5 Vendor Takeaways From The 2023 B2B Buying Disconnect Report

What’s changed this past year in B2B buying?

In one word: lots. If 2022 was The Age of the Self-Serve Buyer, then 2023 is Prove It or Lose It, in which vendors need to demonstrate why their solution is mission-critical with a clear path to ROI to get a buyer to buy.

Over 1,000 vendors and buyers have shared their perspectives in the eighth annual B2B Buying Disconnect report. The 23-page report covers a lot of ground.

Drawing on my experience working in Demand Generation and with B2B SaaS Reviews, here are my five key takeaways for vendors to help reduce the disconnect with buyers.

What are the 5 Vendor Takeaways from the 2023 B2B Buying Disconnect Report?

1. Vendors are underestimating the influence of indirect channels on buyers

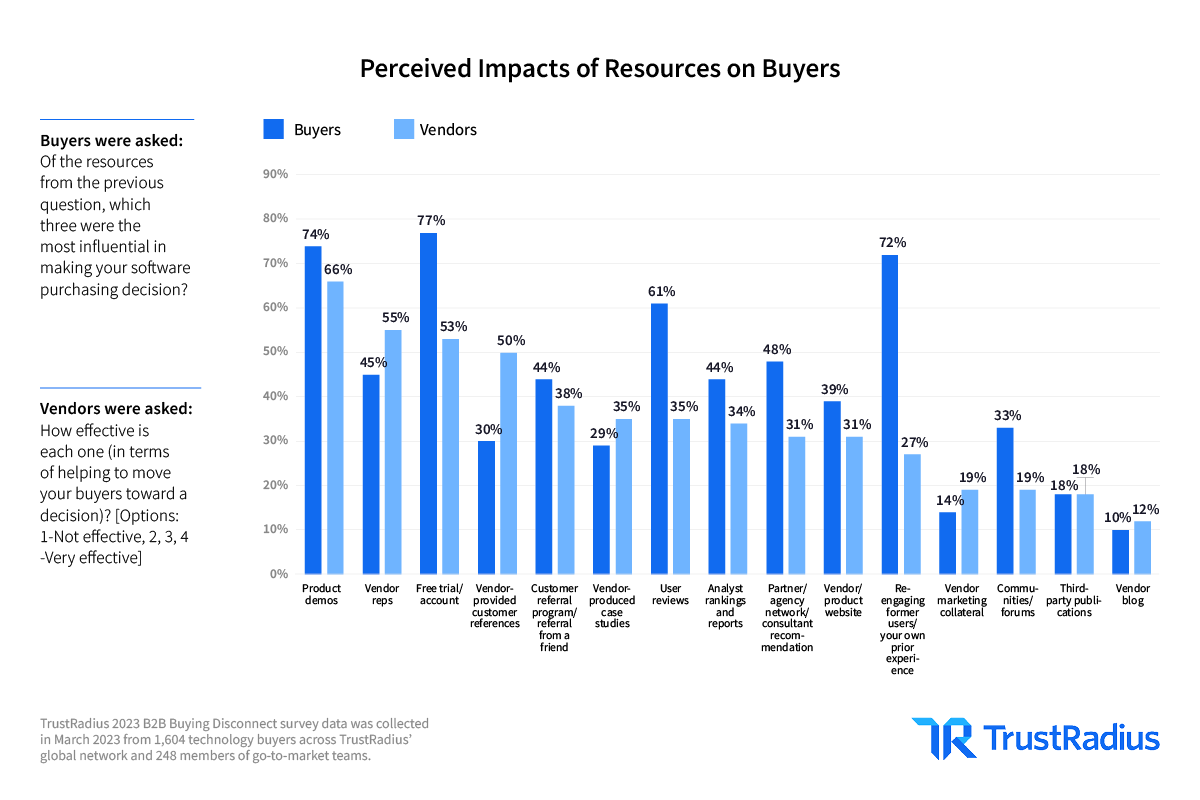

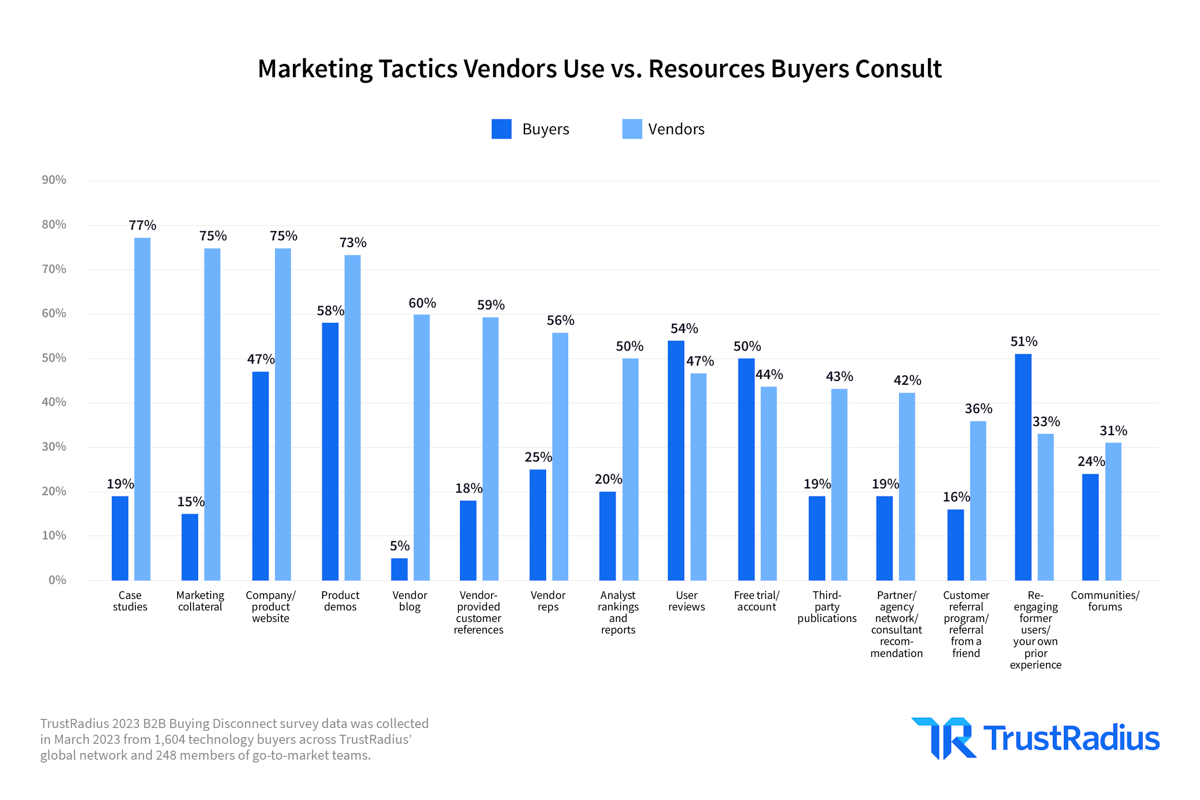

Perhaps the biggest buyer/vendor disconnect: vendors tend to overestimate the influence of their direct efforts and underestimate the influence of their indirect efforts.

Yes, there are product-focused exceptions with direct, like demos and free trials/ accounts. But direct resources like Vendor: reps, customer references, cases studies, marketing collateral, and blogs were all seen by vendors as more effective than how buyers see them.

On the other hand, indirect resources such as user reviews, partnerships, communities, and even analysts are underestimated.

None are a silver bullet, but these indirect resources represent an opportunity for vendors to increase their influence on today’s buyers.

Vendors need to face up to a truth they already know: with each passing years, buyers trust them less and less. By investing more in indirect channels, vendors can increase their credibility and trustworthiness in the eyes of their buyers.

2. ROI, ROI, ROI

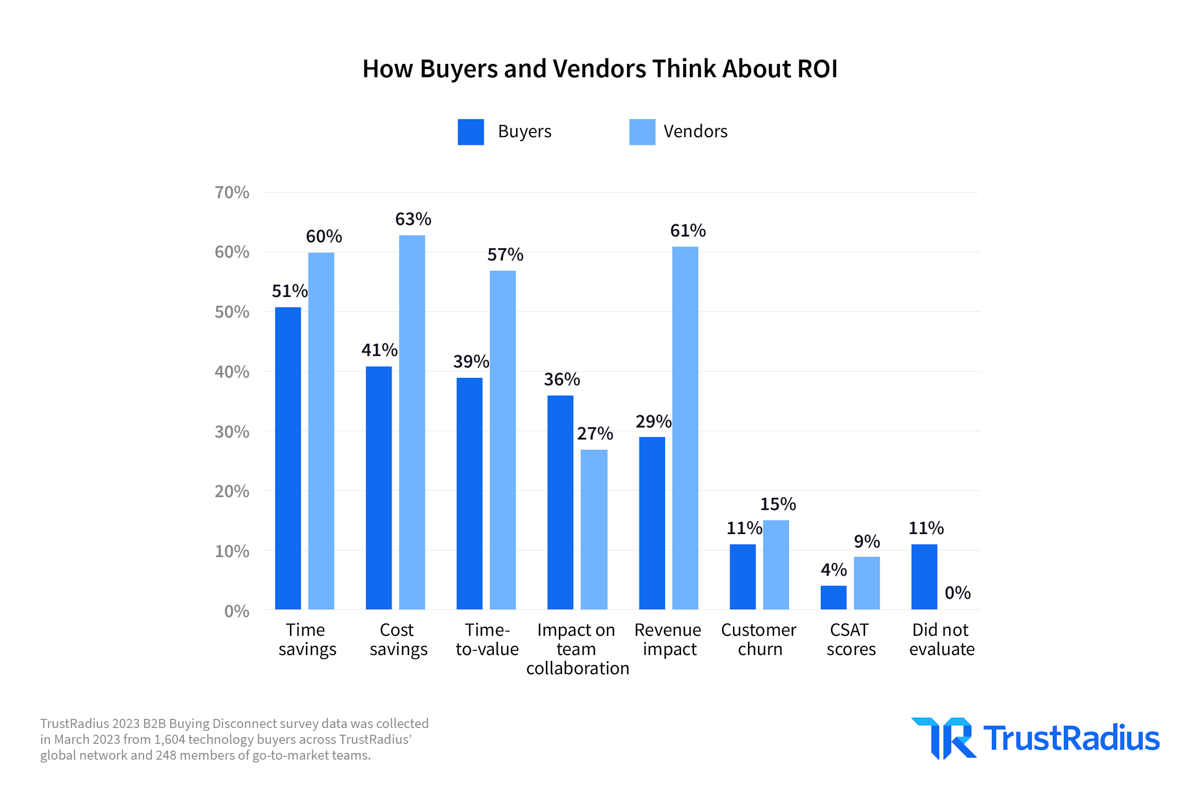

The easygoing season of “growth at all costs” is over. Where now in the unforgiving season of “profitable growth.”

TrustRadius found that “87% of technology buyers adjusted their buying process to ensure they only buy mission-critical products that will provide ROI.”

Buyers surveyed think about ROI in more ways than one: time savings, cost savings, time to value, impact on team collaboration, revenue impact, customer churn, etc. Vendors need to align with their buyer’s view of ROI.

Interestingly, vendors appear to be over-indexing on revenue impact (61%) vs. buyers (29%.) It’s surprising given that 27% of buyers surveyed said there were more decision-makers involved in their buying process due to the current economic climate (everyone seems to be feeling the increased CFO involvement) and that ROI metrics are the 4th top thing a vendor can do to make buyers more likely to purchase.

Perhaps buyers see the mission-critical jobs to be done as the means to revenue impact and place more value on tools that can help them get it done by saving time, better collaboration, etc.?

Regardless, ROI matters even more in this tough environment. As Sangram Vajre at GTM Partners says, you need to prove to your buyer that you can solve a problem that’s important to them. That’s the number one thing that cuts through the noise to marketing leaders as buyers, he’s found through CMO interviews.

3. Help buyers become more self-sufficient

The age of the Self-Serve Buyer continues to unfold. This year’s findings show that buyer self-sufficiency continues to rise.

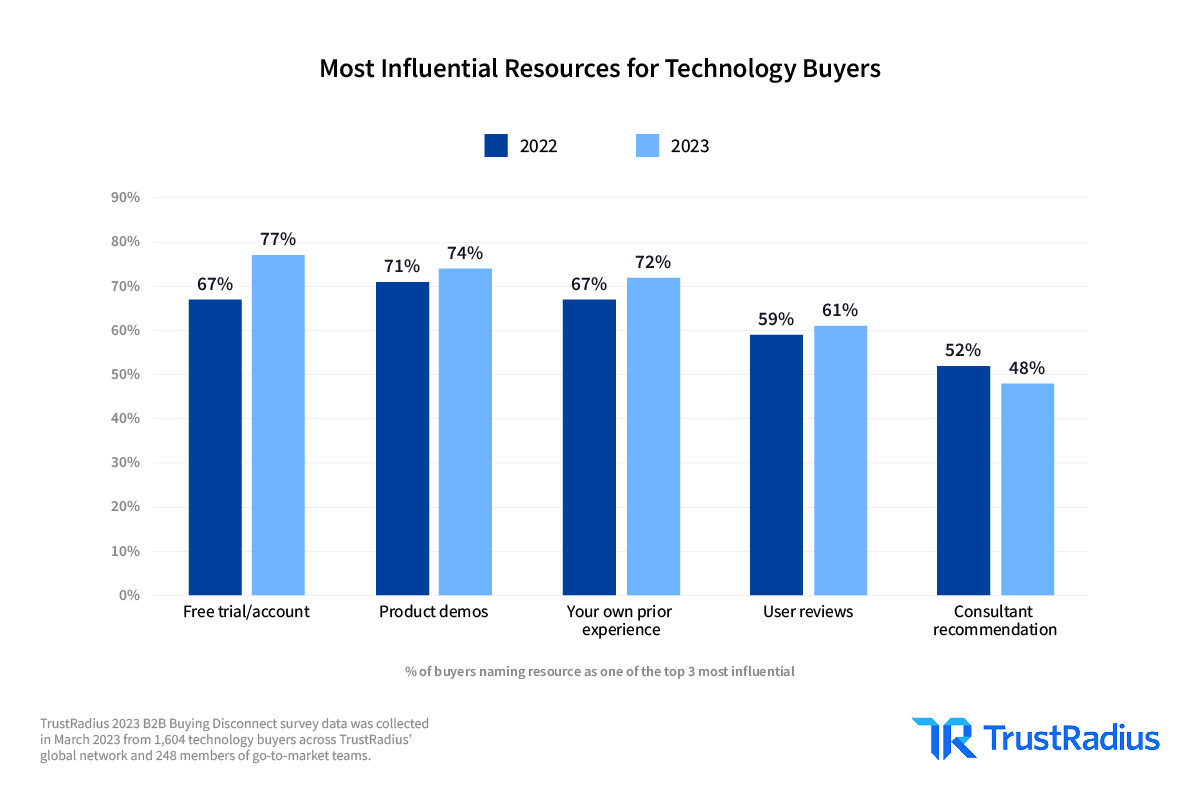

The most influential resources for technology buyers are free trials/accounts and product demos (which buyers prefer to be easily accessible on vendor sites and review sites, and as interactive demos.)

The top three things vendors can do that make buyers more likely to purchase are to make a demo or trial easily accessible, to make pricing transparent, and to generate user reviews.

The next generation of vendors is embracing these tactics that align with buyer preferences: providing free trials, interactive demos, transparent pricing, etc. For mature vendors, now might be the right time to re-assess how well you enable your buyer to self-service.

4. Time to go back to the well

One of the most notable increases from last year’s survey is the number of buyers purchasing products they already know and have experience with.

It’s time for vendors to look closer at re-engaging former users, with only 33% of vendors surveyed listing it as a marketing tactic they’ve used. In comparison, 51% of buyers surveyed said their own prior experience is an important influence in decisioning.

Worse is the disconnect between what resources vendors believe to be effective and what resources buyers say have the most influence. 72% of surveyed buyers said their own prior experience was one of their top three influences, while only 27% of vendors said re-engaging former users is a very effective tactic.

There’s a clear opportunity for vendors to reduce this disconnect. If you have a large customer base, it might be time to look at a solution like UserGems, where they’ve found that previous customers are 3X more likely to buy again, and 20% of contacts change their jobs every year.

5. Balance the needs of review relevance with review quality

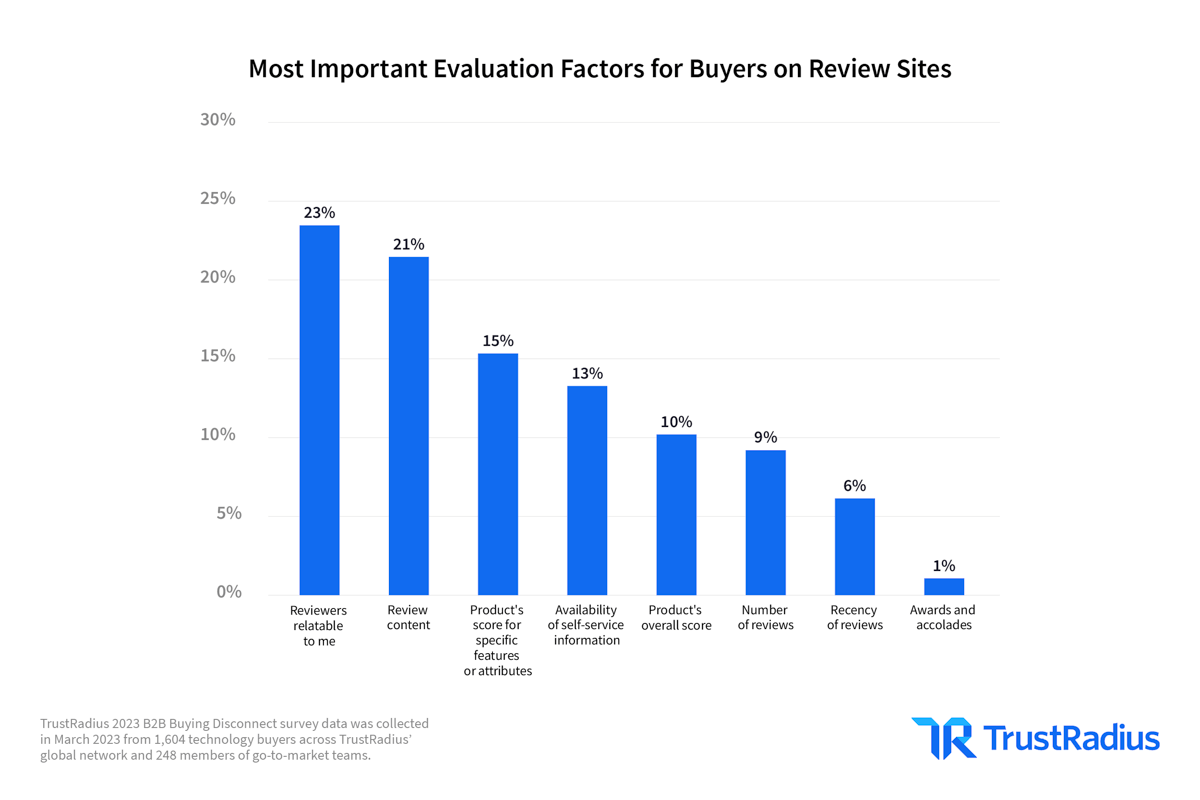

Buyers trust their peers in similar situations to whom they can relate. Vendors need to communicate the most relatable voice of the customer content to the buyer to influence them effectively.

Ask a Sales rep about what a buyer wants from a case study, and they’ll tell you that it’s one that they can relate to, as Sales Hacker found.

It’s the same with user reviews. The single most important evaluation factor on review sites for buyers.

To deliver on your buyer’s desire to read reviews by reviewers relatable to them, you need to drive enough reviews to cover your various types of buyers. If you segment your buyers by company size, industry, job title/role, and use case, consider whether your reviews cover the bases. If not, you should try different ways to get more reviews from underrepresented parts of your customer base so more prospective buyers can see reviewers similar to them and relate to their reviews.

Then comes the need to improve the quality of your review content. Buyers tend to want to know more than a shallow review of a pro and con with a user rating. They want a deeper review that answers more questions. What were the use cases and deployment scope? Did the implementation go as expected? Did they realize an ROI? Reviews that can answer these questions will have an increased influence on buyers.

Adapting to the Prove It Or Lose It Economy

The 2023 B2B Buying Disconnect report provides the findings for vendors looking to reduce the disconnect with buyers in the new prove it or lose it economy.

Vendors must become more aware of indirect channels and demonstrate their solutions’ ROI to stay competitive. To help buyers out, vendors can enable buyers to be more self-sufficient. Additionally, it is important to develop a focused and well-planned strategy for gaining reviews to future-proof a vendor’s presence in the market. Finally, vendors must ensure they deliver quality reviews and relevance when attracting reviewers. All of this must be considered when trying to reduce the buyer-vendor disconnect.

If you want a better understanding of these takeaways and how vendors should react, read the 2023 B2B Buying Disconnect: The Self-Serve Economy Is Prove It or Lose It. Also, you can learn more about how to grow your software business with user reviews on B2B SaaS Reviews.