Why Content, Not Scores, Should Drive Your Review Strategy

If you work for a software vendor, you probably already know that your buyers are using TrustRadius.com as a decisioning platform, along with traditional review sites, to compare products. As they build their long and short lists, reviews and ratings give them a helpful view of the competitive environment.

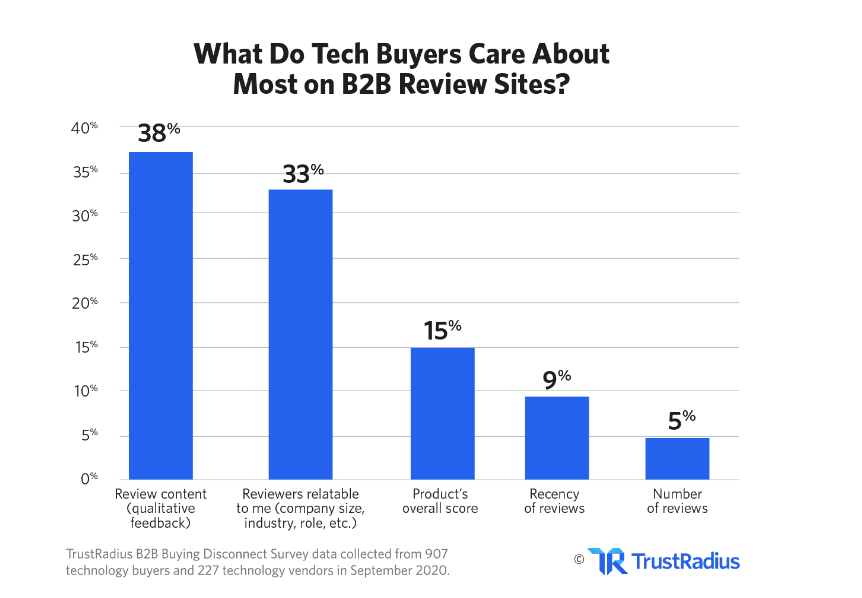

You may think that the overall review score is the primary way buyers compare products. Indeed, when starting out with reviews, many vendors focus squarely — even exclusively — on their star rating. But before you get too obsessed with your score, we’ll share another important insight: buyers care more about in-depth, qualitative feedback and readily-available, self-serve product information than your product’s overall score.

We know that buyers consider multiple factors when they use reviews. These factors work together to determine not only the buyer’s perception of your company and your product, but also how helpful and trustworthy they find your reviews overall. But, when push comes to shove, what is the top priority for buyers? Which piece of information is really going to help them in their selection process? Where should you, the vendor, and we, as a decisioning platform, be focusing our energy to have the biggest impact on buyers?

During our 2022 B2B Disconnect research, we surveyed 2,185 technology buyers. Nearly 100% of them said they want to self-serve part or all of the buying journey (up 13% from 2021). We also asked them for the three most important things they want vendors to provide as self-serve options. Their answers? Software pricing (71%) was the most important, demos or free trials (70%) was second, and customer reviews (35%) were the third most important.

41% of Gen Z and 29% of Millennials named "check review sites" as their first step in the buying journey

*B2B Buying Disconnect: The Age of the Self-Serve Buyer, TrustRadius, 2022

It is clear that customer reviews are becoming increasingly important. But, what is it that buyers like about customer reviews? Is it the easy-to-see star ratings? Is it the story customers share? Let’s find out.

Buyers want the whole (condensed) story

Of course, we had to gather some qualitative feedback of our own about what buyers are looking for most in a customer review—and it’s not just the score. While buyers want to see scores, the number alone is less useful than the context behind it. Here’s what our surveyors from the 2021 B2B Disconnect Report said:

The qualitative feedback we’ve received from buyers during different studies has shown us some important themes when it comes to reviews. These include how buyers are wary of star ratings, who’s writing the review, how often they revisit reviews, and what content is included. Understanding the buyers’ thought processes will help you build a stronger review strategy.

The qualitative feedback we’ve received from buyers during different studies has shown us some important themes when it comes to reviews. These include how buyers are wary of star ratings, who’s writing the review, how often they revisit reviews, and what content is included. Understanding the buyers’ thought processes will help you build a stronger review strategy.

1. Star ratings could be based on skewed, old or imcomplete data

Without digging into the underlying user feedback, buyers feel an overall score could be misleading. When it was collected, how it was solicited and numbers of data points were all mentioned as critical pieces of context.

(Note that at TrustRadius, because we’ve heard the feedback from buyers that overall scores can be misleading if they aren’t factoring things like recency and selection bias, we use our trScore algorithm to address these concerns.)

2. Buyers want to know the person behind their feedback

Buyers also want to view an individual’s rating in context. First, buyers know that no product is the perfect fit for everyone. They want to dig into end-user feedback to understand whether a product will work for their use case, company size, maturity level, industry, and level of complexity.

In this vein, filtered scores, such as those on our segmented TrustMaps, are often more useful to buyers than overall scores. Buyers want to know why reviewers are giving the scores they’re giving, so having comprehensive, recent reviews is more important than a rating alone.

3. Buyers use the score as a jumping-off point

Even buyers who indicate that the overall score is important have caveats as to how they use it. Generally it’s viewed as a way to quickly identify products with unusually low satisfaction, or as an indicator of what to expect in the reviews.

We’ve been told by many TrustRadius users that ratings can be skewed by a company’s needs not fitting right with the product they were using, so their rating is low. That doesn’t mean the product is bad, only that it was a bad fit. Others have said that while rankings are useful, they’re not granular enough to give more than an indicator to start with.

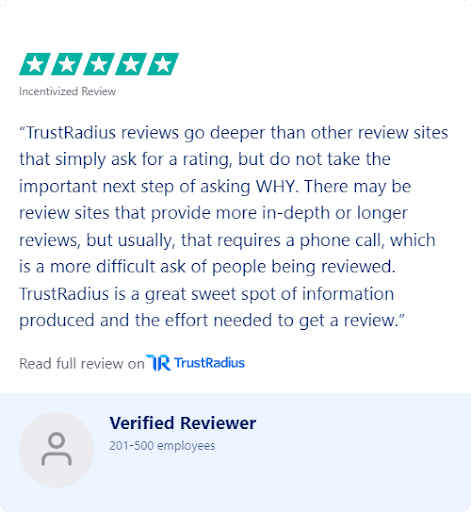

4. Content is king, as one buyer put it

The substance of the reviews is where buyers say they find immense value. The content helps them:

- Understand product strengths and shortcomings

- Suss out best-fit scenarios for different products they’re considering

- Identify questions to ask during a sales process

- Know what to expect post-purchase

All of which are common goals among buyers using our decisioning platform and traditional review sites, and none of which can be inferred from an overall score.

In some cases, the dynamic between content and score varied depending on the buyer’s stage. Buyers jump back and forth between different information resources, including TrustRadius, looking for different information within the reviews as more questions pop up throughout their journey.

So, if you’re confronted with a negative rating or even a less-than-desired overall score, remember that what buyers really want to see is the qualitative feedback behind the numbers, especially as they get closer to a purchase decision. When you put all your energy into micromanaging your score, you’re not focused on enabling the most influential thing for buyers: in-depth, candid insights from people like them, not just the carefully cultivated advocates and heroes who will give your product a five-star rating.

How you can influence buyers

If you want to influence buyers researching your product on TrustRadius, the best way to do so is to ensure there is plenty of high-quality feedback — positive and negative — that gives them a sense of where your product is a good fit, as well as where it is not. Buyers are especially interested in direct comparisons made by users who have past experience with other similar products, and stories about the difficulties they might want to anticipate themselves.

On top of that, including product pricing, free, interactive demos, security documentation, and an open line of communication can go a long way in providing even more content for buyers to pull and learn from.

You have the power to help them find what they’re looking for by inviting a broad, representative sample of your user base to write balanced, in-depth reviews, by adding self-serve product information and keeping the dialogue open so that feedback stays current.

So, take a deep breath, and look beyond your score. If you do, you’ll be on the path toward a buyer- and customer-centric sales and marketing strategy. Having high-quality feedback from a diverse group of customers will benefit your buyers—and your company—in the long run.

For more insights on what is important to buyers, and what you can do to influence them, download our study on the B2B Buying Disconnect.