B2B Review Sites Are Losing Buyer Confidence. Introducing Buyer Intelligence.

B2B buyers struggle to make confident decisions. Per the book, The Jolt Effect, 40-60% of B2B deals end up getting stuck, as the fear of messing up exceeds the fear of missing out, and 56% of stuck deal champions want to buy but lack confidence.

B2B technology review sites were once heralded as invaluable resources to help professionals make informed product decisions. A closer look today reveals a troubling trend that has led many to question the value of these platforms.

The reality is B2B review sites aren’t dead. Tens of millions of buyers still use them each year, and reviews remain one of top three, most consulted, and influential resources for technology decisions.

They are however sick, and run the risk of irrelevance, without a major reset and renewed focus on creating true value for buyers and sellers. They’ve lost focus on what buyers’ need to build confidence and pitted vendors against each other in a race to win favorable placement in 2x2s and accumulate awards.

They’ve become so gamified that scores have become a skewed version of reality. Site ranking systems have placed acute pressure on review quantity which in turn has led to high volumes of shallow reviews of minimal value.

The pervasive use of incentives has led to significant levels of fraud. The lack of strict review moderation processes has allowed fraudulent reviews to be published, degrading buyer trust.

A new approach is required to build buyer confidence and drive informed decisions.

Ten ways review sites and marketers who use them are failing

While review sites help buyers identify solutions, they fail to help them confidently select the right one for their use case.

1. Scores versus buyer use cases

Scores alone don’t help buyers understand which product is best for their use case. Vendors need to build trusted customer proof which builds confidence in their fit for specific use cases.- In the SaaS era, loyalty has to constantly be re-earned. All products need reasonable CSAT ratings to survive. Ratings cluster from good to great.- Cheaper, simpler products outscore complex, expensive products, but that doesn’t mean they’re suitable for enterprise use cases.- Buyers need customer insights about which use cases are supported, compatibility with their stack, cost of ownership, etc. – By focusing solely on scores, vendors fail to develop content that inspires confidence. Their focus needs to shift to building evidence that validates their support of specific use cases and articulates their differentiation.

2. Scores are corrupted

A common vendor practice is inviting only promoters to write reviews, i.e. NPS 9 and 10 customers, even though that practice violates FTC guidelines. – Most review sites do nothing to control sample bias leading to inflated scores and a loss of buyer trust. Per the B2BSaasReviews survey, 49% of B2B review site users limit their usage due to inflated ratings. – Vendors lose on an unlevel playing field as competitors with more customers can out-skew their scores. A VP Global Customer Advocacy at a large software company expressed, “this is a massive point of frustration and we end up spending far too much time trying to fill the quantity bucket versus the quality bucket. It’s maddening because we’re judged on volume sometimes more than quality.”

3. Quantity versus quality

The algorithms deciding 2×2 placement and awards are tied to recent review volume, which puts vendors on a “hamster wheel” of continuously driving short reviews.- You need statistical significance to build confidence, and sufficient examples to cover different use cases, personas and segments etc., but driving 100s of 1-2 sentence reviews with minimal insight and no tie into your content strategy is nonsensical.- In B2C, the average American consumer reads 10 reviews before trusting a product and 31% read 10+, up to 55. The average TrustRadius visitor reads 3-4 in-depth reviews per session. A small minority read 10+.- Buyers seek high quality insights from people in a similar role, with a similar use case, and business maturity. Per the B2BSaasReviews survey, 40% of review site users limit usage due to shallow reviews. – Shallow reviews are of limited value to repurpose for sales, SEO, campaigns, and yield minimal insights for product innovation. – Generic review questions like “what do you like, what do you dislike” fail to elicit content that answers critical buyer questions and differentiates a product.

4. Vendor focus misaligned to buyer wants

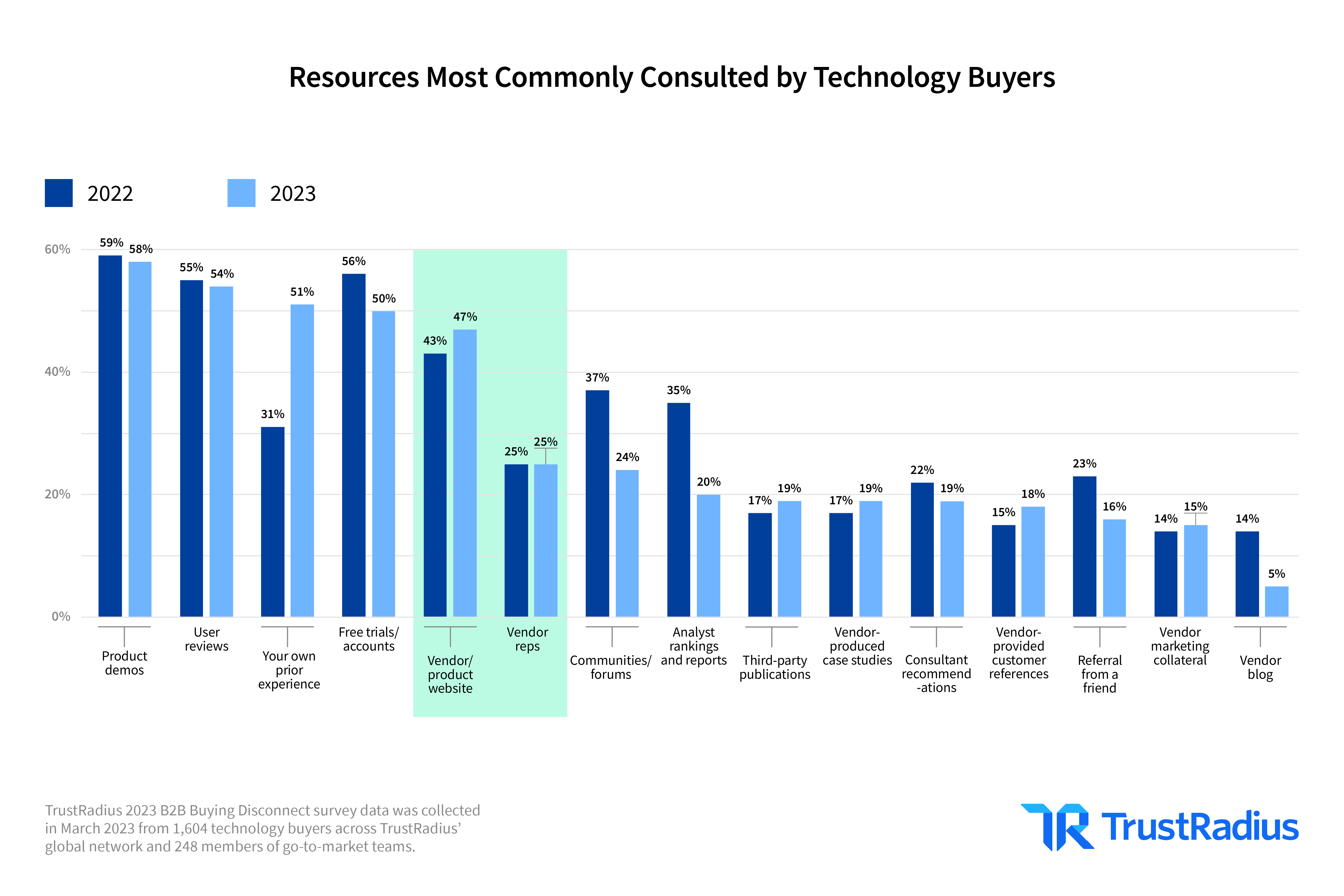

Vendors love to tout placement on 2x2s and award badges but they’re of minimal value to buyers.- A 2×2 may help a buyer build a short list and an award badge is nice for a brand campaign, but neither helps the buyer make a confident selection. – When everyone has similar awards or is placed in the same quadrant of a 2×2, those achievements fail to differentiate. – As awards have proliferated, their value to buyers (and vendors) has been severely diminished. The winner is the review platform building its brand. – Analyst report usage is declining, yet, marketers continue to deem them critical. In our 2023 B2B Buying Disconnect report, 20% of buyers cited the usage of analyst rankings and reports, down from 35% in 2022.

5. Fraudulent reviews

Fraud has become a big challenge. Per the B2BSaasReviews survey, 50 percent of review site users limit their usage because of a perceived lack of authenticity.- In B2B, incentives are necessary to drive review participation. The volume of customers is generally much smaller than B2C, and the request of a customer’s time is higher. Incentives also drive participation from customers in the middle of the NPS spectrum.- The downside of incentives is attracting fake reviewers motivated by making money. They’re willing to go to great lengths including creating fake LinkedIn profiles with job histories and 100s of connections, and writing reviews that seem legitimate.- Unfortunately most review sites do a poor job of policing fake reviews.

6. AI has exacerbated fraud

B2B review sites are struggling to detect AI generated reviews at scale. These fraudulent activities not only deceive buyers, but also erode brand trust. As a result, once-trusted reviews are now viewed with skepticism, making it difficult for buyers to make well-informed, confident decisions.

7. Some sites are unabashedly pay to play

They’re hyper optimized to drive leads versus help buyers. You can buy your way up a category list by bidding more. Some offer buyers the opportunity to “talk to an expert” who in reality is a rep who’ll BANT qualify them and route them to paying vendors only. Some sites restrict sellers from adding content to free profiles (product screenshots, videos, other details). This leads to a poor on-site experience for prospects who are looking to get information about the product.

8. Not a one-stop shop for buyer needs

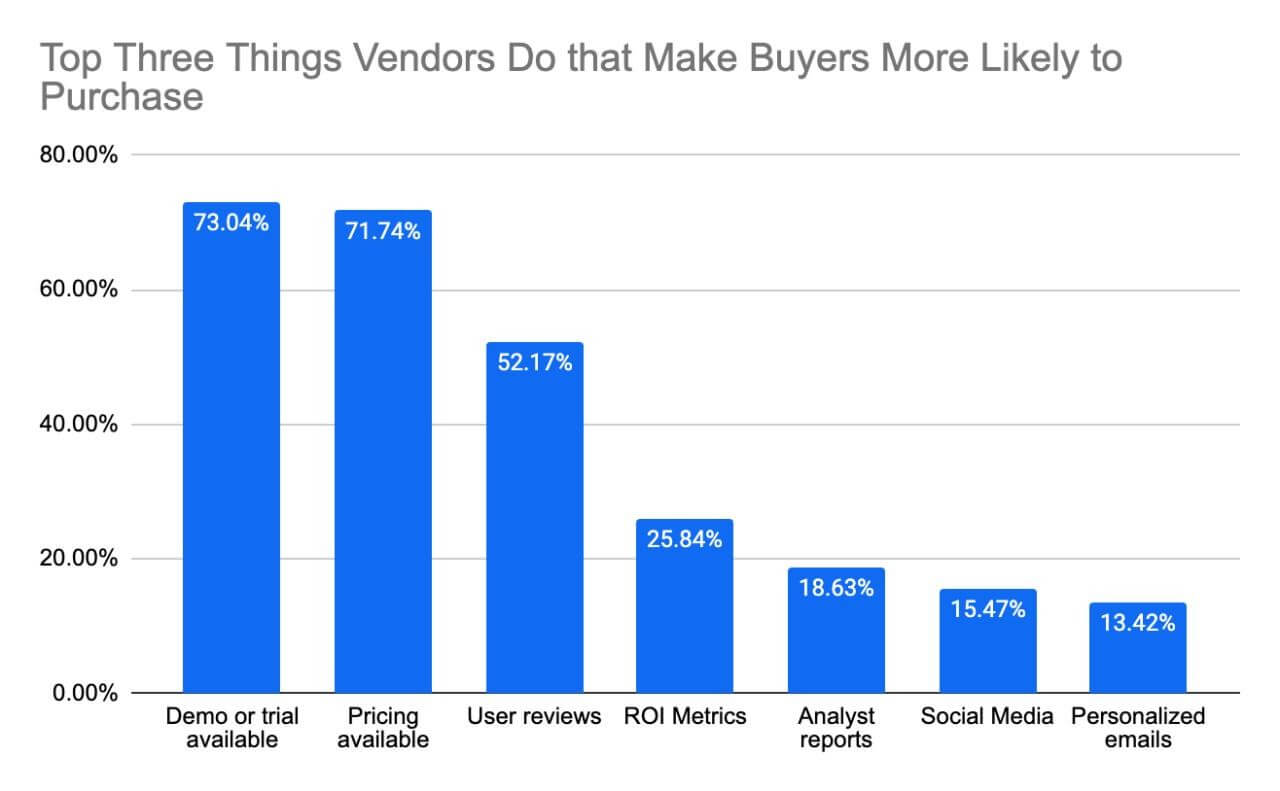

While customer reviews can be extremely valuable, they don’t address a buyer’s complete research needs. Buyers seek detailed product information including integrations, access to demos, security information, and pricing. Our 2023 B2B Buying Disconnect Report cited product demos as the most commonly consulted resource by buyers and second most influential. Demos and pricing are the top 2 things that make buyers more likely to purchase.

9. Ineffective use of buyer intent

Many companies have failed to effectively action intent data. Sending account level data to reps and expecting them to act upon it without assistance is a recipe for failure. Mixing intent signals into a “soup” without recognizing the source or phase of the buyer’s journey greatly sub-optimizes results.

10. Not helping buyers collaborate

B2B buying is collaborative. In our 2023 B2B Buying Disconnect Report, 27% of buyers indicated that they increased the size of their buying groups. Today’s review sites fail to help buying groups organize their research and collaborate to build collective confidence.

Five Ways to Help Buyers Make Confident Decisions

Buyers are increasingly seeking alternative methods for evaluating technology. The most diligent seek out answers from existing connections, utilize online communities, or piece together intelligence from multiple review sites. Buyers who fail to build confidence give up their search resulting in no decision, which hurts technology vendors. A new approach is required to build buyer confidence.

1. Customer feedback buyers can trust

Screen effectively for fraud; correct for score bias and invite all customers, not just promoters, to participate; and showcase the people behind the feedback (make it easy to visit their LinkedIn profile and validate that those profiles are accurate).

2. Actionable insights

In-depth content that provides insights into a customer’s use case, implementation details, the ROI they’ve achieved, and their whole product experience. Per the B2B Software Reviews 2023 survey, most buyers look for four things in reviews: product quality (68%), ease of use (62%), cost effectiveness (53%), and product security (53%).

3. Fast path to answers

Provide concise answers to buyers questions instead of making them sift through 100s of reviews; aggregate feedback from across the web so they don’t have to visit multiple venues; and enable connections with customers to have live conversations.

4. One-stop shop

Easy access to pricing, integrations, security information, demos, and product information in addition to reviews.

5. Collaboration

Help buying groups organize and evaluate their research to build collective confidence in a buying decision.

We call this comprehensive approach to giving buyers what they need to make a confident decision Buyer Intelligence.

What B2B Buyers Actually Want From Reviews

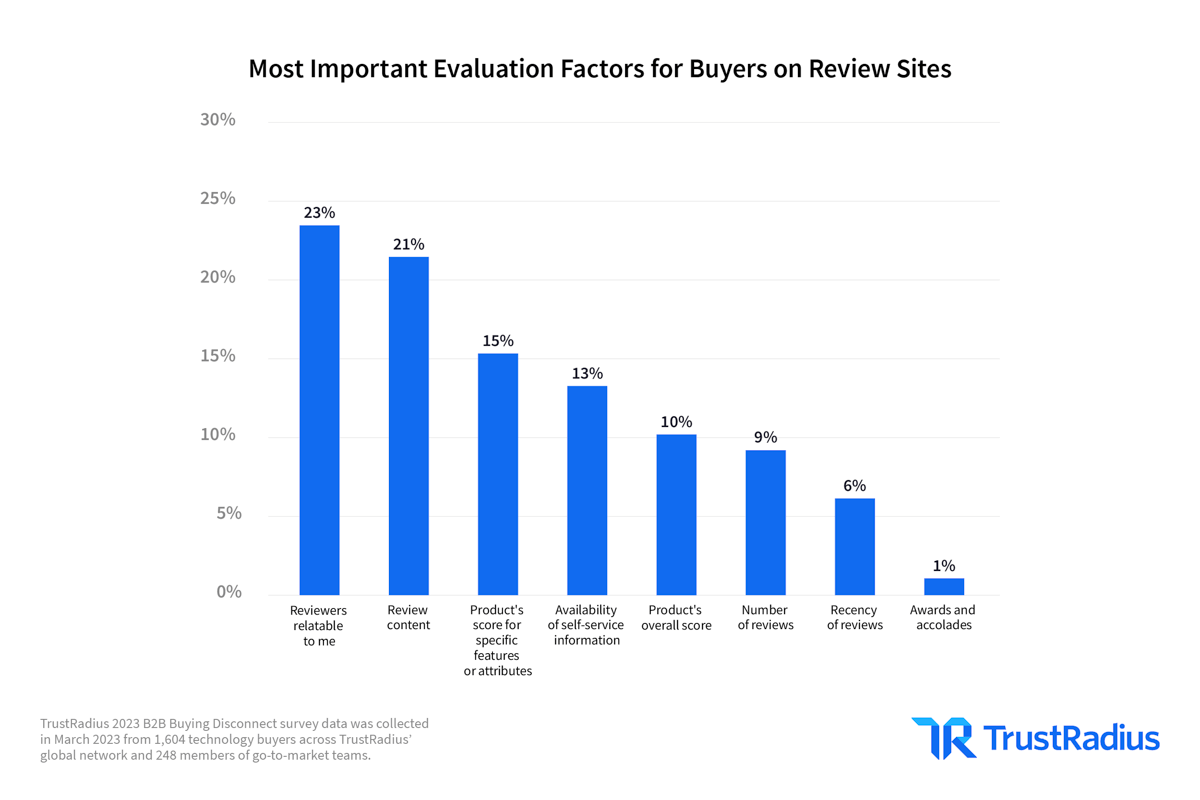

Reviews are a critical component of Buyer Intelligence. When it comes to reviews, what matters to buyers is hearing from people they can relate to, and what those people have to say (or as the nearbound.com team would say, the “Who Economy” versus the “How Economy”). Overall product scores and the number of reviews are less than half as important as the content itself. Awards are almost meaningless to buyers. Yet vendors focus on awards, review volume, and scores, and very few adopt a strategic approach to building useful content.

How Marketers Should Use Reviews

Brands need to redirect their energy towards driving substantive reviews from relevant personas and infuse content from reviews into their own GTM channels. While buyers conduct a great deal of their research in independent venues, a vendor’s website and sales reps remain important sources of information. Brands who harness customer voice content on their website, and through their sales reps experience superior results.

Results are optimized when the content is from an independent source (i.e. reviews), showcases multiple perspectives (so buyers can find people they relate to), and is aligned with the theme of the page or message. For example adding quotes about how a product serves a specific use case on a page that discusses that use case, or quotes about why buyers selected a product over a competitor on a comparative advertising page.

Syndicating review content to a webpage through a dynamic widget increases time on page (so buyers spend more time with your brand), enhances user engagement signals (a big factor for Google rankings), improves conversion (increasing lead generation), and helps rank for new keywords (more organic traffic as the widget content is crawled). Search engine results (SERPs) can be marked up with ratings data, increasing click through rates and rankings. On average brands experience a 20% percent growth in organic traffic to pages with customized widgets. Here’s an example of how Verint backs up its Knowledge Management claims with relevant review excerpts on that topic.

Companies like Alteryx have enabled their sales reps to use quotes from reviews in a targeted fashion for prospecting. Reps are able to retrieve specific quotes based upon different search criteria using a Chrome Browser Extension, and embed those quotes into messages. Prospects are much more likely to respond when they see testimony from someone who shares their use case. In the first two weeks of enabling 1,600 reps, they generated $200k in new business pipeline. Here’s an example prospecting message for Alteryx’s audit use case. In bold, they highlight a relevant quote from a review.

How TrustRadius Builds Trust and Value in Reviews

Here are 7 steps TrustRadius takes to drive content and data that buyers trust:

1. Preventing fake reviews

In 2023, TrustRadius rejected 60% of contributed reviews that we either identified as fake or not meeting our quality standards. We use a combination of technology and human inspection. We also have methods to “out” suspected fake reviewers.

Here’s what a buyer using TrustRadius and other platforms has to say:

“Within the last 2-3 years, fake reviews has become a real pain point. TrustRadius does a lot better than G2 at making sure those don’t get published.”

— Sales Training Manager, Marriott Hotels

Here’s what a vendor that works with TrustRadius has to say:

“The review content is definitely more comprehensive and thorough compared to other review sites. Also, due to the nature of the review collection process with TrustRadius for Vendors, we’ve been able to weed out fraudulent reviewers. We can’t say the same for other review site vendors we’ve worked with. The reviews we’re getting on TrustRadius are for the most part, high quality and thorough reviews and not written by a bot.”

— Manager in Marketing, Computer Software company 1001-5000 employees. Read full review.

2. Correcting for bias

TrustRadius is the only B2B review platform that corrects for score bias. We use three methods: – We source 47% of our reviews completely independently of vendors.- Our scoring algorithm, trScore weights our independently sourced reviews/ratings 100x more than vendor driven reviews, making it way harder for vendors to manipulate their scores.- With our TRUE program, vendors have their reviews count at “trusted” if we can verify they’re sourcing from all customers. They don’t have to be customers to participate.

3. Quality over quantity

While other sites ask, “what do you like”, “what do you dislike”, resulting in <100 word responses, we ask a series of questions about a customer’s use case, alternatives they considered, pros and cons, integrations, ROI achieved, etc., to drive rich insights averaging 400 words. This approach also yields much more useful feedback and content for vendors.

Here’s what a buyer using TrustRadius has to say:

“TrustRadius for Buyers offers a compelling alternative with a more in-depth analysis of the products and more neutral reviews, which helps me make a better decision.”

— Manager in Customer Service, Marketing & Advertising Company, 201-500 employees. Read full review.

Here’s what a vendor that works with TrustRadius has to say:

“TrustRadius is a great fit with the serious technology implementers and users in our target market and it shows in the quality of the reviews we get. We leverage our reviews and rankings in an array of Sales and Marketing actions.”

— Jeff Cotrupe, Director of Customer Marketing and Analyst Relations, SingleStore. Read full review.

4. Highlighting differentiation

Brands often make the same claims. We help buyers discern product differences and brands to differentiate themselves by asking “custom questions”. We highlight that differentiation on our site to help buyers understand key differences at a glance.

Here’s what two of our vendor customers have to say:

“TrustRadius for Vendors offers a unique way of allowing us to ask clients questions that matter most to us. This is a huge differentiator for TrustRadius“ and would be a major point of emphasis from me in my recommendation.”

— Product Manager, Legal Services Co. 501-1000 employees. Read full review.

“Traditional review sites fail to meet the needs of today’s vendors. Superficial reviews, pay-to-play pricing schemes and other issues make it hard to differentiate our solution and engage the right buyers at the right time. With TrustRadius for Vendors, we were able to generate more in-depth reviews to attract in-market buyers.”

— Andrew DeCataldo, Senior Customer Advocacy Marketing Manager, GoTo. Read full review.

5. Journals vs. postcards

Unlike hotels where your stay is finite, business technology usage is sustained and a customer’s product familiarity deepens over time. Moreover, most SaaS products are frequently updated. Most review sites drive short, postcard-like, point in time reviews. We prompt reviewers to update their reviews as their knowledge of a product increases, and as the product evolves, resulting in evergreen, journal-like reviews.

6. Comparative content

We highlight insights from reviewers who’ve considered multiple products in our Comparisons. In most review site comparisons, users are presented side by side information from people who have just evaluated each product distinctly.

7. Summarization

Buyers don’t want to sift through 100s of reviews nor visit multiple sites to assemble answers. We’re embracing AI to summarize customer sentiment on TrustRadius, and across the web.

Here’s an example:

Our Quest to Build True Buyer Intelligence

Useful and trustworthy review content is necessary but insufficient to build buyer confidence. Buyers also need pricing information and want to experience a product through demos or trials.

Over the last 2 years, we’ve added pricing data, interactive demos, and security information. Pricing drives 20 percent of our traffic, and products with pricing experience 3x higher click through rates.

We’ve partnered with all the major players in the interactive demo space (Demostack, Navattic, ScreenSpace ✦, Storylane, Tourial, Walnut). Brands can add interactive demos to their TrustRadius profiles free of charge. Products with interactive demos drive 470% more engagement as measured by session duration and 15% more MQLs.

We’ve partnered withWhistic to add security profiles. Products with Whistic security profiles experience 25% faster deal cycles. Instead of security reviews with spreadsheets taking 50-60 days, products with Whistic complete security reviews in just 1-2 days.

We’re helping buying groups collaborate through enabling them to build research boards of products they’re considering and to share those boards with their buying groups to build collective confidence. In 2023, 27% of companies reported an increase in the number of decision makers involved in purchasing.

Expanding Reach and Enabling Peer Conversations and via LinkedIn

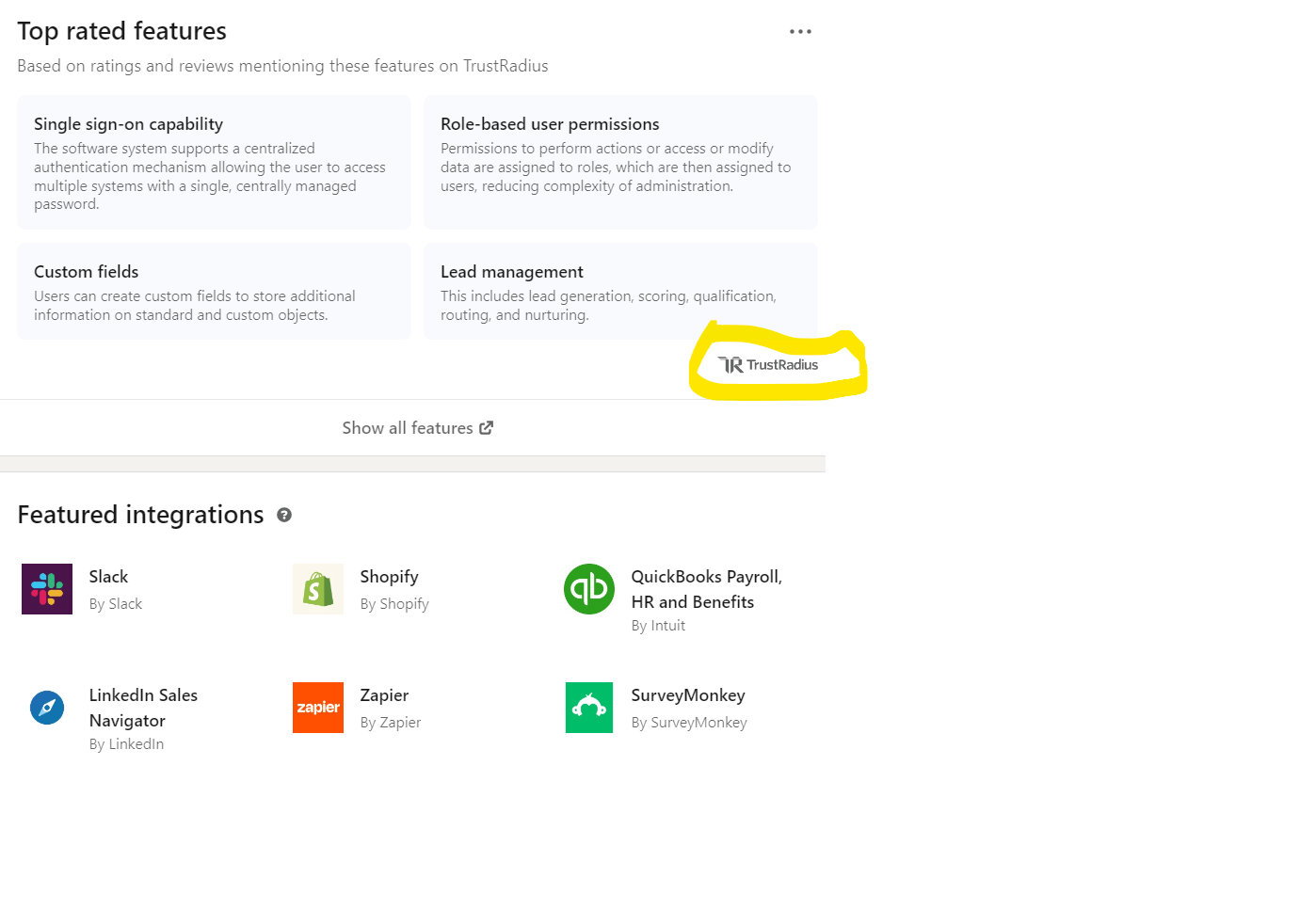

While we serve 14 million active buyers directly on TrustRadius, LinkedIn has 1 billion members. They’ve launched Products & Services Marketplace to help buyers research products. We’re supplying data about top rated features and integrations. Here’s an example for Zoho CRM.

Frequently buyers need to go deeper than what they can read online and want to talk to peers. They don’t trust vendor supplied references and seek independent points of view. LinkedIn is enabling buyers to message people in their network that use a product. This approach works well because LinkedIn has anchored around “trust” to drive connections.

We also want to help buyers connect with people outside of their network who have relevant expertise and experience. People visit TrustRadius to find insights from people with relevant expertise and experience. In the vast majority of instances they don’t know them, but they can trust them and find value in their insights.

Everyone has a “trusted circle” of advisors, but they frequently they lack specific experience with a product or its applicability to a specific use case. The name “TrustRadius” connotes helping people to extend their “radius of trust”. We create trust in peers outside of one’s own network through our acute focus on high quality review content and strict moderation and fraud management processes. The same cannot be said for other “review sites” who publish 1-2 sentence reviews and are lax about fraud.

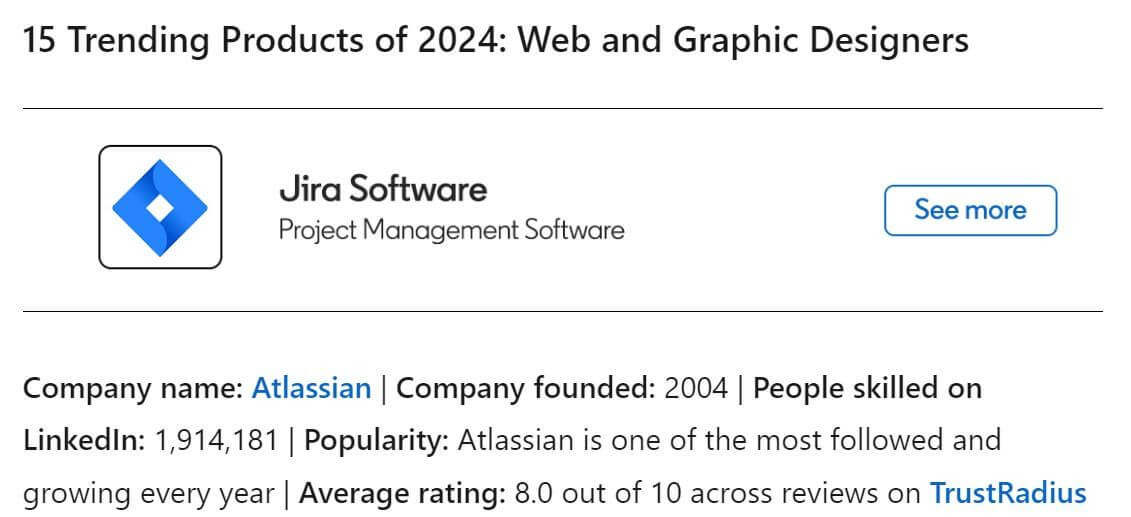

Getting on the radar of future or passive buyers is also critical in marketing. LinkedIn has also started to educate potential buyers with persona-specific digests about trending products. TrustRadius is providing ratings data for this initiative. Here’s an example for graphic designers.

How Buyer Intelligence Drives ROI for Vendors

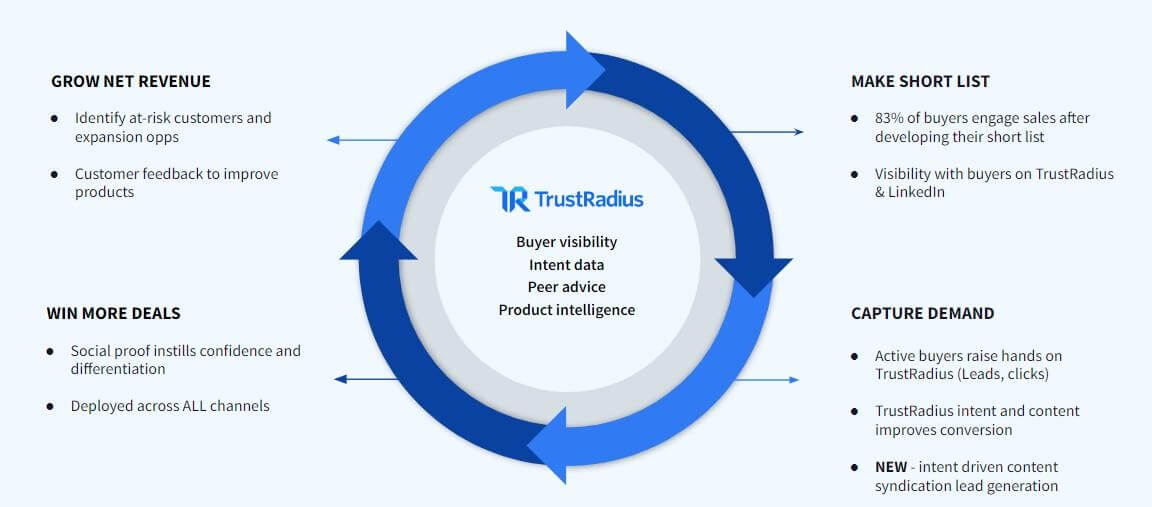

Vendors embracing Buyer Intelligence can realize ROI across all phases of the customer lifecycle.

Make the short list.

Per a recent study by 6sense Inc., 83% of buyers engage sales after developing their short list. The probability of being selected is slim if you don’t make the initial short list, so it’s important to influence buyers where they discover products. Review sites remain important channels to build visibility with active buyers. Reaching passive buyers requires engagement on other channels. That’s why we’re excited to amplify the reach of our content and data to the 1 billion people on LinkedIn.

Capture demand.

Active buyers on TrustRadius can connect with brands through clicking on calls to action or by completing lead forms. Vendors can use review quotes and other social proof from TrustRadius to improve conversion on their ads. We’ve started to publish short synopses of review content to serve demand generation needs. The most popular is compete content as it’s much more credible coming from a third party.

Buyers come to TrustRadius to do in-depth research, spending more than 9 minutes on key pages. 56% of them intend to buy within 3 months and 75% are decision makers. Consequently, the intent signals we generate are powerful indicators of buying propensity. We integrate with LinkedIn Matched Audiences, ABM platforms like 6sense and Demandbase, and sales platforms like ZoomInfoSalesOS and Salesforceto make our data easy to action. Companies that use our data effectively yield higher conversion rates lowering CPL, and drive faster pipeline velocity. Some brands struggle to action intent data and would rather just have leads fed to them. To that end, we’ve launched a leads offering which harnesses our intent data and content assets.

Win more deals.

Social proof is critical to build buyer confidence and to win deals. Your website and sales reps remain critical information sources for buyers. Enabling them with trusted social proof improves conversion and win rates. We provide easy to deploy widgets that stream dynamic review content to your web pages, tied to the theme of that page and a Chrome Browser extension to help your reps easily find the right customer quote.

Improve net retention.

Tech companies have shifted from an extreme focus on new customer acquisition to an approach balancing new customer addition with retention and expansion. TrustRadius helps companies improve their net retention through providing intelligence about which customers are shopping for new solutions, providing social proof to support cross-sell, and generating objective customer feedback that can be used to steer product innovation.

Conclusion: The Time for Buyer Intelligence is Now

Far too many of today’s B2B Tech Buyers fail to build confidence resulting in no decision. Many struggle to discern the difference between products. Economic headwinds are putting pressure on vendors to do more with less.

Confident and informed buyers are far more likely to follow through on a purchase. Review sites help buyers identify solutions but fail to help them build confidence to make decisions. They’ve put vendors on a “hamster wheel” to drive high volumes of shallow reviews in pursuit of awards and 2×2 placement instead of building content that helps buyers build confidence in their support for specific use cases. Scores have become skewed through gamification, and fraud is a rising challenge, leading to declining buyer trust.

A new approach is required to help buyers build confidence. Buyer Intelligence gives buyers high quality customer insights that answer their critical questions. It gives them a fast path to their answers through distilling reviews and other user comments into digestible summaries. It enables them to have conversations with peers who can give them the whole picture about what it’s like to work with a vendor. It provides reliable data uncorrupted by sample bias or fraud. It provides easy access to pricing, demos, security data etc. It helps buying groups streamline their research and evaluation process.

Vendors who pursue a Buyer Intelligence strategy will provide buyers everything they need to make a confident and informed decision. They will they build visibility in venues where buyers discover products and create preference by strategically activating and harnessing the voice of their customers. They will focus on the quality of reviews versus the quantity, their scores and awards. They’ll leverage content from reviews in their own channels to improve GTM performance. They’ll strategically use intent data to drive demand and improve NRR. They’ll use insights from customer reviews to steer their product direction.