2024 B2B Buying Disconnect Report: The Year of the Brand Crisis

Executive forewords

Over the past eight years, TrustRadius has studied the evolution of B2B tech buying behaviors through thorough market surveys, revealing a fascinating shift in buyer behavior and reflection of economic and workplace realities. This ongoing transformation of how technology decisions are made has informed necessary adaptations to GTM strategies.

In our 2023 report, we found vendors needed to “prove it or lose it,” meaning position ROI effectively in an economically challenging year. We also found that buyers were relying much more on prior experience, and were exhibiting traits of risk aversion—longer purchase cycles, watching more demos, and forming larger and more senior buying groups. Like previous years, we continued to see a pattern of buyers self-serving, whether it was seeking independent proof points from relatable people, up-front pricing, or wanting access to demos or trials.

In this year’s report, what shines through is how many companies are underestimating the importance of brand awareness and perception. As vendors have scaled back brand investment, buyers are gravitating toward familiar products that they’ve used before, heard about from their networks, or have had significant exposure to. Of buyers creating short lists, 78% reported selecting products they’d heard of before starting their research. For enterprise buyers, that figure rose to 86%. This means it’s imperative for brands to secure their place in the early stages of the decision-making journey.

The journey toward growth for B2B tech companies is evolving from just focusing on driving sales to earning brand loyalty through retention rates, community, and brand awareness and preference.

As CEO and Founder at Pavilion and Co-host of Topline Podcast, I’ve seen and heard time and again how important it is to buyers that companies are transparent, community-centric, and supportive. Companies doing this in 2024 will see more wins and steadier growth, now and long term.

Gleaning insights from the 2024 B2B Buying Disconnect Report is a great place to start your path upward.

Brand awareness, trust, and transparency drive decision-making in 2024

The dynamics of buyer decision-making have dramatically shifted, placing urgency on vendors to put brand awareness, trust, and transparency at the forefront. These elements are no longer just facets of marketing strategy; they have become the cornerstones for building buyer confidence and loyalty. Today, buyers arrive at their decisions increasingly armed with preconceptions, making the pre-purchase research phase more crucial than ever.

For vendors, 2024 is undeniably “the year of the brand crisis” for those seeking to compete with established market leaders and for market leaders hoping to maintain their status. As vendors have reportedly scaled back the investments of discretionary spending in brand awareness, buyers have doubled down on the principle of know-and-try-before-you-buy. Consequently, they gravitate toward familiar names and proven products, making it imperative for brands to secure their place, not only on the metaphorical “buying stage,” but also in the preliminary stages of the decision-making journey.

With most buyers forming opinions before engaging with vendors, marketing and sales teams must adapt. This necessitates a shift in marketing strategies, diverting the sole focus from account-based initiatives toward a more balanced approach, incorporating more comprehensive brand awareness campaigns that build brand trust and promote transparency. With this approach, sales teams are able to take a more consultative approach and leave the ineffective cold call behind. In essence, 2024 demands a strategic reorientation, with brands actively engaging with buyers well before the point of purchase to foster enduring relationships and drive sustainable growth.

In essence, 2024 demands a strategic reorientation, with brands actively engaging with buyers well before the point of purchase to foster enduring relationships and drive sustainable growth.

In our 2023 B2B Buying Disconnect Report: The Self-Serve Economy Is Prove It or Lose It, the economic climate completely challenged the traditional go-to- market (GTM) playbook. 87% of technology buyers reported adjusting their buying process to ensure they only bought mission-critical products that would provide return on investment (ROI). Additionally, at the same rate vendor-provided resources were being ignored, buyers were turning to self-service. As a result, marketers became laser-focused on proving ROI early in the research process and providing social proof to support product claims to a target audience likely to convert.

However, focusing solely on this approach in 2024 will hurt vendors competing with established brands. With vendors reportedly allocating less of their discretionary marketing spend toward top-of-funnel brand awareness initiatives (an average of 38%) and more to demand generation (an average of 53%), it will feel like the year of the brand crisis. To remain competitive in 2024 and beyond, brands must reorient their GTM strategies to the pivotal roles that brand awareness, trust, and transparency play in the buyer’s decision-making process.

The importance of brand-led growth

The decision process has changed yet again. Buyers are creating a short list and usually go with their first choice; research is done to justify their decision to the larger buying group. To make the short list from day one, your product must be top of mind before a buyer begins the research process. Vendors with market mindshare are securing their space at the top of a buyer’s short list.

The long and short of the infamous short list

Most short lists (63%) include two to three products and 96% include five or less. When selecting a product, 66% of buyers report leaning toward established, leading products—far outranking niche (19%) or new (11%) products. Of buyers creating short lists, 78% reported selecting products they had heard of before even starting the research process. That number was even higher for enterprise buyers at 86%. It’s no wonder top-of-mind brands seemingly edge out niche or new products early in the selection process.

"To stand out among similar products and make the short list, vendors must position themselves as trusted guides. Aim to connect with buyers emotionally and logically early in the decision process. From demos to onboarding— storytelling can be done throughout the buying journey."

Darren Fanton | CEO, ScreenSpace

Once the short list was created, 71% of buyers reported going with the product that was their first choice; only 12% went with a different choice. Coupled with the fact that the majority of buyers (78%) start their research process with Google, it’s becoming increasingly clear why brand-led growth (BLG) companies with strong recognition and robust search engine optimization (SEO) are outperforming competitors in the B2B landscape.

Buying groups and sales cycles

Buying group sizes have had slight shifts over the past year but are stabilizing. Groups of two to five people are what marketers should be thinking about when trying to multi-thread deals. It’s also important to keep in mind there are still people within the company who influence or are involved with the buying decision but not in the designated buying group, per se. By investing more in your brand, you’re investing more in inter- departmental influence through a buyer’s organization (think legal, procurement, etc.)

There are also more senior title decision-makers at the helm (52% holding VP titles or above). With the shift toward more experienced buyers, there could be more reliance on prior product experience and possibly less willingness to try a less established brand.

Over the past year, one-person buying groups grew 3% at the same rate two- to three-person buying groups shrank 3%. For enterprise purchase prices, teams remain larger overall, but it looks like teams are downsizing from more than 20.

When we segmented out the data by company size, small (53%) and mid-sized (39%) businesses peaked at two to three-person buying groups, and enterprise (34%) peaked at four to five-person buying groups. With more senior titles in the buying group, they may be more likely to hold the budget or be able to make purchase decisions. Larger buying groups for enterprise purchases make sense given the higher purchase price likely requiring more approvals.

In terms of purchase length, 87% of buyers reported completing purchases within six-month sales cycles. This number drops to 65% for enterprise buyers, hitting 87% by 12 months. Conversely, vendors only report an average of 70% of purchases completed within six months, hitting 89% at the 10-month mark. Another explanation could be that easier purchase paths equate to faster sales cycles due to fewer deals overall and smaller buying groups.

"The marketplace is buzzing around tech stack consolidation, driven by cost reduction efforts. But when tech purchase decisions are driven purely by finance, we might end up wasting more resources and productivity, resulting in lower ROI and frustration."

Trinity Nguyen | VP of Marketing, UserGems

Either way, with fewer decision-makers involved, it’s even more important that your product is recognizable. If buyers wait to contact a vendor until they make a decision, there’s a short amount of time for vendors to impact buying groups once they make the short list.

Entering the year of the brand crisis

We know buyers are short-listing products they’re aware of before they begin the research process. Yet, vendors reportedly spend less of their discretionary marketing spend on brand awareness (an average of 38%) than demand generation (an average of 53%). Why the disconnect?

One theory is that the impact of economic headwinds, budget cuts, layoffs, and general unease in the marketplace led brands to focus on fueling the pipeline with bottom-of-funnel campaigns. Justifying spend on brand awareness is hard to do when revenue goals aren’t met. However, open answers in our vendor survey reveal enterprise marketers are starting to realize that if you stop investing in brand awareness, you’ll lose in the long term.

“We will double down on awareness as our lack of visibility is costing us with lost deals.”

— Director in Marketing Leadership, 10,001+ employee company

Where’s the disconnect? Buyers are sticking with know-and-try-before-you-buy, while vendors are investing less in brand awareness.

Vendors who focus more on demand gen feel they already have an established brand presence or don’t see immediate gains from building brand awareness, whether as a result of tighter budgets or a desire for quick wins. Those focused more on brand awareness tend to be doing it as an intentional short- or long-term strategy, either as part of expanding into a new market, as part of a rebrand, or as a slower, longer-term growth strategy.

“We are already an established brand. Since we are facing a downtown in our leading market, we will be focusing on creating demand.”

— Individual Contributor in Product Marketing, 10,001+ employee company

With buyer behavior indicating a preference toward consolidating their tech stack, risk aversion to trying new products, or simply wanting the confidence that comes with choosing a proven brand, vendors must be mindful of striking a balance between short-term vs. long-term growth.

“Brand awareness isn’t just about filling the top of the funnel; it’s about engaging buyers throughout the entire journey, including post- sale. In-person events— are they demand gen, brand awareness, or both? Forget about the blurred lines and integrate brand awareness across all channels.”

Millie Beetham | Senior Director GTM Strategy at ZoomInfo Labs, ZoomInfo

Building buyer trust

Do you have the trust factor? Based on the data we gathered, we believe that most of the research buyers conduct is to convince others in the buying group to trust that their choice is right. That said, let’s look at the types of content people like to use to build collective confidence within the buying group.

Buyers are relying on fewer resources than ever, and the only top-five resource that saw an increase year over year (YoY) was “own prior experience.” Buyers continue to favor resources that allow them to get hands-on experience with a product (demos, prior experience, and free trials) and resources that can answer ROI and use case-specific questions, such as user reviews.

In a world where buyers seek information to back up a decision they’ve likely already made, vendors have fewer chances to change a prospect’s mind. However, it’s not all doom and gloom. Vendors can still make an impact by ensuring buyers have a good experience with the resources they want up front and to self-serve.

The role of review sites in maintaining buyer trust

User reviews continue to rank among the top three resources consulted by technology buyers, and some review sites are evolving to increase the self-serve product information they provide to buyers during their research process.

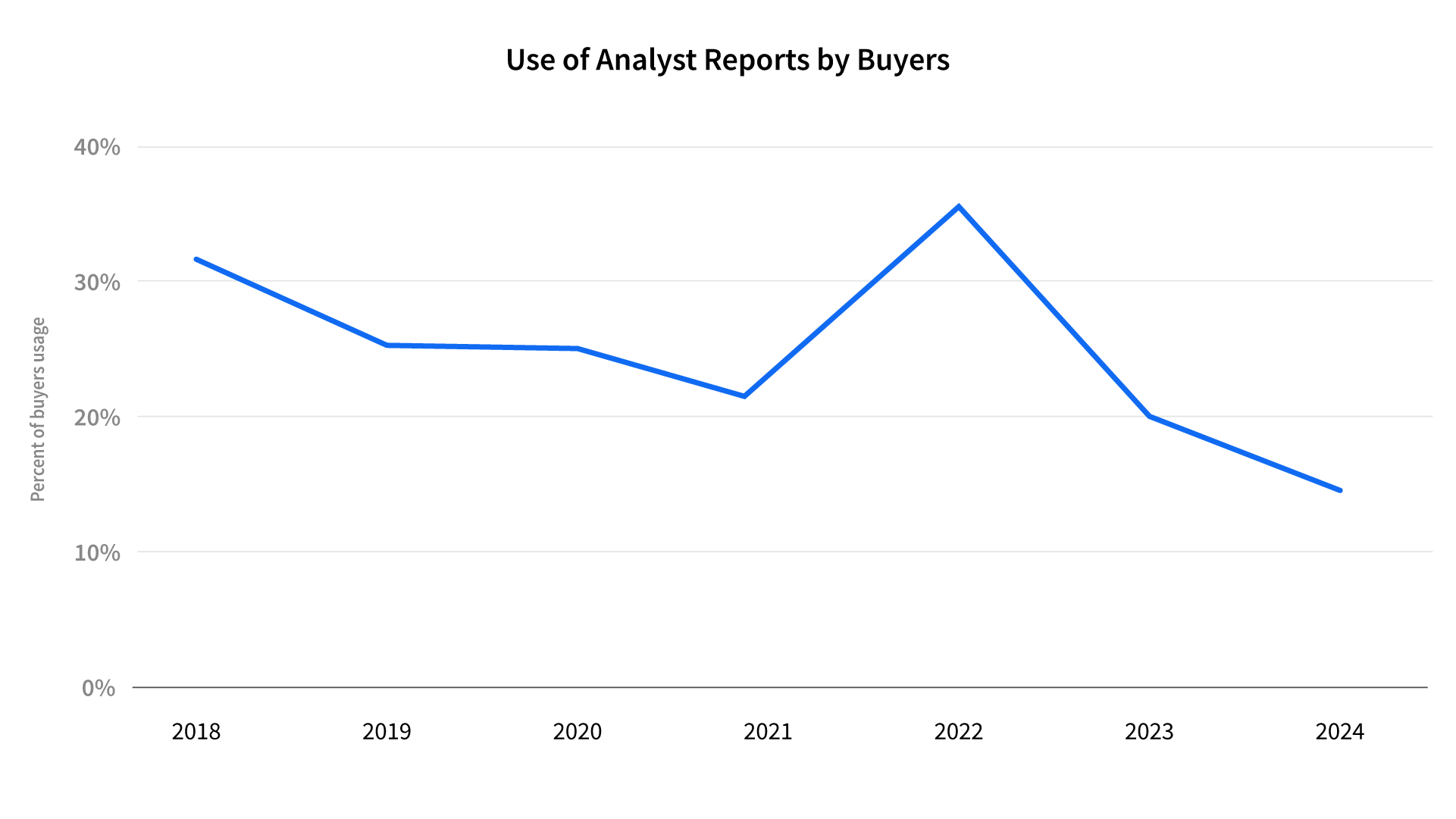

However, review sites aren’t immune to the trust issues plaguing the technology buying process, and saw a decrease in usage YoY. Even though the use of user reviews is down 10% YoY, it has remained flat over the past seven years, while the use of analyst reports reaches historically low usage at 16%—the lowest it has been in seven years and continuing to trend down. One explanation could be more millennial buyers relying on peers instead of analysts.

"Top sales performers recognize that as the sales cycle concludes, buyers shift focus from positive outcomes to potential risks. While early stages involve feature comparisons, inducing FOMO at the end of a sales cycle can prolong indecision. Instead, leveraging peer reviews can reduce perceived risk and accelerate the deal."

Krysten Conner | 3x SaaS unicorn rep (ex–Salesforce, Tableau, Outreach)

So what are buyers looking for when they find a review site they can trust?

73% of buyers believe that they regularly or sometimes see fake reviews online. This indicates that review sites themselves play a vital role in combating fraud and building buyer trust.

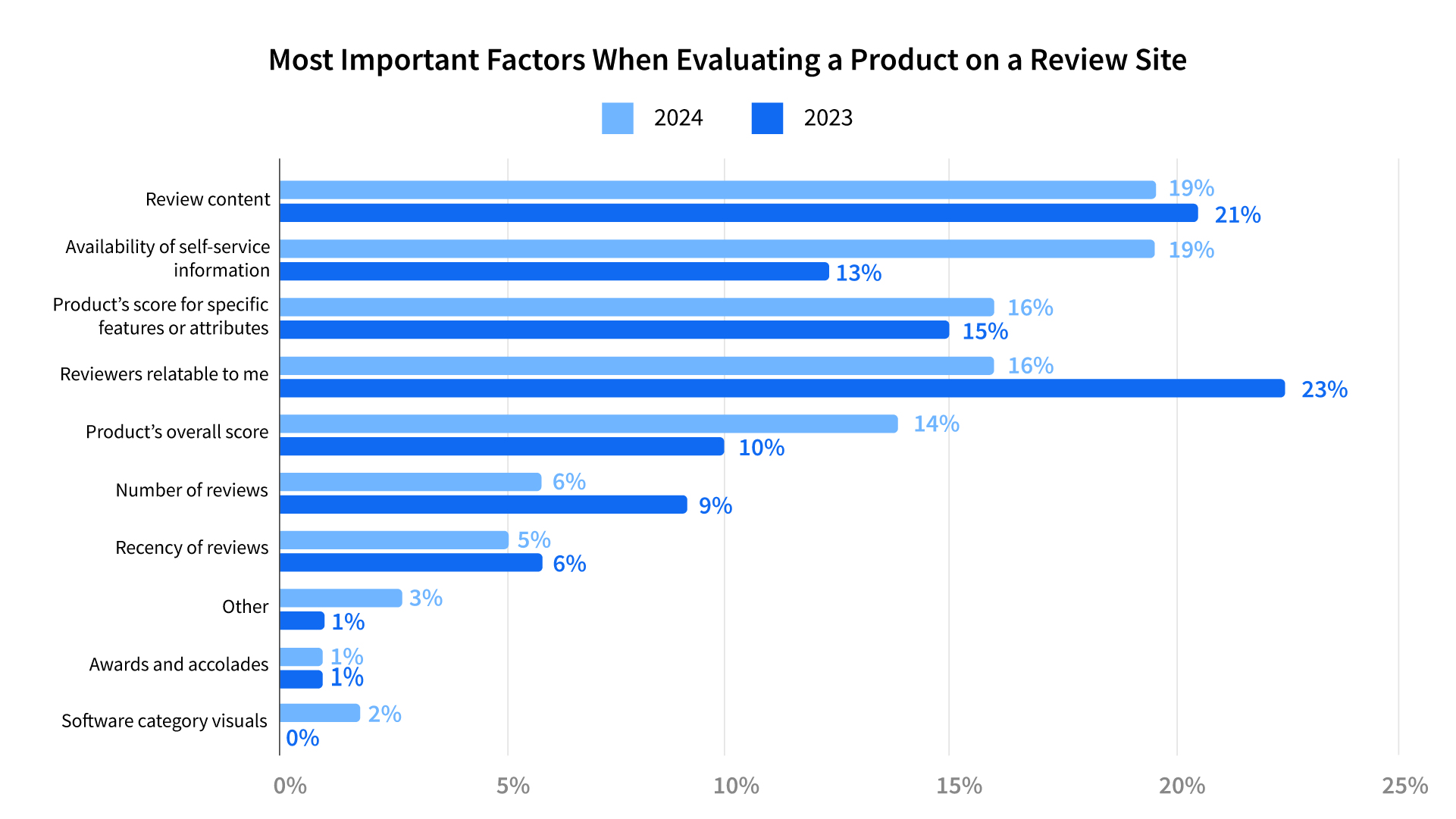

In general, the most important factors buyers are evaluating are:

- Review content: 19% (down from 21% in 2023)

- Self-serve information like demos and pricing: 19% (up from 13% in 2023)

- Product’s score(s) for specific features or attributes: 16% (up from 10% in 2023)

- Reviewers relatable to them (company size, industry, role, etc.): 16% (down from 23% in 2023)

- The product’s overall score: 14% (up from 10% in 2023)

This year, it appears buyers were seeking more tangible and shareable resources from review sites. It makes sense that in a know-and-try-before-you-buy world, resources such as product scores and pricing information saw increased usage. If a buyer already has a product in mind, demonstrating that it is viewed positively by users and within budget is likely a winning strategy to reach a consensus within a buying group.

Enterprise buyers responded similarly, selecting the same top five most important factors, but ordering them differently:

- Product’s score(s) for specific features or attributes: 22%

- The product’s overall score: 17%

- Review content: 15%

- Reviewers relatable to them (company size, industry, role, etc.): 15%

- Self-serve information like demos and pricing: 15%

The product’s score(s) for specific features or attributes is clearly important to enterprise buyers. Given the complexity of enterprise software products, these scores likely help buyers determine whether or not a product has the features that are most important to their specific use case. Scores for attributes such as customer support are likely important for enterprise buyers as well, as nobody wants to make a five- or six-figure purchase decision only to find they can’t get help when they need it.

"Ratings are one of the most polarizing review topics. Scores matter, but alone, they won’t sway buyers. Yet, low ratings risk exclusion. Vendors need strong scores and authentic, high-quality reviews from relatable peers to stand out."

Joe Kevens | Founder, B2B SaaS Reviews

Self-serve information ranks lower for enterprise buyers which might be because the information is harder to find for enterprise software products. Enterprise products are often complex software offerings with custom pricing, so the likelihood that transparent pricing information is available for these products is lower.

All in all, buyers are relying more on their own prior experience and consulting fewer resources when evaluating their technology purchases. For vendors, this means that it’s crucial to ensure that buyers have a positive experience with every resource they seek out in their research process. Engaging with trusted review sites to ensure the content prospective buyers seek, such as quality reviews, pricing information, and product demos, will help you gain mindshare.

The know-and-try-before-you-buy mindset

Buyers are utilizing a know-before-you-buy mindset when creating their short list by prioritizing products they’ve heard about before starting their research process. Once they have that short list though, they shift to try-before-you-buy in an effort to gain product knowledge before making their final purchase decision.

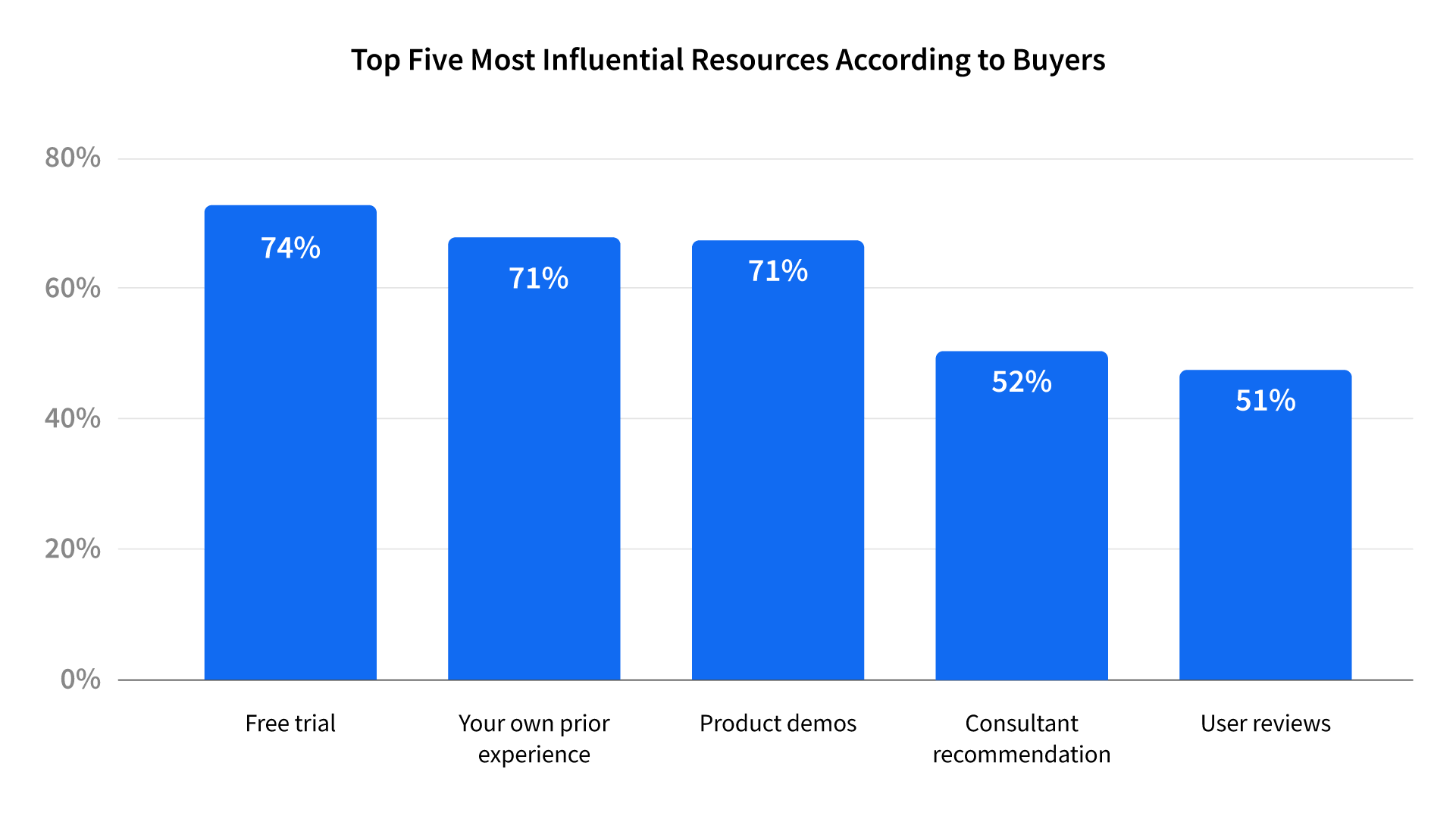

All of the top three most influential resources consulted by buyers in this year’s survey indicate that buyers seek hands-on experience with a product to make a confident purchase decision.

FREE TRIALS

40% of buyers surveyed indicated that they utilized free trials or free versions of the software as a part of their purchase process. Of those who used free trials, 74% said they were the most influential resource during their research.

Buyers want to make sure the product they’re purchasing will meet their needs, and what better way to do that than to use it? Short of having prior experience with the product in another role, free trials are the easiest way to get this assurance.

Where’s the disconnect? This represents a disconnect with vendor marketing strategies. When we asked vendors what their top five marketing tactics were, free trials didn’t crack the list. Vendors should seek to provide their prospects with a quality try-before- you-buy experience to allow buyers to make confident purchase decisions.

PRIOR EXPERIENCE

Of the top five resources consulted by buyers, prior experience was the only one that saw a YoY increase. 52% of buyers relied on their own experience with a product to make their purchase decision.

This year, we noticed a shift in buying group demographics. Group sizes are stabilizing with two to five members, and these buying groups are made up of more senior employees. Given that more experienced buyers are making purchase decisions, it makes sense that prior experience was the most influential resource for 71% of the buyers who relied on it. After all, using the product is the easiest way to determine if its feature set will fit a business’s unique use case.

Where’s the disconnect? Vendors are likely missing out on deals, as only 26% of vendors report re-engaging with former customers. Since more than half of buyers rely on their prior experience with a product, outreach to former customers and product champions who have moved on to new companies is likely an effective tactic.

PRODUCT DEMOS

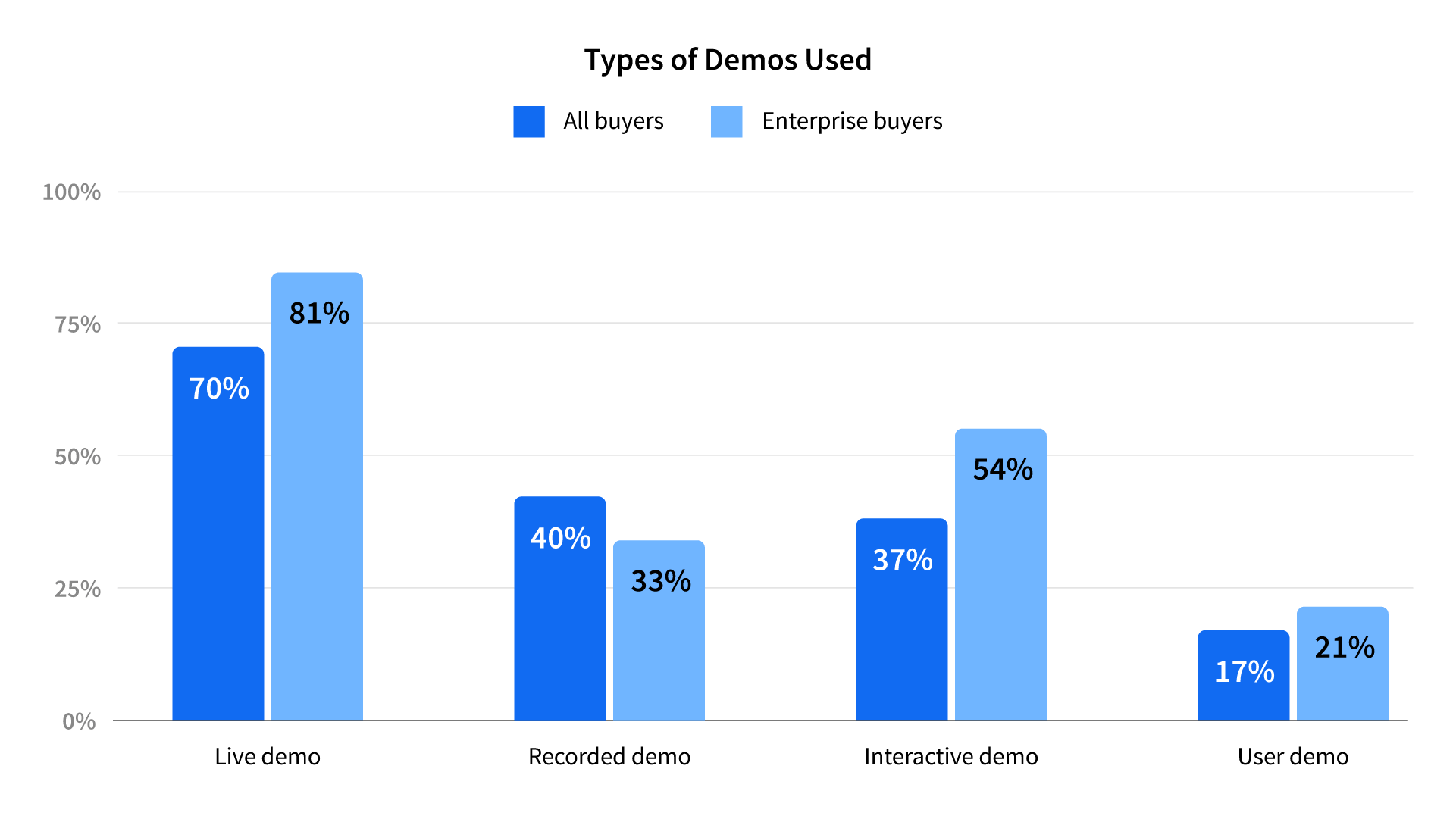

Demos were the most frequently consulted resource for technology buyers, with 54% utilizing at least one type of demo. At the enterprise purchase level, this number increases to 67%. 71% of buyers who utilized demos said demos were the most influential resource they consulted.

The reliance on demos in the world of know-and-try-before-you-buy makes perfect sense. 78% of buyers had heard of the product they purchased before they started their research process. At the start of the purchase cycle, buyers are searching for products they’re generally familiar with, and demos can help answer use case-specific questions about must-have features.

"Compelling demos seal mid-market & enterprise deals. Vendors often view demos as late-stage, but buyers have already shortlisted, consulted peers, & researched. Enterprise buyers rely on experience & peer reviews, with demos sealing the deal. TL;dr for vendors: Don’t underestimate early demos’ power."

Simon Jones | Managing Partner, Destrier

From this pattern, we can see that live demos are a must-have for vendors. 93% of vendors surveyed who offer demos indicated they offer a live demo option, which shows that they’ve figured it out. The majority of vendors who offer demos also offer recorded and/or interactive demos.

This is especially important for vendors in the enterprise market, as enterprise- level buyers were more likely to seek out multiple types of demos. Since enterprise software products are often customizable for a business’s unique use case, free trials aren’t always available. Demos can help buyers determine whether or not a product will fit their needs in a scenario where they can’t rely on a free trial or their own prior experience.

Generative AI’s rightful place in the buying process

Hint: It’s not what you think!

Generative AI (GenAI) tools such as ChatGPT are inescapable in the tech industry. In fact, 48% of buyers indicated they use GenAI tools on a routine basis (monthly or more often). 66% of buyers in total say they use these tools in their jobs.

68% of tech buyers in our sample indicated that GenAI tools have had no impact on their tech buying process. 20% of buyers indicated that GenAI made it easier for them to find the information they needed, while 10% said it made it harder for them to figure out what information they could trust.

While many tech industry folks are experimenting with these tools for everyday tasks, it seems they haven’t yet broken through to tech buying research. Only 21% of tech buyers in our sample utilized GenAI tools in their buying process. A further 9% reported that utilizing GenAI in their research wasn’t helpful.

"As content creation and workflow processes become automated, idea originators, creators, and makers must focus on creating distinctive and authentic assets to remain top of mind. Think SNL Writer’s Room but for B2B marketing."

Grant McDougall | Founder & CEO, BlueOcean

It seems that, for now, buyers are treating AI-generated content with a healthy dose of skepticism and are relying instead on whatever experience they can get with the product via free trials, demos, and peer connections.

As these tools become more prevalent, however, it stands to reason that buyers may begin to see them as a valuable tool in speeding up their research process for technology purchases. This means that vendors will be at the mercy of the data used to train the AI model. Each AI model is trained differently, but the basic principle is the same. The model learns from the data it has access to and utilizes this to create content for its end users.

The good news is vendors can help drive the data that feeds AI models with a strong brand strategy, ensuring there’s plenty of content about their company and products available online.

A strategic approach to embracing transparency

With 66% of buyers leaning toward an established, leading product, and with Google being the top contender of websites used to research products, it’s even more important to have a brand presence and to be considered much earlier in the buying process. Brands must build buyer confidence by proactively positioning product information in research channels.

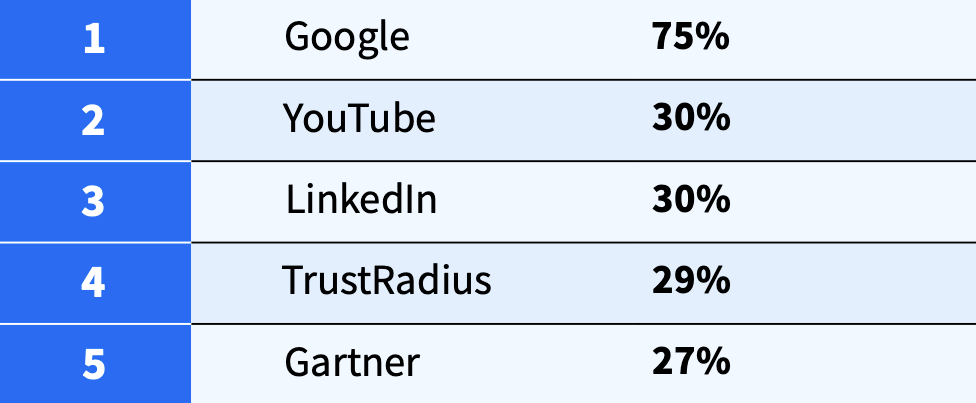

When asked which websites buyers use to research products, the top five were:

Enterprise buyers answered similarly for Google and YouTube but used TrustRadius, LinkedIn, and Gartner more. The top five were:

We correlate the increased use of LinkedIn as a search engine with buyers wanting to find peer conversations about a product or service.

How user conversations guide the decision-making process

56% of buyers said they had conversations with a product user before purchasing (71% were for enterprise purchase prices). Our results show these conversations are overwhelmingly helpful to buyers when making a decision.

Where’s the disconnect? Vendors estimate this number is much lower, guessing an average of 34%, with one-quarter of vendors guessing 12% or under.

But, who are buyers talking to—who is influencing their decisions?

50% of buyers (62% enterprise) are seeking out former colleagues or known peers to discuss options, 35% talk to coworkers (32% enterprise), and 27% are using vendor-provided references (46% enterprise) as their top three choices. With those three adding up to well over 100%, that means buyers are having multiple conversations with multiple groups to help inform decisions. So again, it isn’t solely about what is said about your brand, it’s about who says it.

"Simplifying complexity elevates B2B customer experiences. In a tech- saturated remote world, human connection is invaluable. Embrace conversations happening about you—they’re your most powerful marketing asset."

Rebecca Stone | SVP, Customer Solutions Marketing, Cisco

Though buyers were more likely to seek out peers for conversations, 90% of buyers rated conversations with coworkers highest as helpful or very helpful; whereas, conversations with peers (89%) came in at a close second, and were rated slightly higher than those found through vendor-provided references (83%), community forums (83%), and online search (81%).

The noteworthy part comes in the top three things buyers are looking to gain from these conversations—confirmation, transparency, and validation. Buyers listed “The confidence to move forward” highest (68%)—confirmation that they were making the right decision. Next, was “An answer to a specific question about their use case” (54%)—gaining product transparency by diving further into the details of its capabilities. Then came “validation of their other research findings” (51%). Validating what the vendor told them (49%) was high up in the running as well.

This means buyers who are seeking out conversations around a product already had one in mind as their top choice, but wanted a little more proof before making a purchase.

"For marketers aiming to be found, a go-to- network strategy is vital. Enterprise buyers turn to communities, formal (like Pavilion) or informal (peers), for trusted advice. Focusing only on SEO means missing valuable conversations about your brand."

Kathleen Booth | Senior VP of Marketing and Growth, Pavilion

What buyers wish was different about tech buying

Underscoring the importance of transparency and accessibility in the tech buying process, we asked buyers a new question this year: “What do you wish was different about tech buying?” Overwhelmingly, buyers emphasized the importance of transparent pricing, frustration with vendors contacting them prematurely, access to peer experiences with products, guidance on unfamiliar criteria or requirements, and less aggressive sales tactics.

When we segmented out buyer data for enterprise purchase prices, the wish for “calculating ROI to be easier” rose a staggering 16%, placing it in the top two things buyers wished were different about tech buying.

Enterprise purchase price top five were:

- I wish all vendors had transparent pricing: 51%

- I wish calculating ROI were easier so I could get the budget approved: 47%

- I wish vendors would stop contacting me when I’m not ready to talk: 44%

- I wish I could easily talk to people like me who have experience with the product: 42%

- I wish someone could tell me about the criteria or requirements I don’t know about but should: 36%

"“We have a gigantic ROI gap right now and the adage of ‘Nobody got fired buying IBM’ is resurfacing in the marketplace because proving ROI is difficult to do. To cut through the noise, emerging vendors must substantiate claims with credible and compelling samples of proven ROI, focusing on specificity and richness of offerings."

Evan Huck | CEO, UserEvidence

Peer reviews are one way to validate a buyer’s short list early in the decision- making process. However, if enterprise buyers are not confident that new or niche products will solve their particular use case or provide a positive ROI, they may default back to brands with proven ROI.

If you’re not an established, leading brand, you can still cut through the noise by supporting your marketing claims with tangible examples of ROI supported by customer proof points. Note that customer proof points should come from your ideal customer. People care about who is saying it just as much as what they say about your business.

How buyers make decisions

After buyers have completed their research throughout the different channels, it’s time to make a decision. The effort buyers put into utilizing free trials, user reviews, demos, and conversations shapes the final outcome, and it turns out, after doing all of these things, buyers say reaching a decision was not hard at all (46%) or not too hard (43%).

On top of it not being difficult to reach a decision, most buyers said getting the purchase approved was easy (40%) or somewhat easy (41%). However, enterprise buyers do not tend to have it quite so easy. Only 19% of enterprise buyers said approval was easy to obtain, and 31% said it was difficult, whereas only 17% of the general population listed approval as difficult. This suggests that even when everyone is in agreement, getting approval for large purchases is harder.

46%

of buyers say reaching a final decision was not hard at all after utilizing free trials, user reviews, demos, and conversations.

However, once a decision was made, 79% of buyers were very confident in their final decision, and 99% were either very confident or somewhat confident. Buyers are so confident because they know the product will work for them—often before beginning the research process—because they know the brand and its reputation in advance. To reiterate what Evan Huck, CEO of UserEvidence said, “No one ever got fired for buying IBM.”

That is why it’s imperative for brands to establish their name as a proven solution in today’s buyers’ minds.

How vendors think buyers make decisions

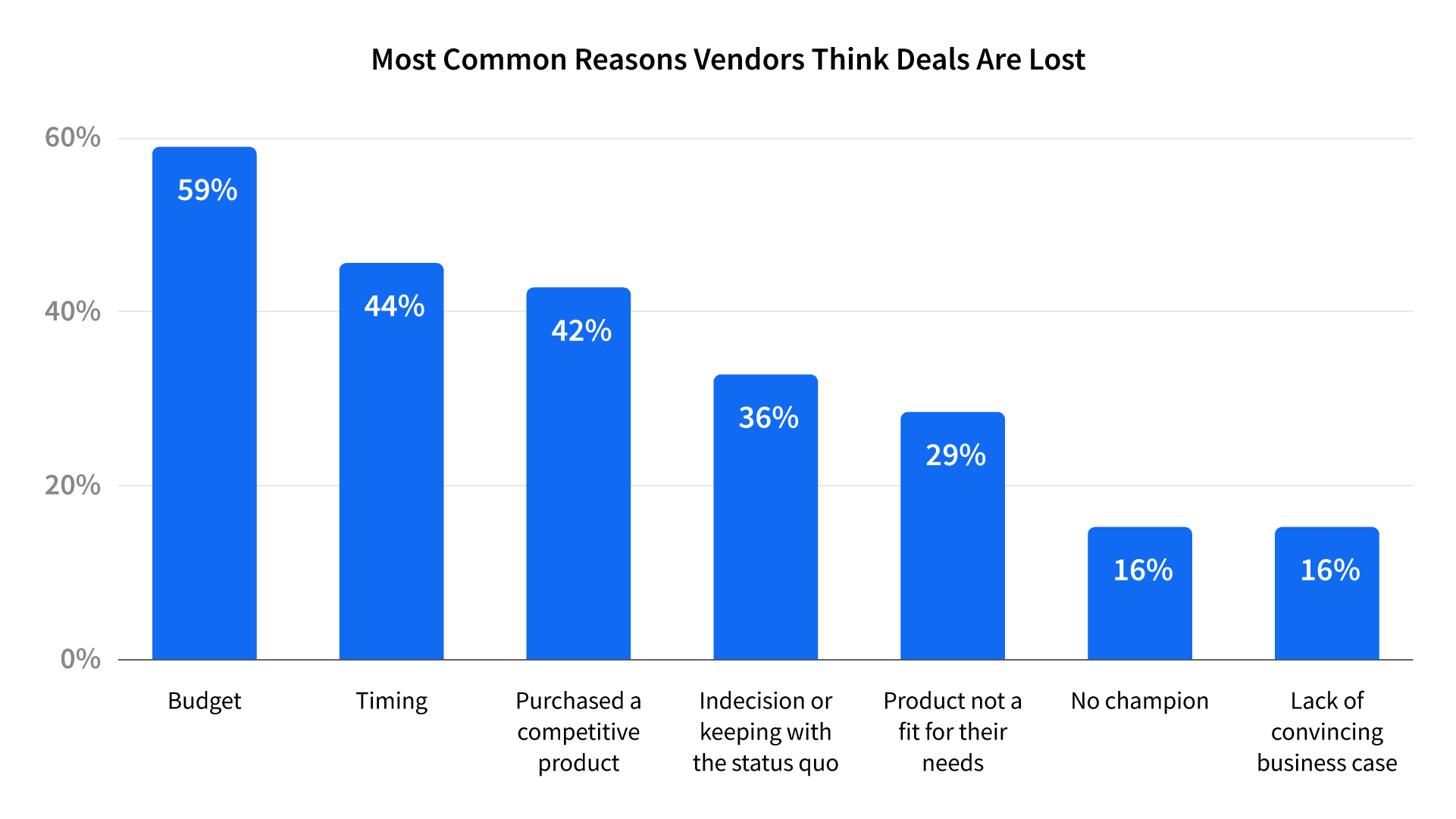

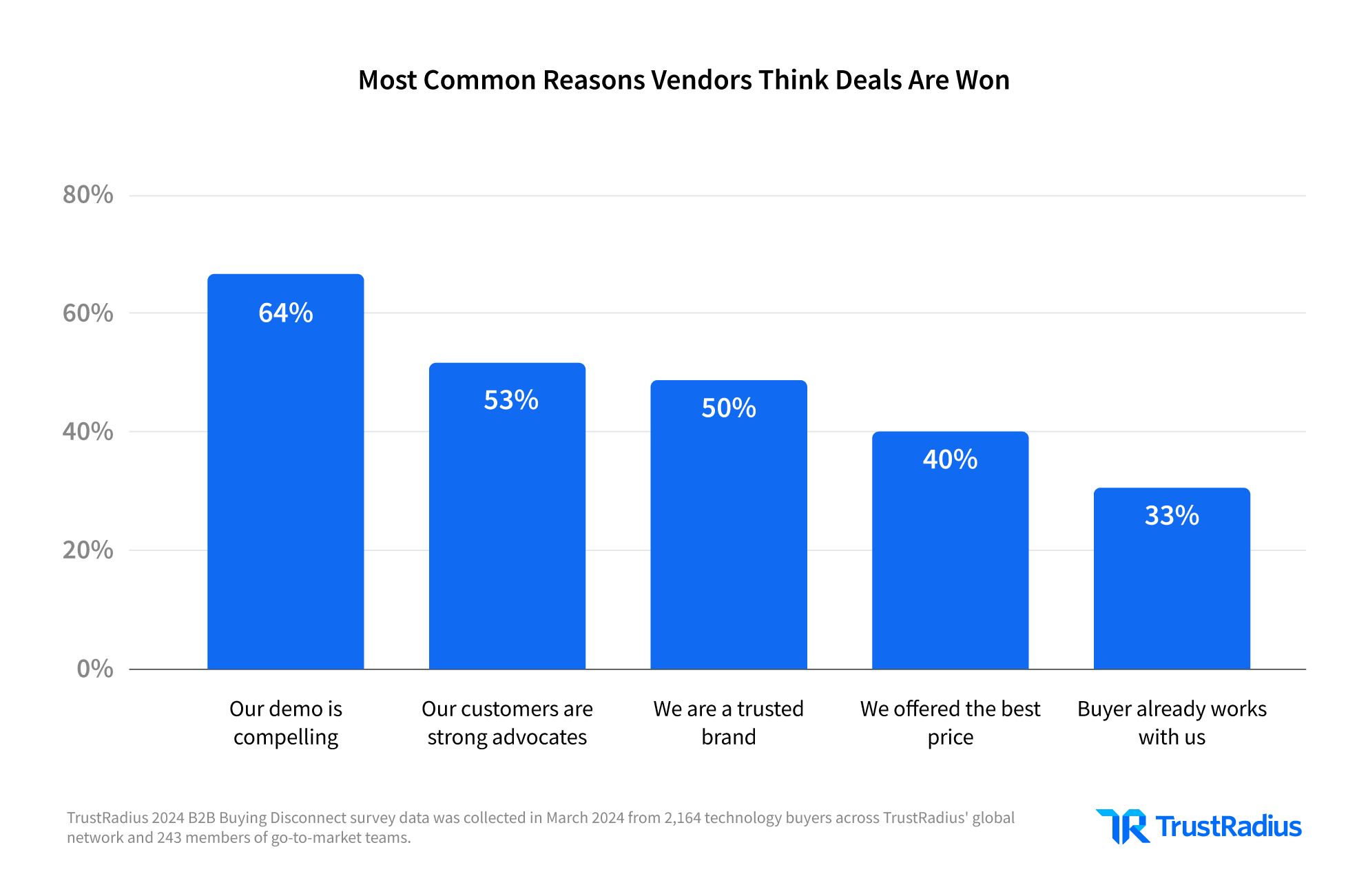

Here is where things get really interesting. We asked vendors what they thought were the most common reasons deals are lost or won. It turns out that vendors believe deals are lost mostly because of a buyer’s budget (59%) and won mostly because their demo is compelling (64%).

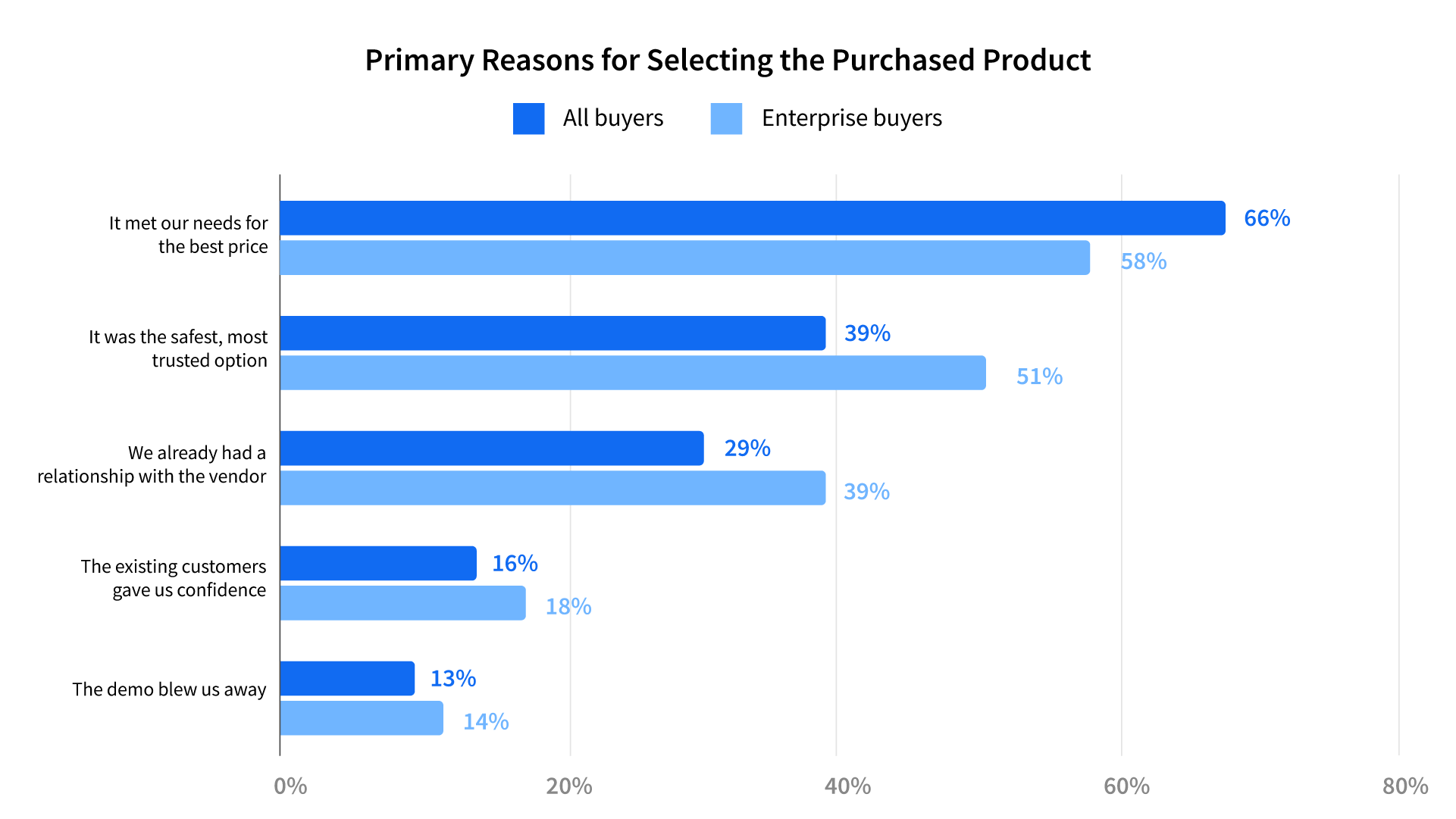

Where’s the disconnect? As for the reasons deals are won, this is a pretty clear mismatch with what buyers are saying. Buyers rank demos lowest as the final reason for choosing a product, while vendors think buyers rank them highest. It’s true that having a demo is very important to buyers during the research phase, but it’s clearly not the deciding factor. In reality, the number one reason buyers select a product is because it “met our needs for the best price” (66%; 58% for enterprise).

Reasons buyers selected the product they ultimately purchased:

- It met our needs for the best price: 66% (58% for enterprise purchase prices)

- It was the safest, most trusted option: 39% (51% for enterprise purchase prices)

- We already had a relationship with the vendor: 29% (39% for enterprise purchase prices)

- The existing customers gave us confidence: 16% (18% for enterprise purchase prices)

- The demo blew us away: 13% (14% for enterprise purchase prices)

"Nearly half of closed/ lost deals result from indecision, influenced by factors like deal complexity and buying group turnover. However, inaction due to risk aversion poses the greatest challenge for tech sellers. Drive decision-making by leading with potential losses incurred by not acting."

Ken Lempit | Host of the SaaS Backwards Podcast and President of the Austin Lawrence Group (B2B SaaS Demand Gen Agency)

Though buyers were not asked why they did not make a purchase, we can deduce from the reasons they did that what vendors think sways buyers and what actually sways them is not lining up.

There also needs to be some thought put into why deals are stalling out. Is the ability to gain collective confidence at a standstill? Is there a fear of making a mistake in the choice or a fear of missing out? Based on the high stakes of a risk- averse, fast-paced economy, it’s likely a bit of “all of the above.”

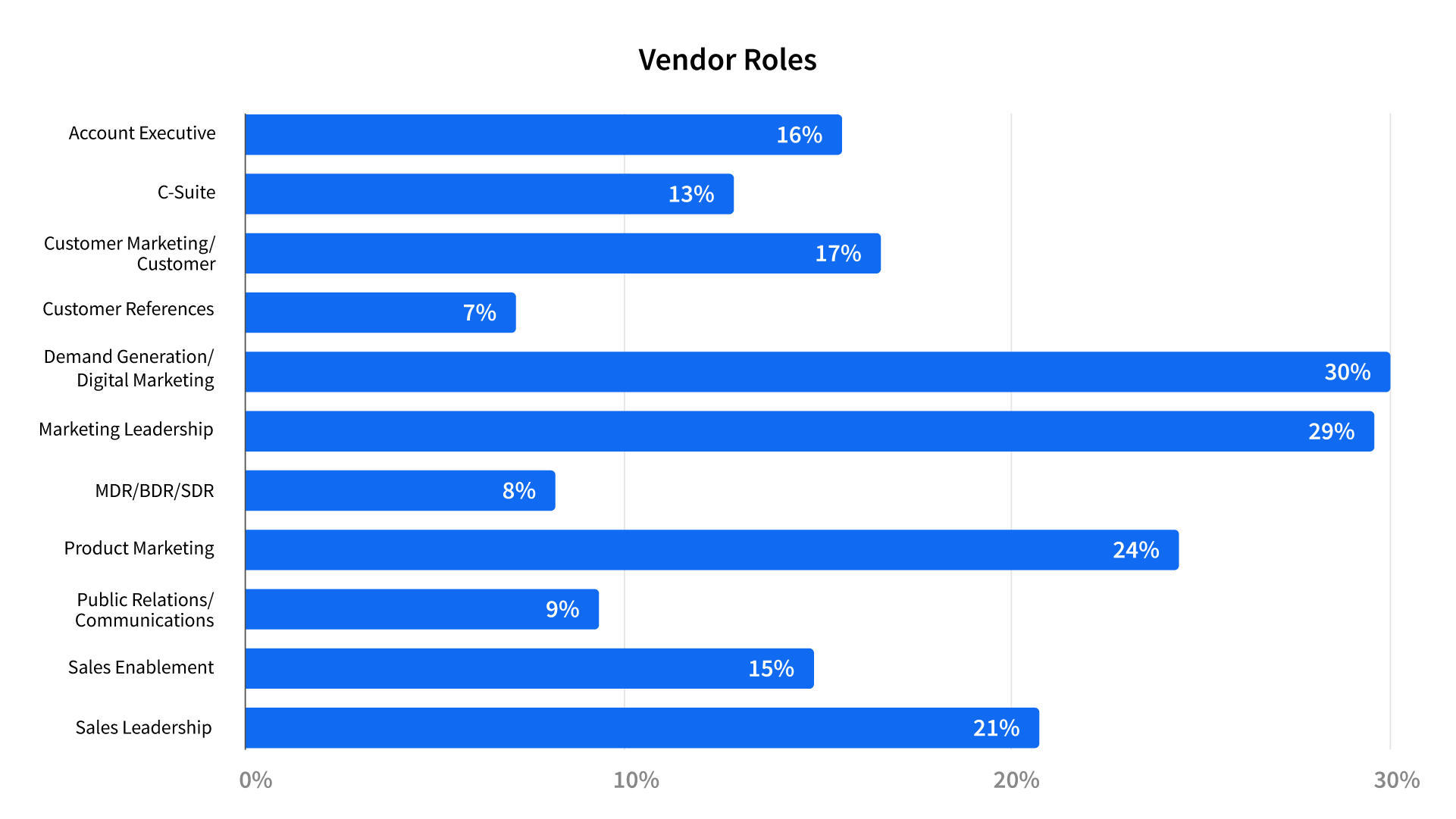

The effectiveness of vendor tactics

Just like buyers letting us in on their favorite resources to use, vendors have disclosed their top five marketing tactics: case studies, vendor website, sales reps, marketing collateral, and customer references.

The use of case studies and vendor websites has not changed much percentage-wise between 2023 and 2024, but things did shift order. Case studies continue to be the top tactic, even though buyers consistently place them low on the list of consulted resources.

Rounding out 2023’s top five vendor tactics were marketing collateral, vendor website, product demo, and vendor blog—only two of which hit 2024’s top tactics, making three in total with case studies. With customer references and sales reps making their way into the top five, this shows that vendors switched to a more personable approach in place of self-serve digital information.

When comparing the top five vendor marketing tactics versus the top five resources buyers consulted, we only have one overlapping resource—vendor/ product website. Sales reps were next in line as a common resource, but in sixth place; whereas the rest of vendor tactics were further down the line for buyers.

Vendors who know the effectiveness of the tactics they’re focusing on can make a better argument for shifting focus or hyper-focusing on certain ones. So how well are these tactics performing?

According to vendors, their top three most effective and very effective tactics are:

- Customer references: 89%

- Sales reps: 91%

- Free trial: 80%

When comparing what vendors and buyers say are most effective, the only one in alignment of the top three is free trials. Buyers listed free trials (74%) as their number one most influential resource consulted, which makes sense why 80% of vendors would find them very effective or effective.

Where’s the disconnect? Vendors list free trials as the third most effective tactic, yet it doesn’t even hit their top five used—that is a missed opportunity. Also, the second and third most influential resources consulted by buyers are prior experience (71%) and demos (71%), yet those also did not fall on the vendor’s top five list. Free trials and demos are a relatively easy add to a vendor’s arsenal, but prior experience can be trickier. Vendors who nurture relationships with former users, and those who have changed companies, may find a richer return on efforts.

Vendor GTM challenges and performance

Because we learned that buyers are creating a short list and usually going with their first choice, it’s imperative a product is top of mind before the research process begins in order to have the best chance at being chosen. Unfortunately, we also uncovered that vendors are spending less on brand awareness than demand generation right now.

So, it’s no surprise that when vendors were asked about their GTM challenges, most responded with sales and marketing effectiveness (24%). Though demand generation is still integral, sales and marketing should shift their attention to increasing brand awareness, which ties in to the second biggest challenge— compelling positioning and messaging (16%).

"The oversaturated tech landscape, flooded with choices, has heightened buyers’ awareness of the consequences of hasty decisions. With so much information, buyers have become cautious to a fault. At the same time, vendors that continue to push product messaging over building brand trust aren’t finding their sales and marketing effective."

Allyson Havener | Senior Vice President, Marketing and Community, TrustRadius

If your grasp on what the target market is looking for is not spot on, your target market will move along to the next option. The compelling positioning and messaging may be challenging teams because it’s not speaking to the brand, but the product.

We also asked vendors to grade themselves on their GTM performance. Fascinatingly, the most common grades vendors gave themselves were a B and B+ (40%, collectively). 80% of vendors gave themselves a B- or above.

What are the A and A+ vendors doing differently, and why are they so confident in their performance? Perhaps they are more aligned with buyers in their GTM efforts and are seeing better results. Or perhaps they are part of larger, well-known brands that are succeeding due to established brand awareness in the public’s eye.

Methodology

Data for the TrustRadius 2024 B2B Buying Disconnect Report was sourced from the TrustRadius global network via an online survey.

In March 2024, we sent online surveys to professionals who were involved in a software or hardware purchase for their organization in the past year. In April 2024, we sent a separate survey to members of go-to-market teams for technology vendors. We received complete, verified responses from 2,164 technology buyers and 243 technology vendors.

All respondents were offered a nominal incentive ($10 gift card) as a thank-you for their time. We’ve included information below on the demographics of our survey respondents.

For a full list of survey questions and answer choices, or if you have any questions about the data, email us at research@trustradius.com.

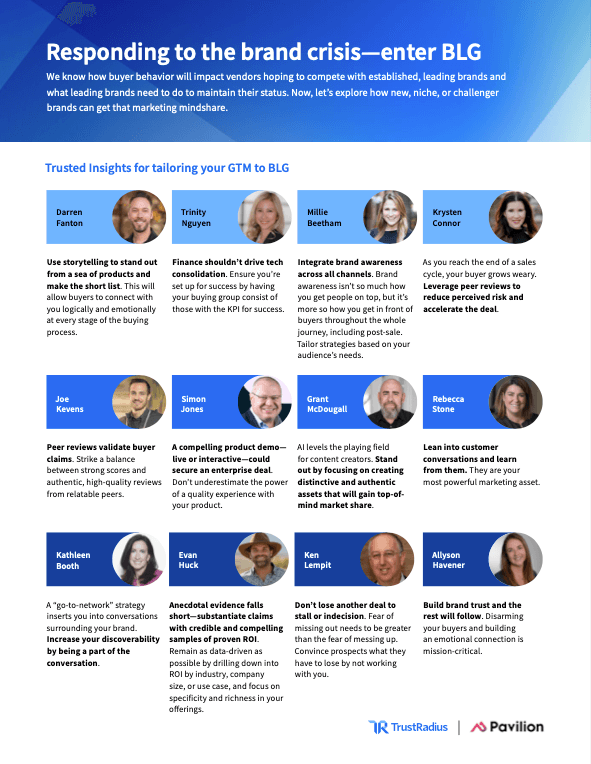

Responding to the brand crisis—enter BLG

We know how buyer behavior will impact vendors hoping to compete with established, leading brands and what leading brands need to do to maintain their status. Now, let’s explore how new, niche, or challenger brands can get that marketing mindshare.

Trusted Insights for tailoring your GTM to BLG

About Pavilion

Unlock your full professional potential—join more than 10,000 of your peers in the world’s largest private community for GTM leaders and their teams.

Achieving success as a GTM executive has never been more challenging. Pavilion provides its members with the skills, tools, and resources needed to advance in their careers, along with a global community built on the values of kindness and reciprocity. With thousands of members across 450+ cities around the world, you’ll never have to go it alone.

Join Pavilion to gain access to our private Slack community, local chapters and events, 50+ Pavilion University courses and schools, a Knowledge Hub, jobs board, conferences and summits, 1:1 matchmaking, and more. Wherever you are in your B2B SaaS career, Pavilion has the tools to support your path. We’ll partner with you from the beginning and ensure you get what you need to make an impact at every stage of your journey. Pavilion is where transformation happens— personally and professionally.

About TrustRadius

TrustRadius is a buyer intelligence platform for business technology. We enable buyers to make confident decisions, through comprehensive product information, in-depth customer insights, and peer conversations. We help technology brands capture and activate the authentic voice of customers to improve their products, build confidence with prospects, and engage in-market buyers to improve ROI.