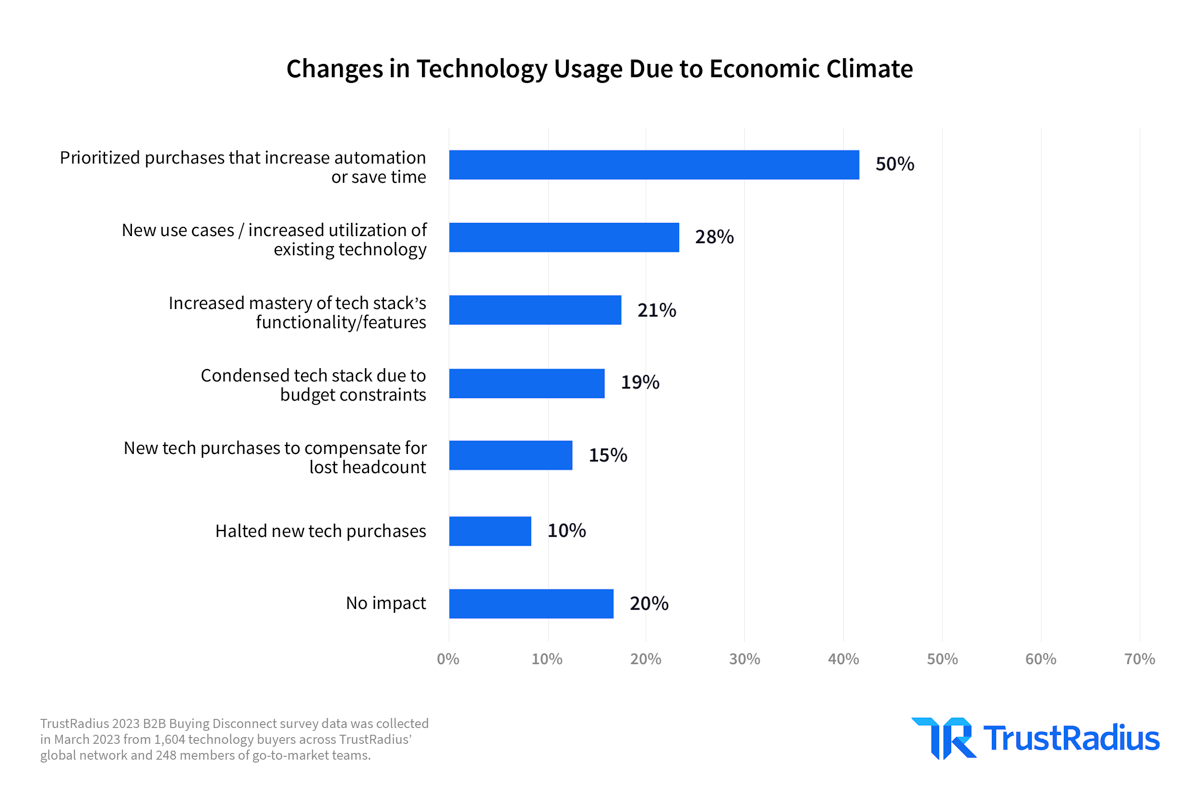

Economic impact to technology usage

Spending hasn’t stopped, but buyers are more risk-averse

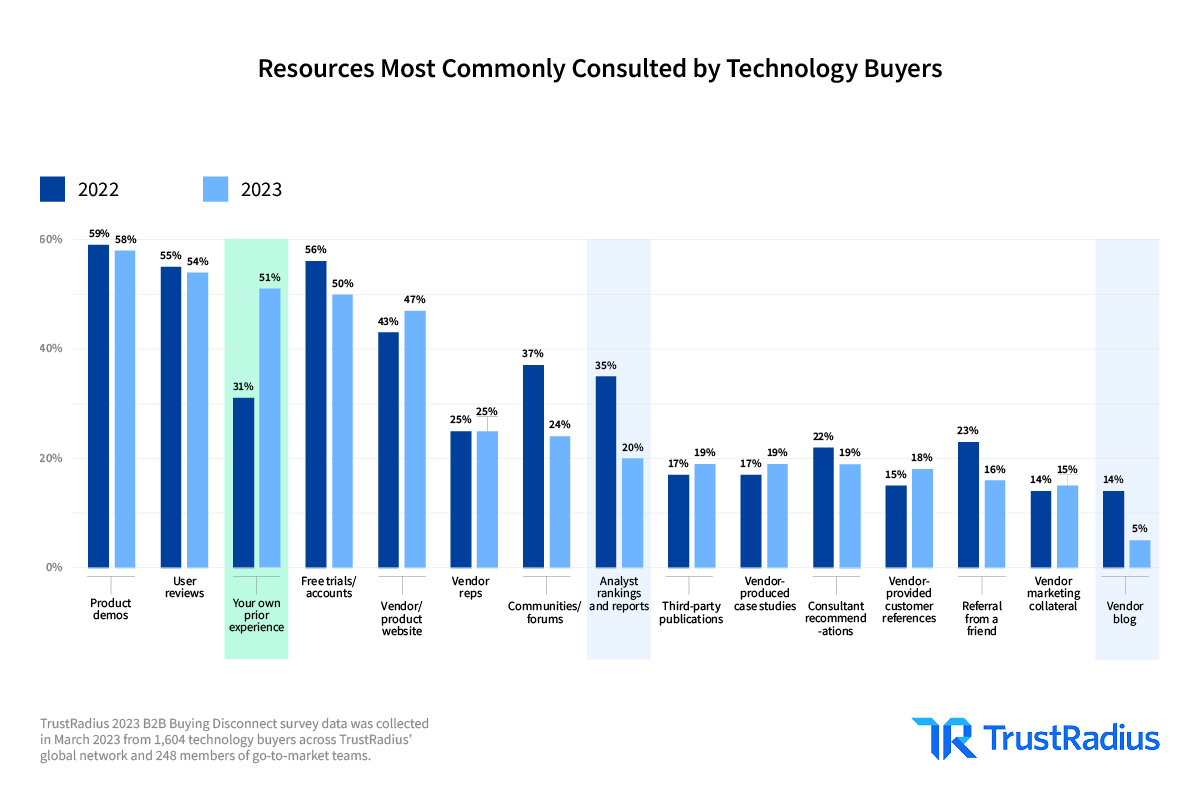

Commonly consulted resources

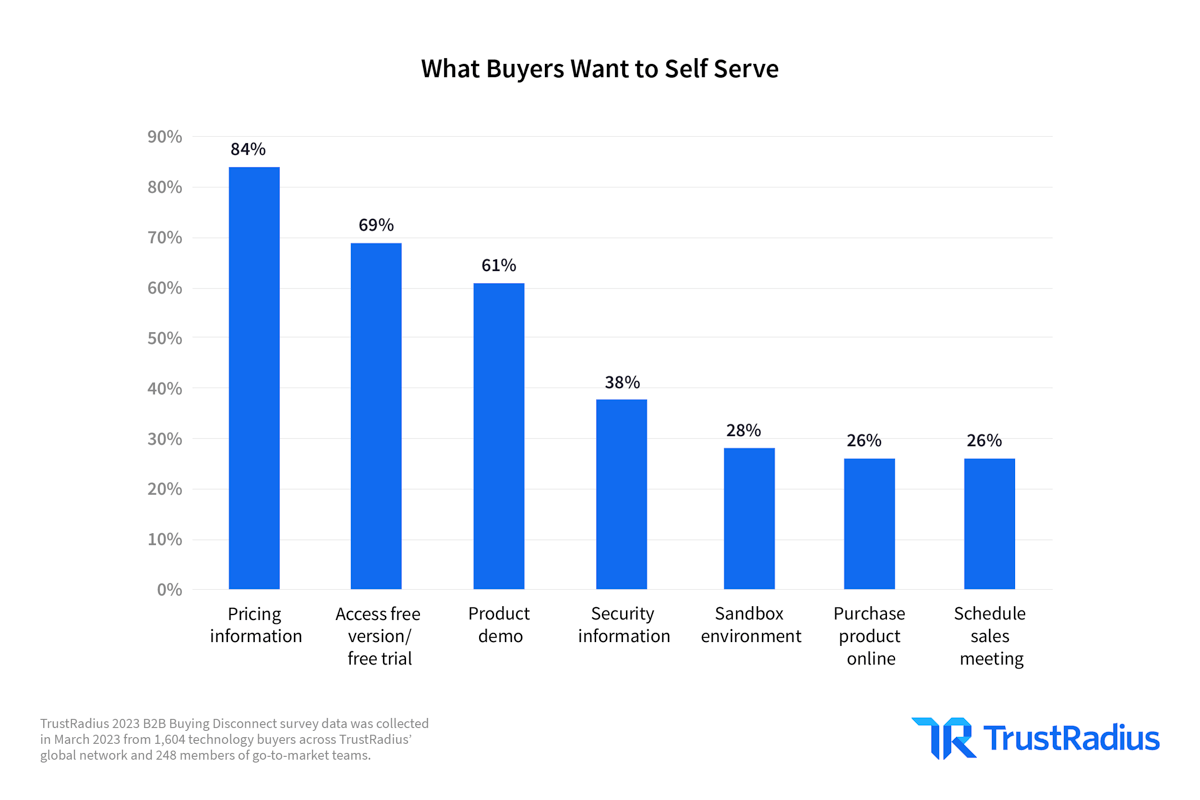

Buyers continue to self-serve at a high rate during their buying process

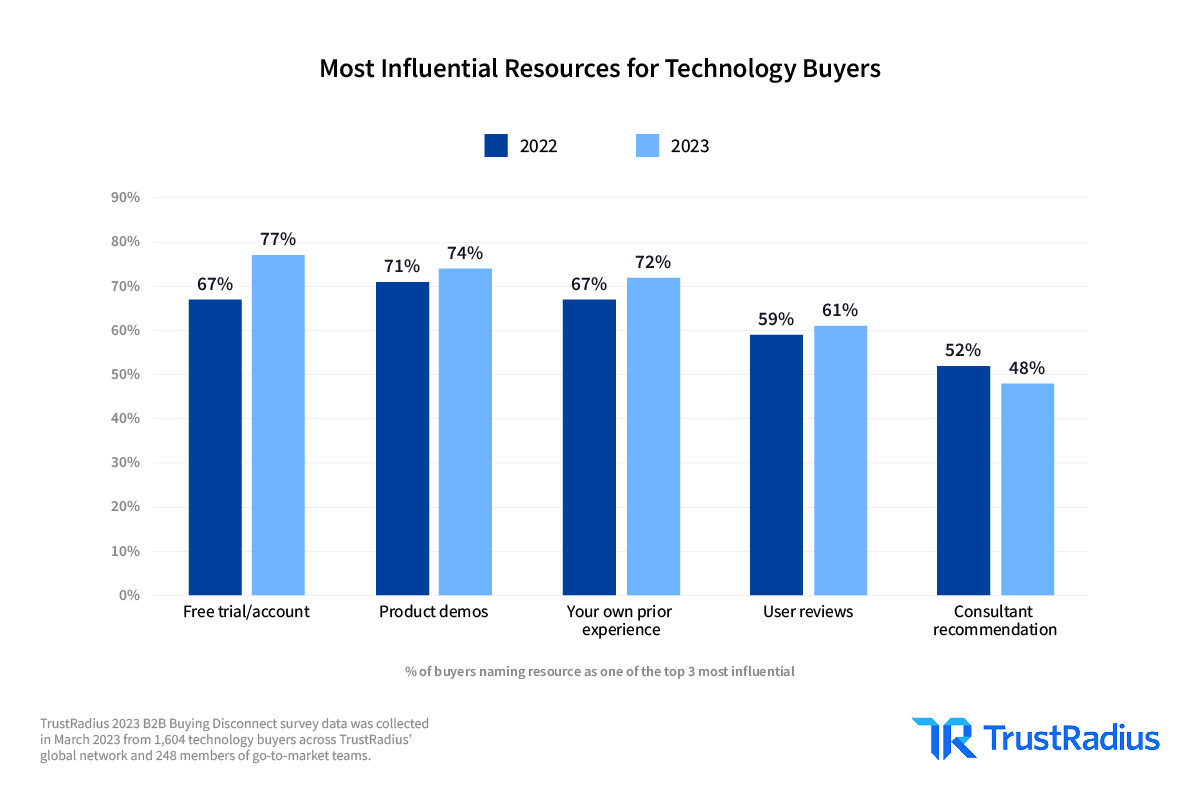

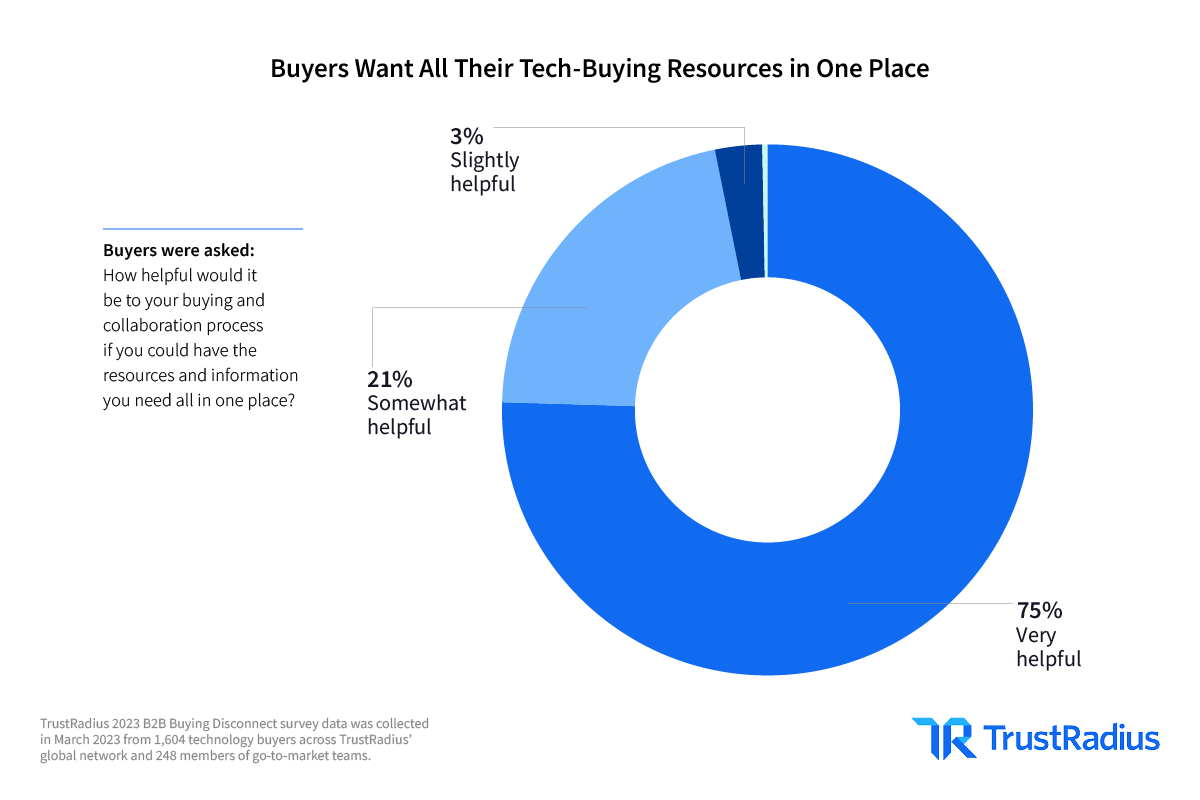

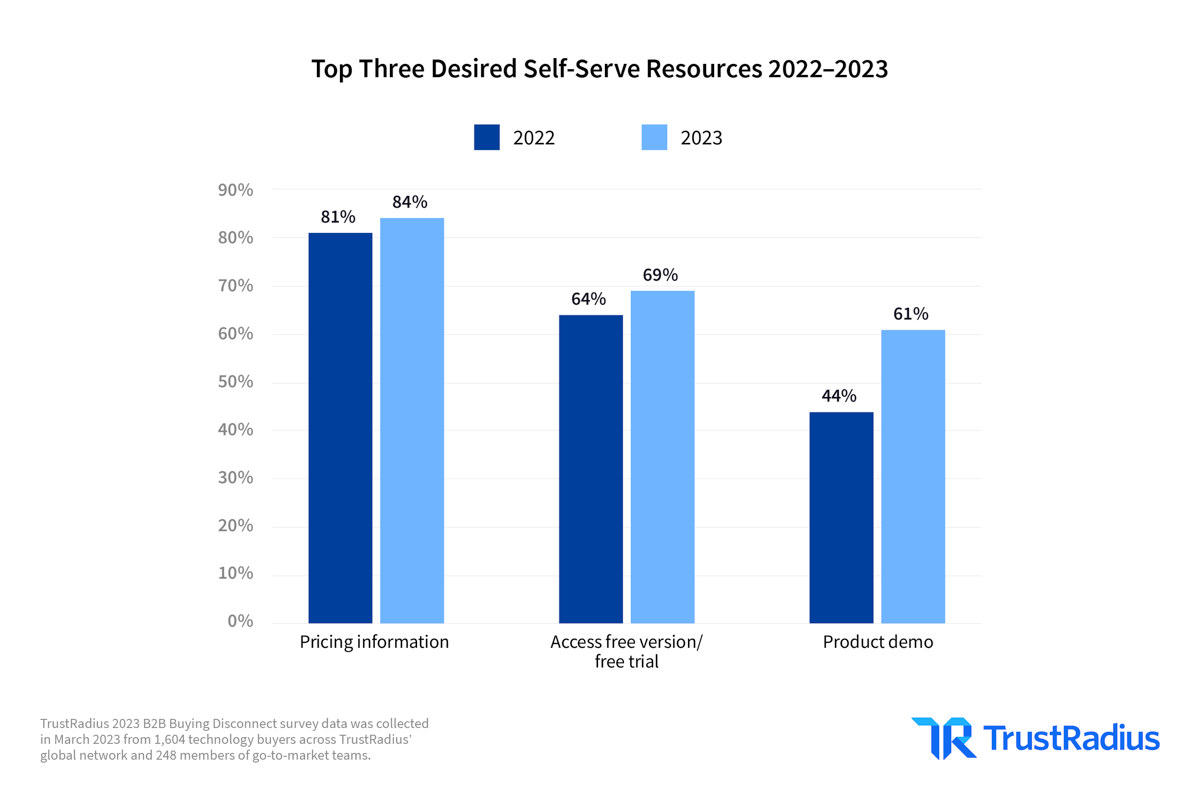

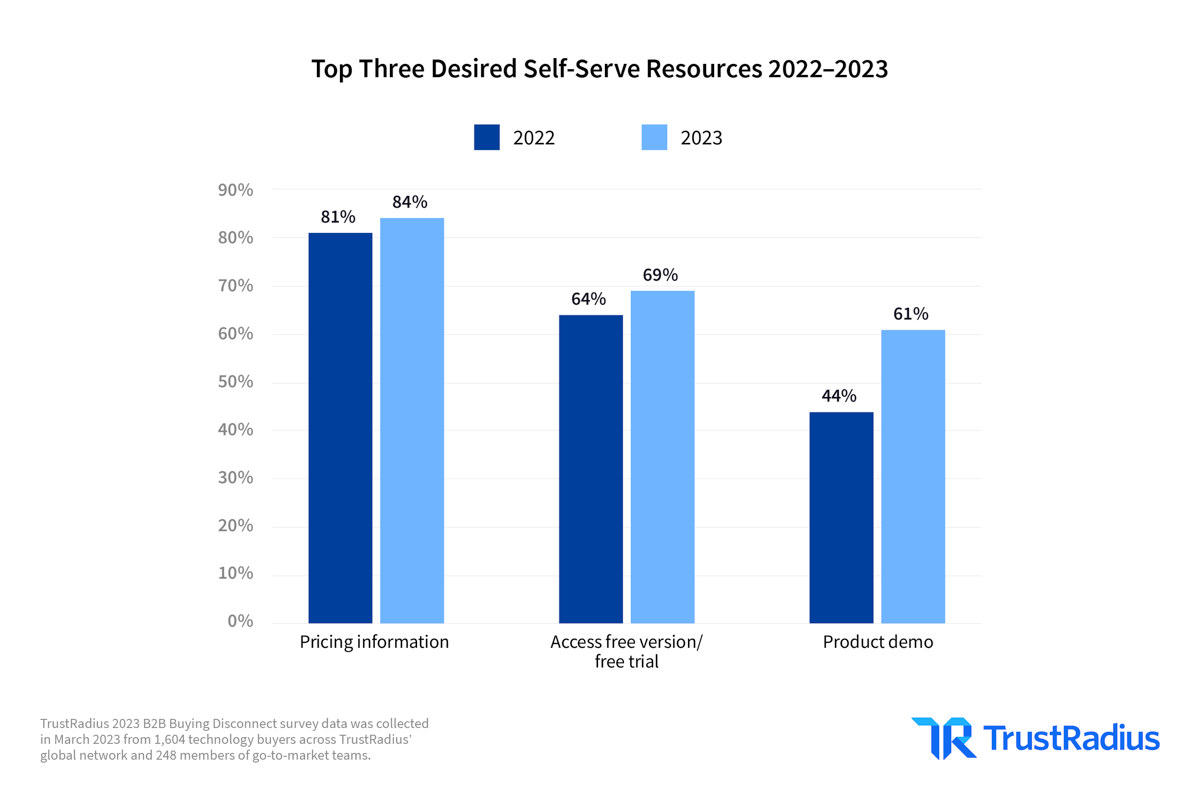

Desired self-serve resources

2023 shows a higher emphasis on pricing, free trials, and product demos

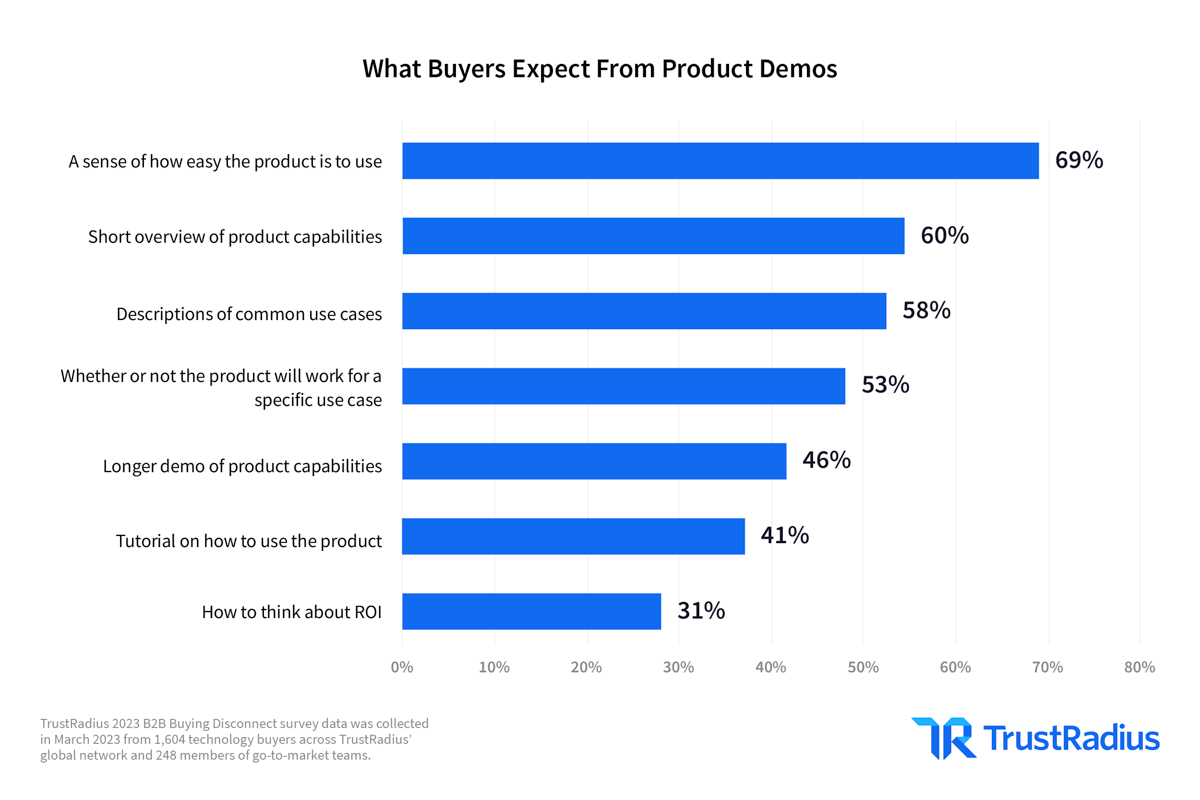

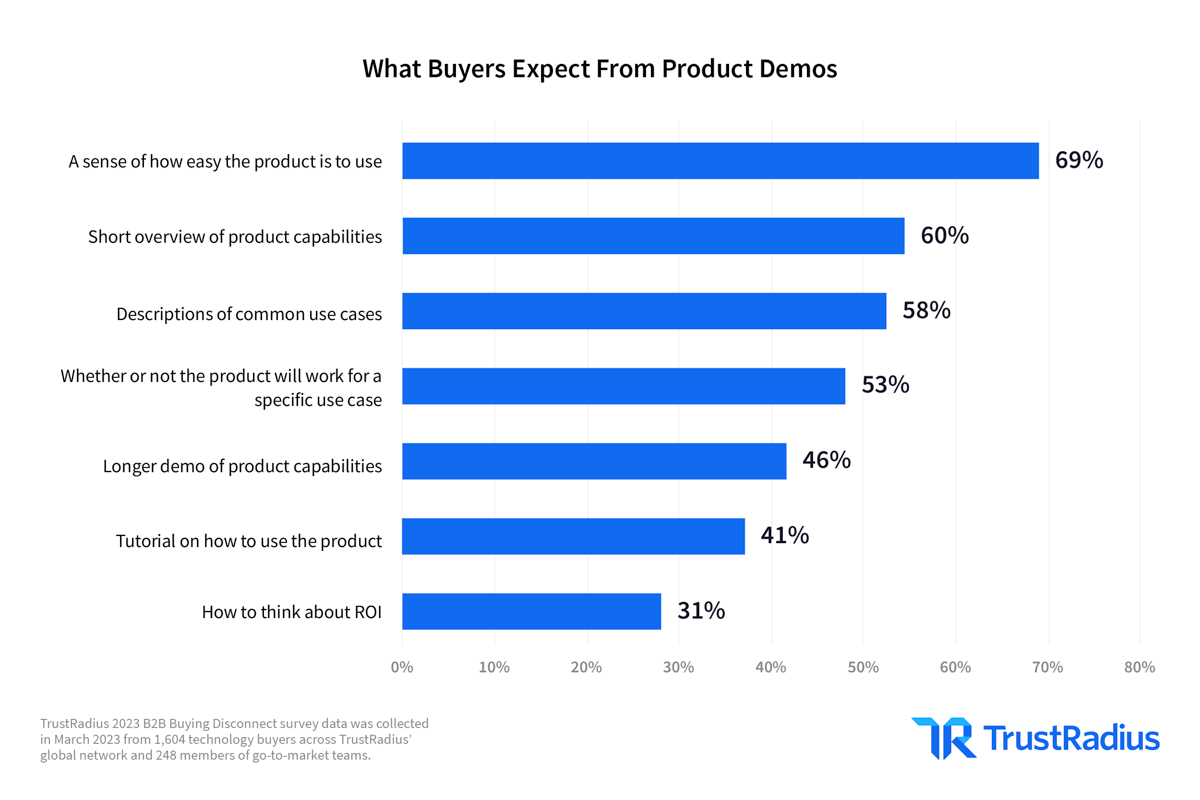

Product demo expectations

Ease of use, capabilities, and use cases are top of mind for buyers

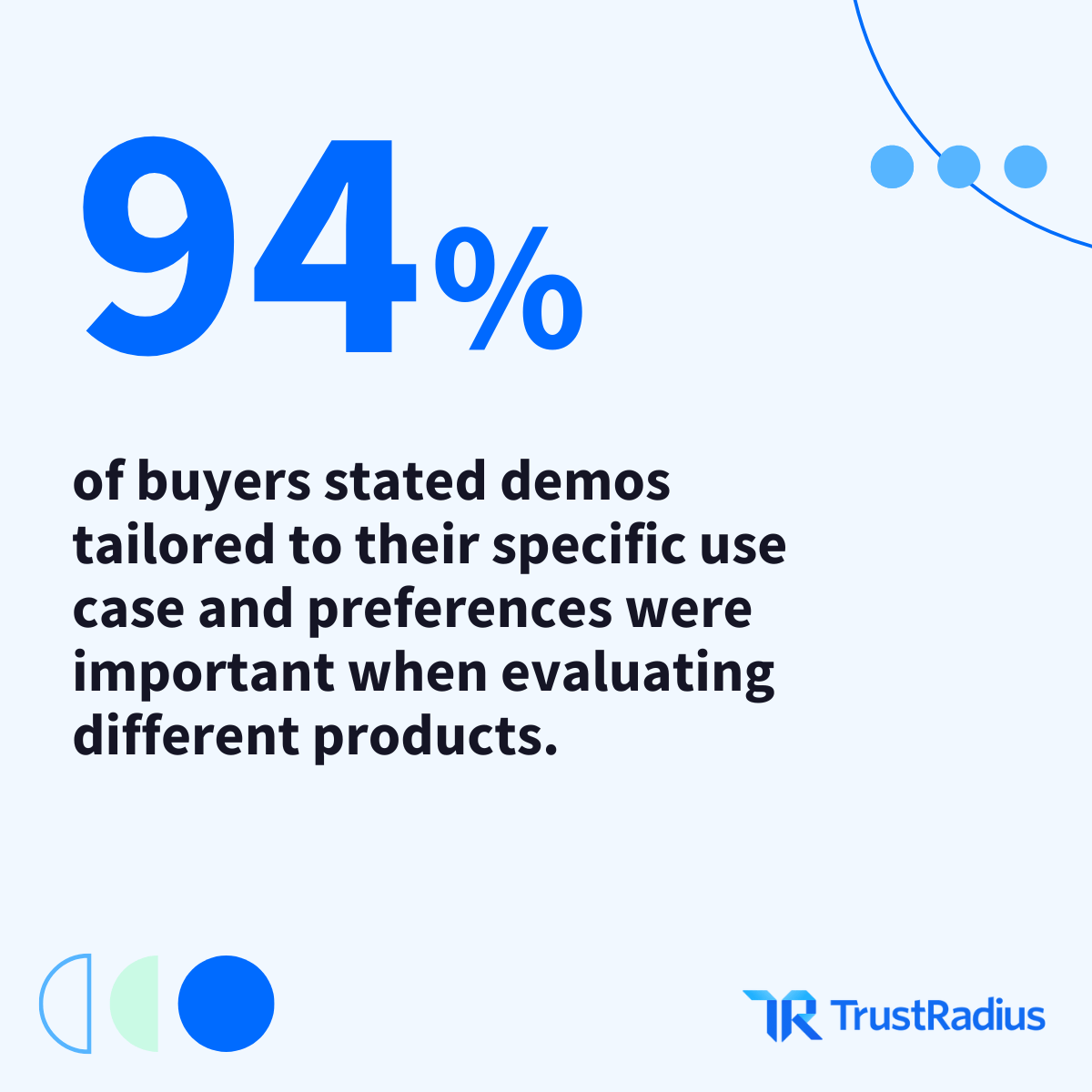

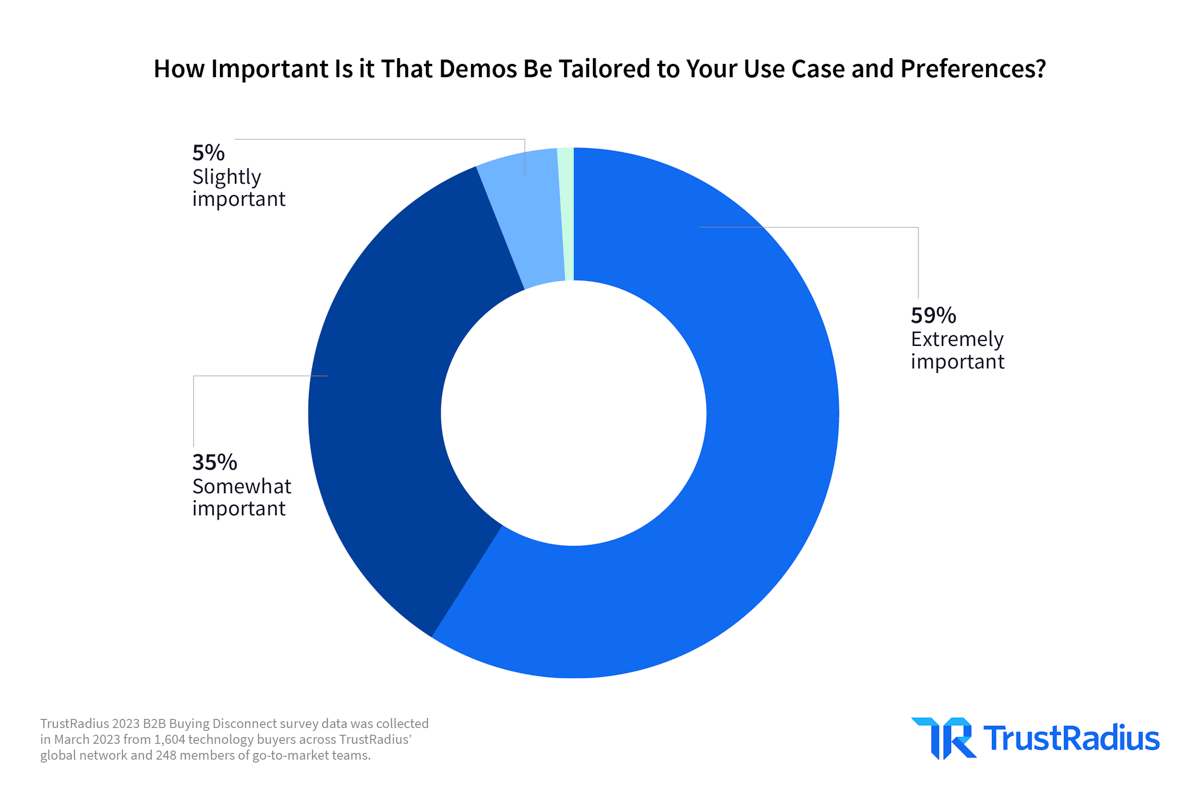

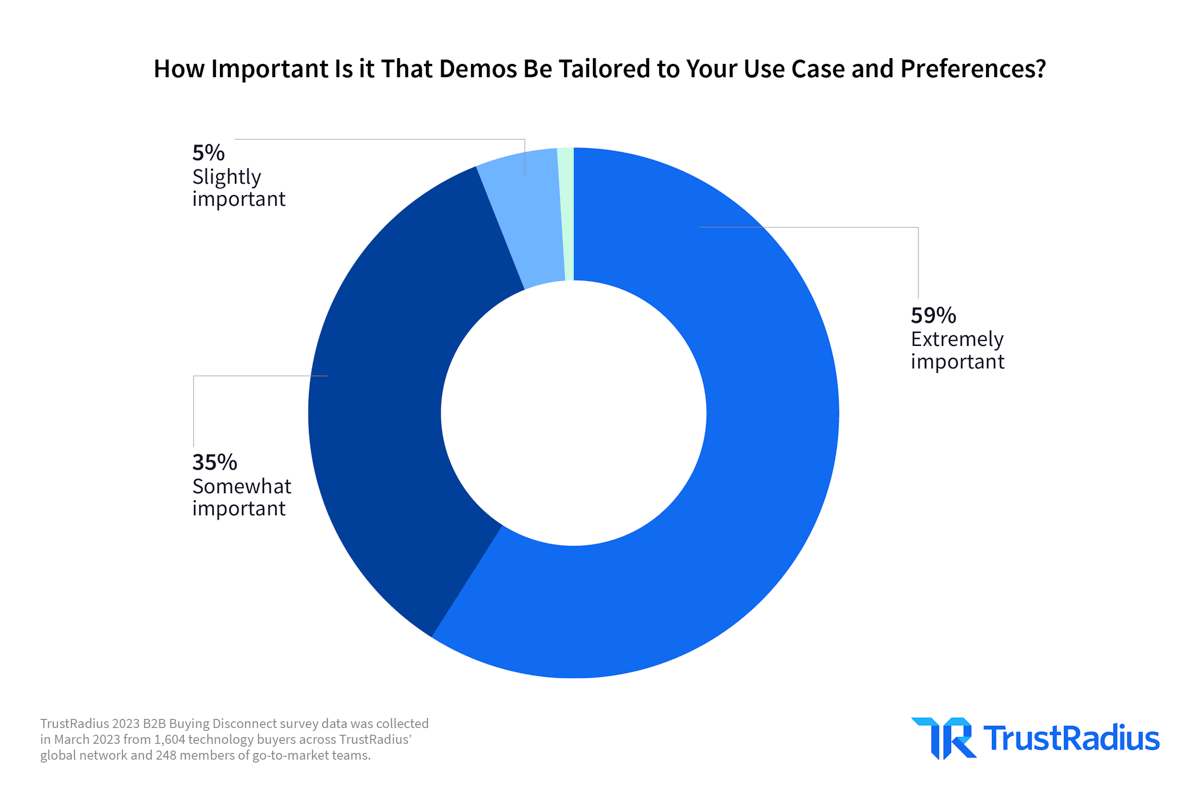

Tailoring product demos

95% of buyers said it’s somewhat or extremely important that demos are tailored to their use case

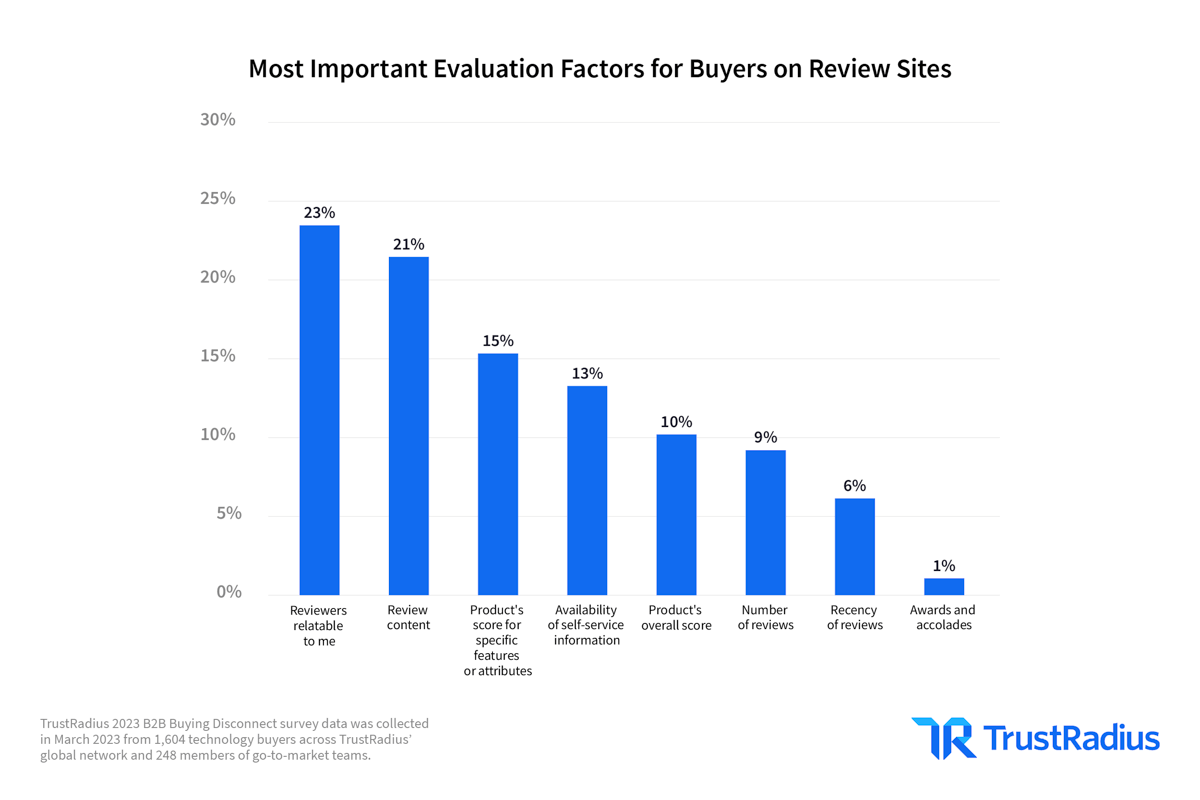

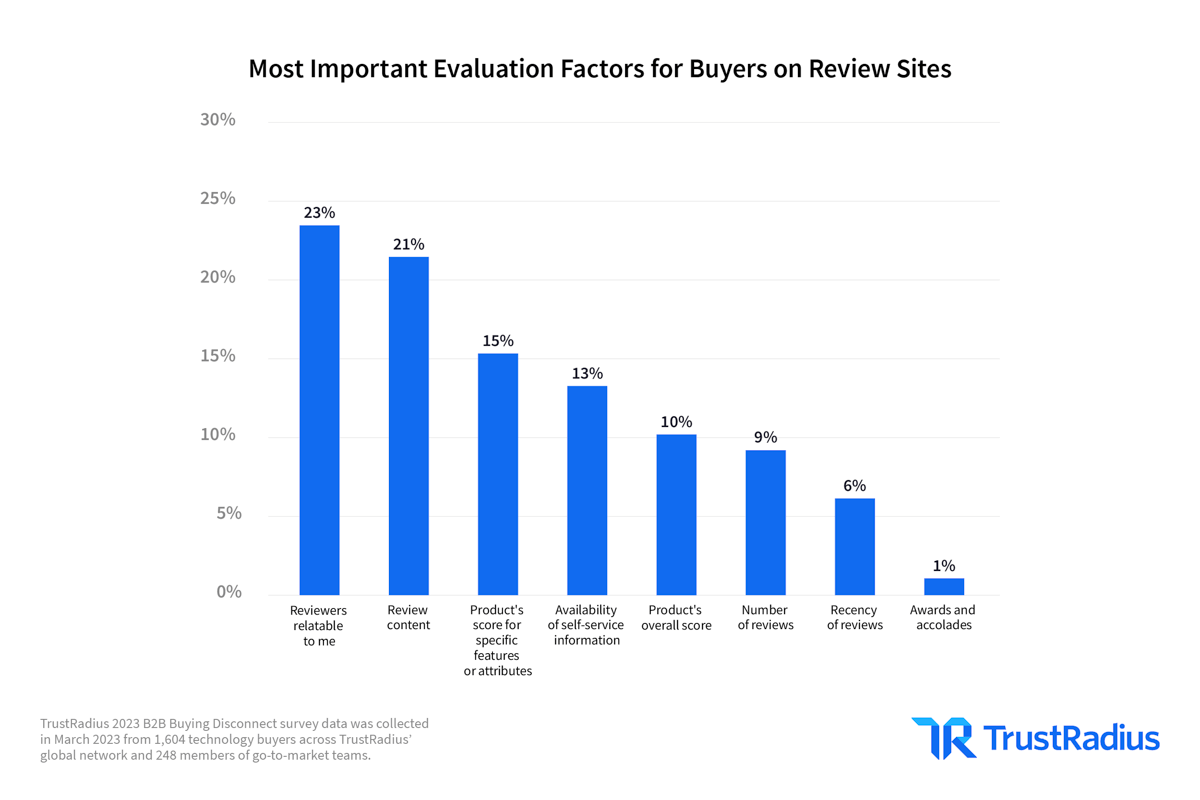

How buyers view review sites

Relatability and review content are the biggest factors for buyers

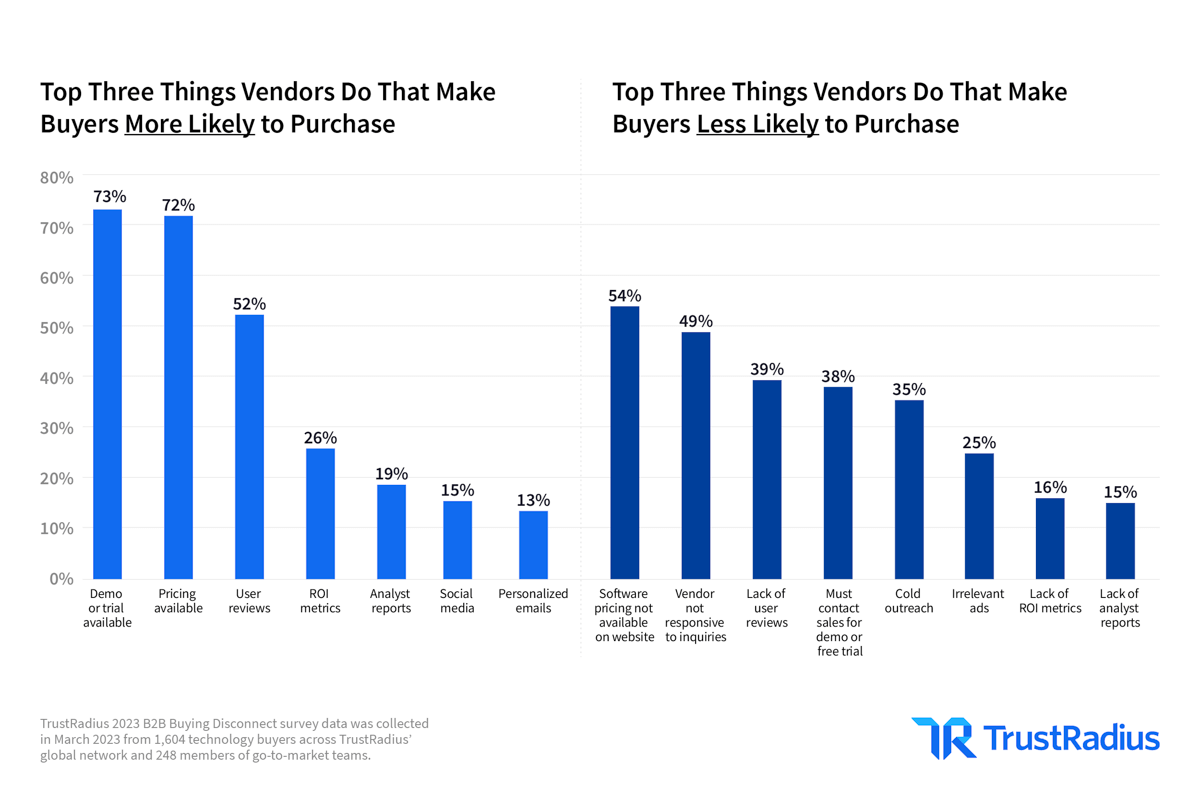

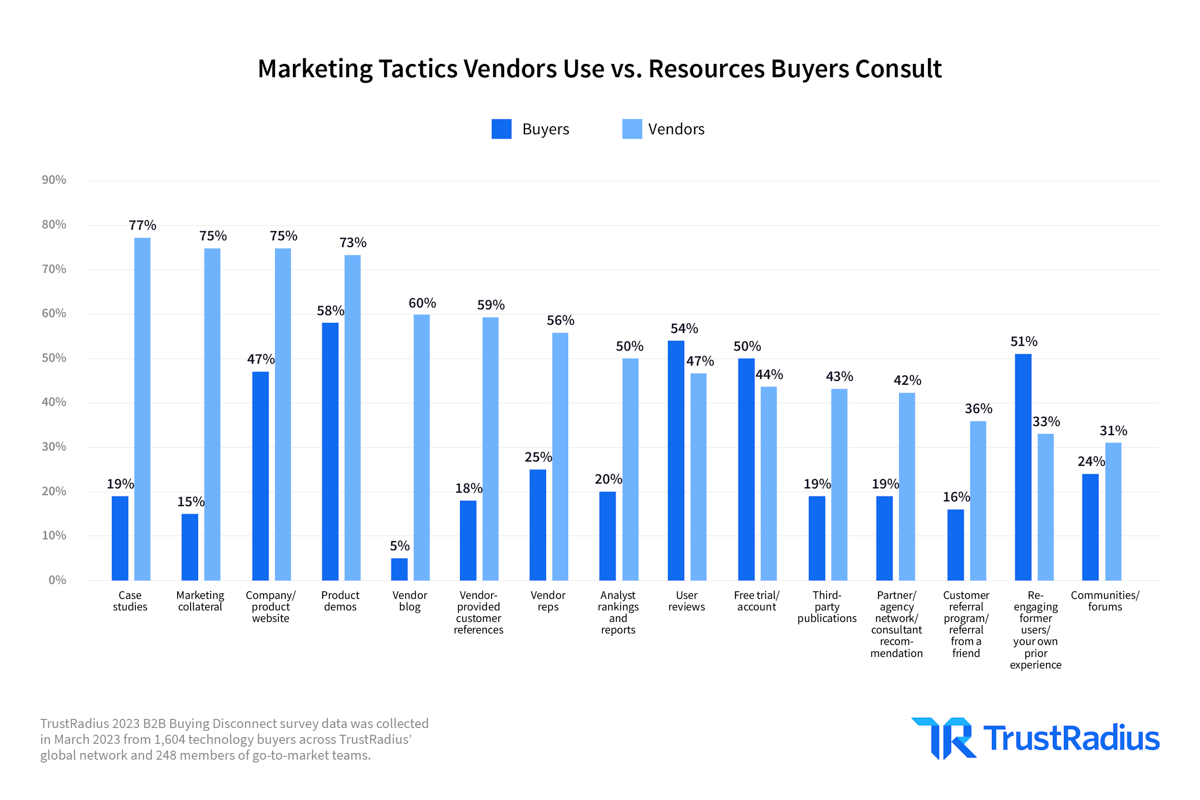

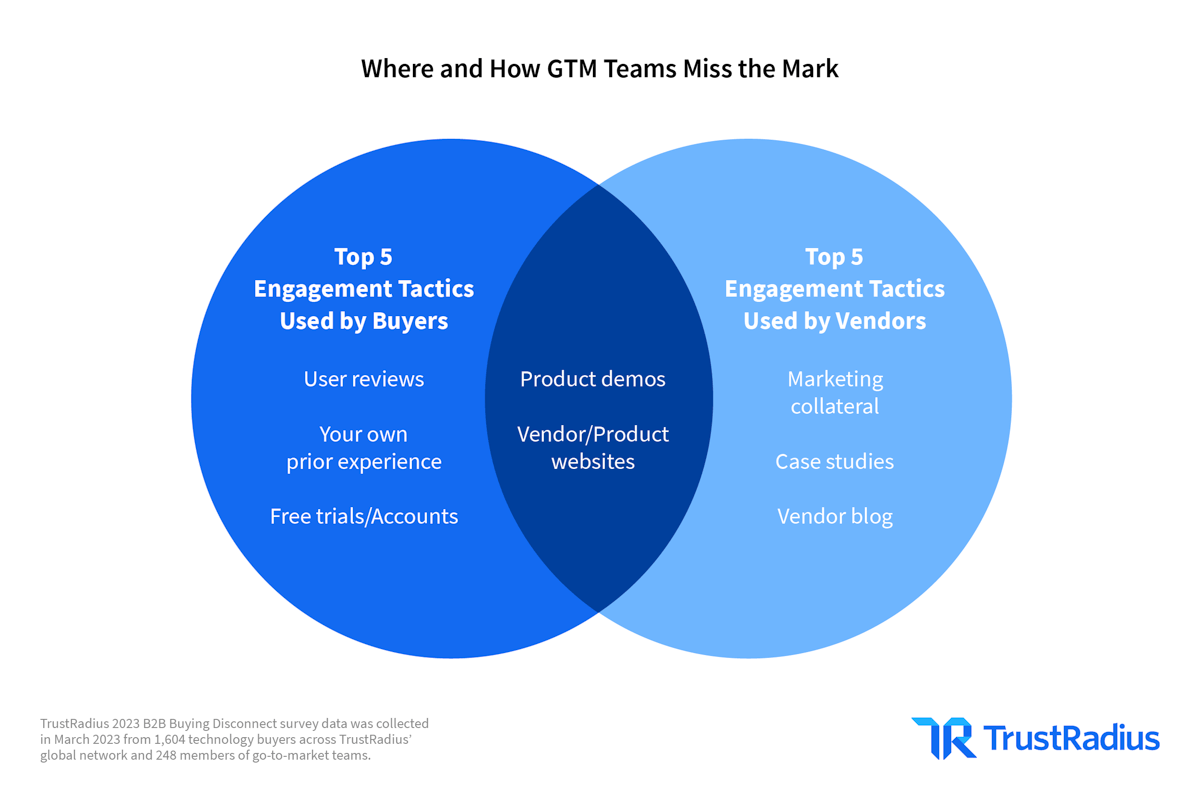

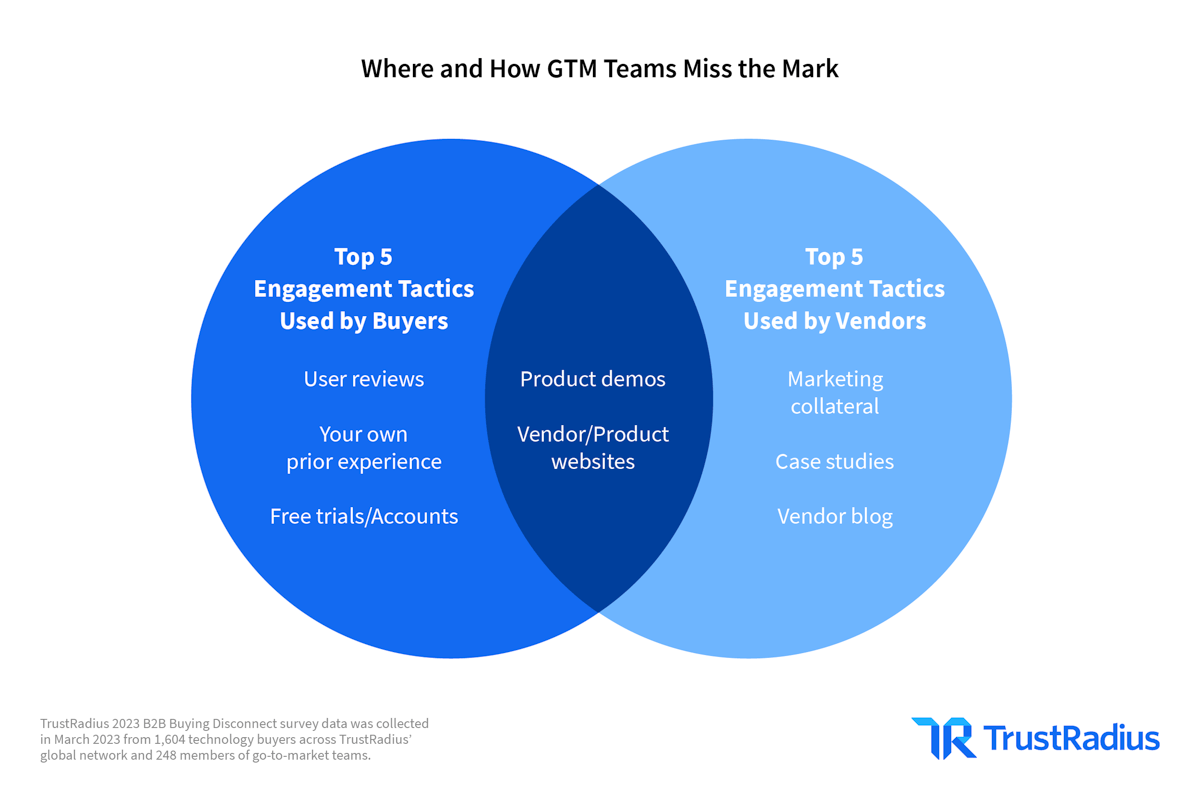

Buyer vs. vendor engagement

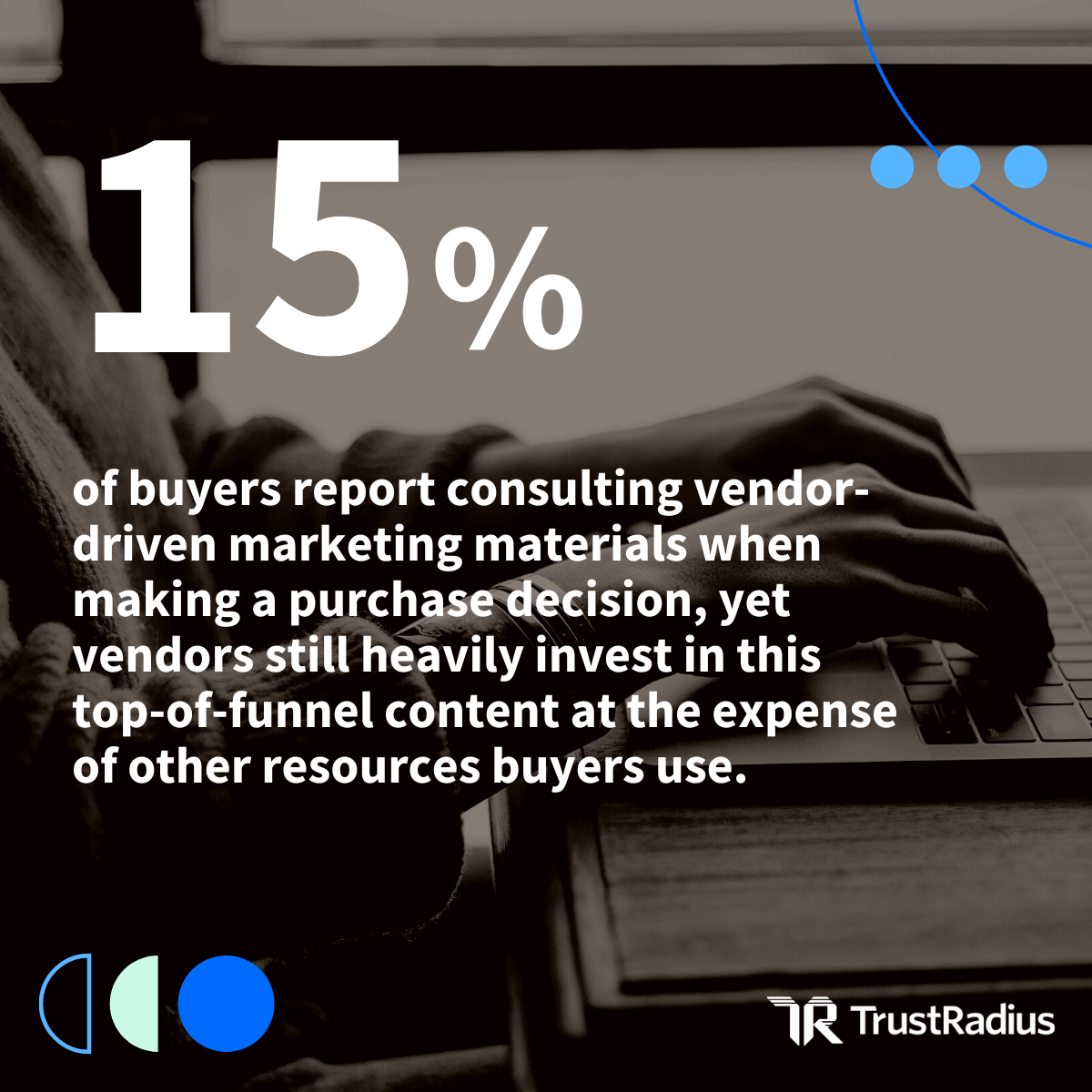

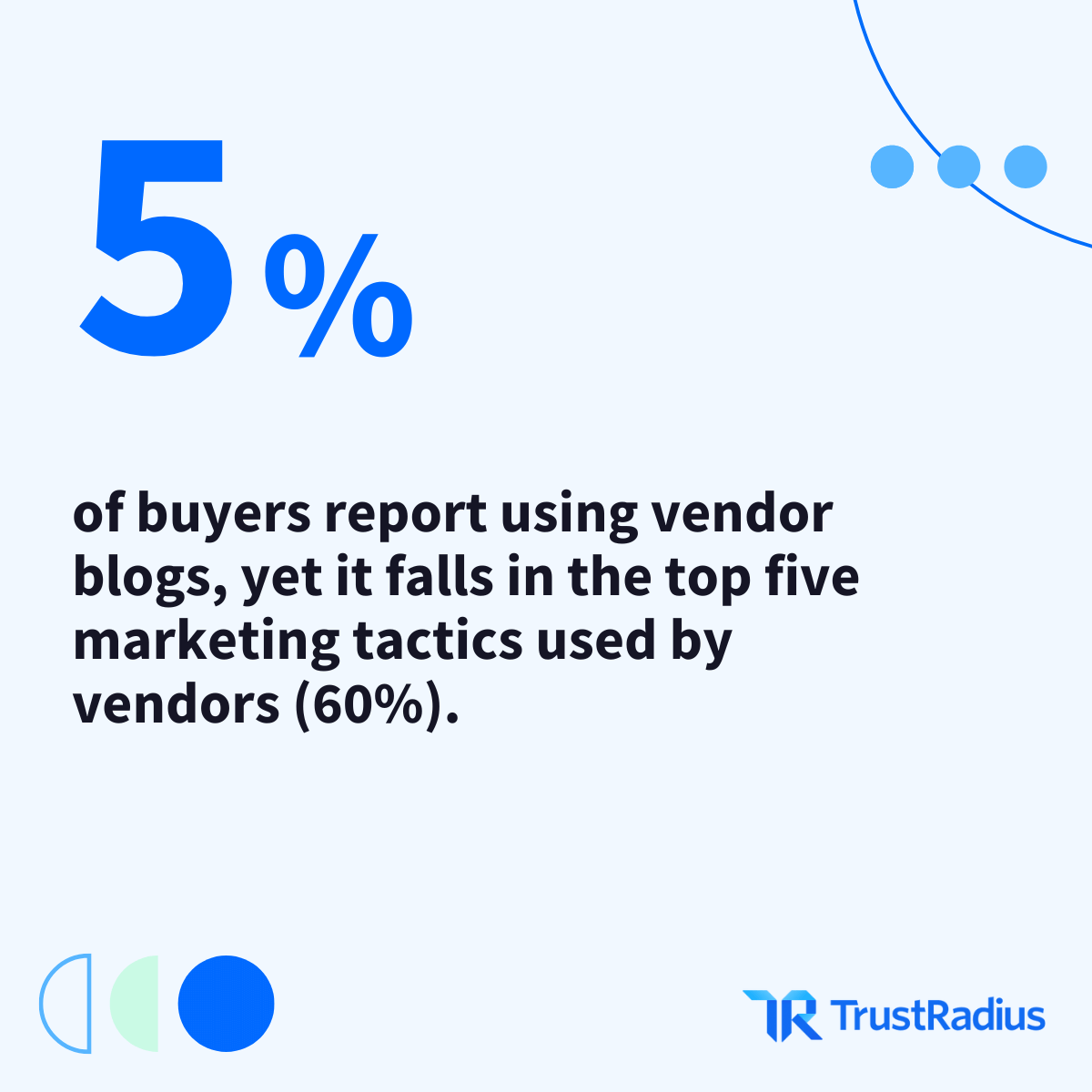

What buyers want and what vendors are providing are very different

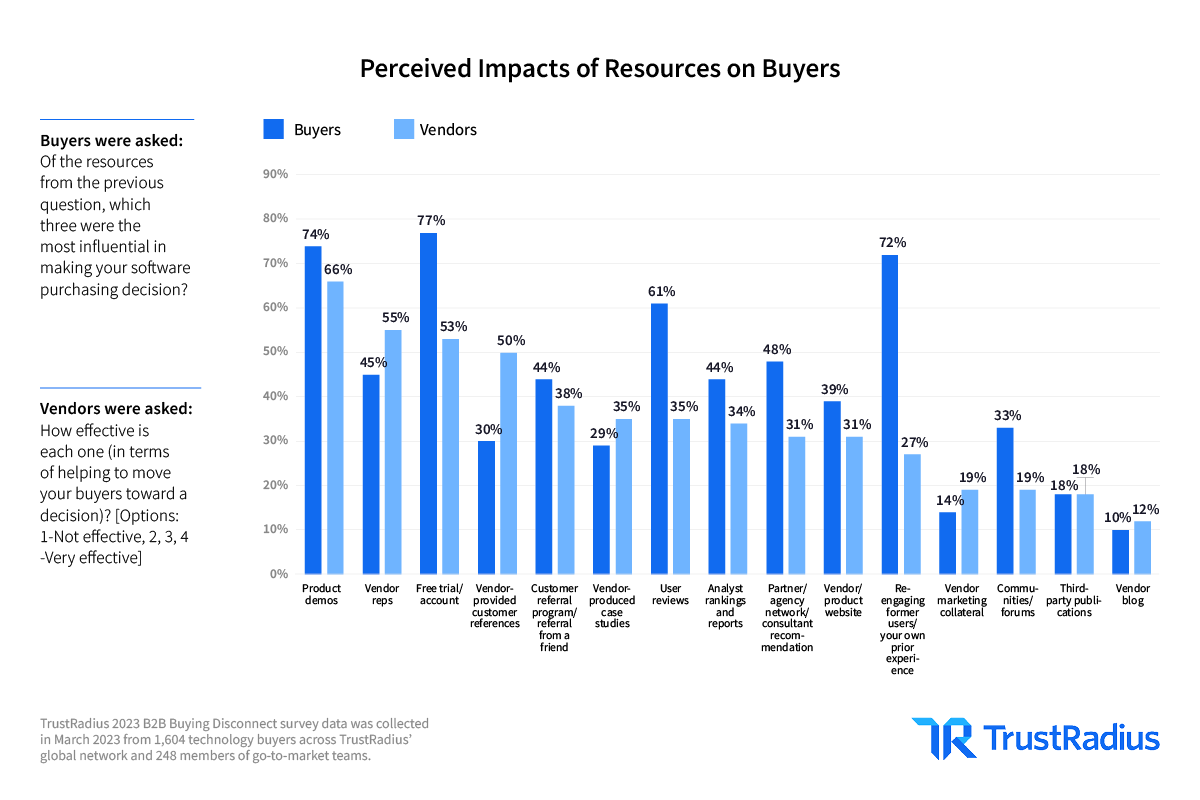

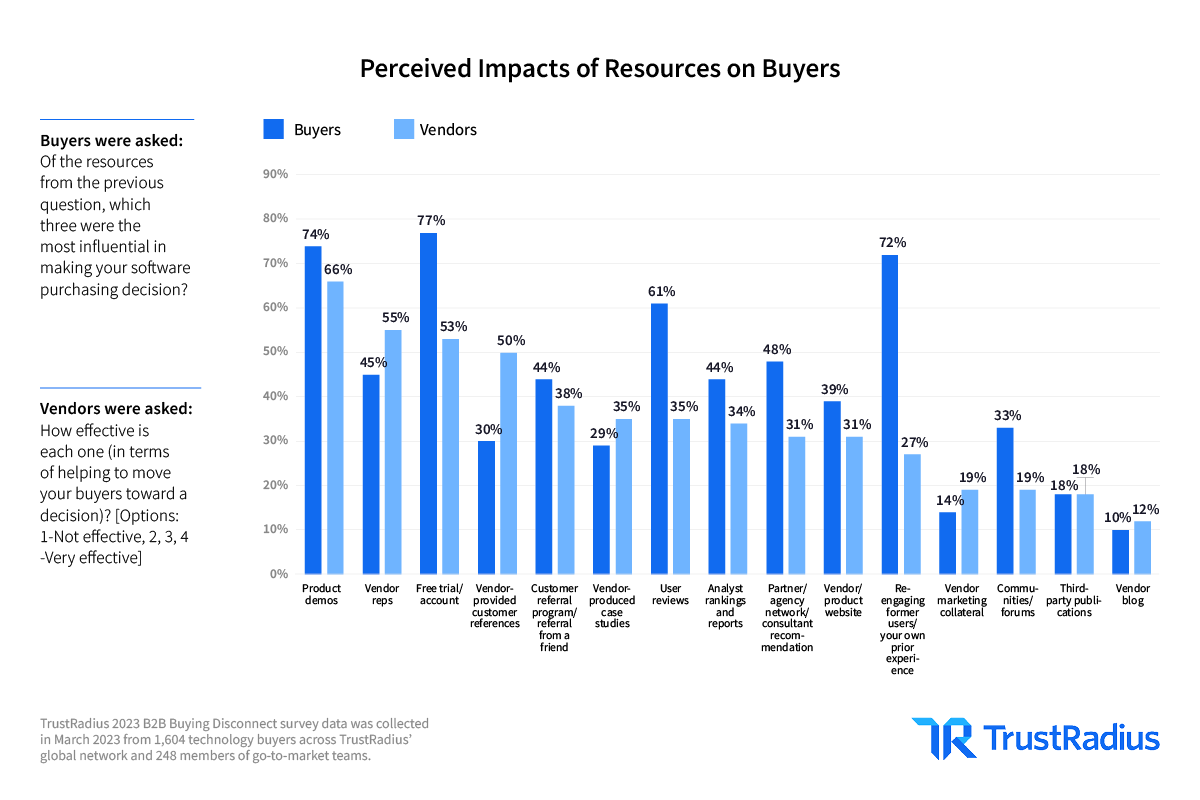

Buyer vs. vendor perceptions

User reviews and prior experience had the biggest gaps between buyers and vendors

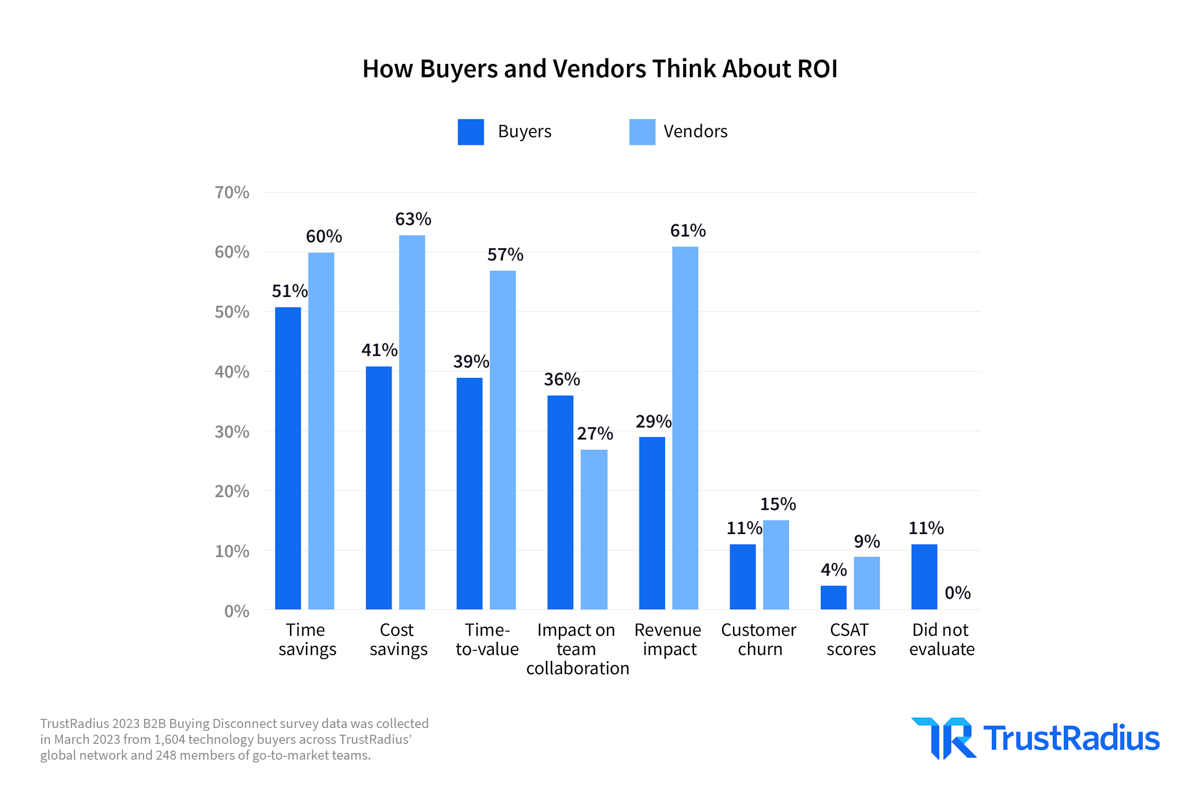

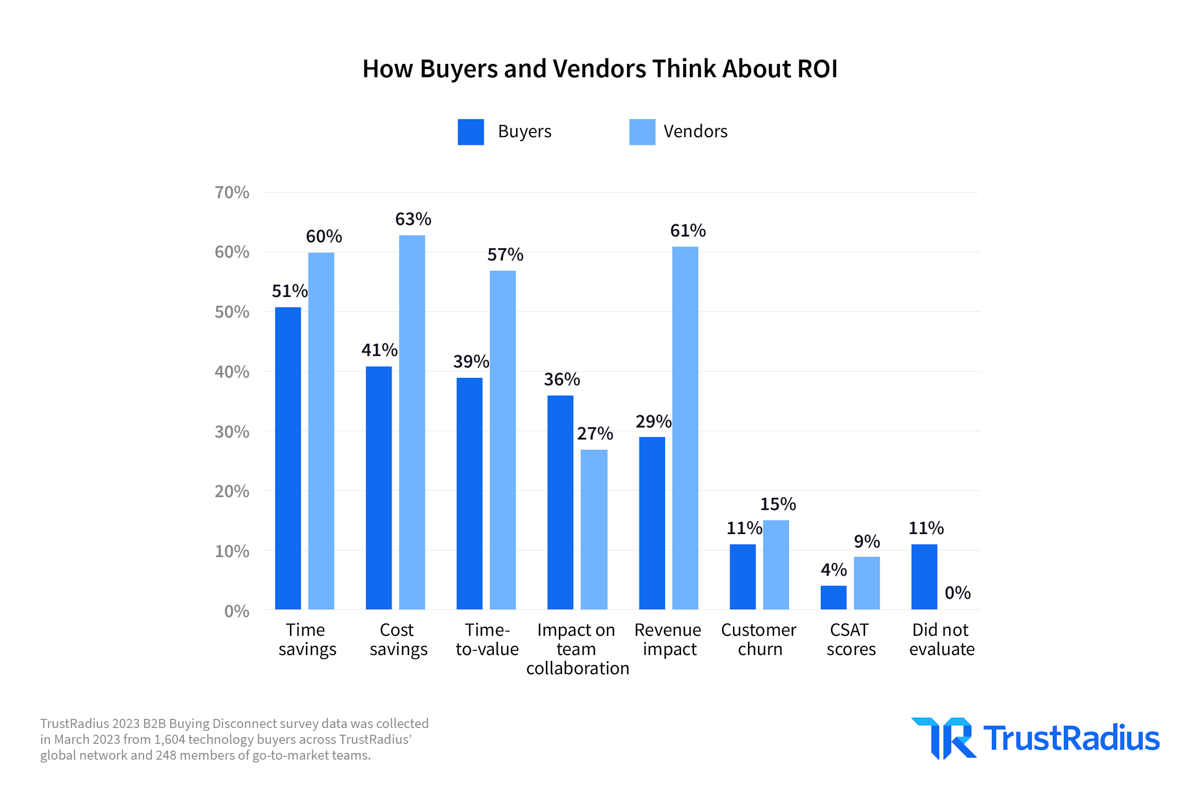

ROI: Buyers vs. Vendors

Both buyers and vendors want to save time and money, while buyers care less revenue impact

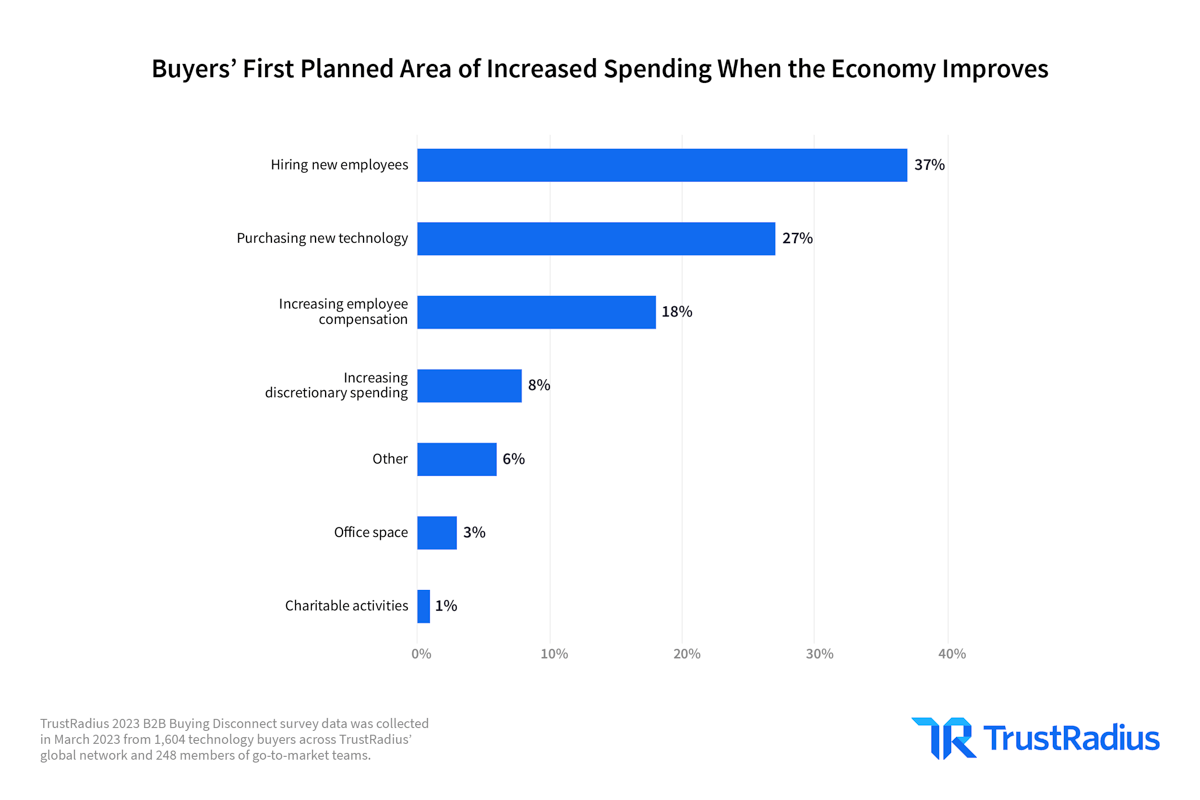

Future buyer spending

Headcount, new technology, and compensation are top of mind for buyers

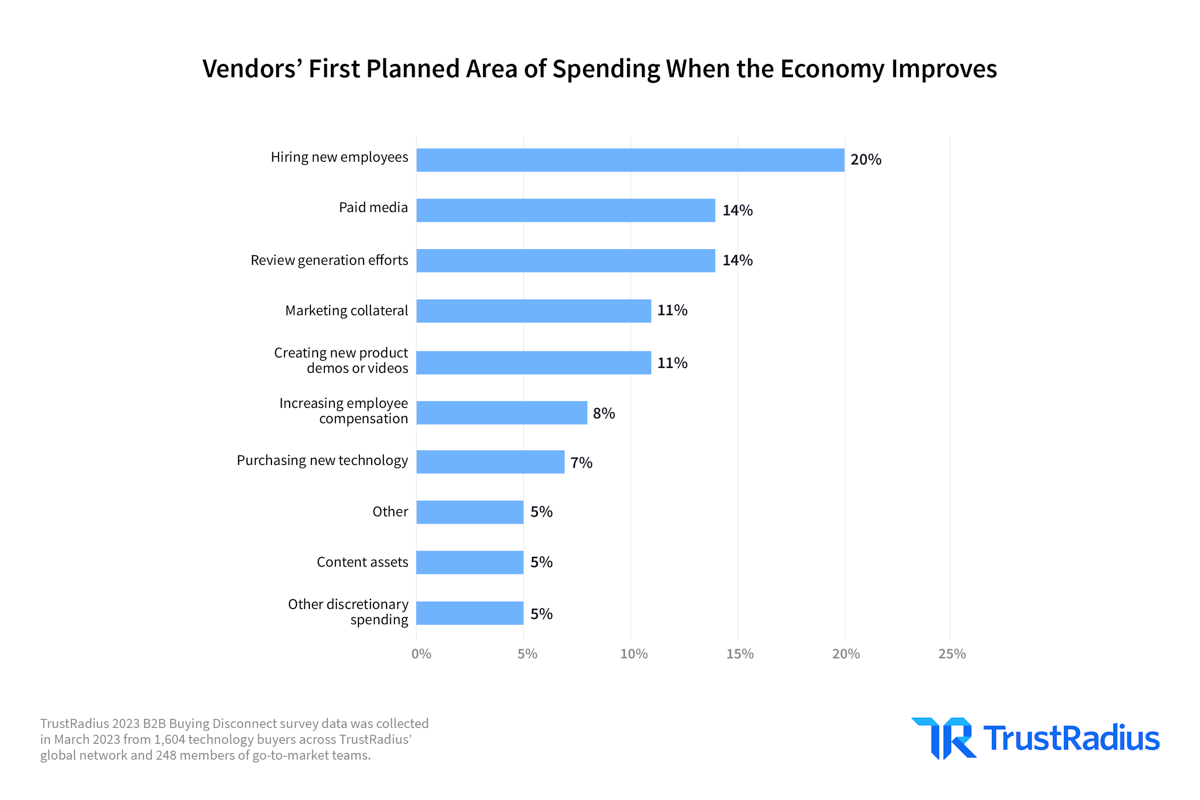

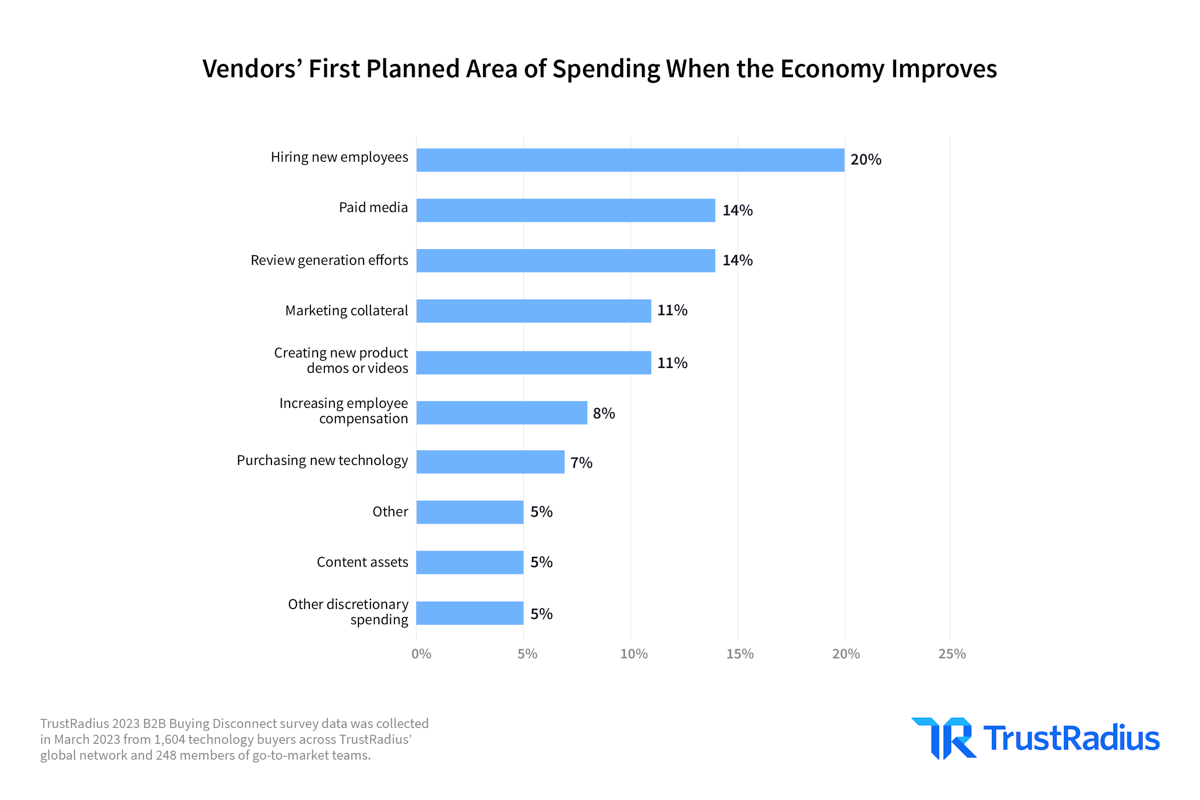

Future vendor spending

Vendors want to invest in headcount and marketing efforts as the economy improves

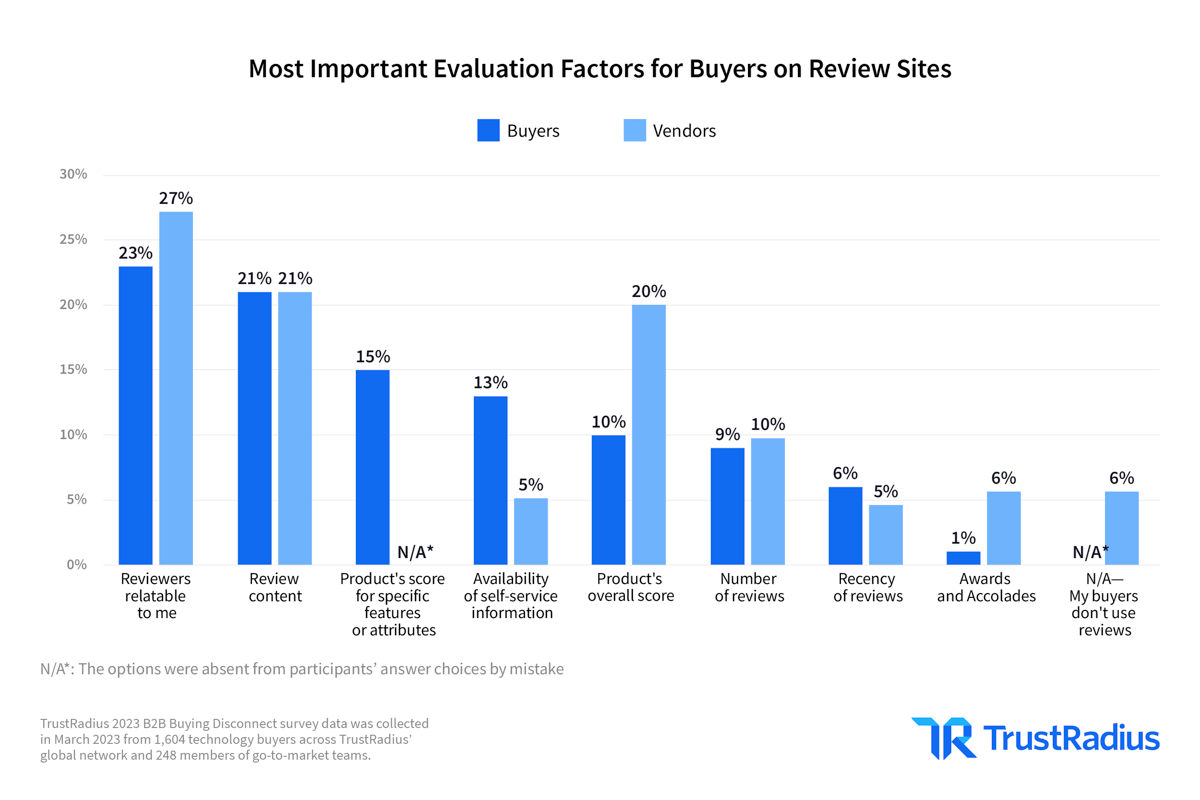

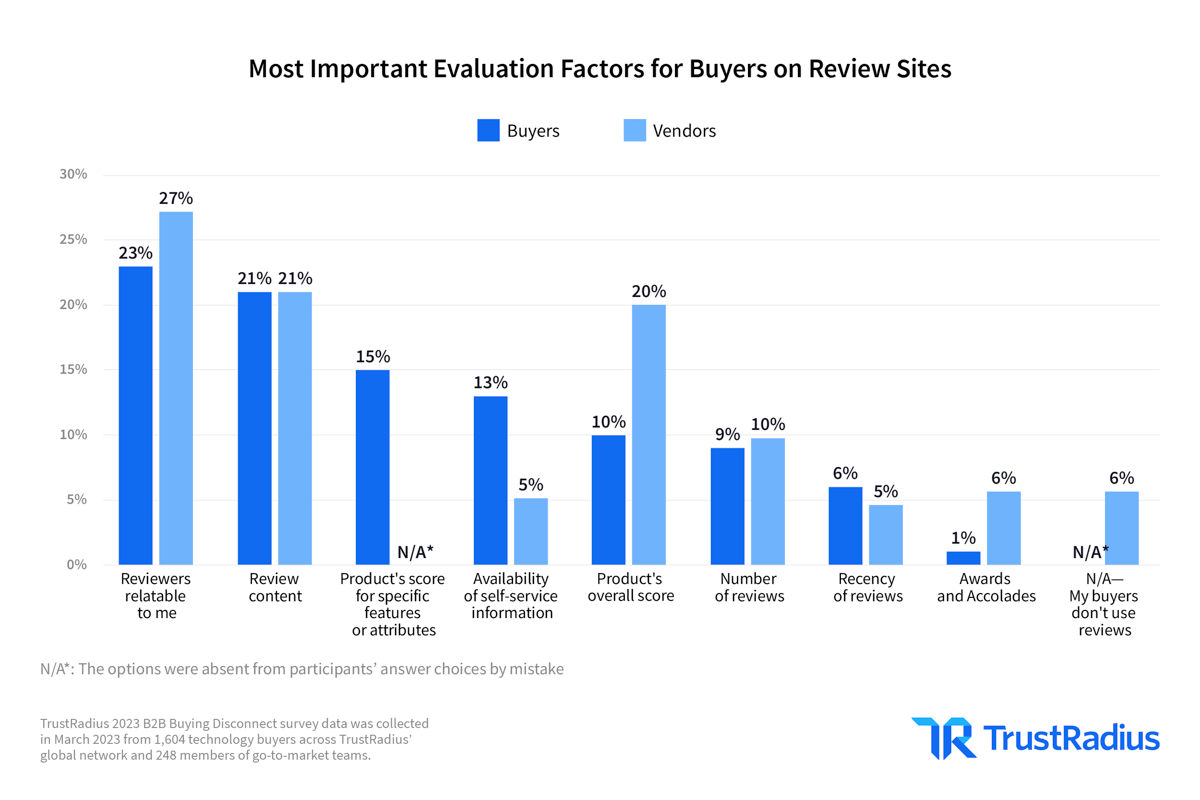

Review sites: Buyers vs. vendors

Relatability and content are the top factors, while vendors may be overvaluing product score

Feel free to customize and share these social posts to spread the insights from our research report and engage with your audience effectively. You can pair with a social graphic, or data asset, or write your own post entirely! We love seeing our data in the wild. Just be sure to tag TrustRadius or mention #B2BDisconnect.

👋 Looking to reach B2B buyers? Embrace the self-serve economy! Pricing, free trials, product demos, and customer stories are the go-to resources for informed buying decisions. Download @TrustRadius seventh annual research report to 👀 see for yourself. https://bit.ly/3WWZXaq #SelfServeEconomy #B2BBuyingTrends #B2BDisconnect

ROI matters! 87% of buyers now consider fast return on investment a top priority when making 💰 purchasing decisions. Are you delivering on this demand? Download @TrustRadius seventh annual research report to see for yourself. https://bit.ly/3WWZXaq #FastROI #B2BTechnology #B2BDisconnect

Economic conditions are 🔄 reshaping buyer behavior. 80% of buyers are seeking time and cost-saving products to navigate uncertain markets. Is your offering aligned with their needs? Download @TrustRadius seventh annual research report to see for yourself. https://bit.ly/3WWZXaq #CostSavingProducts #MarketTrends #B2BDisconnect

Personal experience is 📈 gaining influence! In 2023, 20% more buyers rely on their prior experience when making purchasing decisions. Make sure your solution stands out from the competition. Download @TrustRadius seventh annual research report to see for yourself. https://bit.ly/3WWZXaq #BuyerExperience #Differentiation #B2BDisconnect

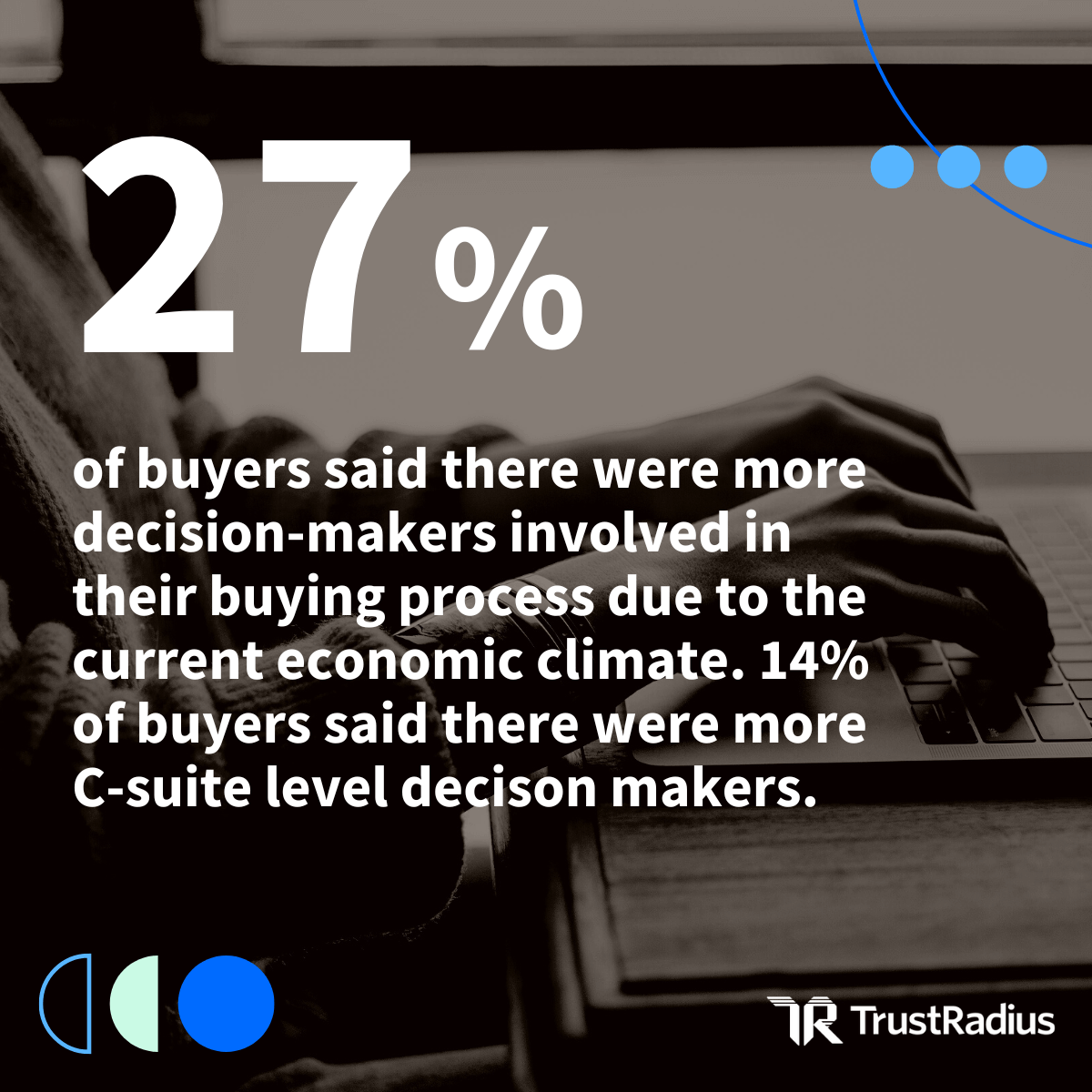

C-suite decision-makers are taking center stage! 27% of buyers report increased involvement of senior executives in the buying process. Are you 😎 prepared to engage with this influential audience? Download @TrustRadius seventh annual research report to see for yourself. https://bit.ly/3WWZXaq #CsuiteEngagement #B2BBuyingProcess #B2BDisconnect

The 💪 power of product demos! 58% of buyers consider product demos as the most influential resource for making decisions. Are you showcasing your product effectively? Download @TrustRadius seventh annual 📜 research report to see for yourself. https://bit.ly/3WWZXaq #ProductDemos #InfluentialResource #B2BDisconnect

Quality customer reviews matter! 💯 Buyers value relatable reviews more than quantity or product scores. Harness the power of authentic customer stories to drive trust and influence. Download @TrustRadius seventh annual research report to see for yourself. https://bit.ly/3WWZXaq #CustomerReviews #TrustMatters #B2BDisconnect

Don’t overlook user reviews! They are one of the most consulted resources for buyers, yet only 35% of marketers see them as very effective 🤯 . Are you maximizing the potential of user-generated content? Download @TrustRadius seventh annual research report to see for yourself. https://bit.ly/3WWZXaq #UserReviews #MarketingStrategy #B2BDisconnect

Late-stage buying decisions demand more than vendor content. Only 5% of buyers rely on blogs at this stage. Ensure your engagement strategy 🔀 adapts to the changing needs of buyers. Download @TrustRadius seventh annual research report to see for yourself. https://bit.ly/3WWZXaq #LateStageBuying #EngagementStrategy #B2BDisconnect

Budget increase on the horizon? 37% of buyers plan to 💰 invest in headcount, while 27% have their sights set on new technology. Are you ready to capture their attention and meet their evolving needs? Download @TrustRadius seventh annual research report to see for yourself. https://bit.ly/3WWZXaq #BudgetAllocation #BusinessGrowth #B2BDisconnect

Want to share 2023 buyer data to validate your product positioning? Or just find it interesting? Position yourself as a thought leader by sharing a link to 2023 B2B Buying Disconnect: The Self-Serve Economy Is Prove It or Lose It in your email signature.

Here’s how:

- Download the below PNG or GIF

- In your email settings, add the PNG/GIF to your signature

- Hyperlink the image to this URL

More resources

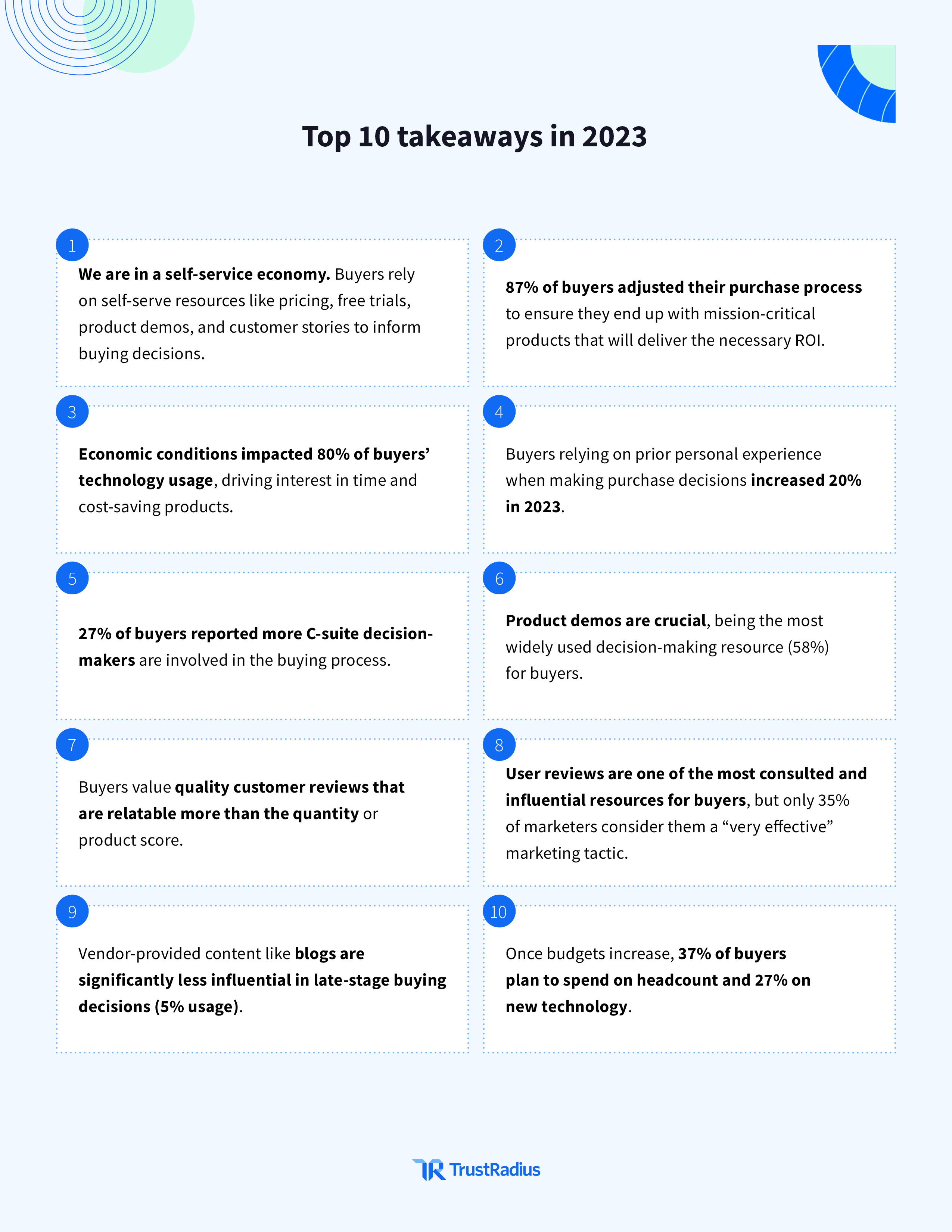

The B2B Buying Disconnect report, titled “The Self-Serve Economy Is Prove It or Lose It,” presents the findings of our seventh annual research on business technology buying and selling trends. Over the years, our research team has closely monitored the changing landscape of technology procurement, aiming to identify shifts in buyer behavior and help tech go-to-market teams effectively engage with their target audiences.

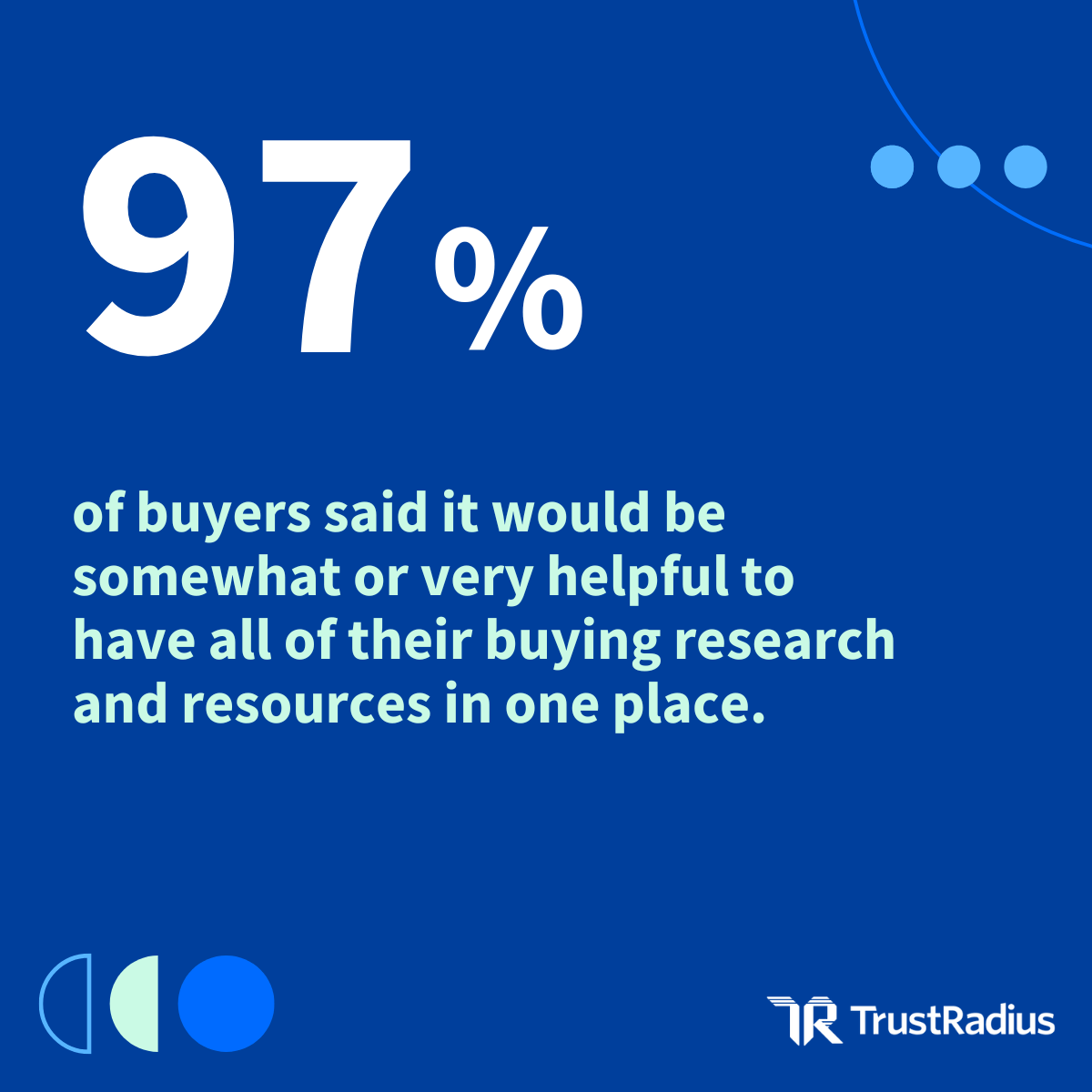

This year’s report highlights the consolidation and reinforcement of previous trends, particularly the emergence of the self-serve buyer as a dominant force in the market. Buyers increasingly rely on self-serve resources, such as pricing information, free trials, product demos, and customer stories, to inform their purchasing decisions. This trend has solidified and become the new norm in the industry.

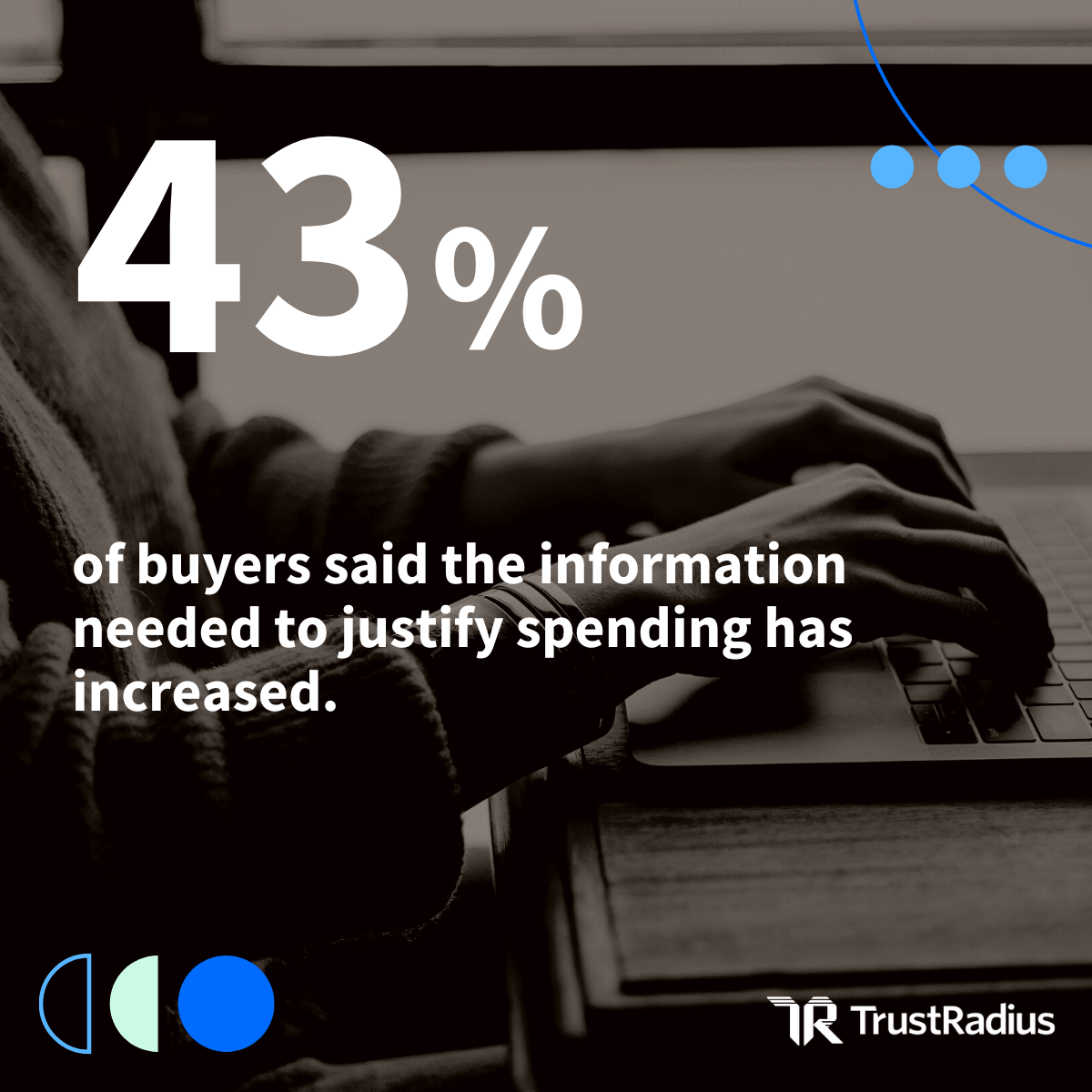

Furthermore, the current economic conditions have brought about new dynamics in the buyer-seller relationship. With tightened budgets and market uncertainties, buyers tend to gravitate towards safer choices when considering new technology investments. Consequently, technology companies seeking success in 2023 and beyond must address the demands of prospective buyers, which include providing provable return on investment (ROI), easily accessible information, and a compelling case to convince the CFO to approve the purchase.

By understanding and adapting to these trends, technology companies can position themselves for success in the evolving B2B buying landscape. The report aims to equip businesses with valuable insights and opportunities to better engage with their target audiences, align their strategies with buyer expectations, and drive growth in a self-serve economy.

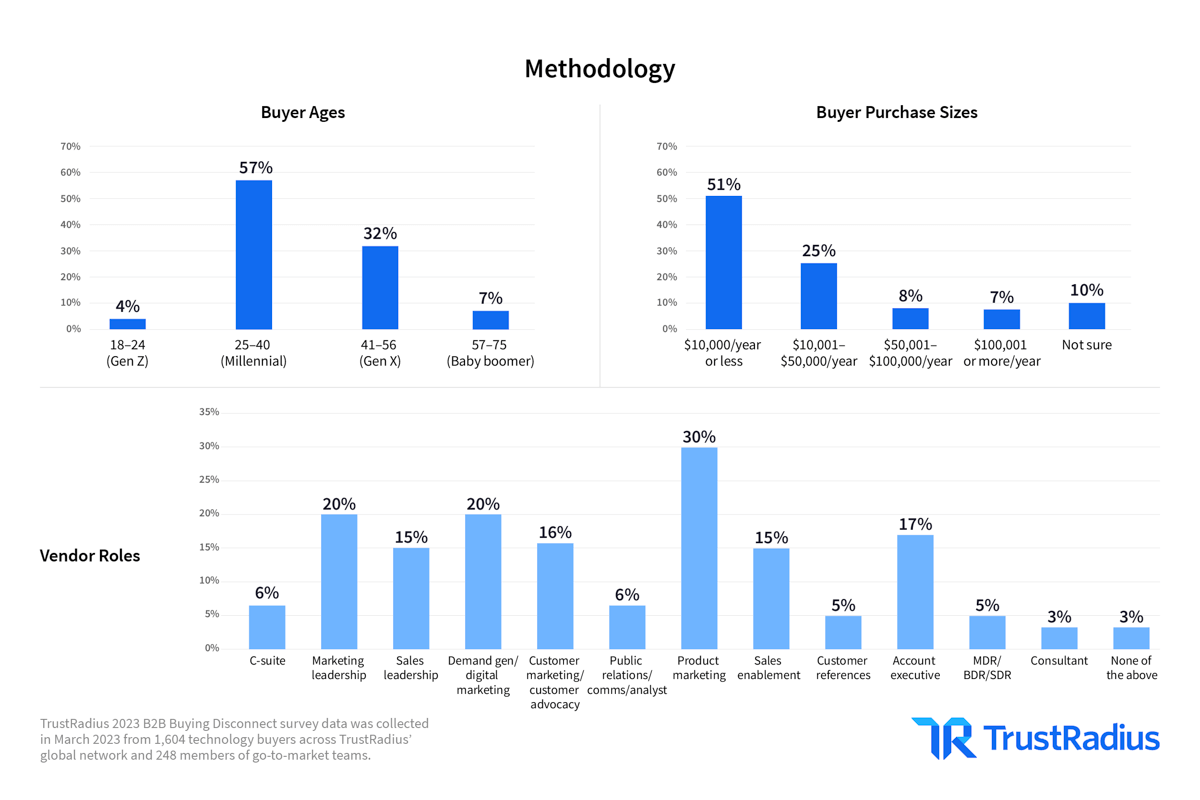

Data for the TrustRadius 2023 B2B Buying Disconnect was sourced from the TrustRadius global network via an online survey.

In March 2023, we sent online surveys to professionals who were involved in a new software or hardware purchase for their organization (technology buyers) in the past year and go-to-market teams of technology solutions. We received responses from 1,604 technology buyers and 248 members of go-to-market teams.

All respondents were offered a nominal incentive ($10 gift card) as a thank-you for their time. We analyzed the response data across various segments, including company size, purchase price, generation, job title, and more. We’ve included information below on the demographics of our survey respondents.

For a full list of questions and answer choices, or if you have any questions about the data, email us at research@trustradius.com.

Q: What is the main focus of the B2B Buying Disconnect report?

A: The main focus of the B2B Buying Disconnect report is to analyze the changing trends in business technology buying and selling. It explores how technology buyers research, evaluate, and choose tools for their businesses, providing insights for tech go-to-market teams to better engage with their target audiences.

Q: What are some key trends highlighted in this year’s report?

A: This year’s report highlights the continued rise of the self-serve buyer as a significant trend in the market. It emphasizes the growing reliance on self-serve resources such as pricing information, free trials, product demos, and customer stories for making purchasing decisions. Additionally, the report sheds light on the impact of economic conditions, with buyers prioritizing products that offer fast return on investment (ROI) and focus on time and cost savings.

Q: How can technology companies thrive in 2023 and beyond, according to the report?

A: The report suggests that technology companies can thrive by addressing the evolving needs of prospective buyers. This includes providing provable ROI, easy access to information, and a compelling case to gain CFO approval. Understanding buyer demands and aligning strategies accordingly will be crucial for success in the self-serve economy.

Q: What role do product demos and customer reviews play in the buying process?

A: Product demos are highlighted as the most influential decision-making resource for buyers, with 58% of buyers considering them crucial. They provide an opportunity for buyers to experience the product firsthand before making a purchase decision. Customer reviews, particularly those that are relatable and of high quality, hold significant value for buyers, surpassing quantity or product scores. They provide insights into real-world experiences and influence buyers’ perceptions and decisions.

Q: What are some future spending plans identified in the report?

A: The report reveals that 37% of buyers plan to spend on headcount and 27% intend to invest in new technology once budgets increase. These findings indicate that buyers are looking to optimize their internal resources and leverage new technologies to drive business growth.

Q: How can businesses benefit from the insights provided in the report?

A: By studying the insights and recommendations presented in the report, businesses can gain a better understanding of the evolving B2B buying landscape. They can align their strategies with buyer expectations, enhance engagement with their target audiences, and ultimately drive growth in the self-serve economy. The report serves as a valuable resource for organizations seeking to adapt and thrive in the changing technology buying and selling environment.

TrustRadius delivers the most credible technology decisioning platform, helping buyers confidently make decisions with comprehensive, vetted product information and customer-generated content. Technology providers are empowered to tell their unique stories, engage high-intent buyers, and gain customer insights. Founded by successful entrepreneurs and headquartered in the technology hub of Austin, Texas, TrustRadius is backed by Mayfield Fund, LiveOak Venture Partners, and Next Coast Ventures.

For media inquiries, to request a quote from a TrustRadius leading research expert, or for special appearances on webinars, podcasts, or at events, please email hello@TrustRadius.com and we will be in touch shortly!