Know the 3 Types of Intent Data: First-, Second-, and Third-Party

Intent data is increasingly important for identifying prospects in all stages of the buying process and building relationships with prospects and customers. But maximizing these opportunities requires understanding the three types of intent data and how each is most effectively used.

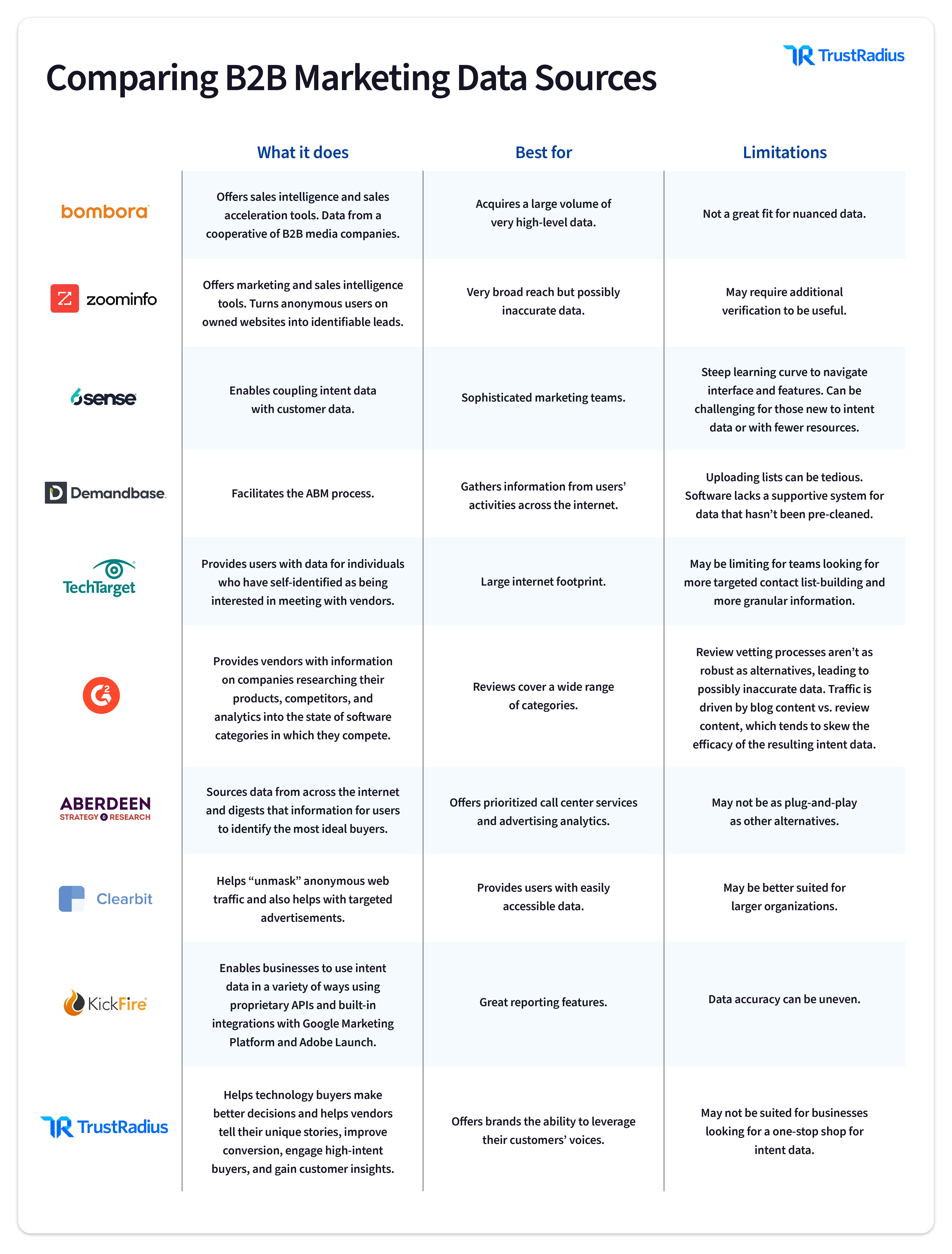

The good news is that marketers realize intent data’s importance. Companies are “viewing intent data as an integral layer of intelligence in their revenue funnel and a critical component of their overall go-to-market strategies,” according to Demand Gen Report. The next step for marketers is educating themselves about each form of intent data and the many sources available for creating unique audiences.

Understanding where intent signals come from helps you effectively act on them. Let’s dig into the three types of intent data and how they can improve your marketing campaigns.

First-party intent data

First-party intent data gives brands insights about their customers from internal resources such as a website, blog, subscription activity, or a customer relationship management (CRM) platform. This data comes from users who interact with content directly from a brand, making it meaningful for forming a clear view of the audience’s intentions.

There are many benefits to first-party intent data. Brands have direct control over the data and its collection, saving time, money, and the headache of dealing with another party. In fact, most brands likely have some form of first-party intent data at their disposal.

However, brands won’t realize the full potential if they don’t commit to strategic involvement and data analysis. Another obstacle for many companies is insufficient knowledge, ability, or time to apply this data meaningfully.

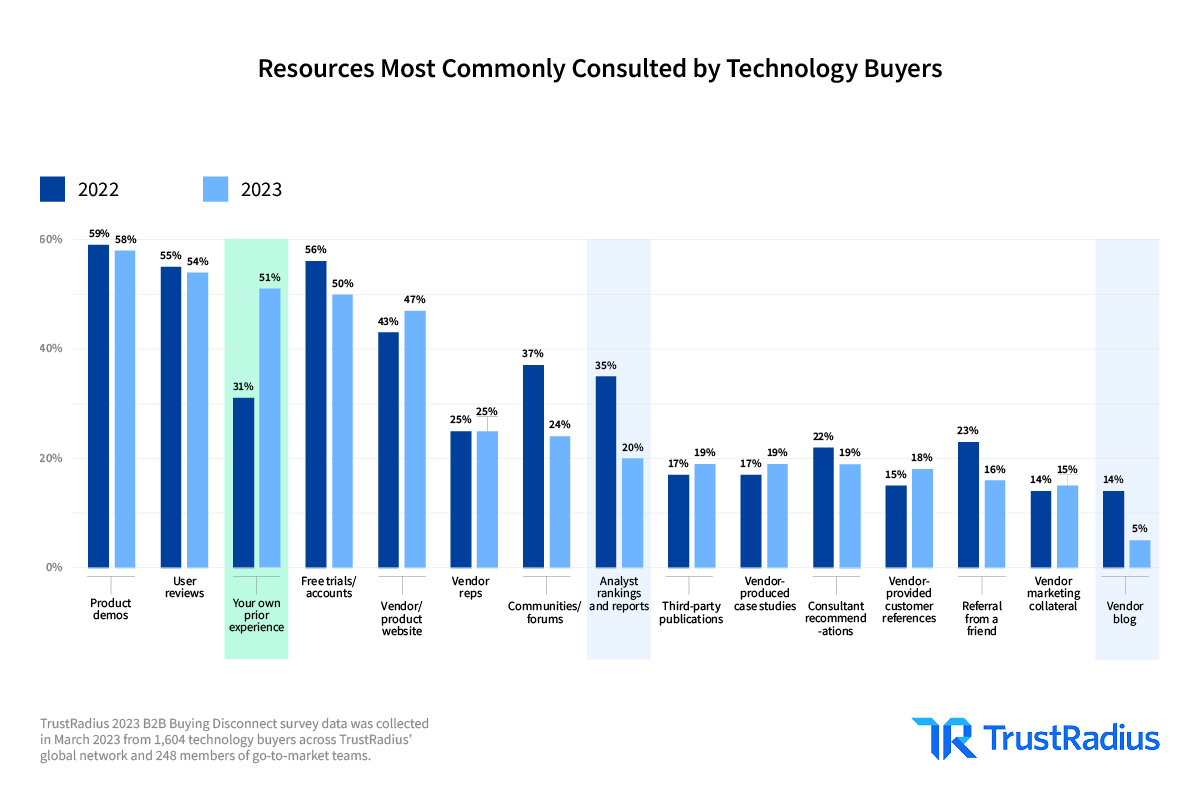

First-party intent data also has limitations. While it tracks the pulse of users who are already engaging with a brand, it’s only highlighting a portion of the overall buyer’s journey when they are on your owned properties. Also important to note is that according to our 2023 B2B Buying Disconnect report, vendor-provided resources have moved down to the number four spot in most commonly consulted resources by technology buyers, making first-party intent data still important, but not as prevalent as before.

First-party intent data is most valuable for prospects and customers who are far enough along their journey that they’re already aware of your brand. Many potential customers, including some who are already in-market for a product or service, won’t appear in first-party data sets before having an experience with that brand.

As the industry moves toward a cookieless future, intent data adoption continues to rise as brands look for new ways to capture customer insights and create personalized campaigns. First-party intent data can help bridge the gap between brands and consumers, but it’s insufficient for capturing the entire customer experience. To expand on this data, brands can partner with external sources of intent data.

Second-party and downstream intent data

One option for brands looking to move beyond first-party intent data is to partner with another business that monetizes its own first-party data. This is known as second-party intent data. This type of intent data is relatively new and is currently available from a limited number of sources. Second-party intent data can be as simple as a publisher collecting first-party data and sharing it with other organizations.

Higher-quality data will contain detailed, actionable, lower-funnel signals from an audience of actual buyers. This highly valuable data from TrustRadius is referred to as downstream intent data, which focuses on actual in-market buyers and is often the next best thing, in terms of quality and impact, after a brand’s own data.

For example, TrustRadius and G2 are each review sites that offer second-party intent data, but there are key differences between the data provided by each, and only TrustRadius data is considered downstream. TrustRadius intent signals typically come from enterprise buyers, while G2 attracts more of a small and midsize business audience.

TrustRadius also provides direct insights on whether buyers are researching your competitors and not you. Because TrustRadius has rich, vetted, unbiased content, averaging 400 words per review, it attracts in-market buyers, producing high-fidelity downstream intent signals. These signals surface companies ready to make a purchase, and this data is not modeled with any other dataset. Vendors can confidently target, and engage in-market buyers using these downstream intent signals in their CRM, account-based marketing (ABM) platforms, or paid media channels.

G2, by contrast, models in blog traffic with their intent data and will block signals that your competitors are getting. Their reviews on average are shorter than TrustRadius’ and less useful for buyers ready to make a purchase.

Third-party intent data

Third-party intent data comes from data conglomerates that purchase intent signals from various websites and model the data to monetize. This type of intent data is best for reaching a large volume of users near the top of the funnel.

Because of the broad nature of the sources of third-party intent data, only a small percentage of the signals in these data sets are directly tied to users who are actively moving toward a purchase.

Third-party intent data is also publicly available to anyone who pays for it, eliminating some of the exclusive benefits found in first- and second-party intent data. Competitors can easily access the same account information and target accounts in a similar manner.

The most effective use of this third-party data is for marketing teams to begin nurturing top-of-funnel prospects in campaigns. Any contacts in those accounts should also be added to a nurture campaign. Marketing teams should warm leads by introducing the brand and providing thought leadership material. Those actions can be followed by demand generation and educational content to help in-market buyers move further down the funnel.

When used in combination with downstream intent data or a CRM or ABM platform, brands can get a more holistic view of customer segments.

Find the right approach for you

Marketers should consider the different types of intent data and their applications when building their campaigns. There’s no one-size-fits-all approach. When we spoke with Jon Miller, Chief Marketing Officer at Demandbase, he explained that “intent data sources are like leads: you can never buy enough or have enough.”

Intent data helps marketing teams be more efficient, but success also depends on the effective use of this data. Remember that while third-party intent data is great for top-of-funnel awareness campaigns, second-party data is more beneficial for bottom-of-the-funnel conversion. While the number of in-market buyers identified from downstream intent data may be smaller than the audience from a third-party data set, the quality of the downstream audience is much higher and will turn into pipeline faster.

There’s little doubt that intent data will continue to develop into one of the most relevant and accurate forms of targeting available. In this modern environment, marketing teams can’t afford to continue to do business as usual. They must find ways to use all types of intent data to gain a competitive edge and stay relevant.

For more information on intent data, check out What is Intent Data? The Ultimate B2B Playbook.