Best Intent Data Sources for Prospecting Customers

Consumer behavior continues to evolve, and most buyers now make decisions without talking to a salesperson. To adapt to this shift in buying behavior, brands not only need to consider new avenues such as intent data, but they also need to dig deeper into the best intent data sources for prospecting new customers.

This change in consumer behavior is a key takeaway from TrustRadius’ 2022 B2B Buying Disconnect Report: The Age of the Self-Serve Buyer, which found that virtually 100% of buyers want to self-serve part or all of the buying journey—up 13% from 2021. Meanwhile, older digital advertising tactics, like third-party cookies, are under pressure as the industry emphasizes more private and secure user experiences.

Intent data is a powerful resource that can help brands reach some of their most valuable prospects in the market. But marketers who are trying to determine where to focus for the greatest return face an overwhelming (and growing) list of vendors, options, and capabilities to choose from, especially concerning intent data. It’s everywhere. However, marketers need to understand the different types of intent data and use them accordingly.

Learn more about the best intent data sources for prospecting customers, including several use cases to illustrate them in action.

Types of intent data sources

Intent data can include first-party data collected directly from a brand’s own web properties, however, many sales and marketing teams don’t know how to measure this data or how to draw actionable insights from it.

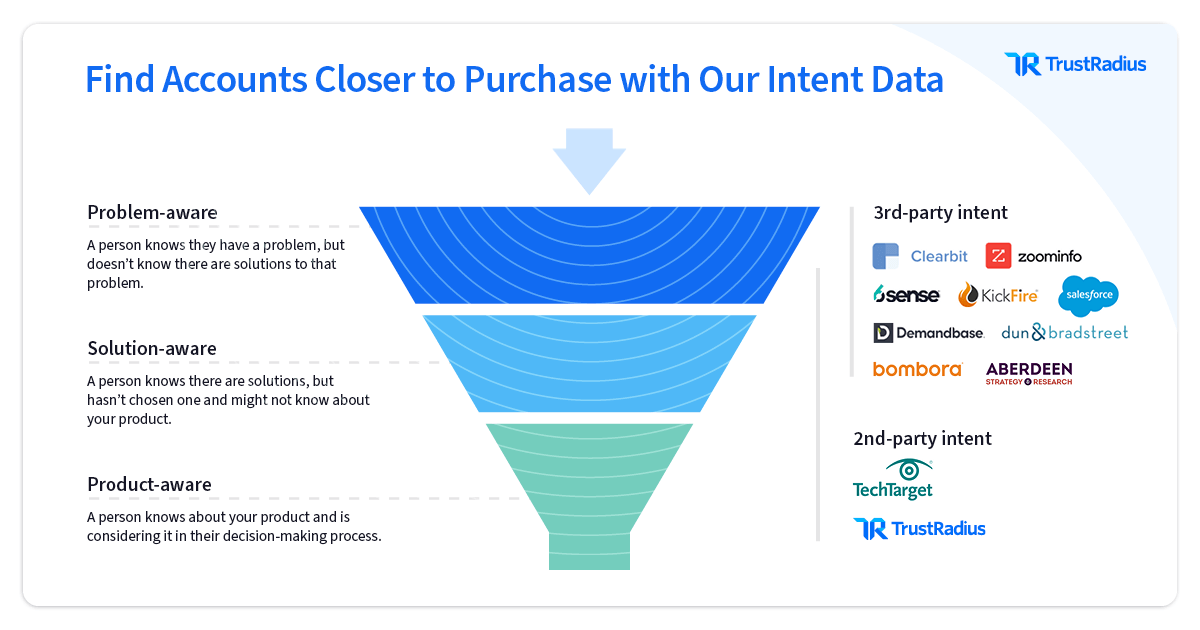

Second-party intent data is essentially a first-party audience that has been monetized and shared. Third-party intent data is aggregated data from across the internet. While it might be sold by a single source, it’s not that source’s owned data.

Top-of–funnel third-party aggregated data

Third-party intent data comes from broad top-of-funnel intent signals provided through publisher co-ops across thousands of websites. Because this data is aggregated and often probabilistic, it can be great for crafting awareness messaging for prospective customers earlier in their journey.

However, only a tiny percentage of the data signals from third-party sellers are actually people looking to buy a product, which challenges many marketers to convert prospects. Many marketers mistake these signals for buyers ready to make a purchase when really they are most likely discovering they have a problem, not a solution to fix it.

The data from third-party providers such as Bombora, 6sense, and Demandbase work best when combined with additional intent data from lower-funnel signals, such as TrustRadius downstream second-party intent data. For example, TrustRadius’ downstream intent data integrates with 6sense to augment top-of-funnel intent data signals, such as those from Bombora, to surface actual in-market buyers ready to make a purchase. These buyers, who are actively looking at your profile or a competitor’s, are in-market because they know they have a problem and are researching a product to support the solution.

By aligning good top-funnel indicators with true in-market signals, brands can create an intent-driven strategy that drives results.

Downstream and in-market buyers

Review platforms like TrustRadius offer more downstream intent data, which is representative of people looking at your product or your competitors’ that isn’t modeled with any other source. Some second-party intent data comes from publishers like TechTarget, with data from content consumption based on a company or product on the site. Other sources, such as G2, include advertising and blog traffic, creating inflated signals that aren’t representative of in-market buyers.

When considering purchasing intent data, it’s important to focus on bottom-of-funnel signals because that’s where many marketers face the most challenges to conversion. These in-market buyers are critical for performance, and connecting with them helps create more efficient, timely campaigns.

Use cases for intent data for prospecting

While intent data is great for supporting sales enablement, targeting high-intent accounts, informing retargeting, and so much more, prospecting is yet another strong use. Out of the 40% of tech companies that rely on any type of intent data, 70% of them use it for prospecting, according to TrustRadius research on intent data.

Embrace the age of the self-serve buyer

One of the best uses of downstream intent data is reaching in-market buyers with appropriate timing. In the age of the self-serve buyer, prospects don’t want to be contacted until they’re ready. In fact, our recent report found that 64% of buyers named cold-calling as the #1 reason they’d be less likely to buy a product from a vendor.

Brands are in the dark for most of their prospects’ buying journey. Intent data helps brands uncover hidden areas of the sales funnel and build relationships with otherwise anonymous prospects. Knowing who and when to contact from in-market accounts can make sales teams much more efficient and effective. Warm leads can then be ushered down the funnel, for example, by partnering intent data with ad retargeting or account-based marketing (ABM).

Enhance lead scoring

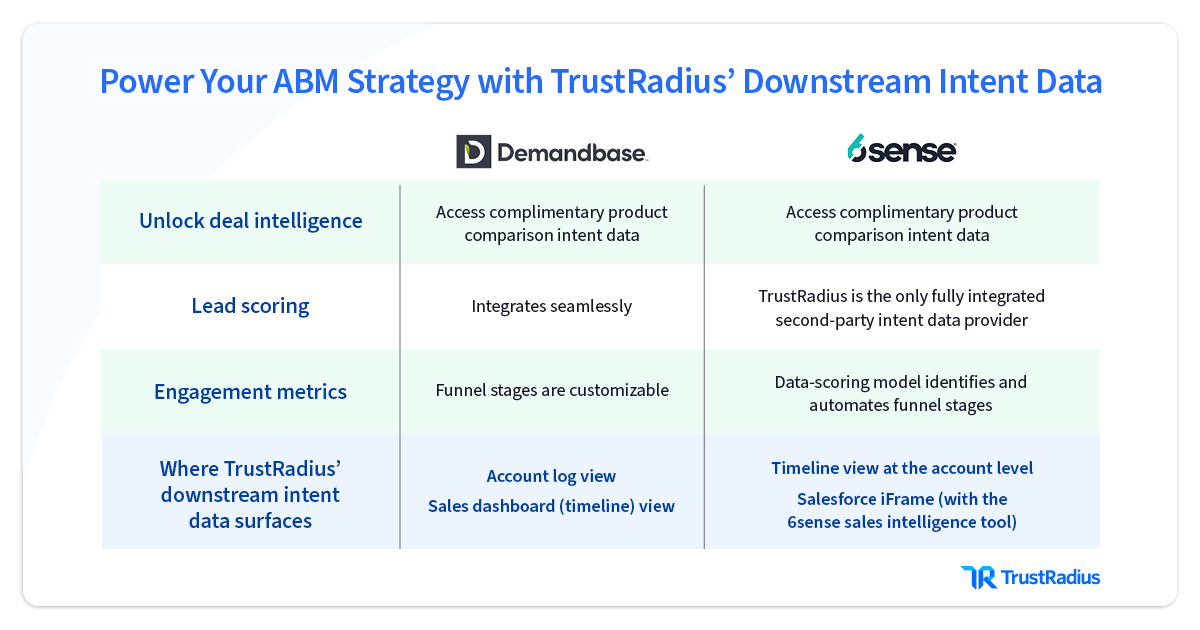

Scoring leads from intent data can be incredibly difficult without an ABM platform. In fact, for Salesforce users, this isn’t an option. However, TrustRadius’ intent data can integrate seamlessly with Demandbase, and it’s the only second-party intent data provider that’s fully integrated into the 6sense platform. Intent data can also help influence engagement metrics. For example, 6sense uses a data-scoring model to identify and automate funnel stages, while Demandbase allows for customized funnel stages.

Improve ABM programs

With bottom-of-funnel intent data, marketing teams, salespeople, and business development representatives can target the same accounts, creating more touch points. Messaging can also be crafted for a more personal touch while using downstream intent data to find insight into how best to position the offering. Utilizing intent data can also help speed up the buying cycle because targeted accounts are actively showing interest and are closer to a decision.

Boost ad performance

Paid ad performance can greatly benefit from downstream intent data, too. Using insights from intent data can help marketing teams create relevant messaging targeted to the appropriate stage of the buying journey for in-market buyers.

Brands can create upper-funnel campaigns for problem-aware audience segments, providing educational material and opportunities to learn more. As buyers progress further down the funnel, campaigns can push for conversion with special offers, discounts, and other incentives.

Intent data can help cost-per-click campaigns by ensuring ad budgets are spent more efficiently. TrustRadius’ downstream intent data dynamically updates based on engagement with a product profile or competitor, so brands get the best return on their investment during the campaign.

Review platforms such as TrustRadius can also offer additional content or social proof, such as positive reviews, awards, and badges. TrustRadius integrates with LinkedIn Matched Audiences to build high-performing ad campaigns using downstream intent data and customer review content. For example, when buyers begin researching products, categories, competitors, or even alternatives, signals on TrustRadius are triggered, which are sent to LinkedIn. This information can also be used to build segments in real time to target with ads highlighting customer quotes and awards won on TrustRadius.

Find new deals

With downstream intent data, brands can find in-market buyers who may be considering them but aren’t in their pipeline. Brands can also discover new competitors based on how users compare their products or services.

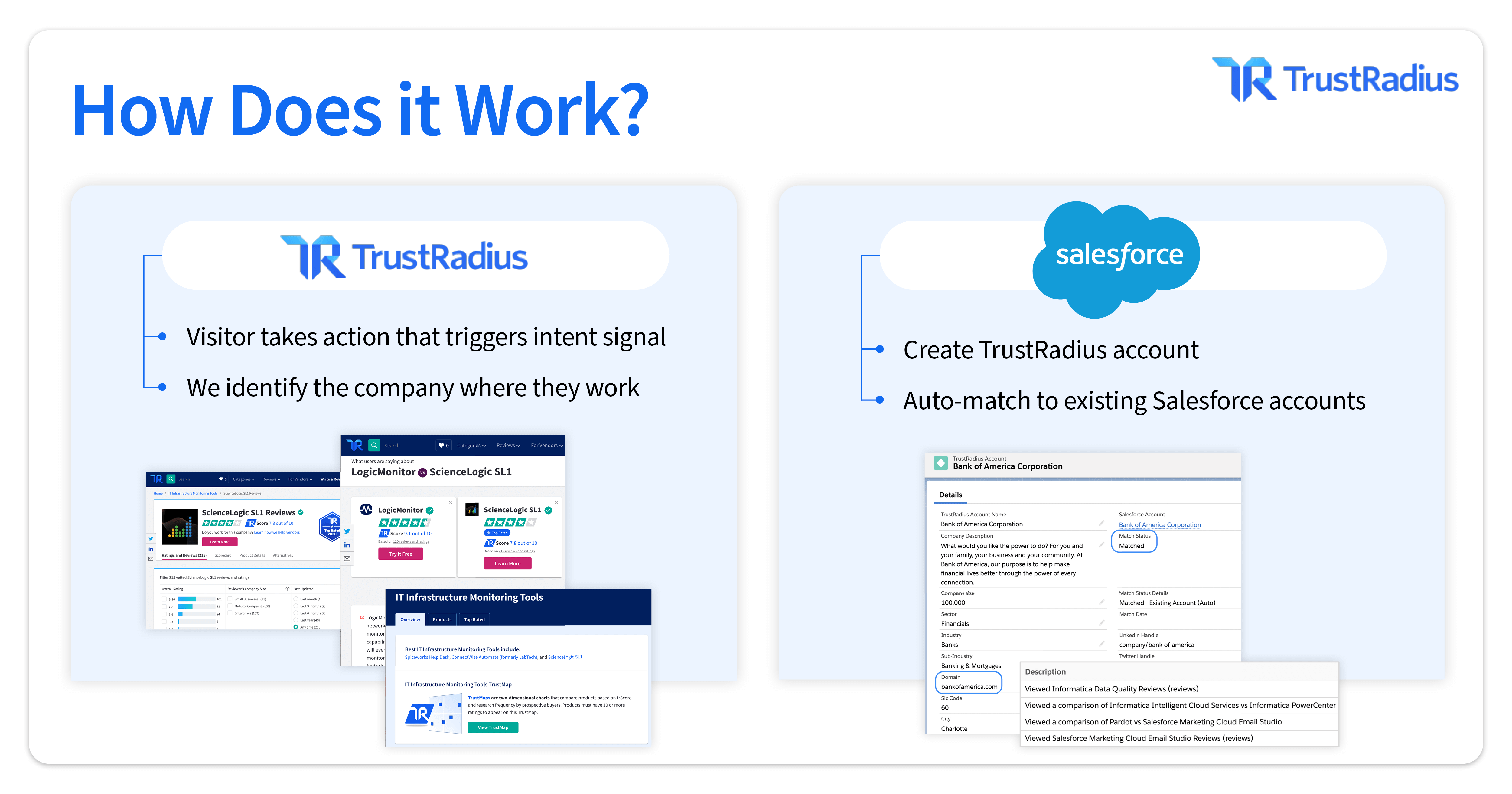

One of the best ways to get full access to intent data is through our Salesforce Connector, which is free and easy to set up. By using the available templatized reports, brands can search for matched accounts (those that were researching on TrustRadius and in your Salesforce) and unmatched accounts (those that are researching a company or category but aren’t in Salesforce).

While matched accounts can offer key insights for activities such as known prospects that are now in-market and customer retention and upselling, unmatched accounts are some of the lowest-hanging fruit available for marketing and sales teams to target that were not known before.

In fact, TrustRadius customers who integrated our downstream intent data with the Salesforce Connector matched accounts report saw a 31% return on the accounts researching them on TrustRadius that fit into their ICP. Within one month of installing the Salesforce Connector, one enterprise client attributed four new accounts and a $44,000 influence to their pipeline. The client noted, this “pays for the program!”

Another well-known mid-market/enterprise company saw a 61% return on accounts fitting into their ICP from TrustRadius’ downstream intent data. These otherwise unknown accounts were not only researching them on TrustRadius but also researching their competitors.

Leverage intent data for prospecting

Buyer intent data provides many benefits, and utilizing it for prospecting is the secret weapon that fills your pipeline for the entire year. Downstream intent data is also relatively new, with many marketers skeptical. Your brand’s use of intent data can create a competitive advantage in reaching users who otherwise would be missed.

Now that you know the best intent data sources for prospecting customers, check out the best intent data sources for customer retention and expansion.

If you’re ready to begin connecting with lower-funnel in-market buyers, contact us to get started.