2022 B2B Buying Disconnect: The Age of the Self-Serve Buyer

Hey! We’ve got new research to share.

2022’s leap to trusted sources and self-service

The B2B Buying Disconnect is TrustRadius’ annual research report that tracks year-over-year changes in business technology buying. Our 2022 report reveals five critical trends in technology buying. Millennials and Gen Z are leading the charge, but these major trends remain true across all segments.

In this report, you’ll find an analysis of buying trends based on TrustRadius’ survey of 2,185 technology buyers as well as tips for technology sellers to adapt to these trends. These insights can help you craft a buying experience that resonates with today’s buyers and sustains business growth.

What is the B2B Buying Disconnect?

The TrustRadius B2B Buying Disconnect is an annual research report that reveals year-over-year changes in business technology buying and selling. The data in this year’s study comes from a survey of 1,134 technology buyers and vendors conducted in September 2020.

Click here for more information on the report’s methodology and demographics.

Meet your new technology buyer: Emily

While not quite a digital native, as a Millennial, Emily conducts much of her life—banking, shopping, and even socializing—via digital channels. Convenience is king. She values her time and isn’t interested in what she considers time-wasters, such as visiting her credit union’s branch or driving to the mall to browse through department stores. She expects information to be readily available before making a purchase. She starts her search online, checking reviews and other impartial sources to help her get the full picture.

As a Millennial, Emily is part of the largest demographic in the workforce today.

Millennials and Gen Z are having a profound effect on how business is conducted, from demanding more flexible schedules and work/life balance to an inherent reliance on technology. Their consumer behaviors follow them to the workplace: valuing their personal time and zero tolerance for unnecessary inconveniences.

They’re also having a significant impact on the business technology buying journey. They prefer to self-serve—researching on their own, seeking information, validating their findings with peers, all before ever engaging with a sales team. Now, older generations are displaying these same buying preferences. To engage with buyers like Emily, technology sellers must adapt by differentiating, being more discoverable, and proving the value of their solution.

1. Buyers have all but replaced vendor-provided content with more trusted sources

When Emily decided to purchase a new car, she started with an online search. She thought about what mattered to her most—size, mileage, aesthetics, price—then asked her friends for recommendations. She read reviews from Edmunds.com and searched the inventory at dealerships within a 50-mile radius.

Only then did Emily make an appointment with a dealership that checked all the boxes. She had zero tolerance for a buying process that she wasn’t in complete control of.

Today’s buyers want to learn about products from trusted sources, including review sites, communities and forums, and analyst rankings. Like Emily, tech buyers use a variety of resources to research products, and their first step is rarely contacting the seller. More than likely, it will be to self-educate, whether by checking review sites, starting an online search, or reaching out to a peer.

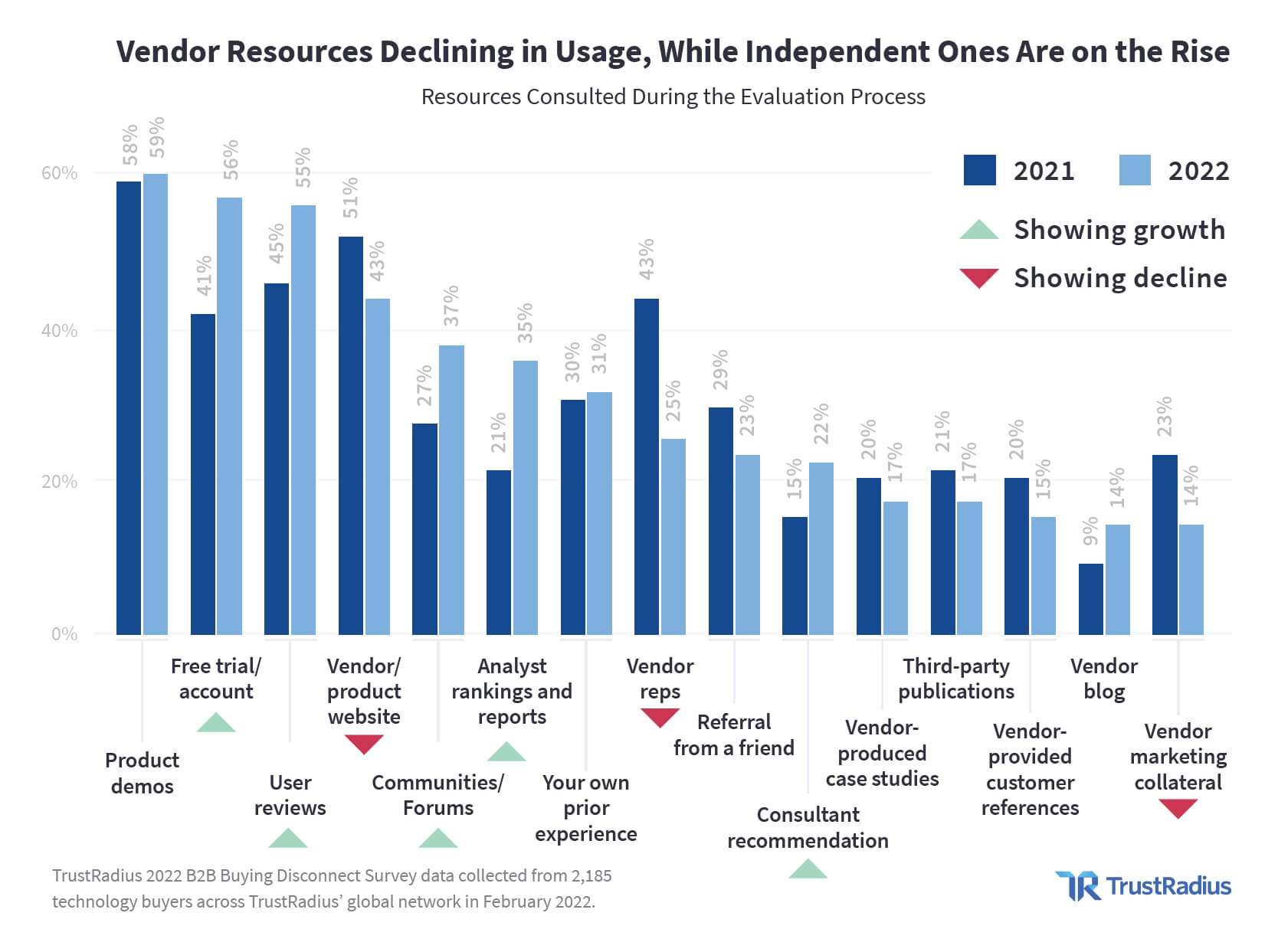

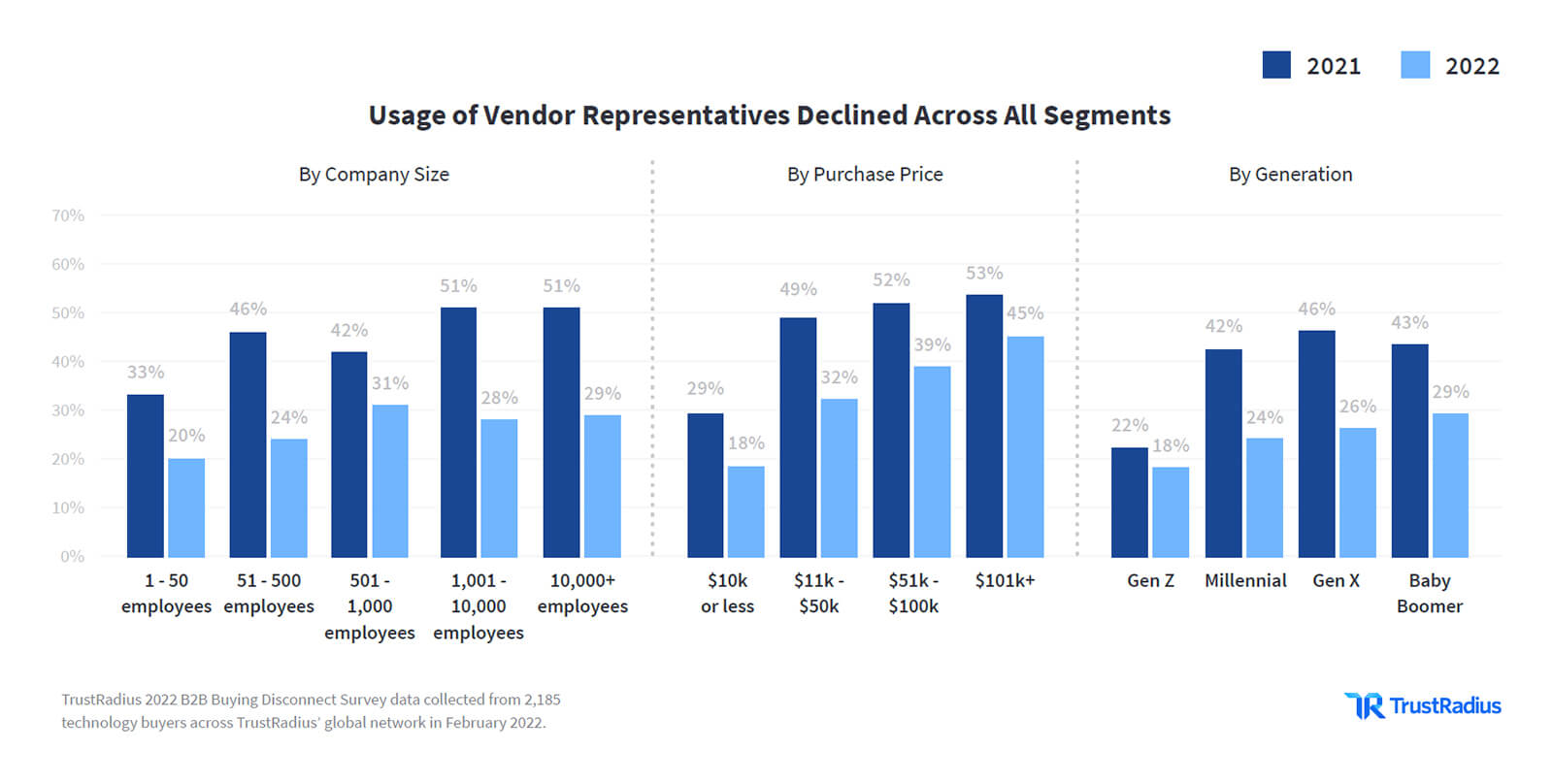

Year-over-year, usage of vendor resources declined across all segments. Five out of six vendor-provided information sources saw drops in usage from 2021 to 2022.

More notably, buyers across all company-size, purchase-price, and generation segments reported using vendor sales representatives less than ever before. In 2021, 43% of buyers reported consulting vendor sales representatives, making it the fourth most commonly used resource. This year, it dropped to just one out of four buyers.

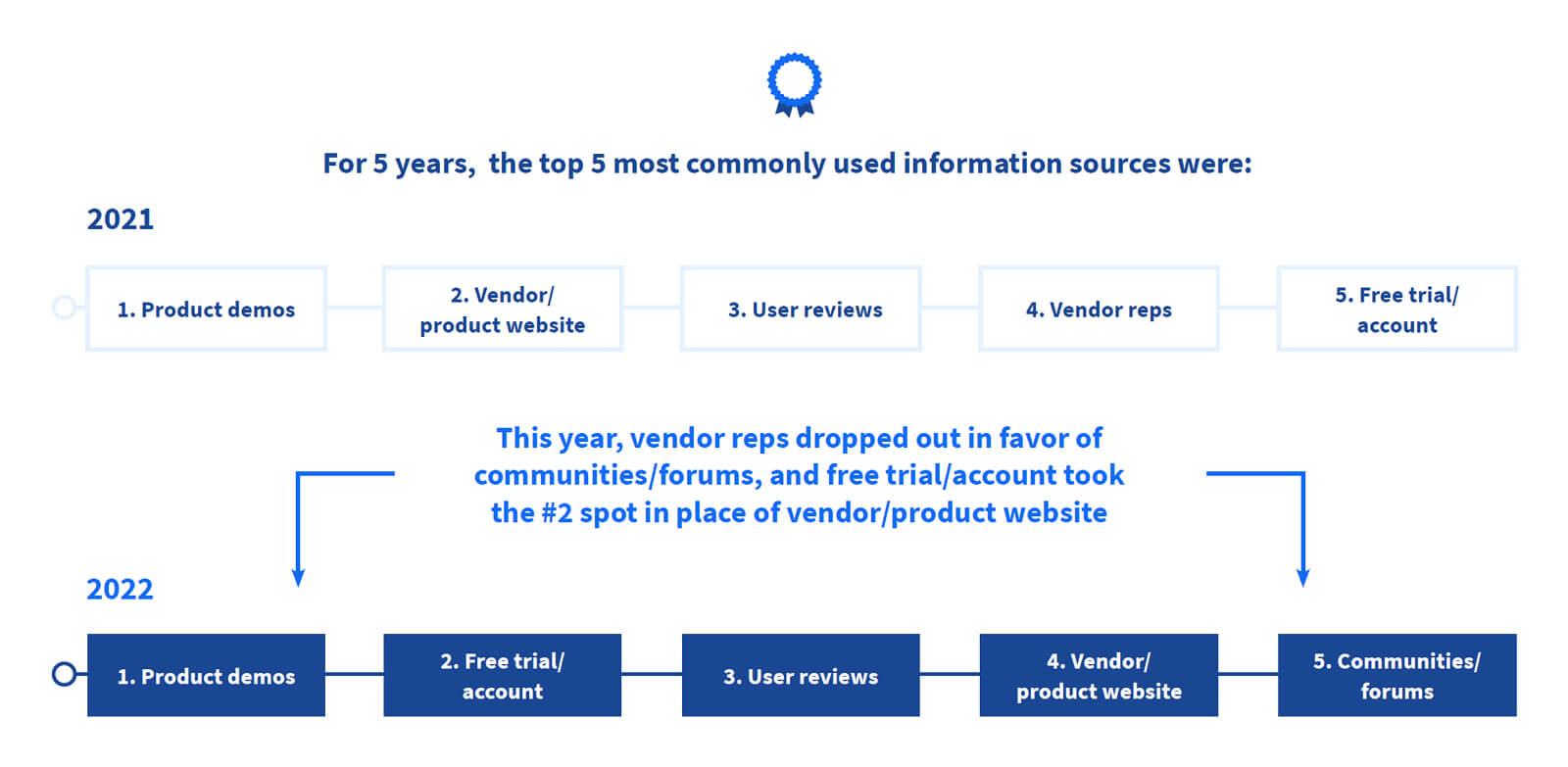

In fact, for five straight years, vendor sales representatives were among the top five most commonly used resources. This year, they dropped from the top five completely, replaced by communities and forums.

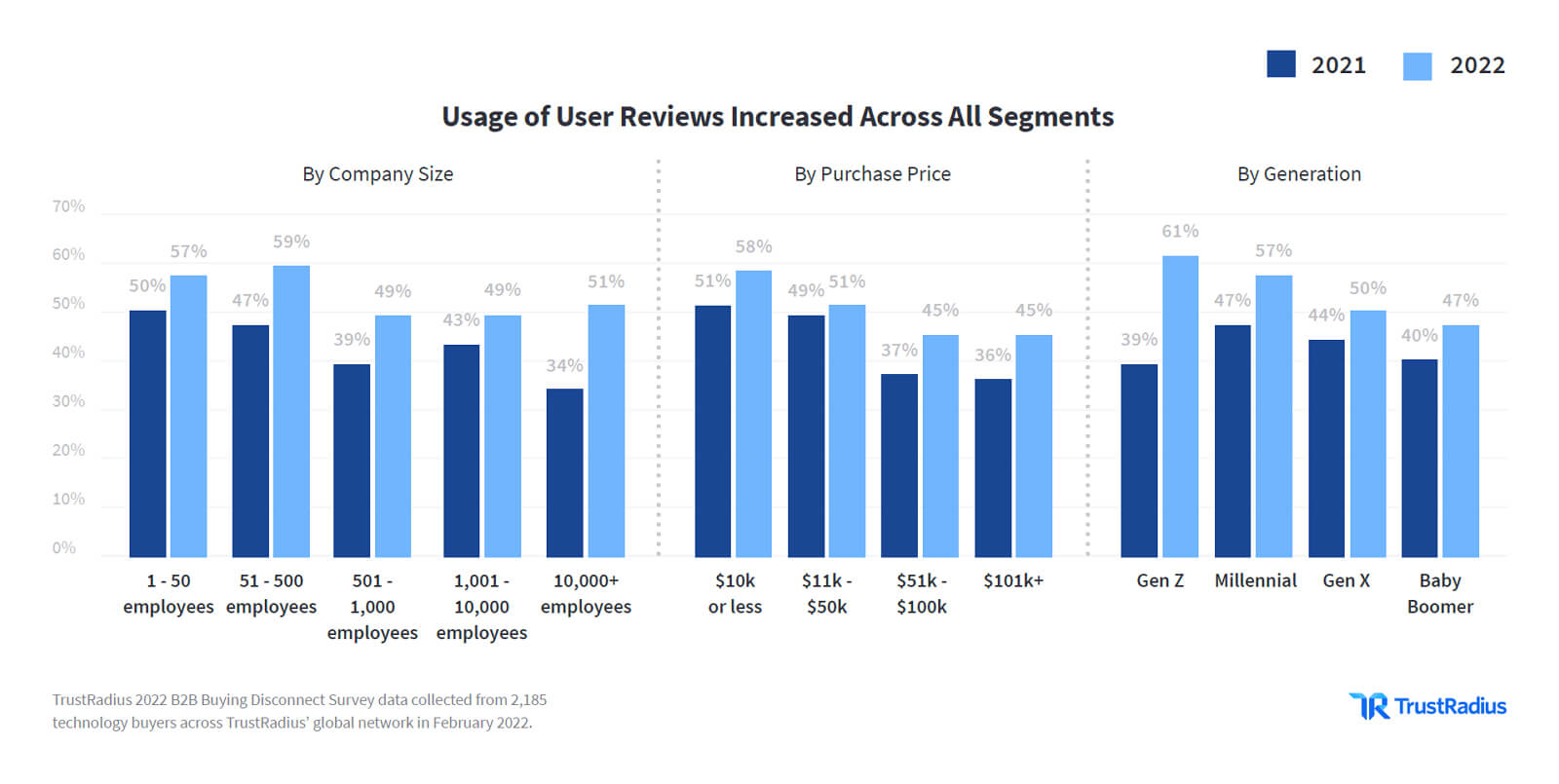

These declines in usage of vendor resources were coupled with increasing reliance on third-party information sources, including user reviews, communities and forums, and analyst rankings and reports. The use of review sites increased from 2021 to 2022 for companies of all sizes, with the most notable gain occurring among companies with 10,001+ employees.

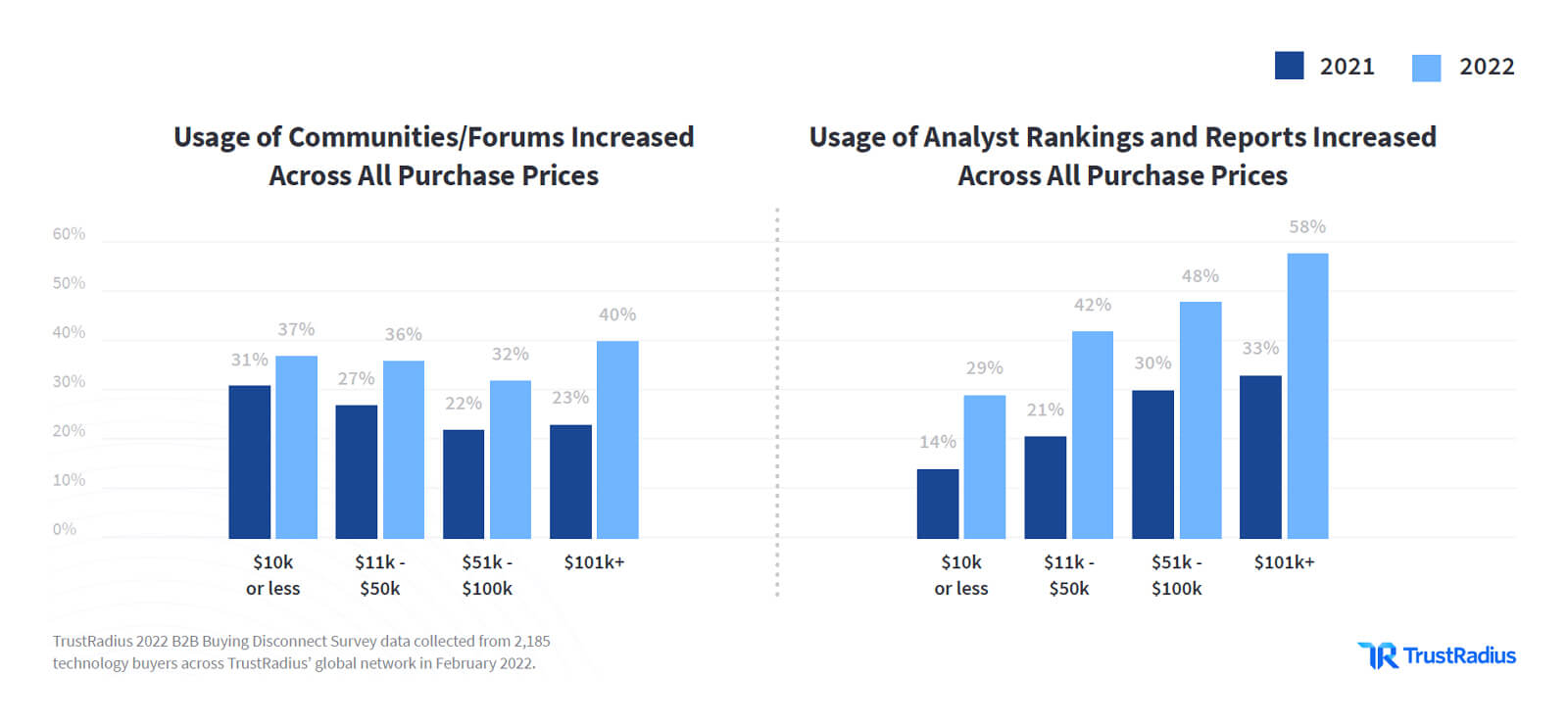

Buyers increased their usage of communities and forums from 2021 to 2022 for all software price points, company size, and demographics. Communities and forums varied by domain but include sites like LinkedIn, StackOverflow, and Reddit.

The same is true for analyst rankings and reports. This resource had been declining year-over-year, but 2022 saw a big jump in usage, with buyers hungry for a diverse set of non-vendor provided resources.

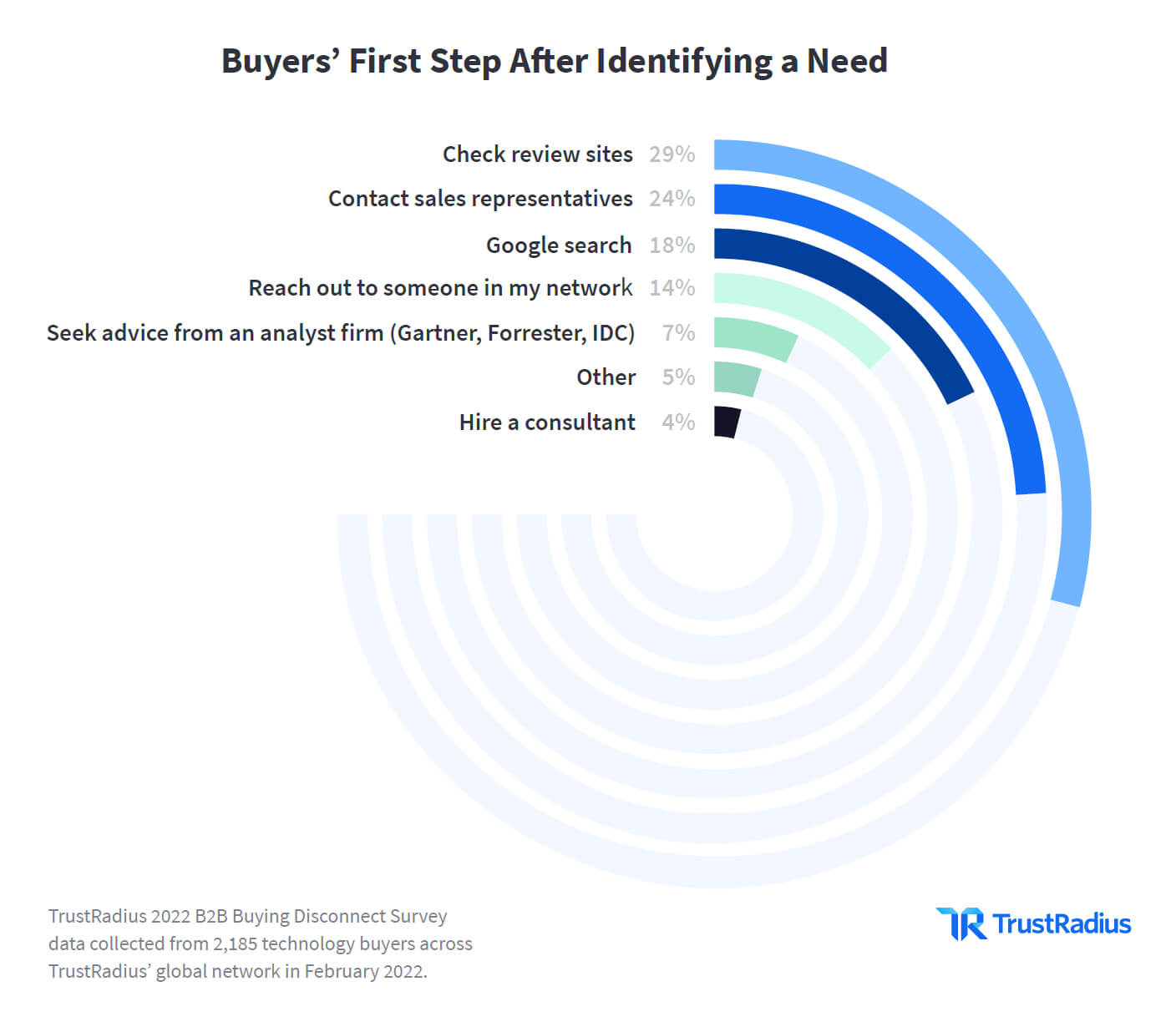

Buyers are relying on third-party sources above vendorprovided information. This is evidenced in their first action as well. 77% of buyers say that, once they identified a need, their first step was to do their own research, whether checking review sites, conducting a Google search, reaching out to a peer, or seeking advice from a consultant or analyst. Only 23% contacted a sales representative.

Tip: Remember that buyers are looking for information about your products from as many third-party sources as they can. To influence them, you have to be in more places beyond your own website and offer buyers a variety of sources on their buying journey, while understanding that they will likely approach these sources in a nonlinear fashion

41% of Gen Z and Millennials named “check review sites” as their first step in the buying journey. @TrustRadius #B2BDisconnect

![]()

2. Buyer Expectations for self-service are higher than ever before

Throughout the process—building her criteria, researching options, narrowing her list to two to three options—Emily expected information to be readily available online. By the time Emily set foot in the car dealership, she knew exactly which car she wanted and how much she should expect to pay.

Millennials—and particularly Gen Z—are accustomed to having information available at their fingertips. They grew up with social media. They frequent online forums for topics that interest them. These generations are highly connected and motivated to seek advice from peers, as well as share their opinions with others. Their behaviors are now defining the buying process, and other generations are displaying these trends as well.

Millennials and Gen Z have a strong preference for self-service options and value third-party resources, including user reviews. 41% of Gen Z and 29% of Millennials said “check review sites” was their first step in their buying journey. They were also more likely than older generations to start with a Google search. When asked which resources were most impactful, Millennials and Gen Z were the most likely to say, “user reviews.”

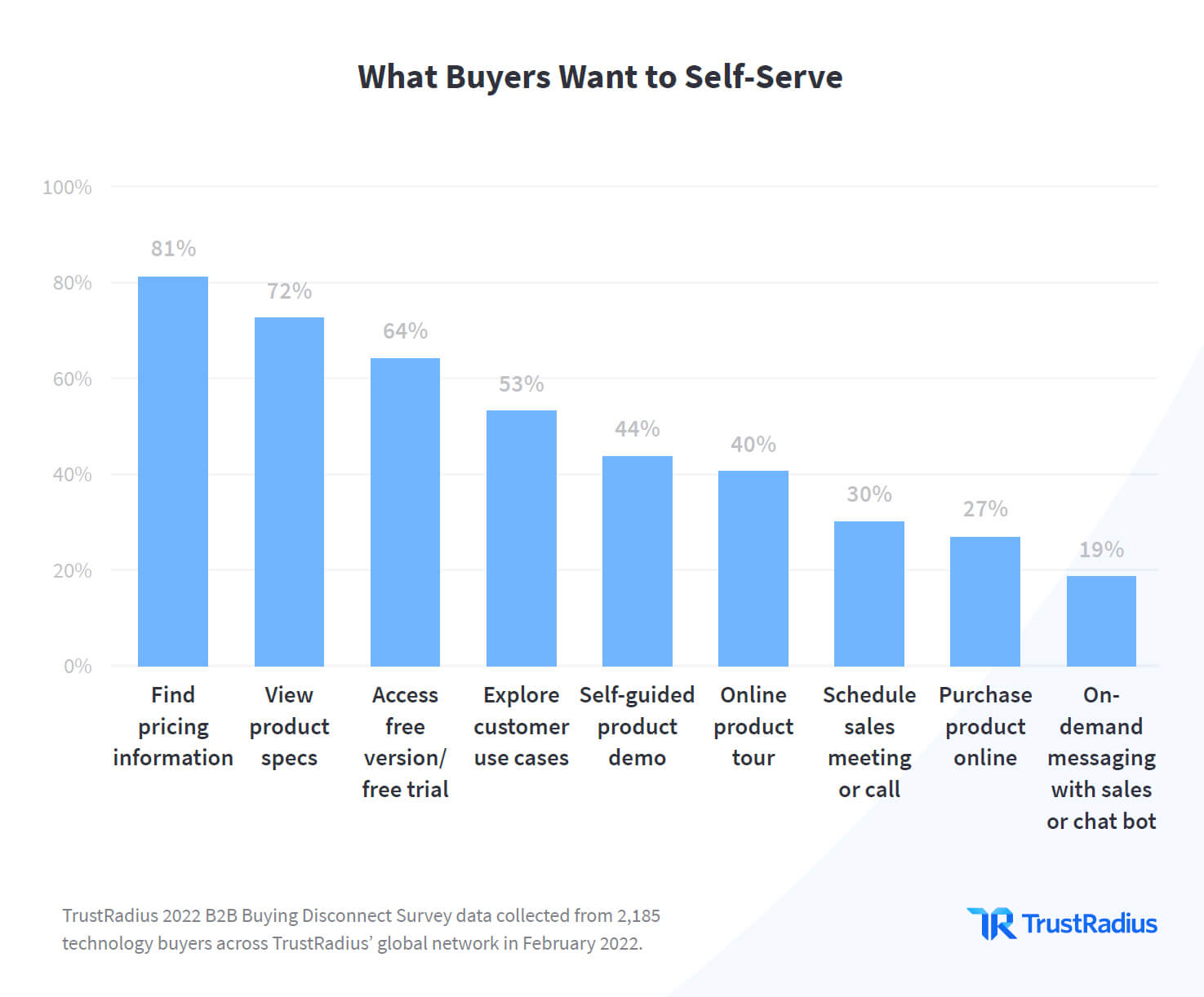

The strongest desires for self service are both finding pricing and first-hand product experience. But the overall desire for information to be easily accessible for buyers the moment they need it is worth calling attention. Beyond pricing and demos, this includes clear specs and messaging, as well as access to customer examples.

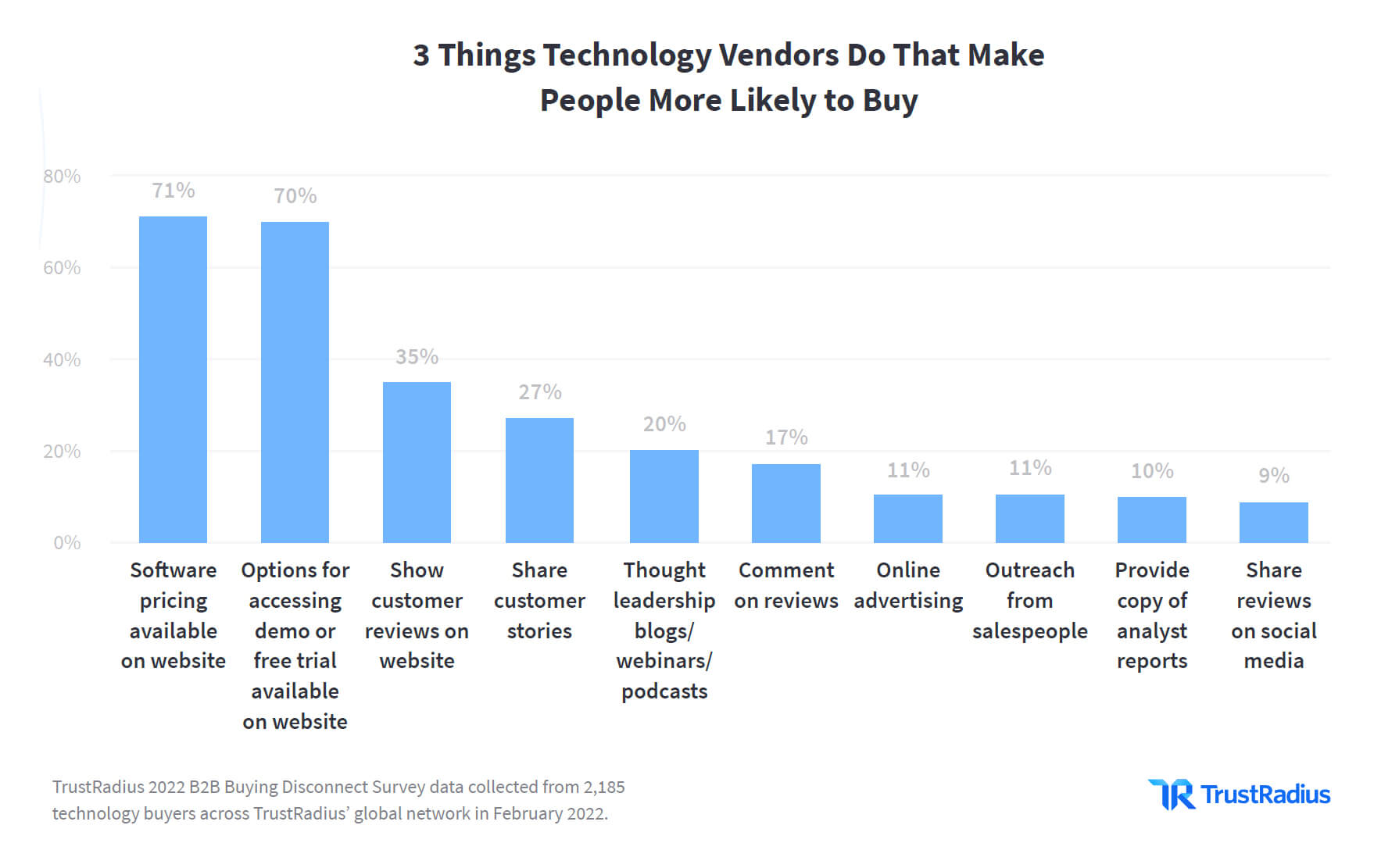

In fact, the top three things buyers say tech vendors can do to make them more likely to buy are publishing pricing on the website (71%), making demos or free trials available (70%), and showing customer reviews on the site (35%).

While buyers reported using vendor resources less, that doesn’t mean that your resources are no longer important. Your website and marketing materials can do the job of making it easy to find accurate, up-to-date information about your product— including feedback from trusted sources like your customers.

Then, your sales representatives can play a more consultative role. Rather than being the gatekeepers of basic information, they can support a buyer’s decision-making process with expert knowledge and help them make sense of all the third-party information they’ve gathered. If you’ve done your job right, the narrative they’re seeing of your product is authentic and consistent across those third-party channels. Finally, they can be proactive about using customer evidence to validate claims.

Tip: Use your website to enable buyers as much as possible by including clear messaging, easy-to-find feature information, and explorable customer use cases. Then, you can leverage your sales reps to be more consultative rather than having reps spend time providing information that buyers would prefer to gather on their own.

Virtually 100% of buyers want to self-serve part of the buying journey – up 13% from 2021 @TrustRadius #B2BDisconnect

![]()

3. Buyers want to try before they buy—and they want vendors to enable it

Emily’s first step in buying a car wasn’t a test drive—but she would never have bought the car without driving it first, regardless of how much peer feedback she got or how many test-drive demos she watched online. She needed to experience the car herself, first-hand.

As buyers create their short list, demos and free trials are increasingly important to them. Buyers want hands-on experience using your product.

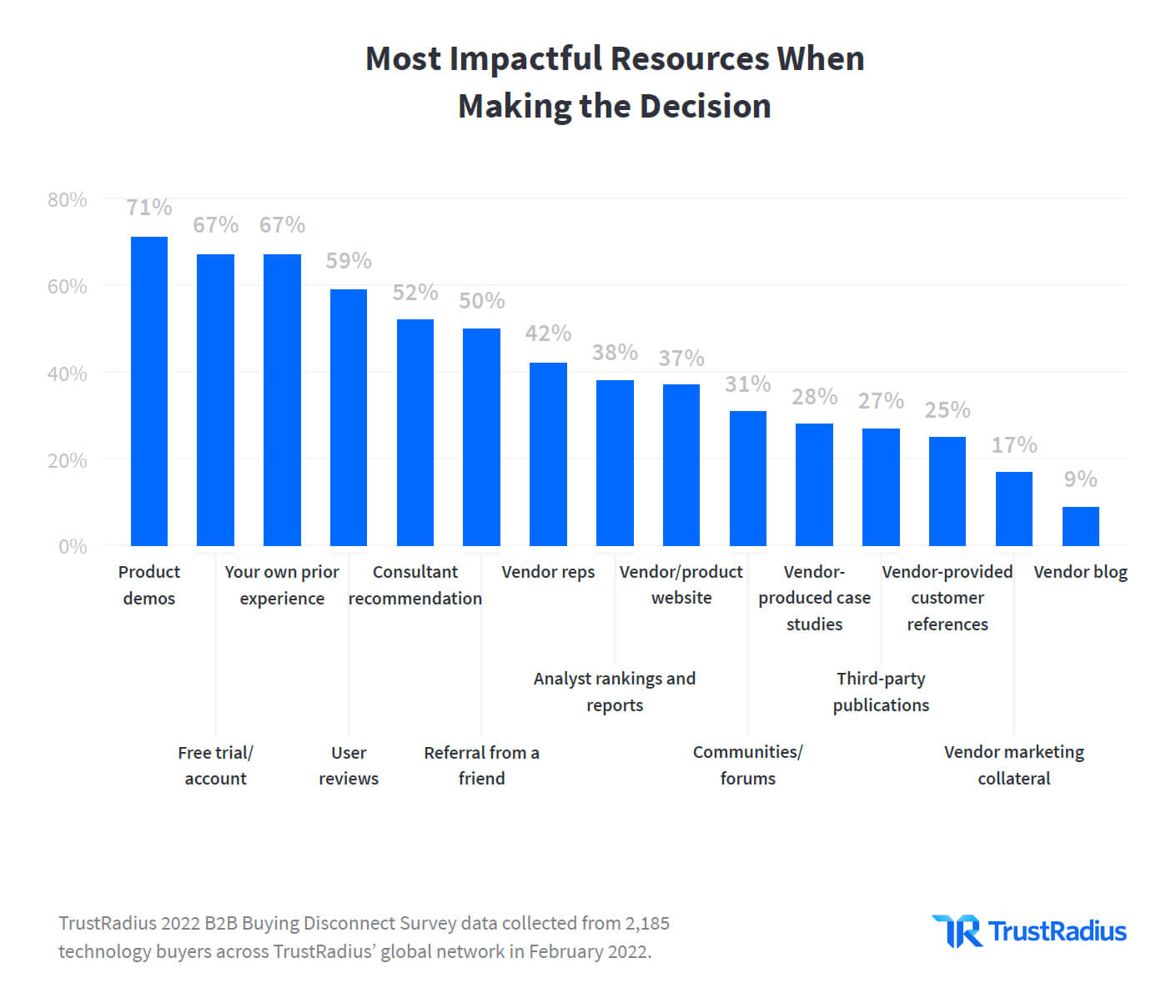

Product demos are the top resource that buyers use during the evaluation process, with 59% of buyers using them. Product demos have been the most widely used resource for six years running. Additionally, this year the use of free trials skyrocketed from 41% in 2021 to 56% in 2022, thus moving from the fifth spot to the second of most commonly used resources during the evaluation process.

The rise of product-led growth as a business methodology likely means free versions or other frictionless entry points are more commonly offered. They’re excellent tools to satisfy buyers’ needs to self-serve and try before they buy.

The top three most impactful resources are all forms of first-hand experience; product demos (71%) again topped the list, followed by free trial/free account (67%) and prior experience with the product (67%)

First-hand experience is prominent when it comes to buyer expectations for self-service: 64% want to access a free trial, 43% want a self-guided product demo, and 40% want an online product tour.

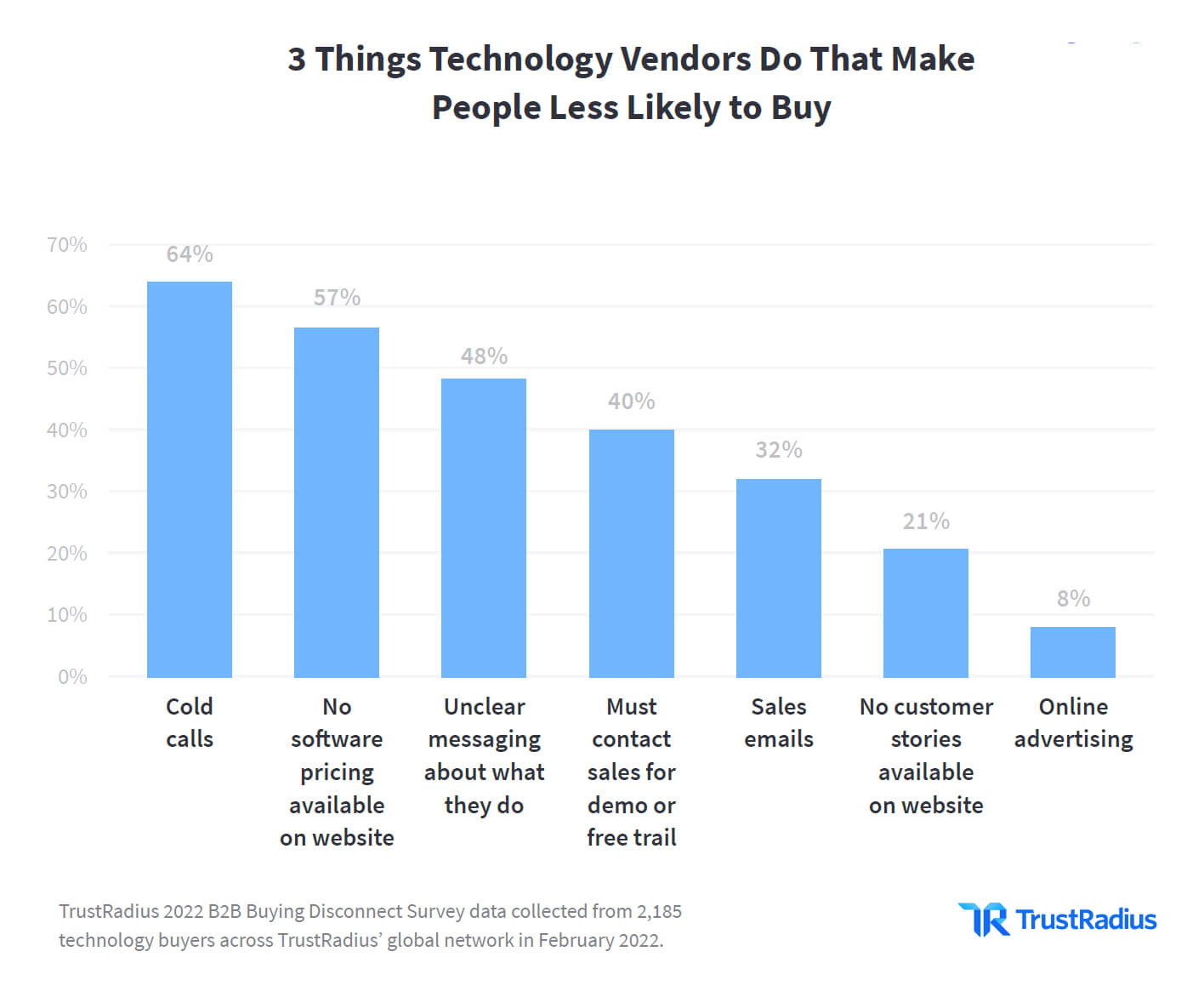

Additionally, 70% of buyers list “options for accessing a demo or free trial” among the top three things vendors do to make them more likely to buy from them. Conversely, 40% of buyers named “having to contact sales for a demo or free trial” among the top three things vendors do to make them less likely to buy.

Tip: Cold outreach—calls or emails— is outdated and ineffective. You’ll have more success with personalized outreach that correlates to where a buyer is in their journey. For example, send bottom-funnel content to in-market buyers who are already showing high levels of intent to purchase your products. Make it easy for them to experience your product first-hand. Give them content that proves your value and differentiates you from competitors.

Buyers name cold calling (64%) as the number one reason they are LESS likely to buy a product. @TrustRadius #B2BDisconnect

![]()

4. Buyers want pricing to be easy to find and transparent

Once she had decided on the make and model car that would best meet here needs, Emily researched which package options to buy. Did she want the less expensive LX version, or was the EX-L version a better deal based on how she planned to use the car? When she arrived at the dealership, Emily was confident in her choice. She had researched pricing on TrueCar and was clear on what she could pay. She wasn’t interested in having the salesperson try to upsell her by highlighting all the features and functions of the upgraded models.

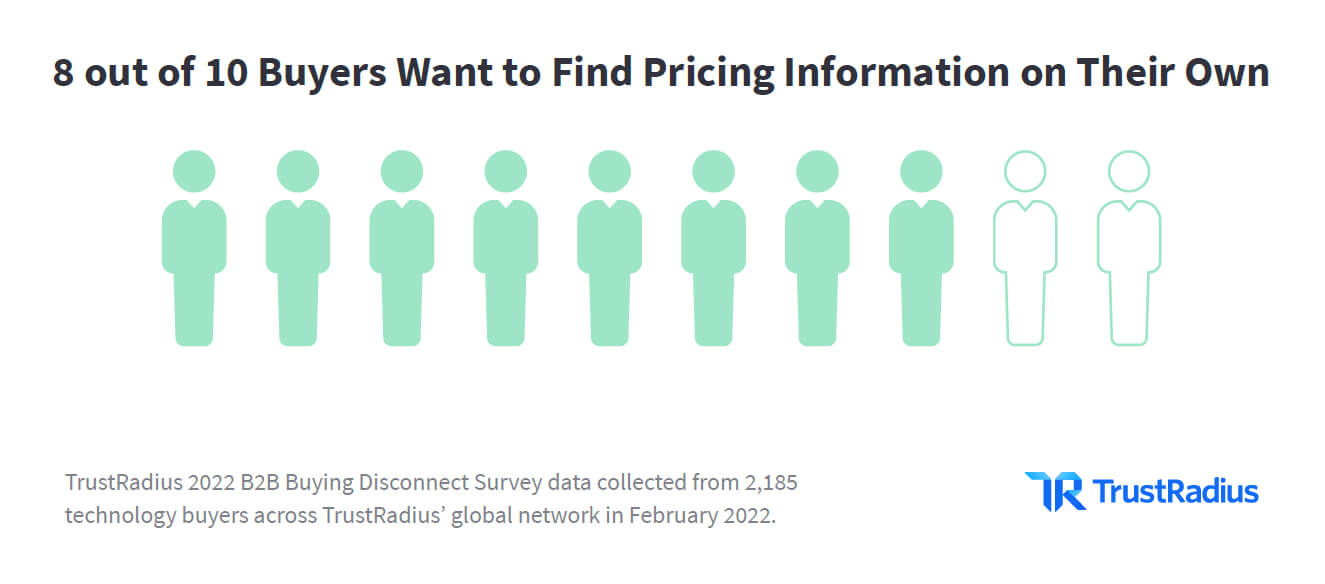

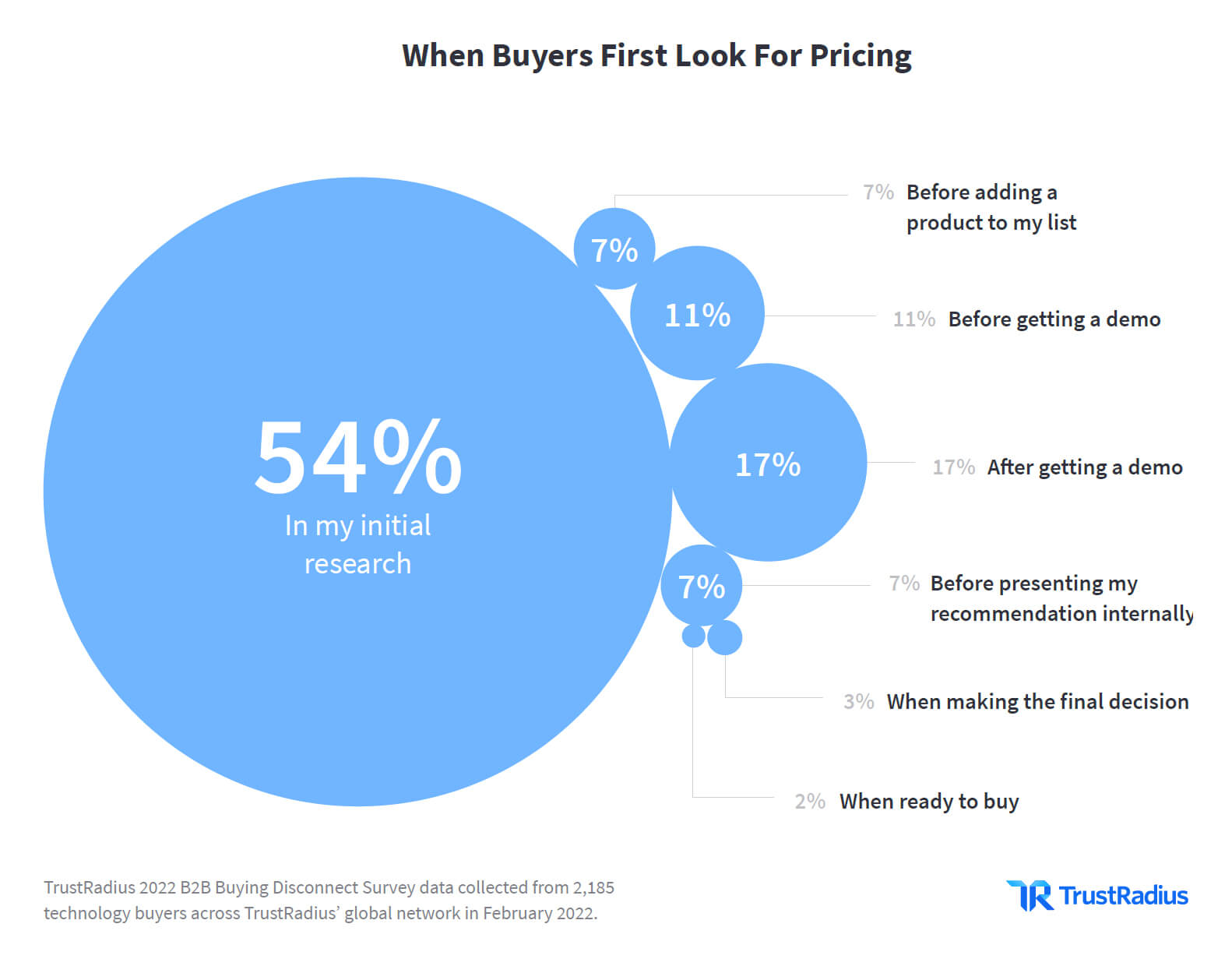

Pricing information tops the list of buyer expectations for selfservice. The vast majority of buyers (81%) want to find pricing information on their own.

Buyers don’t want to learn about your product by sitting through a slide deck. They aren’t keen on booking calls or meetings if they aren’t yet sure that the product will even meet their needs or be within their price range.

The vast majority of buyers (81%!) want to find pricing information on their own. @TrustRadius #B2BDisconnect

![]()

Instead, buyers want to self-educate, including gathering pricing information. The majority of buyers (54%) said they first look for pricing in their initial research. Only 29% first looked for pricing after the demo or later stages.

If buyers can’t easily find pricing, 43% say they’ll delay and collect as much information online as possible. 41% say they’ll book a call with your sales team to try to get pricing information. But 16% of buyers will cross you off their list, and stop considering your product completely.

Vendors resist displaying pricing for a variety of reasons—whether it’s resistance from the sales team, reliance on business partners, complex pricing terms, or usage of global currencies. However, buyers want pricing upfront to avoid wasting their time and yours.

Start driving high-quality reviews on TrustRadius

Claim your free profile today

5. Collaboration among the buying committee has increased and is highly unstructured

Events and expos have traditionally been a great opportunity for vendors to demo their products, discuss features and functions with buyers, and gather contact information for sales follow-up.

That is, until the pandemic brought live events to a screeching halt.

Although virtual tools were starting to become mainstream in business, the pandemic accelerated the trend. Even as live events and office attendance are slowly reemerging from a pandemic hibernation, remote work and virtual collaboration are here to stay.

One characteristic of Millennials in the workplace is team-orientation—a desire to work in teams, and for the whole team to be successful. Since anyone in the organization is able to research products (and influence decisions), and buyers want to make the right decision for the whole group, the buying process has become more collaborative.

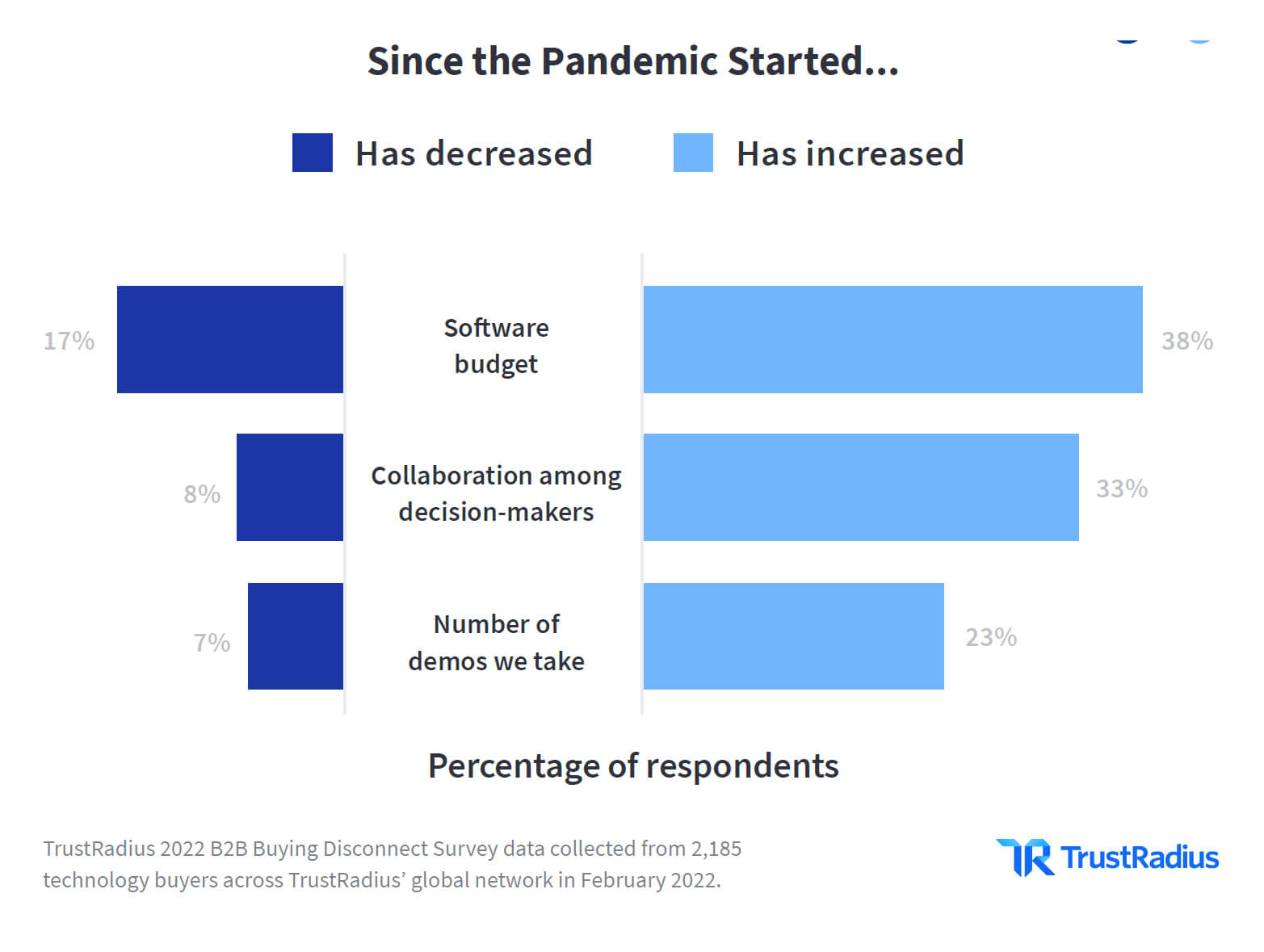

Of course, the days of a top-down decision from the C-suite are long over; the democratization of software buying has been happening for some time. Now, a third of buyers say that collaboration among decision makers has increased since the pandemic.

Together with an increase in software budget (38%), and an increase in the number of demos taken (23%), the amount of collaboration over tech buying in general is on the rise.

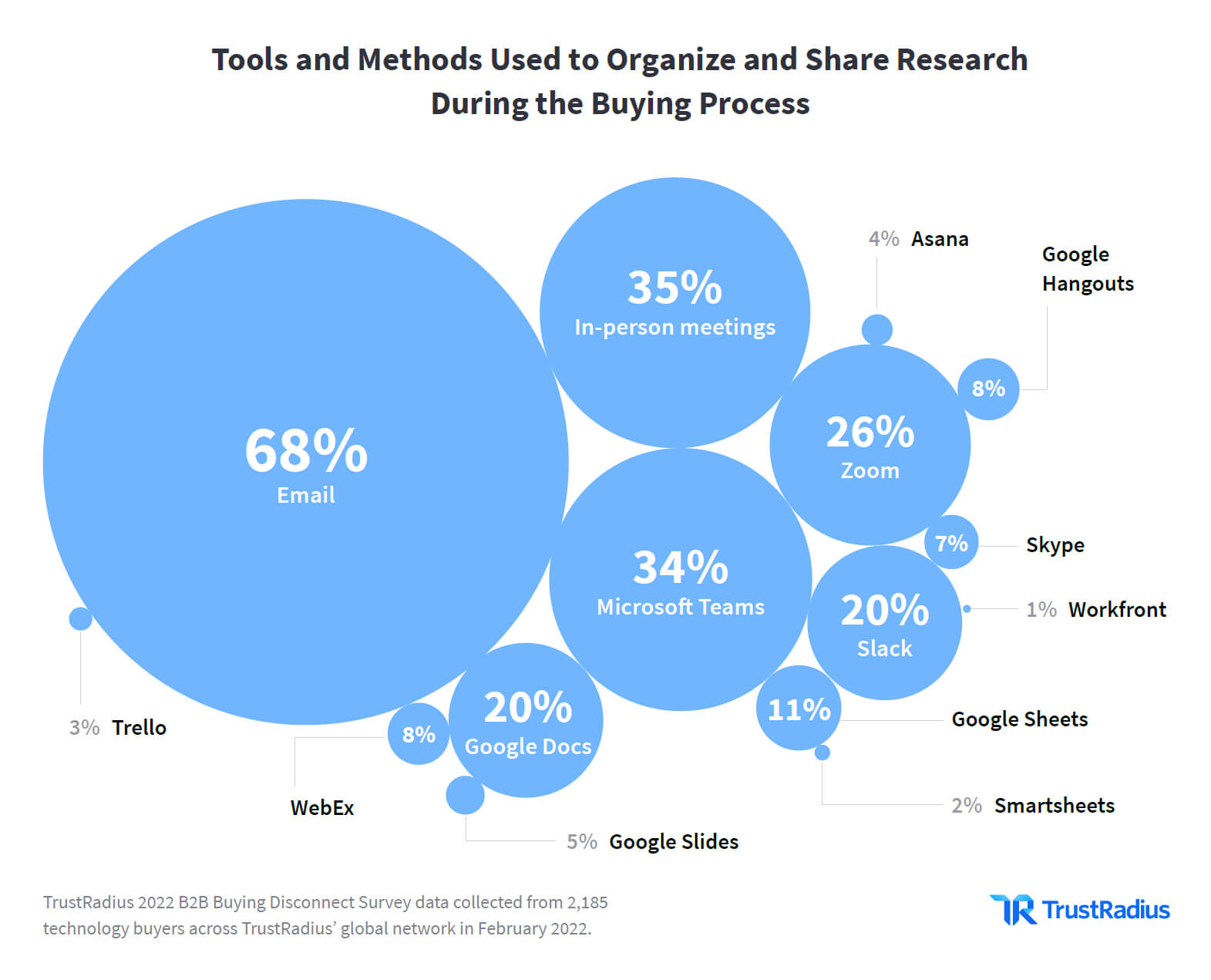

However, the way buyers organize and share this information is fragmented.

Buyers are using everything from email and chat to web conferencing and in-person meetings to organize and share research during the buying process.

Tip: Think about how you can support buying committees as they use a variety of tools to collaborate. The accessibility of information covered in the rest of this report helps. Beyond that, consider offering buyers tools they can easily use across these collaboration channels and content they can easily share with the rest of their committee.

1/3 buyers say that collaboration among decision makers has increased since the pandemic. @TrustRadius #B2BDisconnect

![]()

Adapting to the Self-Serve Buyer

Buyers of all generations prefer to self-serve. They want to perform their own research, including gathering pricing information, reading customer reviews, and visiting communities and forums before they ever speak to a sales rep. They want to try your product before they buy.

Vendors that understand what the self-serve buyer demands have a clear advantage over those vendors stuck in old-school sales methods. Your competitors that still use traditional go-to-market methods such as cold prospecting, generic marketing campaigns, and scheduling “dog and pony shows” will find that buyers will gravitate to vendors that meet their needs for self-service.

Savvy vendors recognize that the buying journey is nonlinear and includes pricing information research, asking questions in forums, watching on-line demos, and reading case studies. These vendors will embrace the opportunity to transition sales reps from gatekeepers of information to consultative advisors.

Shift your mindset to meet buyers where they are in their journey. These trends are here to stay and will only become more and more pervasive in the coming years. Getting started now will give you a competitive edge and loyal, happy customers.

Demographic Information

Methodology

Data for the TrustRadius 2022 B2B Buying Disconnect was sourced from the TrustRadius global network of contacts via an online survey.

In February 2022, we sent online surveys to professionals who helped buy new software or hardware for their organization (technology buyers) in the past year. We received responses from 2,185 buyers.

All respondents were offered a nominal incentive ($10 gift card) as a thank-you for their time. For a full list of questions and answer choices, email us at research@trustradius.com.

About TrustRadius

TrustRadius mends the trust gap between technology buyers and providers. Delivering the most credible research and review platform for software across industries, TrustRadius helps decision-makers confidently choose technology with vetted, peer-based guidance. Providers are empowered to tell their unique story, engage high intent buyers, improve conversion, and gain customer insights. More than 12 million annual visitors generate and use high-quality content like verified reviews, data, and ratings on TrustRadius.com. Founded by successful entrepreneurs and headquartered in the technology hub of Austin, Texas, TrustRadius is backed by Mayfield Fund, LiveOak Venture Partners, and Next Coast Ventures.